My Car Has Been Repossessed What Do I Do – Owning a car may be a luxury, but it can also take up a large portion of your monthly salary. According to Experian, the average monthly payment is $554 for a new car and $391 for a used car. If you have other large financial obligations, such as a mortgage or student loans, you may struggle to keep up with your car payments.

Bad auto loans can ruin your credit and lead to car repossessing. Here’s what you need to know about the car repair process and your options.

My Car Has Been Repossessed What Do I Do

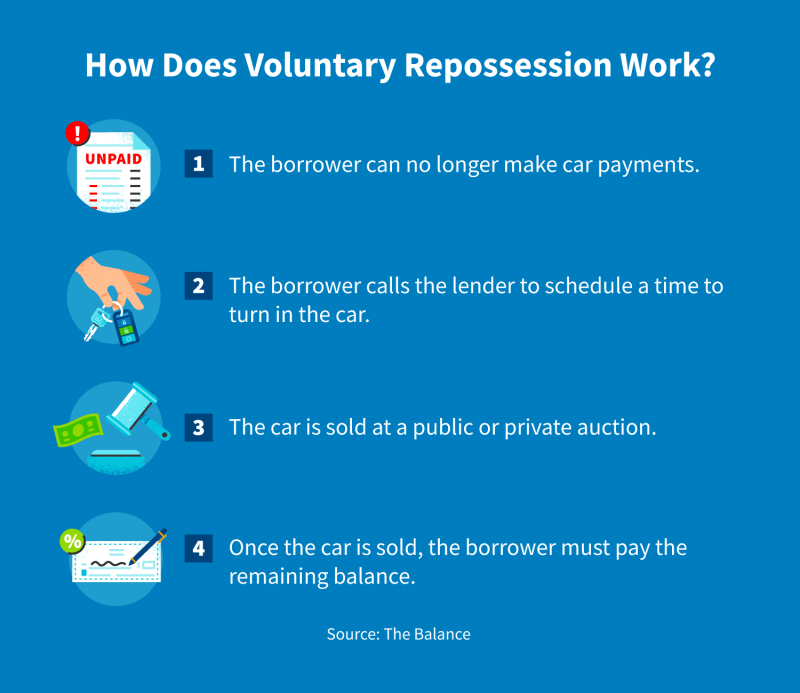

By taking out a car loan, you are entering into a legal agreement to make the required monthly payments on time. If you default, the lender can repossess your car and sell it at auction. They can retrieve your car at home, at work or wherever you go.

Can My Car Be Repossessed If I Make Partial Payments?

Automobile laws vary from state to state. In some states, lenders are not required to notify you of their intention to repossess the vehicle. So you can find an empty parking space instead of a car. Talk about a shocker!

The car repair process can be both scary and emotionally draining. What you need to do to overcome your situation.

Don’t hide from the problem. Contact the lender immediately and find out why your car was hit. The reason could be anything other than lack of payments. Cars can be towed because they are not adequately insured or because of an administrative error.

A quick phone call can clarify the situation and offer options for solving the problem.

My Car Was Repossessed: What Do I Need To Know?

If you are in default, you should check your finances before returning the car. Look at your budget and see if you can keep up with the car payment and other car expenses like gas and insurance.

You may feel emotional after your car is totaled, but remember that you have rights during this difficult time. Here are some examples of common problems you may encounter during the car repair process.

Pay off your loan. The easiest way to get a car repossessed is to pay off the loan in full. While this may not be possible for most, ask a friend or family member to help pay off the balance. Then make an express agreement that you will pay it back over time.

Agree on a payment plan. If you catch up on missed payments and prove that you can make future monthly payments, the lender may be willing to put you on a new payment plan.

Free Financial Assistance For Car Repossession For Low Income Families

Send a car. Sometimes it’s better to walk away if your finances are tight. Lenders auction revalued cars.

Remember that you owe more money to the lender after the sale. Let’s say the lender was able to sell your car at auction for $10,000, but your loan balance is $15,000. Once you get the other $5,000, you’re still hanging around.

File for bankruptcy before the car goes up for auction. Although not recommended, you can file for bankruptcy, which will temporarily prevent you from selling your car. This may give you time to find the money to pay off the loan.

