What Happens To Heloc When You Refinance – A cash out is a mortgage modification option that allows you to convert home equity into cash. The new mortgage is taken out for an amount greater than the previous mortgage balance and the difference is paid in cash.

In the real estate world, refinancing is generally the process of replacing an existing mortgage with a new one, which usually extends more favorable terms to the borrower. By refinancing your mortgage, you can lower your monthly mortgage payments, negotiate a lower interest rate, renegotiate current loan terms, add or remove borrowers from your loan obligations, and “refinance” your home equity.

What Happens To Heloc When You Refinance

A cash-out refinance allows you to use your home as collateral for a new loan, along with some cash, creating a new loan for a higher amount than you currently owe. Cashing out your home equity can be an easy way to get cash for emergencies, expenses and needs.

Home Equity Loan Vs. Mortgage: What’s The Difference?

Borrowers looking to refinance will find a lender willing to work with them. The lender will review the current terms of the mortgage, the balance required to repay the loan and the borrower’s credit profile. Lender offers based on placement analysis. The borrower gets a new loan that pays off the old one and locks them into a new monthly payment plan. Any amount above the deposit will be paid in cash.

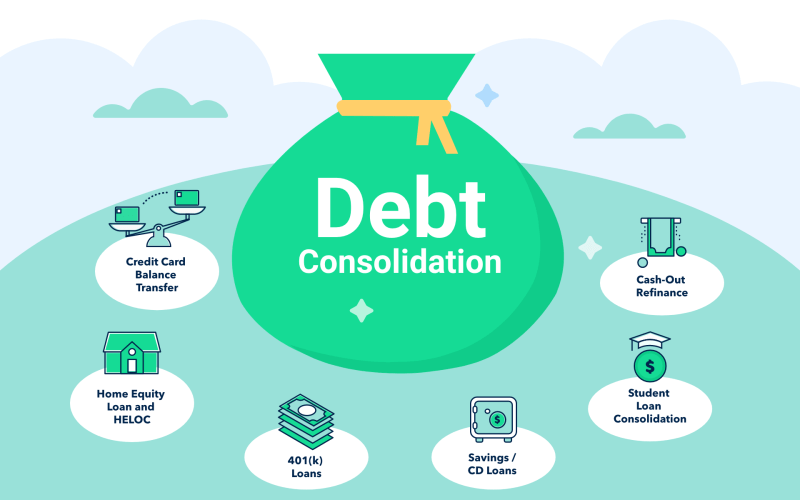

With a regular refinance, the borrower never sees any cash and their monthly payments go down. Withdrawals can be used however the borrower sees fit, but many use the money for larger expenses such as medical or educational expenses, debt consolidation, or as an emergency fund.

Cashing out lowers the equity in your home, which means the lender is taking on more risk. As a result, closing costs, fees or interest rates may be higher than with a typical refinance. Borrowers with special mortgages, such as US Department of Veterans Affairs (VA) loans, including cash-out loans, can often refinance with lower interest rates and fees than non-VA loans.

Lenders set credit limits on how much you can borrow with a cash-out refinance, which is usually 80 percent of your equity.

The Power Of A Heloc

Smart investors who keep an eye on interest rates from time to time often take advantage of the opportunity to refinance when loan rates drop to new lows. There are many different types of modification options, but in general, most of them have a number of additional costs and fees that make the timing of the loan refinance as important as the decision to refinance.

In addition to checking interest rates and payments to make sure refinancing is a good option, consider the reasons why you need the money. This financing option often comes with lower interest rates than unsecured debt such as credit cards or personal loans. However, unlike a credit card or personal loan, you can lose your home if you default on your mortgage or if your home’s value drops and you go into foreclosure.

Carefully consider whether your need for cash is worth the risk of losing your home if you can’t keep up with future payments. If you need cash to pay off consumer debt, take the necessary steps to control your spending so you don’t end up in a never-ending cycle of paying off debt. The Consumer Financial Protection Bureau (CFPB) has some good guidelines to help you decide if refinancing is a good option for you.

