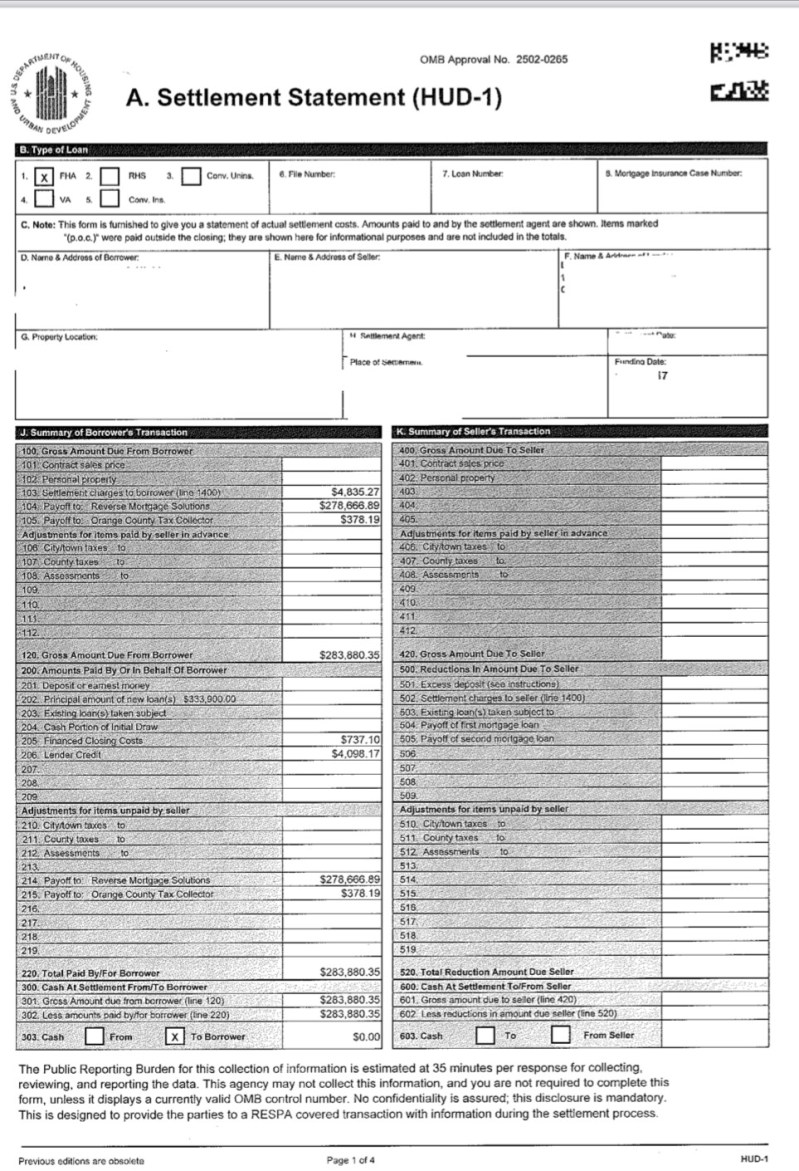

Can You Do A Reverse Mortgage On A Condo – A common misconception about reverse mortgages is that the lender owns your home. This is a lie. As long as you meet the terms of the loan and pay your property taxes and insurance, you will retain ownership of your home.

One of the most attractive benefits of reverse mortgage solutions is that instead of a traditional mortgage that you pay monthly, the payments are made to you while you live in your home. Contact us for more information.

Can You Do A Reverse Mortgage On A Condo

HECM reverse mortgages are insured by the federal government. Federal insurance comes with more security. If the loan is worth more than the home’s resale value, HECM mortgage insurance covers the difference. This means that the loan will only be fully paid off with the proceeds of the sale of your home and no more.

Phases Of A Reverse Mortgage Loan (infographic)

Every adult has different needs. So, there are different payment options to meet different needs. As opposed to receiving a large lump sum payment – you only pay interest on the funds you need each month for maintenance, which dramatically reduces the decline in home equity. Contact us for more information.

Most government benefit programs that are not means-tested, such as Social Security and Medicare, are not affected by reverse mortgages.

A home equity line of credit (HELOC) has traditionally been a very common tool to offer homeowners additional financial security. However, compared to a reverse line of credit, a HELOC can actually be a riskier financial strategy. For starters, HELOCs require a mortgage payment that eats into your cash flow every month… and with the FED planning to raise interest rates, that could get worse. Additionally, HELOCs have no annual interest rates and interest rates can be as high as 18% or more. This can lead to a large minimum monthly payment in the future, forcing you to use debt to support your lifestyle or empty your portfolio. It’s important to note that banks start paying off your HELOC after 10 years, which typically doubles your payment. This high payment can truly be a financial struggle for many seniors, and being forced to sell your home may be the only solution.

Even worse, if the home’s value drops, the bank will freeze your line of credit, destroying the financial security you had overnight. The only advantage HELOCs have over a reverse home loan is their lower closing costs – but when you consider the risks, they almost never make sense.

Reverse Mortgages Are Not A Last Resort!

