What To Do When You Owe The Irs – If you’re a taxpayer who owes taxes, you’ve probably wondered for a long time how much you owe to the IRS or the government. Some people find out how much they owe when they receive a notice from the IRS about unpaid debts. But we certainly don’t want to wait for that to happen.

There are several ways to find out how much you owe the IRS. You can check by mail, by phone, or online. We will describe these options in more detail and how to do each.

What To Do When You Owe The Irs

The IRS offers an online tool to find out how much tax you owe. The tool shows the principal balance and any penalties or interest for each tax year. It also shows the payments you have made in the last 18 months and the repayment amount.

Irs Audit: What Increases Odds Of One And What To Do If I’m Audited?

One of the reasons the online IRS tool is so convenient is that it provides up-to-date information. This is probably the most convenient way to get information about your tax payments. You must have an account on the IRS website to use this service. Make sure you have the following information ready when you register:

The best thing about the online tool is that it updates the interest and penalties every 24 hours, making the information reliable. You can also view or print transcripts here. If you want to request a transcript by mail, it will take five to ten days. Payments usually take one to three weeks to post.

Here’s where to find the IRS online tool. If you don’t know what years you owe, as long as the system allows. Sometimes a mail order is required for records older than 10 years as noted below.

You can also call the IRS directly to ask how much you owe. Taxpayers can call 1-800-829-1040. Lines are open Monday through Friday from 7:00 a.m. to 1:00 p.m. For business taxpayers, call 1-800-829-1240 during the same days and hours. Note that it may take some time in line to speak to someone.

What To Do If You Owe Back Taxes

If you’ve already received a notice from the IRS, you can check your balance in the notice that was mailed to you. If you have a few years, we strongly recommend this method because you may miss a notification because you send a lot. The notice must specify the amount, interest and penalties. Note that the IRS mailed notice covers only one year of tax owed. So if you owe for two years, you have to add the amount on the notice they sent you in the mail. If you believe the IRS has missed a report for a tax year or two, it would be a good idea to call them and find out how much you owe the IRS. You can call the number you provided in the ad.

The IRS website also shows other ways to find out how much you owe, depending on your situation.

If you are a business or individual that files a form other than the 1040, you can get a copy by submitting a 4506-T transcript request. Check the “Account Registration” box. This will include a copy of the declaration and all relevant information. Form 4506-T allows you to request only four records at a time.

Technically, an account decryption request will have residual fees, but account registration is a more comprehensive approach.

Will You Get A Tax Refund Or Owe The Irs? 32% Of Americans Don’t Know

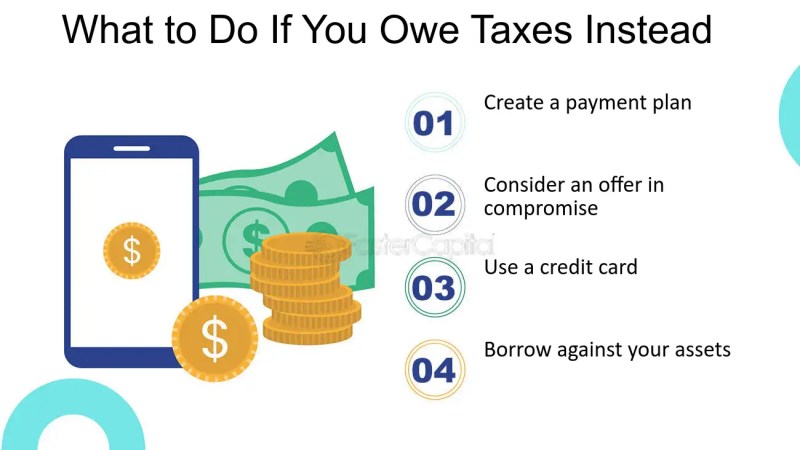

Once you know how much you owe the IRS, the next step is to pay. In some cases, the accumulated amount may turn out to be too high or for some reasons it may be difficult to pay the required amount. In this case, there are also several options for paying off your tax debt if you have trouble paying the amount the IRS is asking you to pay. We recommend that you consult with a tax attorney before making any of the decisions below, unless you cannot afford to do so.

