What Happens When Someone Puts A Lien On Your House – A foreclosure is a legal claim on property by someone other than the current owner. A lien can be placed for a variety of reasons, but usually revolves around some type of debt. If the property owner owes a debt to a creditor, contractor, or collection agency, that party can obtain a court order to place a lien on the property to collect the debt.

Did you take out a loan or provide a service that wasn’t paid in full? If so, you may be eligible to remortgage the property. The foreclosure process is very specific, so you should work with a real estate attorney. Here’s an overview of how to mortgage a property.

What Happens When Someone Puts A Lien On Your House

A mechanic’s lien is imposed by a contractor who has performed any services on the property. This includes construction, plumbing, HVAC, landscaping, and any other contractor or subcontractor services. If you have performed any service and have not received full payment, you have the right to file a mechanic’s lien under the right circumstances.

Can A Family Member Put A Lien On My House?

The first step to ensuring that you have the ability to file a mechanic’s lien is to let the owner and other parties involved know that you are starting work. If you don’t provide it, you may not have the legal right to repossess the property if needed later.

The next step is to send an invoice to the owner requesting payment. If you don’t receive full payment, you can send a notice of intent to default. This lets the owner know that if you don’t get paid in full, you’re willing to give up the property. If you don’t, you may also lose your legal right to an injunction.

If you still can’t get a commitment, you can file a lien with your local court. This part of the process is especially helpful for an attorney to ensure that it is done correctly. There are also specific deadlines that dictate when certain steps must be completed. After the lien is officially filed, a copy must be sent to the property owner.

Be careful to update within the limitation period to extend or cancel it as needed.

Title Has A Lien But Seller Has A Lien Release Letter That He Wants Me To Take Care Of After The Purchase.

Another common type of bond is a judicial bond. It is usually filed by a creditor who is owed a debt in an attempt to collect it. Contractors may file a mechanic’s lien even if there are circumstances that make it impossible to file a mechanic’s lien.

The first step is to file a lien in the county clerk’s office where the debtor currently owns the property. At this stage, it is advisable to consult with a lawyer to ensure that all necessary documents are submitted correctly.

In Texas, a judgment lien stays on the property for 10 years. This gives the debtor sufficient opportunity to repay the debt.

Whether you are a contractor or a lender, you deserve to be paid for your services. Filing a bond is one way to exercise your right to collect payment. Now that you have a general idea of how to foreclose on your property, it’s a good idea to have a real estate attorney work with you to ensure you don’t miss any important legal steps that could prevent you from receiving compensation. Kelly Legal Group works with all types of businesses to provide legal assistance.

What Is A Pre Lien Notice Letter?

Call today at (512) 505-0053 or request an appointment. We will fight for your right to be paid for services rendered. The O’Brien Law Firm represents bankruptcy clients in Kentucky and Southern Indiana. We offer in-person and video/phone counseling for people so they can understand their financial options from the comfort of their own home.

Your home is not just a place of refuge; It is often your most important investment and symbol of security. However, in the complex world of finance and law, there are circumstances when people can ask the worrisome question: Can someone mortgage my house without me knowing?

In this blog post, our Kentucky bankruptcy attorneys will explain the complexities of foreclosures, explore the circumstances under which they may be placed on your home, and discuss how the O’Brien Law Firm can help you protect your home and your financial interests.

If you have questions about real estate liens, call The O’Brien Law Firm at 502-339-0222 for a free consultation.

Liens: Key Risk Assessment Indicators

A real estate lien is a legal claim placed on a property to secure an unpaid debt. It serves as creditors or parties who have a claim against the property owner to protect their interests. When a home is in foreclosure, the property cannot be sold or transferred without discharging the debt or obligation associated with the lien. There are different types of property liens, including mortgage liens, tax liens, court liens, and mechanic’s liens. Each of them has different goals.

If the owner defaults on the principal, the creditor may have the right to initiate legal proceedings. These procedures may include taking out a loan to pay off your debt and possibly foreclosing on your property to satisfy your debt. The guarantee will remain until the payment of the debt or the expiry of the fine. It is important to note that mortgage payments must be paid before the owner can pay any liens.

Title liens come in many forms, each serving a unique purpose and stemming from different circumstances. Understanding these types of liens is essential because they have a significant impact on both homeowners and property owners. Whether you’re dealing with a mortgage lien, tax lien, court lien, or mechanic’s lien, each has its own legal implications and requirements.

Property owners willingly enter into voluntary bonds. The most common example of a voluntary bond is a mortgage. When individuals or businesses buy a home or property and need financing, they voluntarily take out a mortgage from a lender. This agreement allows the lender to seize the property as security for the loan. Although voluntary liens may seem burdensome, they are critical to securing financing and home ownership.

