What Happens If I Owe Taxes From A Previous Year – Paying taxes can be difficult, especially if you can’t file on time. In most cases, you won’t go to jail for a tax refund, but you will face interest or penalties.

Even if you cannot pay by age, you must extend the six-month period. Then check your options for how to pay off the debt.

What Happens If I Owe Taxes From A Previous Year

In this article, we will outline the consequences of not filing or not filing on time, and what you can do if you are the IRS.

Get Paid Online? Here’s How To Tell If You Owe The Irs Taxes

If you can’t pay taxes, you may think it’s worth filing a refund. However, this is the most important thing. You must return or collect to avoid failure to refund penalty. The penalty is equal to 5% of the unpaid amount and 25% of the monthly or unpaid tax.

Note: If the non-registration is due to fraud, the penalty of 5% per month will increase to 15% per month. For returns filed more than 60 days after the due date or an extended date, the penalty is $210 or equal to 100% of the unpaid tax (for returns due in 2019) .

Whether you owe taxes or are on current taxes, you could face huge penalties and interest over time if you don’t pay. The best penalty starts at 0.5% of your monthly salary (plus 25% of your debt). The tax rate is 6% in May 2019, but may change over time.

Understanding your options will help you decide what to do if the IRS. That way you can plan. Here are some of the most common options for people who are in debt and can’t pay.

Will I Get A Refund If I Owe Back Taxes? Unraveling The Irs Fresh Start Program

Taxpayers can set up a tax collection arrangement called an installment agreement. The type of deal you can get depends on your location, how much money you owe, and how quickly you can pay it off. You do not have to cancel the installment agreement if you have paid in installments within 120 days (see #2 below).

Fees or Charges: There is a $149 application fee for an online payment agreement, or $31 if the payment is electronic. $43 for low-income taxpayers. To request a reduced application fee, file Form 13844.

Required action: Complete an online Payment Agreement or Form 9465. You are not required to file a financial report for principal contracts of $50,000 or less. You can hire a professional to evaluate your situation and decide the best solution for you.

Pros: If you take out an installment plan, the interest on the unpaid balance drops to 0.25% per month until you pay the entire balance on time. Interest is charged at the short-term federal interest rate of 3% (interest rate subject to change quarterly). In general, the taxman can cancel the contract if you don’t pay on time.

Tax Underpayment Penalty: What It Is, Examples, And How To Avoid One

Form: Form 433-A or 433-F is required if the balance exceeds $50,000. You can pay with income deductions (Schedule 2159, Payment Reduction Agreement).

Related: Do Interest Plans or IRS Loans Show Up on Your Credit Report? Come out to find an expert.

Fees or Charges: There is no fee to request an extension. A monthly penalty of 0.5% will be charged on unpaid balances.

Pros: This option is good for taxpayers who need a short time to pay all their taxes. The IRS charges an additional 3% interest for the short term of the partnership (the interest rate is subject to change for each installment). With a short-term extension, you avoid application fees (see #1), but not late payment penalties and interest.

How Stock Options Are Taxed: Iso Vs Nso Tax Treatments

The IRS offers options for people in need, including current collection and compliance. For a hardship-based extension, you’re only eligible if you can prove that the tax return caused financial hardship, according to IRS financial standards.

Fees or Charges: No application fees to increase competition. There is no penalty, but interest is calculated with 3% on the partner’s short-term share (interest rate may vary per share).

You can ask someone you know—perhaps a friend or a family member—to lend you a loan. Prices and fees vary by source. This may be a cheaper option, but you should use your best judgment.

If your 401(k) plan accepts this type of loan, it is usually limited to 50%, up to a maximum of $50,000, and you must repay the money within five years.

Who Is Responsible For A Deceased Unpaid Tax?

Pros: If approved, you can borrow money from your 401(k) plan and it may cost you more to pay the taxes you owe. However, defaulting on a loan can affect your future retirement savings. If you don’t pay on time, you leave your company without repaying the loan, or your program ends, the loan is considered a dividend payment. Also, if you are under age 59½, the dividend tax is less than 10% of the first distribution.

Cash or Earnings: varies, usually about $2.49 to $3.95 (credit card) or 1.87% to 2.35% tax (credit card).

