I Owe Taxes But Can T Pay – Underpayment penalties are imposed by the Internal Revenue Service (IRS) on taxpayers who do not make enough estimated tax payments, do not withhold enough tax from wages, or pay late. This is a fine. Individuals generally must pay at least 100% of last year’s taxes or 90% of this year’s taxes to avoid underpayment penalties.

Tax penalty will be imposed on individual or corporate taxpayers who do not pay the total amount of surcharge and amount due. Taxpayers can refer to the IRS instructions on Form 2210 to determine whether they need to report the deficiency and pay the penalty.

I Owe Taxes But Can T Pay

Tax law requires taxpayers to pay taxes throughout the year, either by earning income, paying estimated taxes, or both.

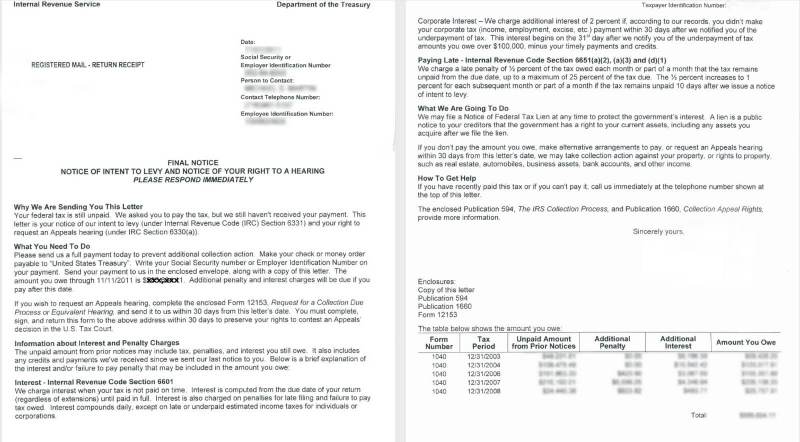

Irs Audit Letter Cp503

To avoid the underpayment penalty, individuals with an adjusted gross income (AGI) of $150,000 or less must pay estimated taxes and withhold equal to the lesser of 90% of the current year’s tax or 100% of the prior year’s tax. Will have to pay. An individual whose AGI exceeds $150,000 in the previous tax year will be taxed at 90% of the tax owed in the current year or 110% of the individual’s tax return for the previous tax year.

The underpayment penalty applies when a taxpayer pays less than the estimated tax amount or pays a disproportionate amount that is not in line with the taxpayer’s current income during the tax year.

Taxpayers with self-employment income should consider their Social Security and Medicare tax contributions when calculating the amount owed.

Some taxpayers, such as sole proprietors, partners, and S corporation shareholders, must pay their taxes in four equal installments per year, while others may pay more frequently. Taxpayers with unequal incomes may sometimes pay different amounts each quarter. Taxpayers can use IRS Form 2210 to determine whether their withholdings and estimated tax payments for the year are enough to avoid penalties.

Owe Taxes And Can’t Pay By The Due Date?

If the taxpayer finds that they have underpaid, they will have to pay the difference and penalty depending on the unpaid amount and overdue period.

Penalties are not a fixed percentage or a fixed amount. It depends on several factors, including the total amount of the reduction and how long the taxes were less. Deficiency payments are assessed each month at 0.5% of the amount due plus the unpaid portion of that month’s tax.

Interest is also charged on overpayment or underpayment of taxes. The IRS sets interest rates on a quarterly basis. It is generally based on the federal short-term interest rate plus 3 percentage points for most individual taxpayers.

Interest rates for the fourth quarter (Q4) of 2023 and the first quarter (Q1) of 2024 are 8% for individual short payments and 7% for large corporate short payments.

What To Do If You Owe The Irs And Can’t Pay

If you paid $5,000 in taxes that year, you paid $3,000 less, and you only paid $2,000. Since the amount is more than $1,000 and you have not paid at least 90% of the amount owed, you may be charged an underpayment penalty unless you meet other criteria to avoid underpayment. The penalty is the then-current federal short-term interest rate plus 3 percentage points. In 2024 the rate will be 8% or $240.

The best way to avoid underpayment penalties is to take steps to ensure that your tax liability is paid in full and on time. You can also avoid underpayment penalties if:

Even if you are not eligible for underpayment penalty waiver, you may still be eligible for underpayment penalty waiver in some cases. For example, if a person changes their tax filing status from single to married filing jointly, the penalty may be reduced due to the increased standard deduction.

This deduction may also apply to taxpayers who earn a substantial portion of their income during the calendar year. One such example is an investment holding sold in December, which would have resulted in significant capital gains taxes.