Cash-out restructuring gives the borrower all the benefits they want from a regular refinance, including a lower interest rate and other potentially beneficial improvements. Borrowers receive cash that can be used to pay off another large amount of debt or perhaps make a large purchase. This can be particularly useful when interest rates are low or during times of crisis, such as after the global lockdowns and lockdowns in 2020-21, where lower fees and a little extra cash can be very helpful.

Best Home Improvement Loans

Home equity loans and home equity lines of credit (HELOCs) are alternatives to cash-out (or installment) mortgage refinancing.

Let’s say you took out a $200,000 loan to buy a $300,000 property, and many years later you still owe $100,000. Assuming the property value does not fall below $300,000 and you have built up at least $200,000 in home equity. If interest rates drop and you need to refinance, you can approve up to 80% of your equity, the article says.

Most people don’t want to take on the future burden of another $200,000 in debt, but having equity can help increase the amount you can get in cash. Let’s say your lender is willing to give up 75% of your home’s value. For a $300,000 home, that would be $225,000. You need $100,000 to pay off the remaining principal. This leaves you with $125,000 in cash.

If you decide to get $50,000 in cash only, you refinance with a $150,000 mortgage with a smaller amount and new terms. The new loan can be $100,000 of the original loan plus the required $50,000 in cash.

Solved Can You Guys Solve This In Excel Please I Don’t Know

That is, you can take out a new loan of $150,000, get $50,000 in cash, and start a new monthly payment schedule for the entire amount. This is the advantage of secured loans. The downside is that your new home lien will apply to both the $100,000 and $50,000 because they will all be combined into one loan.

As mentioned above, borrowers have a variety of options when it comes to refinancing. The most basic type of mortgage modification is a refinance, also called a cash-out refinance. At this rate, you are trying to get a lower interest rate or adjust your loan term, but there is no change in your credit.

For example, if your property was purchased years ago when prices were high, it may be worth refinancing to take advantage of lower interest rates. Plus, the variables can change over your lifetime, allowing you to manage a 15-year mortgage (saving more on interest payments), even if it means giving up your lower monthly mortgage payment for 30 years. With rate and term upgrades, you can lower your rate, adjust to 15 years of payments, or do both. Nothing else changes, only the price and the word.

It has a purpose other than withdrawing cash. You get a tax-free difference between the two cash loans. This is possible because the lender only pays what is left of the original mortgage amount. Any loan amount from a modified and discharged mortgage is paid in cash at closing, which is usually 45-60 days after application.

Reverse Mortgage Refinance Guide: New Limits, Rates & Expert Tips!

Compared to payday loans, payday loans tend to have higher interest rates and other costs such as points. Payday loans are more complicated than interest and term loans and usually have higher collateral requirements. A high credit score and low loan-to-value (LTV) ratio can reduce some of your risk and help you get a better deal.

With a cash-out refinance, you pay off your current loan and get a new one. With a home equity loan, you take out a second mortgage in addition to the primary loan, which means you now have two rights to your property. This results in you having two different lenders each holding a lien on your home.

Home equity loan closing costs are usually lower than cash out. If you need a large amount of money for a specific purpose, a home equity loan can be helpful. However, if you can get a lower interest rate by cashing out, and you plan to stay in your home for a long time, refinancing makes more sense. In either case, make sure you can repay the new loan or you could lose your home.

Discrimination in mortgage lending is illegal. You can take action if you believe you have been discriminated against because of your race, religion, sex, marital status, access to public assistance, national identity, disability or age. One such step is to file a report with the Consumer Financial Protection Bureau (CFPB) or the US Department of Housing and Urban Development (HUD).

Debt Consolidation In Canada

Home equity is the market value of your home minus debts, such as what you owe on a mortgage or home equity loan. Your home equity may fluctuate depending on the state of the real estate market in the community or region in which you live.

To calculate your equity, simply subtract the remaining mortgage balance from the property’s market value. For example, if your home

What happens when you refinance a car, what happens to pmi when you refinance, what happens to escrow when you refinance, when you refinance a home loan what happens, what happens to equity when you refinance, can you refinance with a heloc, can you refinance with a heloc open, what happens to a heloc when you refinance, what happens when you refinance, refinance heloc to fixed rate, what happens when you refinance a house, can you refinance a heloc