Trading In Car You Owe Money On – There are many reasons why you might decide to sell your car before paying it off: your loan payments are too high, the car didn’t pass your test, or it no longer meets your needs. that

You can still sell your car even if you owe it on the loan. This sale involves only one step in the transaction: closing the loan with your lender.

Trading In Car You Owe Money On

Your best course of action will depend on how you plan to sell your car and whether you have positive or negative equity in the vehicle. Although negative equity (having more than the car’s loan value) can be problematic, recent increases in used car prices are helping some sellers avoid this scenario.

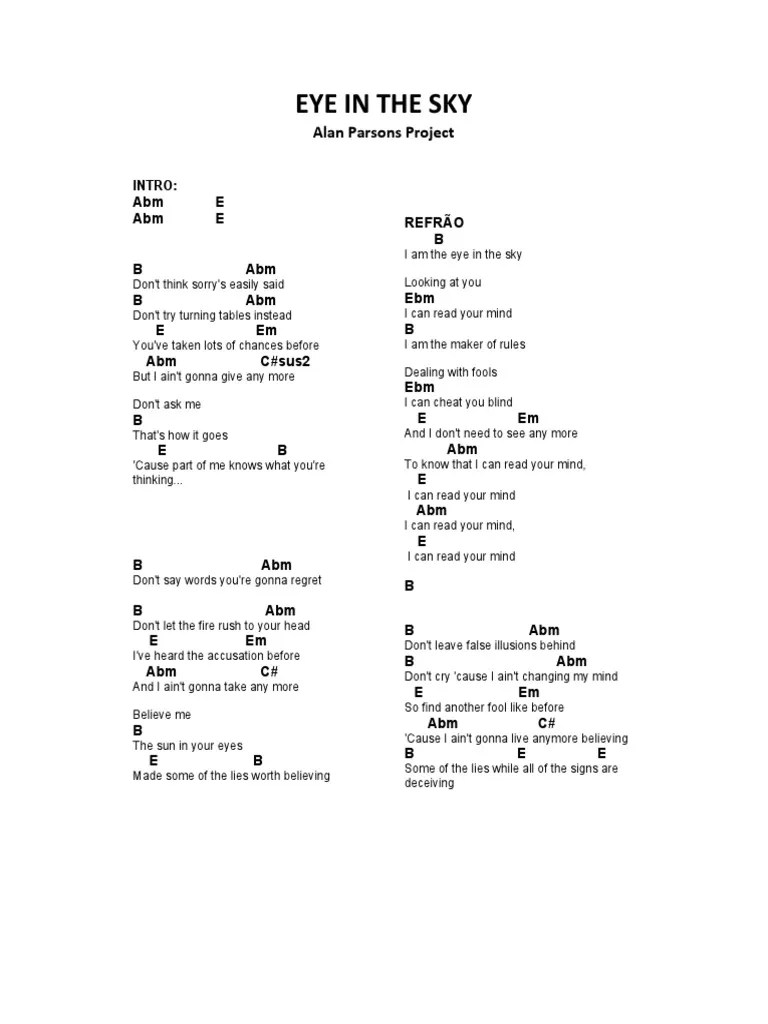

How To Trade In A Financed Vehicle (4 Things You Need To Know!)

If you’re wondering how to sell your car and start making payments, here’s what you need to do.

The editorial section is your source for automotive news and reviews. In accordance with our long-standing ethics policy, editors and reviewers do not accept gifts or free trips from automakers. The editorial department is independent of the advertising, sales and sponsored content departments.

Wild New Hyundai Santa Fe Jan 25, 2024 $35,345 2025 Chevrolet Silverado HD Gets Trail Boss Package, More Standard Equipment Jan 25, 2024 2024 Porsche Macan EV Taycan-Style Jan 25, 2024 In March 2024, Porsche acquired the Macan EV.

News Current Affairs: How Our Tesla Model Y and Jeep Grand Cherokee 4xe Handled Chicago’s Subzero Temperatures Brian Normal and Damon Bell January 18, 2024

Trade In Your Car With A Loan For Cheaper Car

Expert Review 2024 Acura MDX Type S Quick Spin: Price Performance By Jennifer Geiger News Editor

Expert Review 2024 Lotus Elter R Quick Spin: Not Your Traditional Lotus By Aaron Bergman, Detroit Bureau Chief

Expert Review 2023 Mercedes-AMG SL43 Quick Turn: Proof You Really Don’t Need a V-8 By Aaron Bergman Detroit Bureau Chief Holliday. Arrowright Author Johnson Award-winning author Holly Johnson writes expert content on personal finance, credit cards, loyalty and insurance. In addition to writing for CreditCards.com, Johnson regularly works for clients including CNN, Forbes Advisor, LendingTree and Time Magazine. Holi Day on Twitter. Holly D on Twitter with Johnson Holly D. Connect with Johnson on LinkedIn. Contact Johnson

Edited by Rhys Subitch Rhys SubitchArrow Right Editor Personal Loans, Car Loans & Debt Rhys Subitch is an editor who leads an editorial team dedicated to creating educational content about debt products for all areas of life. Connect with Rhys Subitch on LinkedIn Connect with Rhys Subitch by Email Connect with Rhys Subitch

Trading In A Car That’s Still Financed

Founded in 1976, the company has years of experience helping people make smart financial choices. For more than four decades, we’ve maintained this reputation for making financial decisions easier and giving people confidence in what to do next.

