What Happens If You Don T Pay Your Loan – Navigating the complexities of the medical payment system is extremely difficult. Before paying, make sure the service provider has calculated the bill accurately and that you owe it. You may also qualify for financial protection and assistance under federal and state laws.

Medical bills are complicated and often difficult to understand. Factors such as your health care provider, your health insurance company and your eligibility for financial assistance or “charitable services” will determine whether you owe a bill and, if so, how much. Additionally, laws at the federal and state levels can help protect you from certain medical bills, as well as protection from debt collections and credit reports.

What Happens If You Don T Pay Your Loan

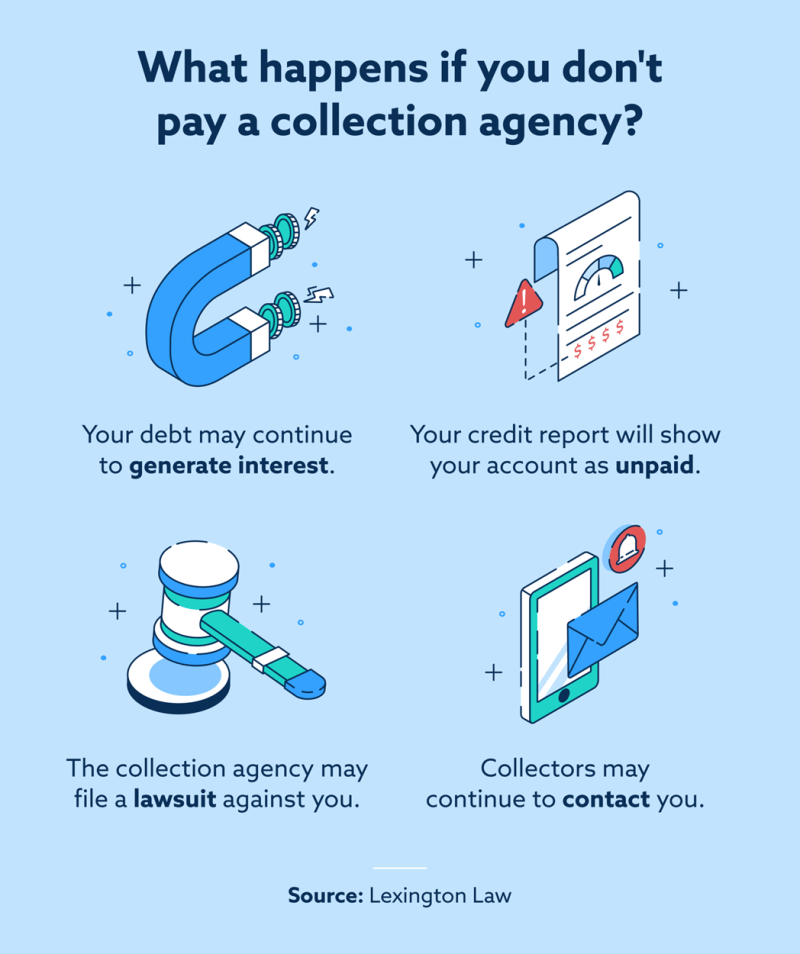

You can take steps to ensure your medical bills are billed correctly and that you get the financial or legal help you need. If you do nothing and don’t pay, you could face late fees and interest, debt collection, lawsuits, foreclosure, and a low credit score.

The Consequences Of Overdrawing A Checking Account

First, make sure you have debt. You could have already paid. It’s also possible that your service provider or debt collector may mistake you for someone with the same name.

Second, check the costs. If something goes wrong, ask for a detailed list of costs. Some issues to consider:

Find billing errors, such as paying twice for the same service or treatment. If you are unsure, contact your service provider’s accounting or billing office. Their number and contact details will be included on the invoice statement. You should do this quickly so you can pay off any bills that arise and avoid late fees and interest.

Third, if you disagree with the demands or want more information, you have the right to appeal to your health insurance company. You have the right to an “internal appeal” and “external review” of the allegation. Look at your health insurance policy and its “explanation of benefits.”

Estimated Tax Payments: What They Are And Who Needs To Make Them In 2024

Finally, remember that you can dispute medical bills with a claims adjuster or credit reporting company.

Starting January 1, 2022, the No Surprises Act (NSA) protects you from “surprise payments” if you have health insurance and provides protection against surprise medical bills if you are uninsured. If you have insurance, the law prohibits certain practices, such as paying out-of-network fees for emergency services. Check if this applies to you. These surprise payments usually occur after you receive care at an out-of-network facility or out-of-network provider and your insurance does not cover out-of-network costs. In this situation, the No Surprises Act can protect you from the difference between out-of-network costs and the amount paid by your health insurance. Some services, such as ground ambulance services, are not covered by the No Surprises Act.

Financial assistance programs, sometimes called “charitable services,” provide free or discounted health services to people who need help paying their medical bills. Under the Affordable Care Act (ACA), hospitals with 501(c)(3) nonprofit status must have a program to provide such assistance. Charitable care laws in some states also require hospitals to provide free or premium supplemental care.

