What Happens If You Don T Pay Your State Taxes – Credit cards are a ubiquitous part of our lives and are still relevant (at least in Singapore), even in the era of e-wallets and other forms of digital payments.

Among their advantages are the speed of swiping (or tapping), ease of payment, and even the prestige of “platinum” or “titanium” cards. Plus, these shiny, sometimes colorful pieces of plastic offer discounts, rewards, or miles on purchases.

What Happens If You Don T Pay Your State Taxes

But before you ski, ski, fly with joy (or tap, tap, tap), it’s important to know that when you use a credit card, you’re not actually paying out of pocket at the time of the transaction.

Do Taxes Really Affect Your Credit Score?

Unlike a debit card, where fees are charged directly to your bank account, the fees charged to your credit card are essentially a short-term loan from the card issuer (such as a bank) that must be repaid. As with any loan, amounts owed are subject to interest.

On the other hand, if you pay all your card bills before they are due, you won’t have to pay interest on them.

The vocabulary of credit card terms is quite confusing. Here’s a quick look at 9 credit card terms that consumers tend to confuse.

Now that we understand the common terms used for credit card bills, you may be wondering: How exactly are we at risk of accumulating credit card debt and how can we avoid it?

When Should I Stop Using My Credit Card Before Bankruptcy?

When you use a credit card, you are essentially borrowing money from the organization or bank that issued the card. These funds are available to you up to a predetermined limit determined by the card issuer. Credit cards offer an interest-free period of approximately 20 to 25 days from the date of your spending. This means that if you pay your bill on time (within the interest-free period) and in full, you will not incur any interest.

On the other hand, late payments result in significant late fees, interest and administrative costs that can impact your cash flow for months or even years. Overdue payments are typically greater than S$100.

Although you can choose to repay only the minimum amount, this is not recommended as interest will still accrue on the amount remaining unpaid after the payment is due. They usually range from 26% to 28% per annum.

Credit card interest is calculated on a compound basis. This means that interest is charged not only on the outstanding transaction amount, but also on any existing interest payments. Since this amount is calculated daily, the amounts can snowball before you know it. Simply put, for every day an outstanding debt is deferred or rolled over, additional interest accrues.

What To Do If You’re Billed For Things You Never Got, Or You Get Unordered Products

Since credit card interest is calculated daily, if you only pay the minimum balance each month, the remaining balance will continue to roll over and grow daily. In the example above, you will reach your $5,000 credit limit in about a year.

When this happens, you won’t be able to spend more on your credit card and will have to pay off a large balance. Your minimum monthly payment jumped from $50 to $150 (3% of $5,000)—it would take you 197 months (16.4 years!) to cover this year’s expenses. In total, your interest on the $5,000 spent will be $15,473.

Paying off a credit card bill over 16 years can reduce your monthly financial resources, leaving less money for other expenses.

If you have outstanding amounts, there are 2 components: the total balance and the outstanding interest.

Manage Your Icloud Storage

It should be noted that when you pay only the minimum amount due on your credit card, this always applies to the payment of any outstanding interest. This means that if you only pay the minimum amount and it is less than the amount owed, it will not reduce your outstanding balance at all.

Failing to pay your credit card bills on time will affect your personal credit score and your ability to get another loan or the amount you can get. This can come as a rude shock to young couples who are trying to apply for a mortgage but find that the amount they qualify for is limited due to their past repayment behavior.

Warm fire is necessary for life, for example for cooking or heating in winter. But if fire is not controlled and monitored, it can easily burn down our homes.

Likewise, a credit card can offer us a lot of benefits, but if left unchecked and unchecked, it can leave us in deep debt or, worse, bankruptcy. As with the fire analogy, the key is how we choose to control and manage the use of the resources available to us. If you feel that a credit card is causing you too much hassle at your stage of life, you can also choose other suitable payment cards.

Why Saying ‘i Don’t Feel Good’ Is Important For Those Dealing With Depression

Talk to a wealth planner today for a financial health review and learn how to better plan your finances.

Alternatively, go to the Plan tab and invest in digibank to analyze your financial health in real time. The best part is that it’s hassle-free: we automatically calculate your cash flow and give you money advice.

This article is for information only and should not be relied upon as financial advice. Before making any decision to purchase, sell or hold any investment or insurance product, you should seek advice from a financial advisor regarding its suitability.