Misconceptions About The Irs

The IRS underpayment penalty for the first three quarters of 2023 is 7% for very underpayments and 9% for large business underpayments. It increased to 8% in the fourth quarter.

“Safe harbor” rules allow you to avoid paying a penalty or reduce the penalty if certain conditions are met. If you owe less than $1,000 or pay more than 90% of your annual tax liability, you can avoid underpayment penalties from the IRS.

Some taxpayers, such as sole proprietors, partners, and S corporation shareholders, must pay taxes at least quarterly if they owe more than $1,000. These payments are called estimated tax payments. You cannot pay your estimated tax liability in one go, but you can pay it in advance as per your budget or make advance payments every month.

If you don’t pay enough estimated taxes, taxes withheld, or unpaid taxes, you may have to pay an underpayment penalty. If you are charged a penalty, check to see if you are eligible for a waiver or reduction. The best way to avoid penalties for underpayment is to accurately determine your estimated tax amount and pay it on time. If you are not self-employed, you can coordinate the amount of tax withheld with your employer.

You Owe Taxes And Can’t Pay? The Do’s And Don’ts

Writers should use primary sources to support their work. These include white papers, government data, proprietary reports and interviews with industry experts. Where appropriate, we also reference original research from other reputable publishers. Please see our Editorial Policy for more information about the standards we follow in producing accurate and unbiased content.

The proposals displayed in this table are from compensation partnerships. This compensation may affect how and where your listing appears. Not all offers available on the Marketplace are included. A deferred tax liability is an item on a company’s balance sheet that records taxes owed until a future date.

Loans are deferred because taxes are deducted and paid at different times. For example, it reflects taxable transactions such as installment sales that occur on a specific date, but the tax is not paid until a later date.

Deferred tax liabilities on a company’s balance sheet represent future tax payments that the company will have to pay in the future.

The Rich Get Richer, The Poor Pay Taxes

This is the company’s expected tax rate which is calculated as the difference between taxable income and pre-tax accounting profit.

Deferred tax liability is the amount of “underpaid” taxes that a company will recover in the future. This does not mean that the company is not meeting its tax obligations. Instead, it identifies payments that have not yet been made.

For example, we know that a company which earns net profit during the year has to pay corporate tax. Tax liability applies to the current year and should reflect expenditure for the same period. However, the tax is not actually paid in the next calendar year. To correct the timing difference between the credit and cash, taxes are recorded as a deferred tax liability.

A common cause of deferred tax liabilities is differences in the treatment of depreciation expense under tax laws and accounting rules.

Does This Mean Most Of The People In The Bay Area Don’t Have To File Or Pay Taxes Until October?

Depreciation expense for long-term assets in financial statements is generally calculated using the straight-line method, although tax law allows the use of the accelerated depreciation method. Because the straight-line method has less depreciation expense than the under-accelerated method, a company’s accounting profit temporarily exceeds its taxable income.

The Company recognizes a deferred tax liability for the difference between accounting profit and pre-tax taxable profit. As a company continues to depreciate its assets, the difference between straight-line and accelerated depreciation decreases, and the amount of the deferred tax liability is gradually eliminated through offsetting accounting entries.

Another common source of deferred tax liability is installment sales. It is the revenue that is recognized when a company sells its product on credit and pays the same amount in future.

Accounting rules generally allow companies to recognize full revenue from installment sales of goods, but tax law requires that revenue be recognized when the installment payment is made.

Will You Get A Tax Refund Or Owe The Irs? 32% Of Americans Don’t Know

This creates a temporary positive difference between the company’s accounting income and taxable income, and also creates a deferred tax liability.

Deferred tax liability is a record of taxes that have been paid but have not yet been paid. This line item on a company’s balance sheet stores funds for known future expenses.

This leaves businesses with less cash flow to spend, but that’s not necessarily a bad thing. This money is used for a specific purpose, namely to pay the taxes owed by the company. Spending that money on other things could get your company in trouble.

Deferred tax liabilities typically arise when standard business accounting rules differ from the accounting methods used by governments. A typical example is the depreciation of fixed assets.

No, That’s Not The Irs Texting About A Tax Refund Or Rebate. It’s A Scam.

Companies generally report depreciation

Owe taxes but can t pay, i owe taxes and can t pay, i owe federal taxes but can t pay, i owe state taxes and can t pay, owe taxes can t pay, i owe the irs money but can t pay, owe federal taxes but can t pay, what if i owe taxes and can t pay, owe back taxes cannot pay, what if you owe taxes and can t pay, i owe taxes but can t pay, owe the irs money but can t pay