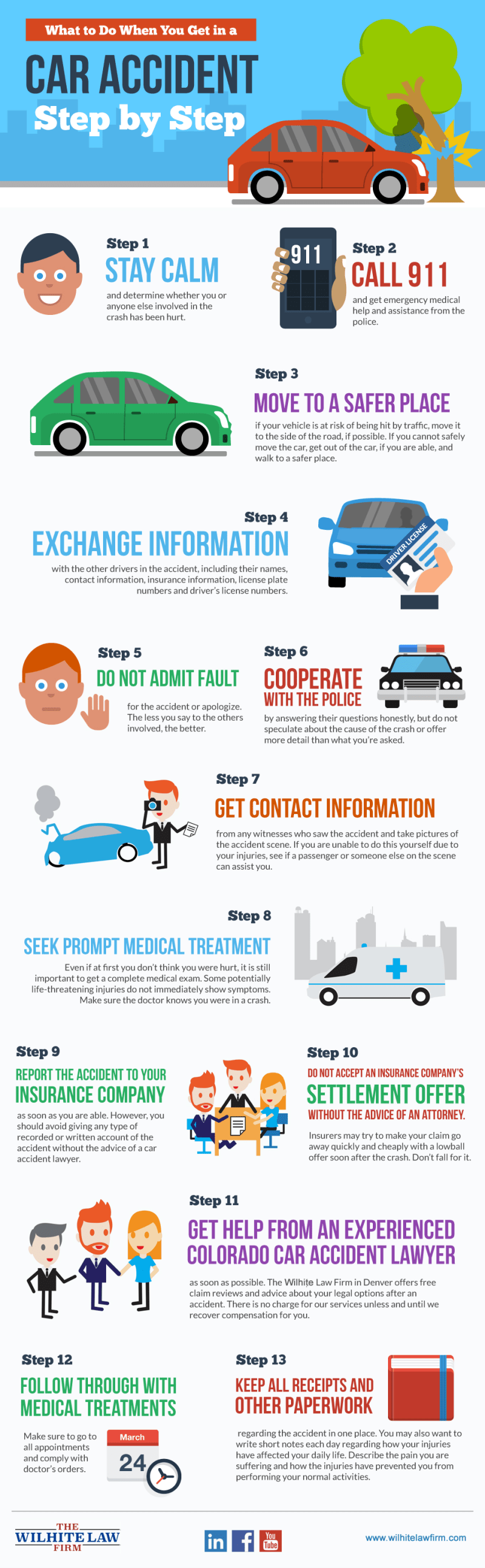

What To Do In An Accident Insurance – Accidents can happen to anyone on the road, no matter how experienced or careful the driver is. Here are five steps to take if you have been involved in a car accident:

After recovering from the consequences of the accident, check yourself and those around you for injuries. If someone needs to be taken to hospital, call the emergency number 995.

What To Do In An Accident Insurance

If possible, take pictures of the accident scene without moving the car. You will need this document later when you file a claim. Take separate and large shots of the accident scene with as much detail as possible and remove the placards of all participants. If you have a dashcam, the footage will also be helpful to prove it wasn’t your fault (hopefully!).

What Happens If You Get In An Accident Without Insurance?

Enter other driver information, including name, NKZH number, address, phone number, and car insurance company. Your insurance company will need this information if they want to file a claim against the other driver.

If you are an insured person, call our 24/7 hotline at +65 61001620 or contact us via Whatsapp to report an accident and get assistance from our team. (It’s also great to have a 24/7 auto insurance line on your phone!)

The next step is to go to a garage to fix your car and schedule a tow truck if necessary. If you are not sure which training to attend, ask your insurer for advice. Many insurers have approved the trainings. However, if you have a plan, such as car insurance, don’t limit your study choices.

Unless you have reliable training in mind, your best bet is to attend a training course approved by your insurer.

What To Do If You’re Caught In A Car Accident?

Authorized repair shops can repair and charge faster because they need less. The training will also require you to provide all the necessary documents for the registration of an insurance claim. Remember that you must pay the excess amount before your insurance company will pay the remaining amount.

In addition to the cost of repairing your car, you may also be reimbursed for medical expenses incurred as a result of the accident. In case of multiple injuries, the car insurance plan also provides accident benefits in the form of compensation.

Finally, if there is third-party liability, such as property damage or injury to pedestrians, your car insurance company will pay for it.

These types of claims require different supporting documents and your insurance agent can advise you on the claim. As always, keep all receipts, bills, medical reports, etc. after the accident.

What To Do If You Are In A Car Accident Checklist

With auto insurance, you can file a claim even if it’s not an emergency. A special engine and transmission cover for qualifying vehicles covers the cost of repairs in the event of a breakdown.

Please call our 24/7 hotline at +65 61001620 or report the error via Whatsapp and our team will advise you on the next step.

In order to apply for an engine and transmission warranty repair, you must go to one of our authorized auto repair shops. Don’t know where to go? Our customer service team can help.

If your car is 10 years old or older, the garage won’t charge you more than your out-of-pocket expenses. $150 max for used cars.

Motor Insurance Fraud

You will be asked to provide supporting documents as documents. This includes the entire history of your car, including records from before you became a politician.

If you do not opt for a pre-inspection, you will not be able to claim the engine and gearbox for the first 30 days or 1000 kilometers from the policy date.

You’ve avoided financial trouble with car insurance, but what happens to your insurance later?