All investments involve risk and you may lose money on your investments. Invest only if you understand and can track your investments. Diversify your investments and avoid putting a large portion of your money into one product issuer. What if one episode contained every possible personal finance scenario that could affect you at any stage of your life. After all, it never hurts to be prepared. Skipping credit card bills and loan payments may seem like an easy solution when you’re financially strapped. The consequences you will have to endure are a completely different story. Credit cards, loans and the increasingly popular “buy now, pay later” services all contribute to the increasing amount of consumer debt that people face throughout their lives. Although every borrower is responsible for paying their bills on time and repaying their loans before they are due, not everyone is able to do so every time. What happens if you fail to meet your payments? Well, it depends on the type of debt you have on your plate. Read on to learn more about the different types of debt and what could happen to you if you miss your Buy Now, Pay Later, credit card, and loan payments. Secured Debt Vs. Unsecured Debt The main difference between secured and unsecured debt is that secured debt is tied to collateral while unsecured debt is not. Some examples of secured debts include mortgages, car loans, and pawn loans. The collateral for these three types of loans are your home, car, and anything of value (such as a vintage car collection, works of art, antiques, wines), respectively. Pawn loans are exclusively for wealthy borrowers. Unsecured debt includes things like credit cards, lines of credit, balance transfers, personal loans, student loans. When is your debt considered paid off? Your credit card debt or debt on an unsecured revolving credit facility, such as a line of credit, is considered past due if the minimum payment is not made by the due date. For a non-revolving unsecured loan, such as a term loan, your debt becomes dischargeable if the due payment amount is not paid on the due date. A home or car loan is considered delinquent if the monthly payment is not paid when due. Generally, banks and financial institutions are not allowed to provide you with additional unsecured credit if your credit card debt or any other unsecured loan is overdue for more than 60 days. This means you won’t be able to increase your credit limits or apply for or get new credit cards or other unsecured credit. What Happens If You Miss Your Credit Card Payments What Happens If You Miss Your Loan Payments What Happens If You Miss Buy Now, Pay Later. Valid until June 30, 2023. Terms and conditions apply. Enjoy low interest rates starting at 3.4% APR. (EIR 6.5% per annum). Valid until June 30, 2023. Terms and conditions apply. For existing debt consolidation plan holders, get 5% cashback when your debt consolidation plan is approved with HSBC. Valid until June 30, 2023. Terms and conditions apply. Apply now. Consequences of Not Paying Your Credit Card Bills #1: Increased interest and late fees. On top of the late fees and interest on your credit card balance that continue to mount and snowball every day, you’ll also have to deal with higher . interest rates and therefore higher fees until you make the payment. Instead of

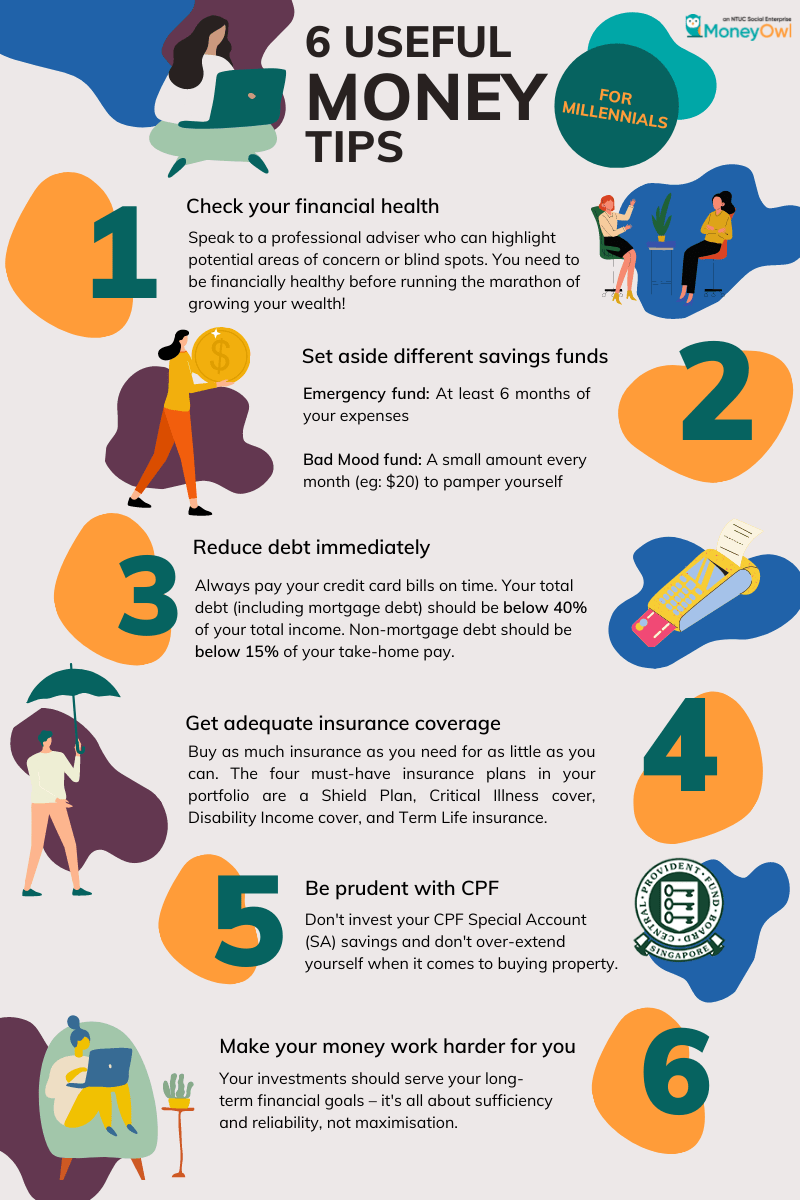

Money Tips For Millennials In Singapore

What happens if you don t file taxes on time, what happens if you don t pay your state taxes, what happens if you don t pay irs taxes, if you don t pay your taxes what happens, what happens if you don t pay your car taxes, what happens if you don t pay state taxes, what happens if you don t pay property taxes, what happens if you don t pay your city taxes, what happens if you don t pay taxes, what happens if you can t pay your taxes, what happens when you don t pay taxes, what happens if you don t pay your property taxes