A payment plan allows you to make monthly payments to the IRS until the debt is paid off in full. The terms of the payment plan will depend on your financial situation. The amount you owe is also taken into account. If you owe more than $50,000, the IRS must provide you with financial information before agreeing to a payment plan. If you owe $50,000 or less, you are eligible for a payment agreement without having to provide financial information. The maximum term of a payment plan or payment agreement is 72 months.

Note that in order to qualify for a settlement, you must also be current on your tax returns. If you are self-employed, you should be up to date with your current quarterly tax payments. And if you have employees, you’ll need to continually update your payroll and Form 941 filings to get a payment plan. For more information, see our guide to IRS payment plans.

Getting a settlement offer allows you to pay off your tax debt at a lower rate than the original amount owed. In some cases, $100,000 can be paid down to $1,000 or even $100 depending on your situation. While an OIC may not be the best option for everyone, it is the best solution to solving your tax debt, especially if you are struggling financially. People with low incomes and no assets usually get OIC approval.

You Owe Taxes, Now What

To get started, you need to complete IRS Form 656 and Form 433-A (OIC). For those who own a corporation, partnership, or LLC, you will also need to file an IRS Form 433-B (OIC).

To learn more about submitting a concession agreement, see our detailed preparation and presentation guide.

Finding non-collection status means the IRS will temporarily suspend collection against you. This is a different category of problem than OIC. If you CNC, you won’t pay anything, but it won’t last forever. Once the IRS determines that your financial situation has improved, it can start charging you again. If you earn or get close to the same amount each year, the IRS can continue to refinance your situation and the debts can stay that way until they are paid off.

If the tax lien is due soon, a CNC is sometimes a better option than an offer in compromise. Check the current status of the no-fee offer and call us to make sure you’re taking the right action.

How Much Do You Owe

Personal income tax returns must be filed with the taxpayer’s returns (the Tax Office cannot replace the returns) and must be kept for 3 years. Payroll taxes and sales taxes are not charged in bankruptcy. For more information, see Nolo’s guide to filing taxes in bankruptcy.

If most of your debt is tax debt, bankruptcy is not the best option. Most people who file for bankruptcy are eligible for an Offer in Compromise. A discount is better for your credit, and in many cases, tax debts can be completely dismissed as if they never existed, but the bankruptcy will stay on your record for a while.

If you have other debts that equal or exceed your tax debt, bankruptcy may be your best option. For more information, see our Commit vs Lose guide.

Do you have money to pay? This is usually the best way. If you have a lot of money, a lot of assets, or make a lot of money every month, you may not qualify as an engagement provider. The IRS will give you a 60-120 extension to pay in full by calling and asking. You only get one of these, so use them wisely. They usually give 60 days for in-stock cases and 120 days for out-of-stock cases.

What To Do If You Haven’t Filed Your Taxes In Years

No one wants to be on the bad side of the IRS. Consequences of not paying a debt or reaching a settlement with the IRS can include:

If you don’t pay your tax on time, you’ll be charged late fees and interest. This is problematic because you will pay more interest and penalties. If you accept a settlement offer, bankruptcy offer, or bankruptcy offer, these additional penalties may be waived and interest may be waived.

Most taxpayers do not file taxes when the IRS seizes their assets. The IRS can levy taxes on your assets, such as bank accounts, homes, and cars. If you don’t fix this, the IRS will be sleeping in your house at some point. And contrary to popular belief, the IRS does not immediately levy on your property or assets after receiving a notice. He usually takes

Owe the irs, what happens when you owe the irs, owe the irs help, do you owe the irs, what to do if you owe the irs back taxes, you owe the irs, owe taxes to irs, owe the irs money, owe money to the irs, what to do if you owe the irs, when you owe the irs, what to do when you owe the irs money