With strict corporate policies in place, you can rest assured that we put your best interests first. All of our content is written by highly qualified experts and edited by subject matter experts to ensure that everything we publish is factual, accurate and reliable.

Our credit reporters and editors focus on a variety of financing options that consumers care about most, the best interest rates, the best lenders, how to pay off debt, and more, so you can feel confident investing your money.

With strict corporate policies in place, you can rest assured that we put your best interests first. Our award-winning editors and reporters create honest, accurate content to help you make smart financial decisions.

What To Know About How To Sell A Financed Car

We appreciate your trust. Our mission is to provide our readers with accurate and unbiased information, and we have editorial standards to ensure this. Our editors and reporters carefully check the editorial content to ensure that the information you read is accurate. We create a firewall between advertisers and the editorial team. Our editorial team does not receive direct compensation from advertisers.

The editorial team writing on behalf of you, the reader. Our goal is to provide you with the best advice to help you make smart personal financial decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team does not receive direct compensation from advertisers and carefully reviews our content to ensure accuracy. So whether you’re reading an article or a review, you can be sure you’re getting reliable and trustworthy information.

You have a money question. There are answers. Our experts have been helping you take control of your finances for over 40 years. We always strive to provide clients with the expert advice and tools they need to succeed on their financial journey.

We adhere to strict editorial policies, so you can be confident that our content is honest and accurate. Our award-winning editors and reporters create honest, accurate content to help you make smart financial decisions. The content created by our editors is factual and factual and not influenced by our advertisers.

How To Trade In A Car That’s Not Paid Off Indiana

We make it clear that we can bring you quality content, competitive pricing, and the tools you need to explain how you’re making money.

Is an independent, ad-supported publisher and competition service. We receive compensation in exchange for the placement of sponsored products or services or for clicking on certain links posted on your site. Therefore, except where prohibited by law for our mortgage, home equity and other home finance products, how, where and in what order these products appear in the categories listed may affect these returns. Other factors, such as our website rules and whether products are offered in your region or within your selected credit score range, may affect how and where products appear on this site. While we strive to provide a broad range of offers, this does not include information on financial or credit products and services.

Between inventory shortages and skyrocketing prices, the auto market has been tough to navigate the last few years. However, in September, the average price of new cars decreased slightly for the first time in five months. According to Kelly Blue Book, used car prices have also stabilized.

If market changes have forced you to replace your car with new tires, don’t rush to the dealer and miss out on a lot. First, take steps to increase the car’s trade-in value. This includes researching your car’s current value, fixing mechanical issues, and making sure your car looks its best.

Trade In A Car That’s Not Paid Off In 3 Steps

Knowing the car’s value is important, especially if you plan to trade it in. Do your research to find the current value of your vehicle. You can use resources like Clay Blue Book and Edmonds to get current resale values, but you need to be honest with yourself about the repair and condition of your vehicle.

Also, remember that you will get less money than you would sell your car for.

“A lot of people think they’re going to get a higher price,” says auto expert Lauren Fix, “but dealerships need a profit margin and will offer lower prices than those listed on these sites.”

The mechanical and physical condition of your car is a major driver of value. Therefore, it is better to solve any problem relatively easily.

Should You Trade In Your Car Or Sell It Privately?

In general, small repairs that won’t cost you much out of pocket and are likely to increase your vehicle’s resale value are worth considering. This can include minor cosmetic repairs like dents and scratches or replacing a dead light.

Research repairs that will increase your car’s resale value, calculate the costs associated with each repair, and determine which repairs are most cost-effective.

You should also check the National Highway Traffic Safety Administration for vehicle recalls that affect your vehicle. Recalled parts can be repaired free of charge, and the extra effort will increase the value of your car.

Keep receipts for repairs and maintenance and check your files for out-of-date files. This can prove to the dealer or buyer that the vehicle has been taken care of. Get your car’s history report to review when the dealer evaluates your trade-in.

How To Sell A Car You Still Owe Money On

Convenience points indicate that clean, well-maintained cars are likely to fetch the highest prices.

“Clean the car inside and out,” he said. “Detailing a car for resale is like building a house.”

Zach Shefska, founder and CEO of Your Car Advocate, believes that shopping around your car is possible.

For example, you should check with Carvana, Carmax, and other major used car dealers before discussing a trade-in with the dealer you plan to buy from. You can use these figures to calculate the base value of your car and do other pricing research.

How Soon Can You Trade In A Financed Car?

By negotiating your trade-in and purchase separately, you’ll be able to get the lowest possible price on your new vehicle.

Chefska advises buyers to be wary of dealers who try to bundle two transactions into one deal. They do this because the chances of making a profit are greater when both traders are working

Trading in a car you owe money on, trading car in when you owe money on it, trading in your car you owe money on, trading in a car you still owe, trading in my car that i still owe money on, trading in my car when i still owe money, trading your car in when you still owe, trading a car you owe money on, trading in a car you owe on, trading in a car i still owe money on, trading in a car you still owe money on, trading in car still owe money