How To Trade In Car Upside Down – It’s a bad feeling when you want to get out of your reach, but you have to pay more than you deserve. Since all new vehicles depreciate when they are not new, this happens a lot. According to Edmonds, 26 percent of sales have negative stock, or $3,854. It’s more about getting a new loan. If you are stuck in your business, here are some tips.

Many industry experts say that when you buy a new car, it loses 11-20% of its value by the time you leave the dealership. Sorry, it’s unfair, but once a car is sold, it’s no longer a new car. This is an old car and the number of potential buyers is limited. After an average of five years, your car will be worth 37% of its original purchase price.

How To Trade In Car Upside Down

Last year, the average purchase price for a new car was $35,000, and the average car price was roughly the same. Car buyers don’t put enough money down to cover the inevitable depreciation in the first year, so they end up paying more than the car is worth.

How To Trade In Your Car

The more money you give up front, the more likely you will break even in your business. If you want to sell the car, the sale price will not pay off your loan. If this is your problem, find out what happened in the solution.

First check the value of your car. Check NADA, Edmunds, and Kelley Blue Book, and compare to get the best idea for your car. Then contact your lender and apply for your loan. While you’re on the phone, ask them if they offer any options to reduce your negative balance. Subtract your loan balance from the value of your current car and figure out the negative number.

It’s unfortunate to have a negative impact on your business, but you have some options. It takes a little practice, but it’s worth it in the end. Check your budget to cut extra and pay more each month to reduce your principal. The more you pay each month, the faster you will reduce your balance to the point where your business is worth what it owes.

If you want to get rid of your car now and have some money on the side, another option is to sell it yourself and pay yourself. Financing and low interest rates can help you save. Lenders stop offering more auto loans, and homeowners find lower interest rates on home loans. Community banks and credit unions sometimes offer more loans than big banks.

Eddy’s Chevrolet In Wichita

If you are well positioned in your business, things are not as bad as you think. At Velocity Mazda, we offer competitive pricing and a wide range of financing services. We are happy to answer any financial questions you may have today. Knowing how to sell a used car without losing thousands can be a difficult task. If you’re looking for ways to eliminate bad balance in your car, you’re in the right place.

I used to have a bad habit of trading cars with bad balance, losing thousands every time. I have financed ten cars in ten years.

What is madness? Repeating the same thing over and over expecting different results? Yes, that’s me.

I’m sure many of you can relate. The truth is, we’ve all made financial mistakes, but this one takes the cake for me.

Do You Need Gap Insurance?

My husband and I bought a new car a few years ago and decided after a while to finance it for $48,000 and make a minimum payment of $733.

We are basically tired of paying the equivalent of a house payment for a car. Once we know the credit score, we go to the credit union.

We sat down with our bank and explained the situation. In order to get a NADA car value, we know exactly how “in the hole” we are.

As a former banker, I know how NADA decides how much money banks and credit unions pay for auto loans. They don’t even use Kelly’s blue book.

Trading In A Leased Car: How It Works

ENT is garbage in my opinion. This is not the actual price of the car. I might understand it differently if banks and credit unions used KBB, but they don’t.

Car dealers use KBB to their advantage when selling your car. Let’s say you go to your bank. You talk to your bank and find you have $5,000.

If your local bank doesn’t work with you, try Lending a Tree. Their rates are low depending on the loan, but click here to find out if this is the right option for you.

Whatever you do…don’t do dealerships on your loan. When they find out about your financial situation, you lose all your power.

Can An F1 Car Drive Upside Down

Now that you know the value of your car, you discover that you owe $5,000 more than what you can sell your car for. If you are looking at vehicles and have an idea of what you are looking for, talk to them about it.

Let’s say you find a 2009 Buick Enclave and it costs $12,000 with 90,000 miles on it. They can import the vehicle on the NADA website and give you a sale price. Sometimes a bank or credit union will offer a loan of 125% of the value.

It’s good to know going forward, because if you’re flexible, you can sometimes press the wrong amount into it. But in situations like this, I always recommend coverage for the gap…always.

Check to see if your insurance company and lender offer collision coverage that will cover the vehicle. Not all brands are created equal, but it’s always important to compare apples to apples and make sure you’re not paying too much for the product.

Stranger Things Upside Down Autograph Card A Lb Linnea Berthelsen As Kali Auto

Car dealers typically make their money by selling health and disability insurance, and setting rates (especially for used cars).