What Is A Tax Lien Sale?

An involuntary lien is usually the result of a legal or financial obligation that the owner has failed to meet. Common examples of involuntary liens are tax liens, court liens, and mechanic’s liens. This type of property lien can pose significant challenges for property owners. They may result in lawsuits, foreclosure proceedings, or restrictions on the sale or transfer of property.

A lien is a legal claim filed against real property or a person’s personal property based on a court order. When someone owes a debt or loses a lawsuit and the court awards the creditor or the winning party a financial judgment, a bond may be filed to ensure that the debt is satisfied.

This lien is mainly used as collateral that allows the creditor to claim the amount due by seizing and selling the debtor’s property, if necessary. A judgment lien can affect the debtor’s ability to sell or renovate their property because the lien must often be satisfied before any ownership can be transferred.

Court relationship has several meanings. This can interfere with the borrower’s ability to freely sell, transfer or refinance their assets, as potential buyers or lenders may be deterred by the foreclosure action.

Hidden Liens On A Car Title: What They Are And How To Spot Them — Dirt Legal

This allows the creditor to initiate a legal process, such as a foreclosure or foreclosure, to collect the debt by selling the property and use the proceeds to satisfy the judgment amount. This means that the debtor’s property is essentially held as collateral until the debt is paid, which can have significant financial and legal consequences for both parties.

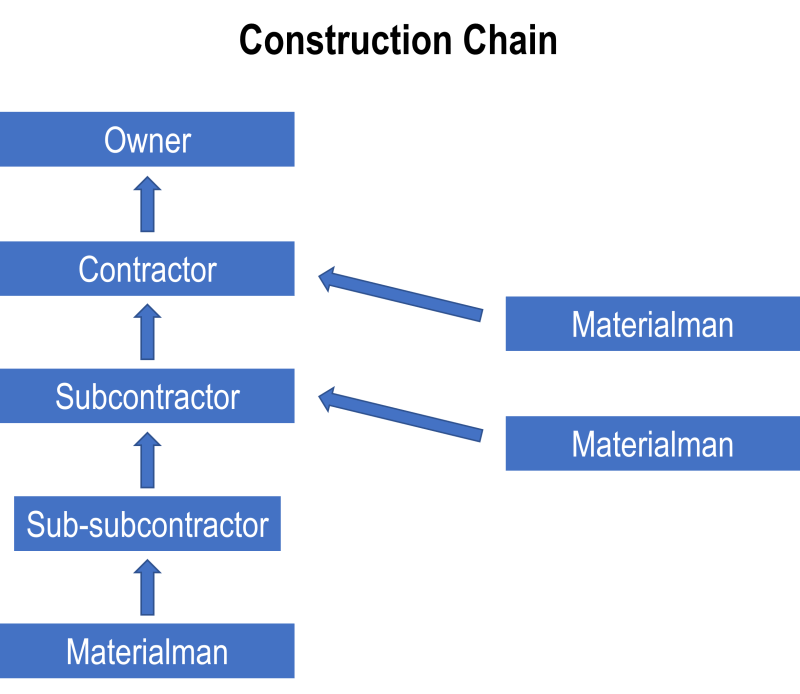

A construction lien, also known as a mechanic’s lien or contractor’s lien, is a legal claim filed against property by a contractor, subcontractor, or supplier who provided labor, materials, or services for a construction or improvement project and failed to perform properly. compensated. Construction liens are designed to protect the rights of those involved in the construction industry and ensure that they are compensated for their work.

When a construction lien is filed, it effectively encumbers the property, making it difficult for the owner to sell or refinance until the payment problem is resolved. Construction liens can lead to legal action, including foreclosure, if the debt remains unpaid.

A property tax lien is a legal claim filed against a property by a governmental entity, usually a local municipality or county, when a property owner fails to pay property taxes. These liens are a way for the government to secure unpaid property taxes to support public services such as schools, roads and emergency services. When a tax lien is placed on your property, you give the government the right to collect the taxes by selling the property at a tax sale if the owner fails to do so.

Fact Check: Kyle Rittenhouse Is Not Taking Hold Of Whoopi Goldberg’s Property

What happens when someone puts a lien on your house, what happens when a lien is put on your house, what happens when someone totals your car, what happens if a lien is put on your house, how can someone put a lien on your house, what happens if you have a lien on your car, what happens if you have a lien on your house, what happens when someone hits your car, what happens when someone crashes your car, what happens when a lien is placed on your home, what happens when someone steals your identity, what happens when someone hacks your phone