Conversely, a reverse line of credit never requires a mortgage payment, which frees up significant cash flow. In addition, the interest rate has annual and lifetime caps below 10%, so the share consumption is still relatively low. Although the fees may be higher, because the bank never freezes the line of credit AND the line grows each year, a reverse line of credit is a much safer and more effective financial tool than a HELOC. Contact us for more information.

Reverse mortgages can be a very touchy subject depending on who you talk to and how knowledgeable they are. In fact, reverse mortgages have come a long way since their inception in the 1960s, and many people have worked hard to make sure they are a safe and viable option.

Many different people need to discuss a reverse mortgage. You may need to discuss this with your partner or discuss it with your elderly parents. For simplicity’s sake, we’ll discuss scenarios such as when you talk to your parents.

Scenario: Your parents know about reverse mortgages and how mortgages can help them, but are very skeptical.

Reverse Mortgage Companies

There are many different types of information about reverse mortgages. Some of them are correct, some are outdated and some are completely wrong. Reverse mortgages have been around for over four decades and have seen many changes and improvements during that time. It can be very helpful to have a conversation about what is true and what is false.

Guess what, the Great Recession made retirees more conservative than before. We’ve all heard of cutting back on prescriptions or keeping the temperature down to avoid going into debt in the winter. It may be a good idea to discuss how reverse mortgages work and what benefits they can provide for seniors who are going through a big change. An understanding approach and the right information can help a lot!

It can be really tempting to switch to a reverse mortgage. Like any other financial tool, a reverse mortgage is perfect in some situations and less so in others. Also, many mortgage brokers run ads aimed at attracting your parents’ interest. If possible, catch your parents before you make any decisions and gain important insights.

Answering television ads is one of the worst ways to get a reverse mortgage. Frankly, this is a bad way to deal with almost any financial instrument. Why?

Is A Reverse Mortgage Right For Me?

If a reverse mortgage is right for your parents, taking action is easy: Contact UMAX Mortgage. We take the time to understand your parents’ situation and get them the reverse mortgage they need. We also provide transparent guidance and insights to help you and your parents make the most of the situation. We are here to help you.

A person may be 62 years old and have the right amount of home equity, but those are not the only boxes that need to be checked for a reverse home loan to work for them. There are other compatibility factors to consider and hopefully an honest, loyal advisor.

Reverse mortgages are long-term decisions that force you and your parents to think about what the future holds. Will your parents be able to live in their own home in the next few years, or have they already lost a significant amount of their independence? Are you willing to help them grocery shop, take care of their property, and do housework?

While these conversations may not be fun, they are important and can save you and your loved ones a lot of headaches down the road.

How To Get Money Out Of Your Home Without Selling It: 4 Creative Ways To Do It

Scenario: Your parents are open to the idea of a reverse mortgage, but other relatives disagree.

This is a very common scenario and it’s not hard to see why. Reverse mortgages have a reputation, and it’s not a good one. Many of these negative views stem from misconceptions and misinformation. The rest depends on the actual problems with the HECM program. The good news is that these problems have been solved in recent years. Some common myths you may hear are:

Ultimately, a reverse mortgage can offer seniors valuable liquidity when they need it most. If you have done your research and consulted with UMAX, but your family is still struggling to agree on how to proceed, professional mediation can be very helpful.

This can be the best scenario as it gives you and your parents a great opportunity to find the perfect solution. Whether you know it or not, if you and your parents recognize that their cash flow needs to be adjusted and are willing to do something about it, you’re in a much better position than most families.

How To Qualify For A Reverse Mortgage And How Much You Can Borrow

You can take the time to explore all of your options for selling, renting, or downsizing the home. If a reverse mortgage is a good solution, contact our experienced mortgage advisors. We take the time to make sure you are fully informed so you can move forward with confidence.

Reverse mortgages have been around for over 40 years. During this time, they have evolved and evolved to meet the needs of homeowners while protecting their interests. As a result, it has gotten to the point where reverse mortgages can really make a positive difference for many people. At UMAX Mortgage, we pride ourselves on helping hard-working people make the most of their real estate and financial opportunities.

1961: The reverse mortgage was invented by Nelson Haynes, a mortgage broker in Portland, Maine. He created a mortgage to help a widow named Nellie Young stay in her home after the loss of her husband, Haynes’ high school football coach.

About eight years after the first reverse mortgage was created, Yung Ping Chen, a UCLA professor, gave a congressional hearing in support of a mortgage that would allow homeowners to enjoy the value of their homes. This caught the attention of the chairman of the Senate Aging Committee. It was not until the eighties that more success was achieved.

Reverse Mortgage Loans: Home Financing For Seniors

1983: Congress held its first hearing on reverse mortgages. Senator John Heinz proposed that reverse mortgages be insured by the Federal Housing Administration (FHA) and Home Equity.

Reverse mortgage condo guidelines, non fha approved condo reverse mortgage, what age can you do reverse mortgage, reverse mortgage condo, reverse mortgage on condo, can you do a reverse mortgage on a manufactured home, can i get a reverse mortgage on a condo, can you do a reverse mortgage on a mobile home, when can you do a reverse mortgage, reverse mortgage condo requirements, can you get a reverse mortgage on a condo, can you do a reverse mortgage on a condo