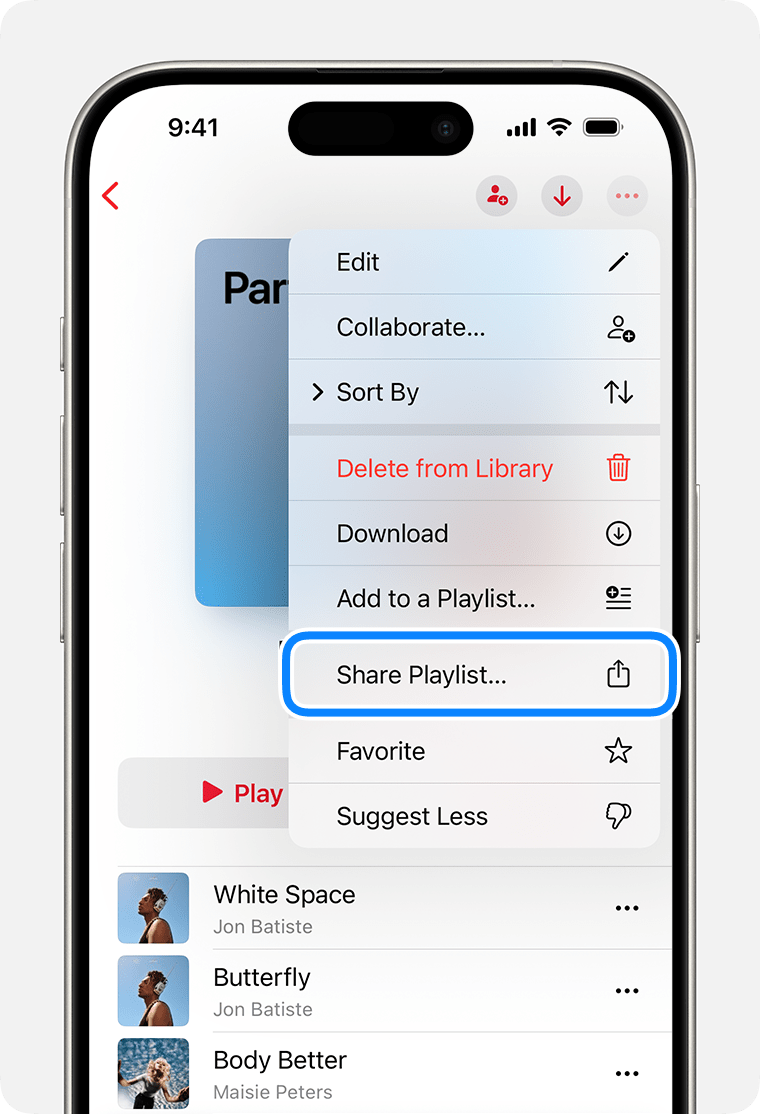

Before you get started, you need to know your credit score. You can find your FICO score here. So you talk to your bank to weigh some options. After talking to your bank, when you know how much you have to take out of pocket, the next stop is Carmax.

In order to do this, they will give you an appraisal and Carmax will extend the purchase of your car for a specified amount.

It’s not BS. There is no overlap. It takes about 45 minutes to approve your car and you can walk out in 7 days with a paper that says they will buy your car for $X.

Top 10 Best Truck Parts In Jersey City, Nj

So you want to make sure you complete the decision making process before doing this. But take that piece of paper… wrap it up, put it in your bag, and now you’re going to the dealership looking at the car. And you choose not to give too much information about what you want to do.

Go to the dealer and ask to test drive a particular car. You will be asked if you have a car for sale. Don’t tell them you still have a business.

Don’t lie to them, but say, “You know what? I don’t know what we’re going to do.” So get in, try driving. See how you like it. And look carefully. Before getting approved by your bank, but also about financing the car. As long as the dealers know, that’s fine. Don’t share your plans.

Knowing your credit score can help you get the best rate. Then you can sit down with them and explain that you want to agree on the price of this car. Try to negotiate a car purchase price without advertising your business.

Is Your Car Loan Upside Down? How To Handle Negative Equity

Car dealers hate me for this, but we have to. As consumers, we need to protect ourselves.

See if they can agree on your price, then let them know if they want to sell your car or if you don’t mind not telling them.

Also tell them that you compared at CarMax, but are waiting to get their quote. Don’t share the Carmax offer.

You will receive a request. They want you to enter some numbers and sign something to buy a car. They may ask you to start the paperwork.

Volkswagen Dealership Cypress Tx

Don’t do it. While you’re thinking about it, ask if you can check the car at night. Take the car to a car dealership.

And another seller’s car tell them that

Trade in upside down car for lease, how to trade in your car when your upside down, trade in upside down, trade in car with upside down loan, upside down loan trade in, how to trade in car when upside down, upside down trade in car dealership, leasing a car with upside down trade, trade in upside down car, how to fix upside down car loan, how to trade in upside down car, how to sell an upside down car