But be careful; If the vehicle is the sole cause of the bankruptcy, this option should not be used. Bankruptcy has long-term financial consequences and will negatively affect your credit rating.

Inflation, High Car Prices Hurt Us Consumers And Boost Repo Demand

Refurbishing your car is a traumatic experience, but you should take it as a learning experience and improve your finances.

Determine how you can save on all areas of your life, including car-related expenses. A nice and expensive car is not worth your financial trouble. Choose a cheaper car or alternative means of transport to work or public transport.

Your credit can also take a big hit. Your bad debt can be sent to collection, and it can stay on your credit report for up to seven years. It is important to take steps to repair the damage. Always pay your dues on time and only start getting a new loan when you can pay safely.

If you have trouble paying other bills, you should seek help immediately. Talk to lenders to work out alternative payment plans and find ways to increase your income.

Can Bankruptcy Help Me Get My Car Back After Repossession?

Call to speak with a member of our team. We’ll ask you some basic questions to get to know you better and guide you through the process

And answer all the questions. No pressure to participate! Need a quick tip? Talk to one of you. Missing a car payment may not seem like a big deal, but missing a payment can result in your car being repossessed, depending on the lender and state laws. [1] So if you suspect you will miss a payment, contact your lender as soon as possible to make a plan. To help you understand common lender practices and repossession laws, this article covers the details of car repossession and what to do if you forget to pay your car loan.

Depending on your state’s laws and loan agreement, the repossession process may begin after you miss one car payment and you are considered delinquent.

Even if a default does not result in foreclosure, contacting your lender to resolve the situation early can help you avoid these negative effects on your finances and credit:

Buy Here Pay Here Repossession Laws

If you do not receive any payment, your account may be considered delinquent. Default refers to payments that have been missed for 30 days or longer, and creditors may use a different time frame before they consider your account in default: some may wait 90 days, some may wait longer, but some may wait less than 90 days. Missed payments can negatively affect your credit and make it harder to get a loan in the future.

If you forget to pay for your car, don’t panic. Follow these steps to see if you can get back on track.

Check the loan terms if you are not familiar with them. Find your paperwork from your lender and find information about late payments, payment deadlines, and the total balance of your loan. [1] If you can’t find your lender’s late payments and when they will be added to your balance, contact your lender to learn more about how late payments affect your credit terms.

Check if you’ve been late with payments in the past. If it’s rare, you can move on to the next step, but if your payments are late or not at all, you may want to evaluate whether a car loan is right for your financial situation. If a car loan is hurting your finances, it may be time to explore other options with your lender.

How To Get A Repo Off Your Credit Report (jan. 2024)

With a budget, you can manage your loan repayments and make your payments on time before the end of the loan. Create a budget to cover the missed payment and cut expenses if necessary.

Then adjust your future budgets so that your next loan payment doesn’t fall through the cracks. Financial experts generally recommend allocating 10 to 15 percent of your gross income to car payments, including principal, interest, fuel, and car insurance. [2]

If you can’t make your payments (even if you fail the first time), contact your creditor. Be proactive by discussing the situation and asking about possible long-term options, such as long-term car loan financing to lower your payment. Even if you pay a higher interest rate and total interest, changing the term of your loan can help you make your payments. It might work better if you think you missed a payment.

You can even ask the lender to change the payment date so that it syncs with the same payment date. This step can make it easier to continue making payments. [3] [4]

Car Repossession: How It Impacts Your Credit

Late car payments can negatively affect your credit score. The more late payments you have and the longer they last, the greater the impact on your credit score. Additionally, a chargeback can stay on your credit report for up to seven years. [1]

If you default on the loan, your car will usually be repossessed, and the loan agreement will tell you how this will happen, for example, if you don’t pay on time. Lenders can impound your car without notice or with a court order, and they can even use electronic immobilizers to prevent the car from being impounded in the first place. The lender then tries to sell the car to pay off the rest of the loan

Car has been repossessed what to do, find out if your car has been repossessed, what to do if your car has been repossessed, how to find out if a car has been repossessed, how do i know if my car has been repossessed, car has been repossessed, how to find out if my car has been repossessed, my car has been repossessed, my car has been repossessed what do i do, how do you know if your car has been repossessed, how to find out if your car has been repossessed, my car has been repossessed now what