Can You Sell A House While Paying Mortgage – Are you thinking about giving up your home but are having trouble deciding because of your mortgage? If you are moving or want to sell your property. You should know the pros and cons before making a decision.

Selling a home with a mortgage can be difficult if you don’t understand what it means. But at the same time It can give you an edge in the market.

Can You Sell A House While Paying Mortgage

So how do you decide? Let’s explore the pros and cons. of selling your home even if you have a mortgage.

How To Buy Another House While Owning A House

Selling your home is a decision that can change your life. It’s also hard to get it back if you make a different choice. Therefore, it is important to be sure of your choice.

If the value of your property has increased since you bought your home You can make a profit. Keep in mind that this method works even if you have finished paying off your loan.

This way, you can create additional funds for various investments. and improve overall financial stability. As a result, you will feel more confident when approaching opportunities and achieving success.

In this case, it is important to understand buying and selling real estate to ensure you follow the correct instructions from start to finish. You can check out How to Sell a Home on Arcadia to see how it works.

Can I Sell My House While In Forbearance?

One of the benefits of selling your home is that it can lower your monthly mortgage payments. This will give you more budget for other expenses and investments.

It also provides you with financial opportunities and avenues that will help you achieve your long-term goals. This is because you have more financial flexibility and can make strategic decisions.

Selling your home gives you the opportunity to move into a new home that suits your lifestyle and current financial situation. Some common reasons for moving include family-sized accommodations, job transfer, expenses, and more.

Whatever the reason and timing of your move, You must be able to showcase the home even if you live there. It’s best to list your property as soon as you post your ad. That way, you’re always available to anyone who wants to inspect the home in person.

Should I Pay Off My Mortgage Early In This Economy?

When you sell your house You will receive your capital. This is especially useful if you need to cover expenses. related There may be costs for moving, repairs, etc.

Access to your home equity also gives you the leverage you need to reach your real estate goals. It also provides more flexibility in terms of financial support and security.

Repaying your loan on time has a positive effect on your credit report. So you want to make sure you maintain consistency even when you’re moving.

Selling your home with a mortgage is one way to continue meeting your payment obligations. This way, you can increase your credit score and improve your general financial worth.

Should I Pay Down My Mortgage Or Invest?

Keep in mind that you must definitely continue to find buyers who will pay on time. This way it won’t have a negative impact on your credit score and won’t be a waste of your effort.

Remember to be careful when choosing a buyer. This includes background checks and verification of ability to pay. You can also hire a real estate agent to help you find the perfect buyer.

Despite the advantages, you can expect to find some disadvantages. Please note that this affects the overall results. Therefore, it should be carefully considered. Some of them are as follows:

If you are thinking of selling your house Remember that you will usually have to pay a commission to your real estate agent. They usually calculate this fee as a percentage of the home’s final sale price. Therefore, it can affect your total income.

Which Comes First: Selling Your Home Or Buying A New One?

Before You Deal With a Real Estate Agent Please ask them about the fee structure and additional charges to avoid problems later. It also helps you set your expectations.

If the value of your home is less than what you owe on your mortgage You may find yourself in a tough spot where you need to sell short. This means selling your home for less than you owe on the mortgage.

Remember that short selling can affect your credit rating. It can also have long-term effects on your overall financial situation. Therefore, it is important to think carefully about all the implications and consider seeking professional advice before making a decision.

The real estate market is unpredictable. Prices fluctuate all the time. For this reason, you should keep in mind that if there is a foreclosure, You may not receive enough money from the home sale to repay the loan in full.

Tips To Sell Your Home For More Money

When this happens There can be serious financial implications for the situation outside your property. Therefore, it is best to check the market conditions and be strategic in looking for buyers.

If you are considering selling your home with a mortgage. It’s important to weigh the risks against the potential benefits. That way, you can carefully plan your next steps. And make sure those steps won’t cause any more problems.

The more you understand them, the better. The more informed your decisions will be, this way you can free yourself from debt and open up new housing opportunities!HDB What happens to your money after you sell your flat in Singapore? Find out where your money goes

Everyone should understand what happens to our money when we sell our private condominium or HDB land in Singapore so that we can plan the use of the proceeds carefully. Whether it is buying another property invest in the stock market start a business or allocate funds to pay for your child’s tuition.

Do You Really Need That 20 Percent Down Payment On A House?

For many reasons People often receive less money than they expected after selling real estate. If we intend to use the majority of this money for other purposes, such as opening a business, paying off debt, or investing We may be very surprised when we see how much money there is in our reality.

Let’s not delve into what happened from a transactional perspective. Instead, we focus on money. Selling your HDB involves several steps. First of all, you should have a 5-year MOP (minimum occupational period) if you are selling your HDB flat, although you can contact a real estate agent before this. But the transaction is completed only after MOP if you are selling personal property. You should also consider seller’s stamp duty (SSD), which applies to sellers who unload their property within three years of purchase.

Before you agree to sell your house You need to think about your housing options first. You should also know that it may take a few months for your money to come in from the sale of your property.

