What To Do If I Get Audited By The Irs – There are steps you can take to reduce your chances of being singled out for a tax audit.

This article is for informational purposes only. This content is not legal advice, it is the expression of the author and has not been evaluated for accuracy or changing the law.

What To Do If I Get Audited By The Irs

There’s no guaranteed way to avoid an audit, but there are some precautions you can take to prevent your business from raising a red flag.

How To Write An Audit Report: 14 Steps (with Pictures)

Until recently, the chances of your small business tax return being audited were slim. Bloomberg cites IRS data showing that only 140 of the 4 million small business returns filed in 2018 were audited. The number was slightly higher for S corporations, but less than 0.5%.

But by the end of 2020, the IRS has announced it will add auditors to allow the agency to increase audits by 50%.

A net annual loss—especially a small loss—can put you on the IRS’s radar. The IRS may view this loss as an indication of unreported income, prompting them to scrutinize your return.

“When the IRS sees a net business loss, they’re basically asking for an audit,” says Steven John Kaplan, CEO of True Contrarian Investments, LLC. He adds: “You have to report all your income but not all your expenses, so if you have a low net profit for the year, write off some expenses.”

What To Do (and Not Do) If The Irs Audits You

Although you must report 100% of your income, you can avoid overreporting losses by reducing the number of deductions you claim. For example, rent, car expenses, mileage and technology write-offs can save you money, but they can also lead to an IRS audit if you owe more than you earn.

Listing your business expenses provides transparency and prevents the IRS from questioning the information you provide. Being vague about business expenses can lead the IRS to think there’s a problem or that you’re knowingly misrepresenting your income.

“When you have the option of putting a certain expense in a general category or listing it separately under ‘other expenses,’ it’s always better to list it clearly,” advises Kaplan. “Rather than detailing each separate advertising and travel expense, the IRS may think you’re trying to track expenses that wouldn’t exist if you included advertising or travel together.”

Instead of assuming the auditor will understand why your travel expenses suddenly dropped 100% last year or your online advertising spending increased 300%, fill out additional paperwork and include it when you return to explain in detail what happened. file

How To Conduct An Audit

That way, if you mark your return and find yourself in front of a man, you’ve already answered a lot of questions about their sudden changes.

Some people think that filing before tax season increases the chances of an audit because there are fewer returns in the fund. This perception causes people to apply for extensions too late. But filing late isn’t a good way to avoid an audit, says Steven Terrigino, CPA and partner at The Bonadio Group.

Document on time, pay on time,” he says. “[This] creates a history of compliance with all relevant filings—including payroll and sales tax.”

Don’t worry about the risk of auditing an e-file versus a paper file. Choose the one that suits you best because the method of submitting the application does not increase the chances of an audit.

How To Conduct A Successful Compliance Audit: Step By Step

Some businesses believe that filing an amended return means admitting to the IRS that you did not file the first return. Submitting an amended report does not automatically trigger an audit, but it increases the likelihood of significant changes without sufficient justification. This is because amended returns older than three years cannot be e-filed, so questionable returns are flagged for manual processing and scrutinized by a person.

Don’t forget to attach supporting documents to your return. However, unless it is critical to the change, it is best not to overwhelm the IRS with unnecessary documents that could lead to an audit.

Most audits by the Tax Administration are determined by paperwork discrepancies and mathematical errors. Terrigino recommends “make sure all government-issued forms, such as 1099-INT and 1099-DIV, match the information you reported on your tax return.”

Double-check your account to make sure there are no errors in your documents. If the numbers don’t match, the IRS will notice.

Chapter 2 Audit Policies And Event Viewer

Try to use exact numbers whenever possible, as round numbers sound fishy. The IRS generally doesn’t mind if you round to the nearest dollar, but rounding to tens or hundreds of dollars to get clean, round numbers can trigger an audit.

Be careful not to use the same number year after year unless you have documentation that the number is correct. Expect costs to change, and if yours don’t, they could raise some red flags.

How much can you claim in charitable donations without an audit? Answer honestly and report the actual amount you contributed or any other deductions you are entitled to. Keep details and documents of your deductions and donations so you can show proof if needed.

“Don’t overestimate your contribution limit, go overboard on the home office, or go overboard on meals and travel,” says Terrigino.

How To Prepare For A Financial Audit

These and other expenses such as bad debt, accidental damage and medical expenses are scrutinized more closely. Also, don’t suddenly include a big discount that you haven’t taken advantage of before. This is noticeable.

