Should I Rent Or Sell My Home Calculator – As a parent, you may want to ask yourself if it makes more sense and financial sense to sell your home or sell it. The decision can seem overwhelming as there are various factors to consider such as market trends, property valuation and future plans. The good news is that technology offers a solution with the Should I Sell or Rent My Home Calculator, a tool designed to help homeowners make an informed decision based on facts and figures.

“Sell or Rent My Home” is an easy-to-use online tool that helps homeowners calculate the potential financial results of selling their home versus renting. In many ways, this calculator will help you make the best decision for your specific financial needs and goals.

Should I Rent Or Sell My Home Calculator

3. Monthly rental income: A realistic estimate of the amount you can charge your tenants if you decide to rent.

How Do You Calculate A Cap Rate On A Rental Property?

5. Projected Annual Home Appreciation: An estimate of how much your property will be worth within a year.

Based on this information, the calculator will provide a comparison between the potential combined income from renting and selling the home.

1. Objective analysis. Accounting removes the guesswork and emotion by providing an objective assessment based on numbers and real data.

3. Easy to understand: The tool clearly highlights potential results and provides guidance on market conditions and economic trends.

Should You Sell Your House Before Buying A New One?

4. Informed Decision Making: This calculator gives you the knowledge to help you make a more confident decision on whether selling or renting is the right choice for you.

The “Should I Sell or Rent My Home” calculator is an invaluable aid to homeowners when making one of life’s most important financial decisions. With this simple tool, you can gain clarity and knowledge while deciding on the best course of action for your funds. Regardless of your choice, using this calculator makes more sense than being impulsive. Written by Sarah Lee Cain Written by Sarah Lee CainArrow Legal Insurance Associate Sarah Lee Cain is an experienced content marketing writer specializing in financial technology, credit and lending. , finances and personal confidence. His work has appeared in Fortune 500 companies, publications and startups such as Transferwise, Discover and Live Loans and KeyBank. Sarah Lee Kane

Edited by Michele Petry Edited by Michele PetryArrow Right Senior Editor, Home Lending Michele Petry is the senior editor who manages the site’s content. Michele Petry on LinkedIn Linkedin Contact Michael Petry Contact Michael Petry by Email

Founded in 1976, it has a long history of helping people make smart financial choices. We’ve maintained that reputation for four decades, empowering the financial decision-making process and giving people the confidence to take their next steps.

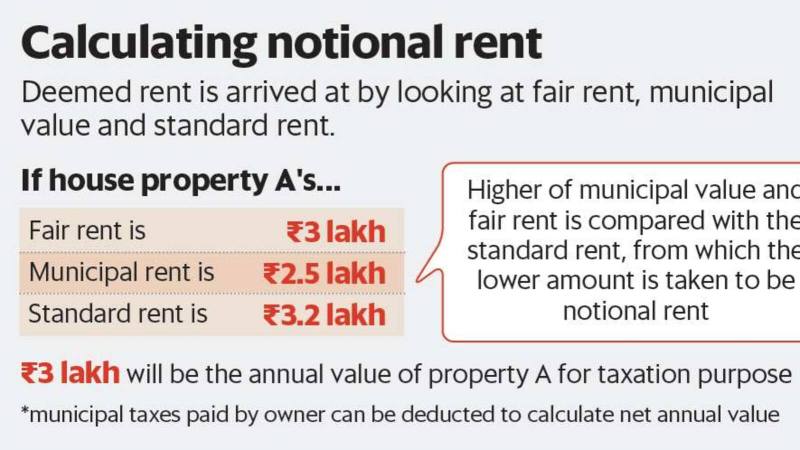

Itr Filing: How To Calculate Net Annual Value From House Property, Deductions Allowed From Rental Income

Follows a strict editorial policy, so you can be sure we put your interests first. All of our content editors are highly qualified and subject matter experts, ensuring that everything we publish is unbiased, accurate and reliable.

Buying or selling a home is one of the biggest financial decisions a person will make. Our live reporters and editors are dedicated to educating users about this life-changing deal and how to navigate the complex and ever-changing web. Finding the right agent to close and then help you feel confident that you are making the best and most professional real estate transaction.