It all depends on whether they consider it your fault or not. If the evidence shows that you were at fault for the accident, you will still be entitled to NCD from your insurance company.

What To Do If You’re In An Accident

However, if you are found guilty, your claim will be considered a fault claim. Thus, you will lose 30% of your current NCDs. For example, if this year your NC was 50%, but you are responsible for the accident, next year the deduction will be reduced to 20%. Additionally, your insurance company may charge you an additional premium when you apply for premiums next year.

In short, if you are involved in an accident, your car insurance goes up a lot. If you’ve been involved in three or more at-fault accidents in the past three years, or if your claim exceeds $7,000, getting insurance can be difficult and expensive.

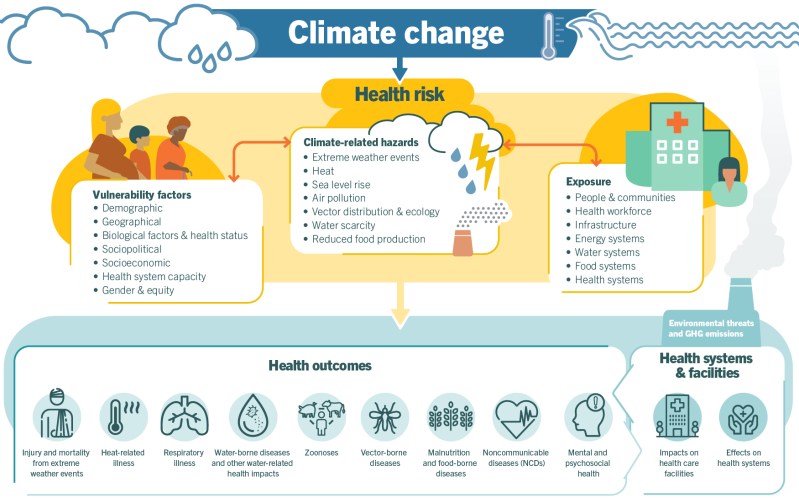

This does not mean that it is impossible to get insurance. When you contact us, our property and casualty insurance experts will provide you with the information that is best for your case. The problem with accidents is that they are sudden, unexpected and often without money. The consequences of a fatal accident can change your life and the lives of your family.

Ask yourself: Would your family suffer financially if you were killed or disabled in a serious accident?

Accident Insurance: Protecting Your Health And Wallet

If you are the sole breadwinner or main contributor to your family, the answer is probably yes.

Therefore, you and your family should have Personal Accident Insurance (PA). PA insurance covers the financial consequences of an accident and provides you and your family when you need it most.

Personal accident insurance is an annual policy that provides compensation for injury, disability or death resulting from abuse, accident, external or apparent. Definitions of violent, accidental, extrinsic and apparent vary from insurance company to insurance company.

Different PA policies offer different coverage and payout amounts. The most common types of coverage typically offered include accidental death, permanent disability, temporary or partial disability, medical expenses, corrective surgery, medical expenses, and funeral expenses.

What To Do If You Have A Car Accident

The plan is designed to pay out if you are seriously injured or killed in an accident and the policyholder receives tax-free coverage for any unfortunate events covered by the policy.

Do I need a PA if I already have health insurance and health insurance?

It changes from time to time. Let’s be honest, some of us need it and some of us are lucky enough to never need it. But how do you know? Accidents don’t happen when you introduce yourself, they just do.

The difference between PA insurance and life insurance or health insurance and life is the cause of injury or death. PA insurance does not cover injury or death from natural causes, such as illness, like life insurance does. Similarly, life insurance does not cover non-fatal events.

How To Make A Car Insurance Claim

Therefore, accident insurance works as a supplement to life insurance. It’s designed to protect you and your family if an accident leaves you unable to earn money or, worse, kills you. That’s why it’s a good idea to purchase PA and life insurance to protect your loved ones should something happen.

PA and medical insurance will cover you in these situations, but even if you are seriously injured, you will need medical and medical insurance to cover the necessary medical bills.

Coverage and benefits vary by insurance company. Therefore, it is important to read the fine print before purchasing an insurance policy to ensure that it meets your requirements.

There are also such. Death, disability or injury resulting from the following events is generally not covered:

What You Should Do If You Get Into A Car Accident?

Get a PA for people who work in certain dangerous occupations, such as law enforcement officers, drivers, pilots or flight attendants, air traffic controllers, race car drivers, fishermen, or people with dangerous recreational activities who participate in bungee jumping, rock climbing and driving . Weather We recommend checking with your insurer or agent about these exclusions before proceeding.

If you have more than one PA policy, you or your beneficiaries will receive a death or disability benefit.

However, some claims, such as medical expenses, can only be filed under one PA plan. If your medical expenses are higher than expected, you can cover the difference with PA secondary insurance.

Personal accident insurance is not a substitute for life insurance, but it can provide you and your family with protection in the event of an unexpected accident that results in injury, disability or death. Must be used with health insurance for full coverage.

Why Do You Need A Group Personal Accident Insurance?

As with other insurance products, insurance terms depend on the insurance company. Before signing up, read and understand the products and policies offered by different insurance companies and purchase the product that best suits your needs. Malaysian roads are full of accidents.

What to do when in an accident, progressive what to do in an accident, geico what to do in an accident, what to do in an auto accident, what to do after an accident insurance, what to do if in an accident, what to do in an accident, what to do in car accident insurance, usaa what to do in an accident, what to do in an accident car, allstate what to do in an accident, avis what to do in an accident