Parent. If you enroll in and participate in the Qualified Medicare Beneficiary (QMB) program, physicians, providers, and other service providers cannot bill you for services and products covered by Medicare, including deductibles, coinsurance, and deductibles. If a service provider asks for payment, it is against the law. If the provider does not stop paying, call Medicare at 1-800-MEDICARE (1-800-633-4227). TTY users can call (877) 486-2048. If you are an eligible Medicare beneficiary, Medicare can ask your provider to stop billing you and refund any payments you have made.

Brushing Scams: How To Identify Them And Protect Your Identity

Veteran. You may qualify for financial hardship assistance. This assistance can include repayment plans, deductible relief, debt settlement and other assistance. If you need help understanding or disputing your bill, contact the VA Health Resource Center at 866-400-1238. Visit the VA financial hardship website to find out what options are available for your situation and how to apply for assistance. If you have a billing dispute, write a letter explaining the situation and send it to your local VA Medical Center in an envelope marked “Payment Dispute.”

Consumer assistance program. Many states offer assistance to consumers who have health insurance problems. This state map will help you find help in your state or territory.

State agencies, such as the state attorney general, state insurance department, or insurance commissioner, may also offer helpful information and complaint processes.

CFPB. If you are experiencing debt collection problems due to unexpected medical bills or on your credit report because unexpected medical expenses are listed as a negative item on your credit report, you can file a complaint with the CFPB online or by calling (855). 411-CFPB (2372).

Is It Normal To Lose Feelings In A Relationship?

We are the Consumer Financial Protection Bureau (CFPB), a US government agency that ensures that banks, lenders, and other financial companies treat you fairly.

The contents of this page provide general consumer information. This is not legal advice or regulatory guidance. The CFPB updates this information periodically. This information may contain links or hyperlinks to third party resources or content. We do not endorse any third parties and do not guarantee the accuracy of any third party information. There may be other resources that meet your needs. Alison Martin Alison MartinArrow Better Investor, Personal Finance Alison Martin contributes personal finance coverage, including mortgages, auto loans, and small business loans. Martin’s work began more than 10 years ago as a digital content strategist and has since been published in a number of prominent venues, including The Wall Street Journal, MSN Money, MoneyTalksNews, Investopedia, Experian, and on Credit.com. As a Certified Financial Education Educator (CFE), Martin also shares his passion for financial literacy and entrepreneurship through workshops and interactive programs. Connect with Alison Martin on LinkedIn Linkedin Alison Martin

Edited by Aylea Wilkins Edited by Aylea WilkinsArrow Better Editor, Student Loans Aylea Wilkins is an editor specializing in student loans. Previously, he edited content related to personal and home loans, as well as auto, home, and life insurance. He has been an editor professionally for nearly a decade, and his primary goal is to help people make confident financial and purchasing decisions with clear, unbiased information. Connect with Aylea Wilkins on LinkedIn Linkedin at Aylea Wilkins

Founded in 1976, the company has a long history of helping people make smart financial decisions. For more than four decades, we have maintained that reputation by clarifying the financial decision-making process and giving people confidence in what to do next.

What Should I Do If I Can’t Pay A Medical Bill?

Follows a strict editorial policy, so you can trust that we have your best interests at heart. All of our content is produced by highly trained professionals and edited by experts in the field who ensure that everything we publish is objective, accurate and reliable.

Our loan experts and editors focus on what matters most to consumers: different loan types, best interest rates, best lenders, debt resolution, and more, so you can invest your money with confidence.

Follows a strict editorial policy, so you can trust that we have your best interests at heart. Our award-winning editors and reporters produce honest and accurate content to help you make informed financial decisions.

We appreciate your trust. Our mission is to provide readers with accurate and unbiased information, and we use editorial standards to ensure this. Our editors and reporters carefully check editorial content to ensure the information you read is accurate. We protect the firewall between our advertisers and editors. Our editors receive no direct compensation from our advertisers.

Don’t Stifle Your Sneeze

The editors write on behalf of YOU, the reader. Our goal is to give you the best advice to help you make smart personal financial decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial staff receives no direct compensation from advertisers, and our content is carefully checked for accuracy. So, whether you read articles or reviews, you can be sure that you are getting authentic and reliable information.

Do you have money-related questions? You have the answers Our experts have been helping you take control of your money for more than four decades. We continually strive to provide consumers with the expert advice and tools they need to be successful on their lifelong financial journey.

Follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters produce honest and accurate content to help you make informed financial decisions. The content created by our editors is objective and factual and is not influenced by our advertisers.

We’re transparent about how we can provide you with quality content, competitive prices, and helpful tools while explaining how we make money.

What To Do If Your Partner Is Friends With An Ex (and You Don’t Like It)

Is an independent advertising-supported publishing and comparison service. We receive compensation for posting sponsored products and services or clicking certain links on our site. Therefore, this compensation can influence how, where and

What happens if you don t pay a personal loan, what happens if you don t pay your personal loan, what happens if you don t pay your loan, what happens if you don t pay a bank loan, what happens if i don t pay my personal loan, what happens if you don t pay a payday loan, what happens if i don t pay a loan back, what happens if i don t pay a payday loan, what happens if you don t pay a loan back, what happens if i don t pay a loan, what happens if you don t pay off a loan, what happens if you don t pay a loan