What Happens If Someone Else Is Driving My Rental Car And Gets In An Accident – When the person who took you to your car calls and says they’ve been in a car accident, it’s a bad situation. Everyone is fine, but the car is badly damaged. What happens now?

Many drivers do not know which insurance to use or who to apply for. Is it the owner of the car or the driver? Since you loaned your car to someone, will the insurance cover the damage or deny your claim?

What Happens If Someone Else Is Driving My Rental Car And Gets In An Accident

It is in your best interest to know all the facts about your car insurance policy and what to do when someone else is driving your car.

Person Enjoys Drinks On Their Dd Nights As They Can’t Operate A Vehicle, Gets Under A Friend’s Skin

In most states, the vehicle’s insurance will cover the vehicle instead of the driver, so any damage claim will almost certainly be handled by your insurance, regardless of who was at fault. driving. However, not all insurance providers are the same and different states have different requirements. It’s always a good idea to check your state’s specifications.

Depending on your insurance policy, they may also cover damage caused by vehicle rollover, hit and run or pothole.

Most insurance providers do not cover natural disasters, bodily injury expenses, accidents with animals or pedestrians.

Most of these insurances have a minimum level of coverage with the option of additional coverage for a higher price.

I Was Asked Why I Don’t Drive So I Wrote A Poem And Tried To Explain It. Does Anyone Else Struggle With Driving? It’s So Overwhelming

If the driver of your car is at fault, the insurance company will check the liability clause in your policy. This is the person who is not allowed to use your vehicle. Based on the findings, they will decide whether you are responsible or not.

It is possible that the damage to your vehicle will not be fully covered by your insurance. This may be due to the maximum coverage allowed by your policy, or you may have simply purchased this level of coverage through your insurance provider. If there are additional costs, they can be taken out of your pocket or the driver’s insurance can be used to cover the difference.

Even if your policy limits are sufficient to satisfy the claim, your insurance company may still want money back from the driver’s insurance. Your insurance company may pay the entire accident claim but may contact the driver’s insurance company to recover some of the costs.

In the event of an accident, you must prove that the driver of your vehicle is authorized to drive your vehicle. It’s not always easy to prove that they didn’t, because there isn’t much evidence to say that they did or didn’t. So always verify who collected your vehicle and record everything about when and why it was impounded.

Am I Insured To Drive Someone Else’s Car

In the event of an accident, make sure they get all the necessary information from the other driver about their insurance. Even if they are not at fault, your insurance provider will likely want to know about their coverage if your policy does not cover all costs.

When you’re not sure about your policy or what happens in the event of an accident, it’s always best to talk to a professional. It’s never a bad idea to talk to a Boston personal injury attorney, as most offer a free consultation to see if the case is legitimate. This can help protect you, if your friend does not want to pay you for the accident. Legal help can help you discuss your policy with your insurance provider and make sure they pay what they owe.

When you pay for car insurance, you have to decide who will be driving. As much as we want to trust our friends and family, you need to know their driving record and whether they have insurance. Don’t be afraid to pick someone up if they are known to be careless with their vehicle.

Law Credo is the world’s best legal guide providing comprehensive information on various legal terms relevant to your legal matter. You will get all very accurate and complete information for free. If you want to know about something that is not on our website, you can contact us through the Contact page. Many people who live in California let family and friends use their vehicles. Unfortunately, car accidents can happen with little warning. If you let someone borrow your car and it gets into an accident, it can be very troublesome and frustrating. Additionally, the legal issues that follow most car accidents can be very difficult to navigate. Finally, the added factor of someone else driving your vehicle can make a difficult situation more difficult.

Car Accident Claims & Injury Compensation Amounts

At a basic level, when someone else borrows your car, they are effectively borrowing your insurance. This is because your car insurance policy covers your vehicle, not you as the driver. So, if you borrow a friend’s car and they borrow your car, the two of you are effectively trading car insurance.

In California, the driver who causes a car accident is liable for all damages resulting from the accident. Their auto insurance policy may cover some or most of these damages, but the total cost of a serious accident may exceed the coverage available. If you let someone else drive your car and they get into an accident, your car insurance policy kicks in.

Proving fault after some California car accidents can be difficult. Working with an experienced attorney is not only the best way to establish full liability for car accident damages, but also the best way to maximize your recovery from a subsequent insurance claim or personal injury claim. Your attorney can help you gather evidence such as cell phone records, traffic camera footage, and witness testimony.

No matter how many car accidents happen, there are a few things every driver should know about managing the legal consequences of these situations. First, do not accept an insurance settlement without consulting an attorney. Agreeing to pay will prevent you from seeking further compensation for a similar incident in the future. Accepting early payment can result in much less compensation than you could legally claim. Always consult an attorney before contacting an insurance company after a car accident.