Schedule C is the IRS tax form for reporting your business profits and losses. If you’re a small business owner, always report your income or loss using Schedule C for the best chance of avoiding an audit.

“While there are other methods that sometimes avoid paying a portion of your Medicare tax or have other benefits, they also greatly increase the risk of an audit,” Kaplan says.

Fill out your tax return carefully and do not leave any questions blank. Every question on the tax form must have a correct answer, even if the answer is $0. An unintentional oversight can bring you extra attention.

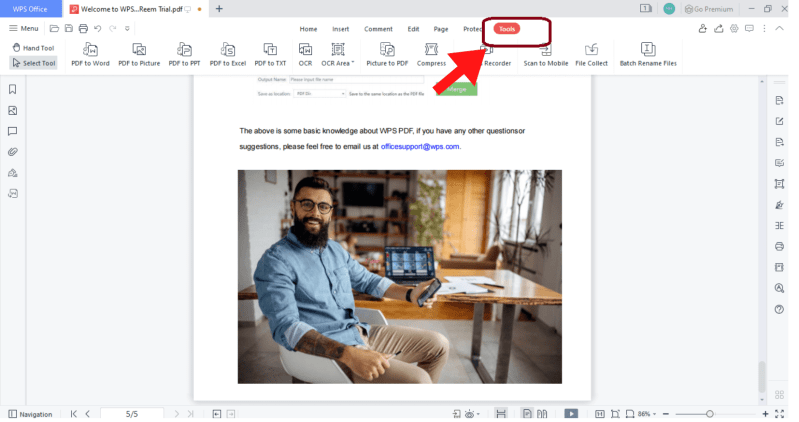

What To Do If You Are Audited By The Irs: Learn The Types Of Audit Letters Here And Follow These 5 Steps

Filing an unsigned tax return is more common than you think. If you don’t do something as simple as a sign, the IRS may think you’ve neglected other parts of your return, which should be scrutinized. Check and verify the return for your signature before filing to reduce the risk of an IRS audit.

The timeline for the 2022 IRS audit process is three years, so your 2019 tax year is still eligible. Even if you follow all the advice on how to avoid an audit, this can still happen. Here are some things you can do if you get the dreaded IRS letter in the mail.

Finally, revisions are less likely. Following these tips on how to avoid an audit of your business will help reduce your chances even further. Don’t give the IRS a reason to review your accounts and you’ll save yourself some time and stress.

Now that you know how to avoid an IRS audit with our tips, you can do what you do best, running your business.

Comparative Returns On Irs Audits By Income Groups

Knowing what other trademarks are available will help you understand if there is room for the mark you want to protect. It is better to detect early so that you can find a sign that is easy to protect against.

Want to talk to your parents or grandparents about estate planning, but the topic seems taboo? you are not alone Estate planning discussions can be difficult for many families. Use our tips to open the topic sensitively.

Considering an LLC for your business? The application process is not complicated, but in order to apply for an LLC, you need to do some homework first. Company audits are important to ensure that a company’s financial statements are true and fair. Therefore, the Companies Act (CA) sets out requirements relating to several aspects of company audits, such as the appointment of auditors and companies exempted from audit requirements. This article explores these questions.

The directors of the company must appoint at least one accounting firm as auditors of the company within 3 months of the incorporation of the company. In Singapore, only accountants or accounting firms approved by the Accounting and Corporate Governance Regulatory Authority (ACRA) can act as auditors of a company.

The Audit Process For Charities

The auditors will be on duty from the moment of their appointment until the conclusion of the next annual meeting of the Company. Therefore, when a newly founded company appoints the first auditor, this auditor remains in office until the conclusion of the first annual assembly of the company.

During the first annual general meeting, the company must appoint a new accounting entity (or re-appoint the same accounting entity) to act as the auditor of the company until the next general meeting. This auditor will hold office until the conclusion of the next annual general meeting of the company.

If the directors do not appoint a company auditor, any member of the company can apply to ACRA.

If audited by the irs, what happens if you get audited by the irs, what to do if audited by irs, what if i get audited by the irs, if i get audited by the irs what happens, what if you get audited by the irs, what happens if u get audited by the irs, audited by the irs, what to do if i get audited by the irs, what to do if you get audited by the irs, what to do if your audited by the irs, what to do if you are audited by the irs