Follows a strict editorial policy, so you can be sure we put your interests first. Our award-winning editors and reporters produce honest and accurate content to help you make the right financial decision.

We appreciate your trust. Our mission is to provide readers with accurate and balanced information, and we will have editorial standards in place to do this. Our editors and reporters review the editorial content to ensure the accuracy of the information you read. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Price To Rent Ratio: Determining If It’s Better To Buy Or Rent

Editors write for YOU, the reader. Our goal is to give you the best advice to help you create your personal financial plan. We follow strict guidelines so that our editorial content is not influenced by advertisements. Our editorial team receives no direct revenue from advertisers, and our content is carefully reviewed to maintain accuracy. So whether you’re reading an article or a review, you can be confident that you’re getting reliable and trustworthy information.

You have money problems. there are answers. Our experts have been helping you master your money for over four decades. We agree to provide the expert advice and tools you need to succeed in your financial life journey.

Follows a strict editorial policy, so you can be sure our content is fair and accurate. Our award-winning editors and reporters produce honest and accurate content to help you make the right financial decision. The content produced by our editorial team is unbiased, scientific and not influenced by our advertisements.

We are clear on how we can create quality content, competitive strategies and useful tools for you to make money.

What To Do If Your Landlord Decides To Sell Your Home

Is an independent publisher advertising support and investment service. We receive compensation in exchange for placing sponsored products and services or for clicking on specific links posted on our site. Therefore, this amendment may affect how, where and in what order products appear in many categories, except where prohibited by law in our mortgage, home equity and other lending products. . Other factors, such as custom page rules and whether a product is offered in your region or automatically selected within a custom credit score range, may also affect how and where the product on this site. Although we try to provide a wide range of offers, this does not include information about individual financial or credit products or services.

There are many reasons why he wants to move. But whatever your reason, one question remains: What will you do with your current home? Depending on your financial situation and the local housing market, it may be better to rent than to sell, or vice versa. If sales vs. If you’re stuck in the middle of selling your home, here’s a look at what factors to consider, including cost.

A home is the largest financial asset most people own, and deciding what to do with it should not be taken lightly. There are pros and cons to both: for example, you get a large amount of money down the road from a sale, while you get a small steady increase in monthly income from your tenants. If you can afford to live somewhere, let the house entertain you, renting also allows you to build equity to build the house. Find out which type is best for you in the following situations.

Selling your home is a good option if you need to pay cash for your next home

How Much Is Your House Worth?

If your ability to buy a new home is limited by access to cash tied up in your current home, selling is the best option. So you can take whatever you have from selling your home and put it into new money. Buying a new home while selling your current one can be a difficult balancing act, so be sure to work with an experienced real estate agent who can guide you through the process.

Managing a rental property is time-consuming and often complicated. Are you ready and able to organize yourself? If not, can you provide network managers? Consider whether you want to take on additional responsibility as a landlord, which means protecting tenants and property issues among other responsibilities, or paying a third party to take care of things .

Real estate prices have risen across the country in recent years, and housing prices remain high. Depending on how long you’ve owned your home, how much you paid, and how hot your local market is, they could sell it to you for a substantial net profit. Check out nearby real estate listings to see what homes similar to yours have sold for.

If you sell your home for a profit, you can exclude up to $250,000 of the capital gain from the sale (or up to $500,000 for a married couple) from taxes. To use it, your home must have been your primary residence for at least two of the last five years.

Real Estate Deal Analysis Spreadsheet

If your move is temporary and you plan to return to your city in the future, you may want to keep your home and rent it for the time being. Knowing you’ll have a place to live when you return can give you security and peace of mind — and if you’re in foreclosure, at a lower price than selling and buying another home later.

Extra income can be hard to come by

How much should i sell my house for calculator, sell my home calculator, should i sell or rent my home, should i sell my home, should i sell my house now or rent it out, should i sell my rental property calculator, should i rent my house or sell it, should i sell my house or rent it out calculator, should i rent or sell, should i rent or sell my home calculator, should i sell my condo or rent it out, should i sell my house calculator