If you sell an HDB and buy another, you can use HDB’s Enhanced Contra Facility to reduce your cash outlay or loan requirements. If you are purchasing personal property You need to make sure you have a plan so that you can earn money from your sales. (and have a place to live) before paying for a new purchase

Buying A House In Canada With No Down Payment

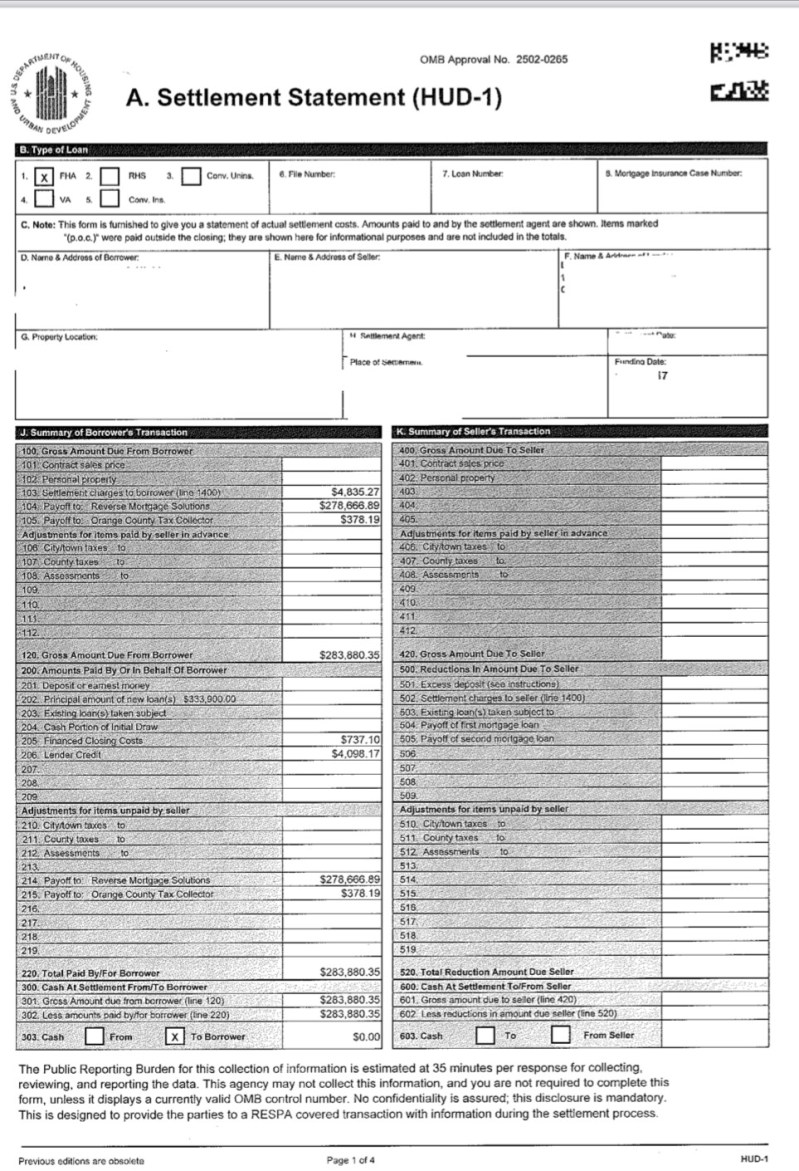

When you agree to sell your house You should consider how much money you will receive before making any other financial arrangements. Let’s use a simple example. to explain this process

Your debt is the first thing that needs to be paid off. This amount will be deducted from your sale. Your sale of $500,000 will be used to pay off the remaining HDB debt of $270,000, leaving you with a residual income of $230,000.

Read more: HDB or bank loan: pros and cons to consider before deciding which home loan to borrow

Down Payment: Next, you must return the money you “borrowed” from your CPF account, which can be up to the $37,500 down payment you made when purchasing the property. This is because you can pay the full down payment with money in your regular account if you take out an HDB loan.

Should You Make Extra Mortgage Payments? Compare Pros & Cons

Interest earned on prepayment: in addition to the principal amount used. You must also pay the accumulated interest “owed” on your CPF account. This is the 2.5% interest you earn if you don’t use the money. That’s about $5,100.

Stamp duty and other charges paid with your CPF: You can pay stamp duty and other charges, such as legal fees, in your Ordinary Account (OA) when you buy a BTO flat, which should total around $9,000.

Accumulated Interest on Stamp Duty and Other Charges: The accumulated interest on this first payment will be $1,200.

Monthly loan payments: During the five years you live in the home. You will need to repay the loan using CPF contributions. You will also need to repay this amount. In this scenario

Mortgage Repayment Calculator

Can you sell a house while still paying mortgage, how to sell your house while still paying mortgage, can you sell a house while paying mortgage, sell house while still paying mortgage, can you sell house while still paying mortgage, can i sell my house while paying mortgage, can you sell house before paying off mortgage, can i sell my house without paying off the mortgage, can you sell your house while paying mortgage, paying mortgage while selling house, can i sell my home while still paying mortgage, can you sell your house while still paying mortgage