Selling Your House And Paying Off The Mortgage – You can sell your home at any time, even before the mortgage is fully paid off. It’s not uncommon for people to move before the mortgage is fully paid off. When you sell your home, you’ll have cash flow that you can use to pay off your mortgage, and if you have any money left over, you can even use it to buy a new home.

If you decide to sell your home before paying off the mortgage in full, it’s important to pay off the mortgage balance first. This guide will guide you through everything you need to know before you decide to buy a home with a mortgage.

Selling Your House And Paying Off The Mortgage

There are many factors to consider when selling your home before paying off your mortgage. These include:

Farm: Pay Off Your Mortgage Sooner

The first step in buying a home before paying off your mortgage is knowing how much you have left to pay. The lender wants to make sure your loan is paid off in full before anyone else moves in, and that will be their top priority.

You will need to arrange a valuation of your property as this will determine whether the sale of your property will be sufficient to pay off the mortgage. If not, you will need to ask your lender for permission to sell the property.

After your appraisal, if the proceeds from the sale of your home are sufficient to cover the remaining mortgage payments, the next step is to sell your home. You may have some money left over after paying off the loan.

The quickest and easiest way to do this is through an urgent home buyer like Good Move. We can market and sell your home for cash in as little as seven days.

Should I Pay Off My Mortgage Early In This Economy?

If the amount sold for the house is not enough to cover the mortgage payments, you will have to repay the loan yourself. This is called the credit deficit. If you default on your mortgage and buy another property, your lender has the right to take legal action against you and you can get into a lot of legal and financial trouble.

If you are in debt, you may want to consider selling short. This occurs when the lender agrees to accept a deposit to complete the sale of your property.

If you are selling your house, the next step is to find a new place to live. If you are having trouble finding a new home, you can apply to your local council to be classified as homeless.

If you’re wondering “What happens to my mortgage when I sell my UK house?”, you have two options: pay off the mortgage after selling the house or move to another property.

How To Buy And Sell A House At The Same Time

Transferring your mortgage refers to the process of transferring your existing mortgage agreement to your new home. Find out all about mortgage transfers and whether it’s the best option for you in our guide.

Whether a home loan transfer or repayment is the best option depends entirely on individual circumstances:

There are some additional costs to consider when selling your home before paying off your mortgage. The main costs to consider are:

If you are thinking of selling your home before paying off your loan and want a quick sale, contact our friendly cash professionals.

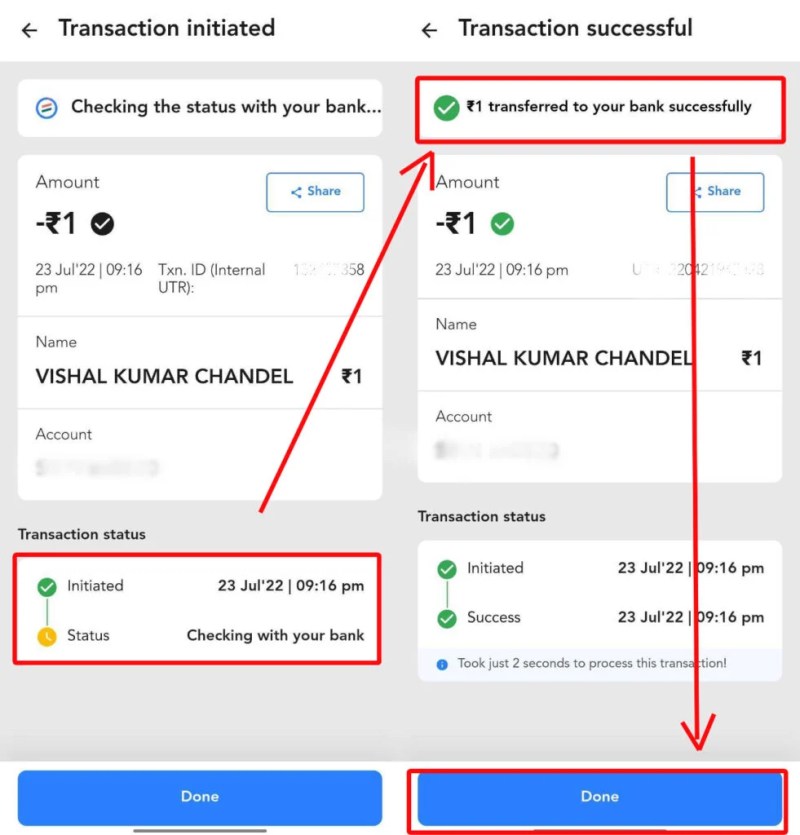

What Documents You Should Save To Prove You’ve Paid Off Your Mortgage

We are proud to be the most regulated real estate buyer in the Fast Home Sell industry. We are an active member of the NAPB (National Association of Estate Agents) and RICS regulated, which means you can sell your home to us quickly and easily. As a homeowner, what happens to the sales process after your home is sold? Need to get your mortgage back? Learn More.