Pros: This type of payment is convenient and gives taxpayers greater control and flexibility in making payments. They can also earn points, miles or other credit card rewards. However, high credit card balances can affect your credit score, and prepaid credit cards may not be suitable for people with bad credit.

Our tax officer can help you with what steps to take if you owe tax but can’t pay. Get help from a trusted tax professional. Underpayment penalties are fines imposed on taxpayers who do not pay the estimated tax, have no withholding tax, or are late in filing. Individuals must pay at least 100% of last year’s income or 90% of this year’s income to avoid payment penalties.

Your Tax Questions Answered

Tax penalties are imposed on individual or corporate taxpayers who fail to pay enough of their estimated income and withhold their due amounts. Taxpayers can consult the IRS instructions on Schedule 2210 to determine if they need to report a tax return and pay a penalty.

Tax laws require taxpayers to file taxes as they earn income throughout the year by making withholdings, making estimated tax payments, or both.

To avoid the full payment penalty, individuals with adjusted gross income (AGI) of $150,000 or less must pay the lesser of 90% of the current year’s taxes or 100% of the taxes of the previous year, including estimated taxes. An individual with an AGI of more than $150,000 in the previous tax year must pay 90% of the tax owed for the current year or 110% of the individual’s previous tax return.

Taxpayers are exempt from paying tax due to a tax year that is not due for tax due in a tax year.

Things Not To Do If You Owe Back Taxes

Self-employed taxpayers should consider their Social Security and Medicare tax liability when calculating the applicable amount.

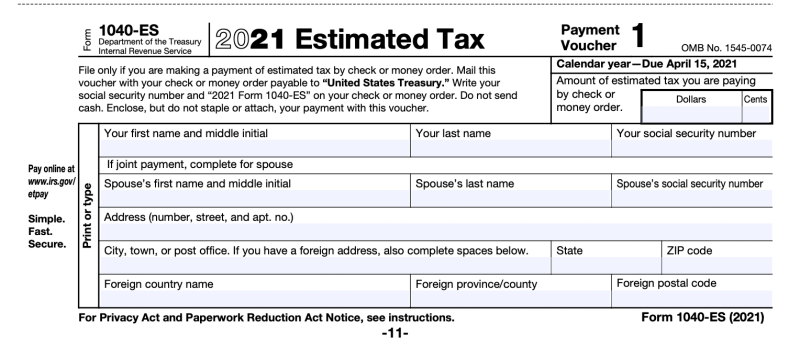

Some taxpayers, such as sole proprietors, partnerships, and S corporation shareholders, must file four annual tax returns, even if they file more than that. Taxpayers who receive their income in installments may in some cases pay different amounts each quarter. Taxpayers can use IRS Form 2210 to determine if their withholding and estimated taxes for a year are sufficient.

Taxpayers must pay the difference, as well as the amount owed and the amount of time that has passed if they know they have not paid.

The penalty is not a fixed rate or flat dollar amount. This depends on a number of factors, including your credit score and the length of time you haven’t paid taxes. There is a penalty for non-payment, which is 0.5% of the loan per month and part of the month is tax-free.

Do I Have A Tax Refund From 2019? Irs Has $1.5b Unclaimed

Unpaid and delinquent taxes can add interest. The IRS sets the interest rate quarterly, usually at the federal short-term rate and 3% for most taxpayers.

This share is 8% of personal income and 7% of corporate income in the fourth quarter of 2023 (Q4) and the first quarter of 2024 (Q1).

If you owe $5,000 in annual taxes, you will pay $3,000 less in taxes if you pay $2,000, which is more than $1,000 and you don’t pay at least 90% of what you owe. So if you don’t meet a certain standard you will receive a minimum wage. The punishment will be the government’s punishment for a short period of time plus three percent of the period. That rate is 8% through 2024, or $240.

The best way to avoid underpayment penalties is to take steps to ensure your taxes are paid on time. You can avoid prepayment penalties if:

Restricted Stock Units: How Rsus Work

In some cases you may be entitled to reduced compensation

What happens if i owe taxes from a previous year, what to do if you owe taxes, what to do if i owe back taxes, what happens if you owe taxes, what happens if i owe state taxes, owe taxes from previous year, what if i owe taxes from a previous year, what happens if i owe taxes, if you owe taxes from previous year, if you owe back taxes what happens, what happens if you owe federal taxes, what to do if i owe taxes