Black Box Policy: What If Someone Else Drives My Car?

Second, it is important to get as much information as possible from the scene immediately after the accident. If the driver of your vehicle has been involved in an accident and is able, they should take a picture of the accident scene, the injuries and the damage to the vehicle. These photos can be very important in insurance claims or personal injury claims in the future.

It is wise to consult an attorney after any car accident, but this is especially true if responsibility for what happened is not immediately clear. Your attorney will help you determine what evidence you need to establish fault in the accident, which may reduce your liability and obtain substantial compensation for your damages. Additionally, when someone else borrowed your car and was injured, your attorney can represent them as well or recommend a local personal injury attorney to represent them.

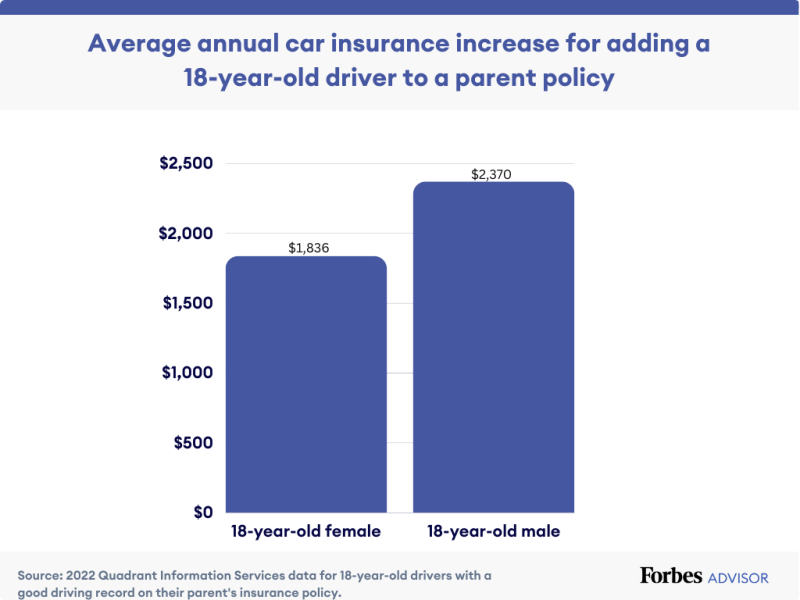

If a person other than the registered owner of a vehicle causes an accident while driving that vehicle, the victim has the right to file an insurance claim against the person’s car insurance policy -registered property. Remember that if you let someone else borrow your car, you are essentially letting them borrow your insurance policy as well. Therefore, you may see price increases or other penalties as a result of the lender’s actions.

Most car insurance carriers allow policyholders to add additional people to their policy, usually a spouse or other family members. It usually doesn’t matter if the driver of your car is listed on your insurance; Your insurance tracks your car. So, regardless of who was driving at the time of the accident, your insurance policy will come into play if the driver of your vehicle causes or takes part in the accident.

Can Someone Else Drive Your Car With An Ignition Interlock In Maryland?

If your vehicle loaner is involved in an accident and the other driver is at fault, California’s at-fault rule comes into play. Both you and the lender will have grounds to file a lawsuit against the at-fault driver’s insurance policy. You will receive the cost of repairing the vehicle, and the injured party will receive compensation for the injury from the at-fault driver’s insurance.

The California Department of Motor Vehicles (DMV) strongly recommends the purchase of insured/uninsured motorist coverage for any driver. Although not required by law, this type of coverage can be beneficial if you are involved in an accident caused by an uninsured driver. California has one of the highest rates of uninsured drivers in the country, and adding this coverage to your auto insurance policy is cost-effective.

We hope this answer clears up your questions about car insurance after a car accident when someone else is borrowing your vehicle. Easton & Easton is a full-service personal injury firm with years of experience representing clients injured in auto accidents. Our team has successfully represented many clients in cases involving very complex insurance matters, and we can apply that experience to your situation. Additionally, if you have legal questions about a recent accident involving your vehicle, we can help. Contact Easton and Easton today

If someone else is driving your car and gets into an accident, what happens if someone is driving your car and gets in an accident, what happens if someone else is driving my car and gets in an accident geico, what happens if someone else is driving my car and gets in an accident without insurance, what happens if someone else is driving my car and gets in an accident state farm, if someone else gets in an accident in your car, what happens if someone else is driving my car and gets in an accident, if someone else is driving your car and gets in an accident, if someone else is driving my car and gets in an accident, what happens if someone gets your ssn, what happens if my car gets towed, what happens if someone sues you after a car accident