Need to get your home back when selling your home? Get answers to this and other frequently asked questions about selling your property.

Most home sellers expect to make a profit when they sell their property in a volatile market. However, what many may not realize is that after the debt is paid off, all the remaining sales may not provide them with money that they can use immediately.

Those who used their savings to buy their property must return the original withdrawal amount plus accrued interest to their account after the sale. All housing allowances received and accrued interest must be returned to their current accounts. If the amount of the grant to be repaid is more than $30,000, part of it can be deposited into the contractor’s personal/retirement account and MediSave account.

Should You Sell Your House Before Buying A New One?

Since the savings are for your retirement needs, any money used to buy a home reduces the amount of pension you can receive. Therefore, when you sell the house, you have to pay back the amount you used and the interest on that amount.

Any amount you get back can be used to finance your home or further retirement. To help you better plan your finances, here are answers to frequently asked questions about what happens to the selling process after your home is sold.

Yes, if you’ve used a down payment or home loan service, you’ll have to repay the original amount you took out of the account, plus accrued interest. The amount of interest is the same amount you would have earned if you had kept the money in the account.

The returned amount will be used to top up your pension account up to your full pension. Any balance over and above the full pension will be paid to you in cash. You can access the website using Singpass to find out exactly how much you will get back when you sell your property.

A Legal Guide To Selling Your Home

All home sellers must return the original amount withdrawn from the home plus accrued interest. However, if you are 55 or older and you pledge your assets to pay out savings in a retirement account, you will have to pay back the amount pledged plus the principal withdrawn and accrued interest.

When you sell your home, you must also pay back the housing benefit you received, plus the interest that has accrued. Your housing grant refund will usually be credited to your checking account. However, if you have received more than $30,000 in grants, you can put some of this into your personal/retirement account and MediSave account. You can then use these funds for health care and retirement needs under various approved plans.

If the sale price after your home loan is paid off is not enough to cover the desired return, you do not have to pay a cash deduction if you sell the house for market value.

However, any optional fees (such as an option fee or an optional exercise fee) that you received from the cash buyer when the property was sold are considered part of the purchase price. This amount must be refunded to your account before the transaction can be completed.

Can You Sell A House With A Mortgage? Here’s What Happens

The method of distribution of proceeds from the sale depends on the type of property sold and when it is sold or refinanced.

If you bought or refinanced a private house on or after 1 September 2002, or if you bought a house from HDB, the refund will be split between you and your landlord’s account in the following categories:

In the case of private properties purchased before September 1, 2002, which were not subsequently refinanced, you can learn more about the distribution of refunds.

If you sell the property within three years of its purchase, you must pay a stamp duty deposit (SSD). This is set at 12%, 8% and 4% of the value of the property sold in the first, second and third year of sale.

Cpf For Home Purchase

If you use a broker to sell your property, you must pay a commission, which is usually 1% to 2% of the sale price. You should also take into account various other transaction costs such as administration fees (which range from US$40 to US$80 for HDB flats depending on the type of flat) and legal fees (for an HDB flat sold for US$500,000, legal fees are payable according to ‘ The seller’s fee ranges from $280 to $300 depending on the type of condo. When will you make your last mortgage payment? When selling a home, this is a detail you may forget or think about. So Read More Helpful Information about how to pay and when your final payment will be made before closing the purchase.

Tl/dr; The final payment time depends on the closing date and credit terms of the seller.

Selling house paying off mortgage, paying off mortgage after selling house, paying off mortgage when selling house, selling a house while still paying mortgage, selling a house before paying off mortgage, when do you stop paying mortgage when selling house, paying mortgage when selling house, selling home before paying off mortgage, paying off house mortgage, mortgage and selling your house, paying off your mortgage, can you sell your house before paying off the mortgage