How To Check If I Owe Taxes – Wondering if you’ll get a stimulus check if you’re tax-deductible? Or are you wondering if there is a possibility that the Tax Office can use it to pay off your debts?

If you want to answer these questions correctly and get a complete understanding of the process, then this article is for you.

How To Check If I Owe Taxes

Usually, if you have state or federal debt, the IRS will take any refunds you receive and use them to pay off the debt you owe. This means the IRS can automatically take your refund amount to pay state taxes, child support or student loans.

Tax Underpayment Penalty: What It Is, Examples, And How To Avoid One

However, what you need to keep in mind is that you will receive your incentive check even if you owe taxes. However, an exception is child support payments.

To help you get a good understanding of stimulus checks and everything related to them, this article will cover the following topics:

A stimulus check, also known as a government stimulus payment, is a financial payment from the government to individuals and families to stimulate the economy during difficult times.

These payments are usually distributed during recessions or economic downturns in an effort to boost consumer spending and stimulate economic growth. In fact, when you spend that money, it drives revenue and stimulates spending by retailers and manufacturers, and thus the economy.

Can’t File Your Income Taxes By Today? Here’s How To Get An Extension

What you need to remember is that the amount of your stimulus check is usually based on your income and can vary depending on the specific program or law that was used to distribute the funds.

A check can be mailed or directly deposited to eligible individuals and families. The latest stimulus text was approved by the CARES Act and the Economic Stimulus Act of 2020 during the COVID-19 pandemic.

Because the government gives you money even if you haven’t paid any taxes, the stimulus payment is actually a refundable tax credit.

Although you usually get tax credit money when you file your tax return in April, during the COVID-19 emergency, the government wanted you to be able to use the money when you need it instead of waiting until next April to receive it. . So they made the necessary preparations for the same.

Why Was Federal Withholding Not Taken From My Paycheck?

Although traditional tax credits are a way to reduce the amount of tax you pay to the government, most tax credits will not get you a salary.

This is because the IRS will notice that you have paid too much tax. That extra money will then be paid to you in cash or the IRS will use it to pay off your debts.

Stimulus controls are an important strategic tool of government because the National Bureau of Economic Research has found that how fiscal stimulus is delivered makes a difference in overall patterns of consumer spending.

In fact, receiving a stimulus check increases consumer spending, not only providing a lifeline to those in need, but also boosting the economy.

Steps If You Haven’t Filed Your Taxes In A While

However, they also found that applying tax credits equal to the amount given in the stimulus check did not have the same effect. This is because people could not spend money on the things they needed because part of it went to pay off any debt. This led to less consumer spending, which in turn led to less growth in the economy.

So, the IRS uses your previous tax returns to see if you qualify for the incentive check. However, you don’t have to worry because once you file your 2020 tax return, the IRS will not ask you for a refund.

Whether you will receive a stimulus check when you owe taxes depends on the specific circumstances of your tax debt. Generally, if you owe taxes and have a debt on your tax return, the IRS will offset your incentive check against your outstanding tax debt.

However, if your debt is collected by the IRS, your stimulus check may be intercepted to pay the debt. If you owe money to your state or local government, your stimulus check cannot be intercepted. In addition, if your tax debt is below a certain threshold, you may still be eligible for a stimulus check.

For Those Who Pay Estimated Taxes, Second Quarter June 15 Deadline Approaches

It is also important to keep in mind that if a person’s stimulus check is garnished to pay a tax debt, they will not receive a refund of an outstanding debt on their credit.

That’s why it’s important that people check with the IRS or a tax professional to clearly understand their specific situation and take action to potentially receive an incentive check if they qualify.

So, while in a common scenario the IRS will take any refund you receive to offset federal or state debt, such as outstanding student loans, child support payments, or state taxes, it doesn’t work the same way as a stimulus check.

This is because stimulus money is designed to provide a lifeline to those who need it and also provide a boost to the economy. This means you’ll get a stimulus check even if you owe very little, and the IRS won’t use it to offset what you owe the government.

Make A Payment To Extend Your Time To File And To Pay

However, you can still use your stimulus check to pay off your tax debt. But it would only make sense to do this if your basic needs are already met.

As a general rule, the IRS will not use your stimulus check to offset what you owe the government. That way, you won’t be denied a stimulus check just because you’re late with your tax payment.

However, the only exception to the tax incentive rule is child support arrears. This means that if you owe child support, you will receive a notice from the Office of Fiscal Services informing you that part or possibly all of your stimulus check will go toward paying off your child support debt.

A stimulus check is actually a tax-free increase from the government. This means that if you get a stimulus check, you don’t have to pay tax on it. In fact, you don’t even have to report it as income on your tax return.

How Stock Options Are Taxed: Iso Vs Nso Tax Treatments

Therefore, the incentive check is not considered taxable income. The implication of this is that the payment will not reduce your refund or even increase the amount you owe the government when you file your 2020 tax return.

In fact, because the stimulus payment is actually a refundable tax credit, the government will give you the money even if you pay them nothing in the form of taxes.

Well, if you didn’t get all the stimulus money you were entitled to in 2020, that means you may be eligible for a refundable recovery credit when you file your tax return. This will give you access to the stimulus money you missed last year.

However, you should keep in mind that a recovery credit is not a check, but more of a traditional tax credit. This means that a recovery credit is a way to reduce the amount of tax you pay to the government, which will result in you having more disposable income.

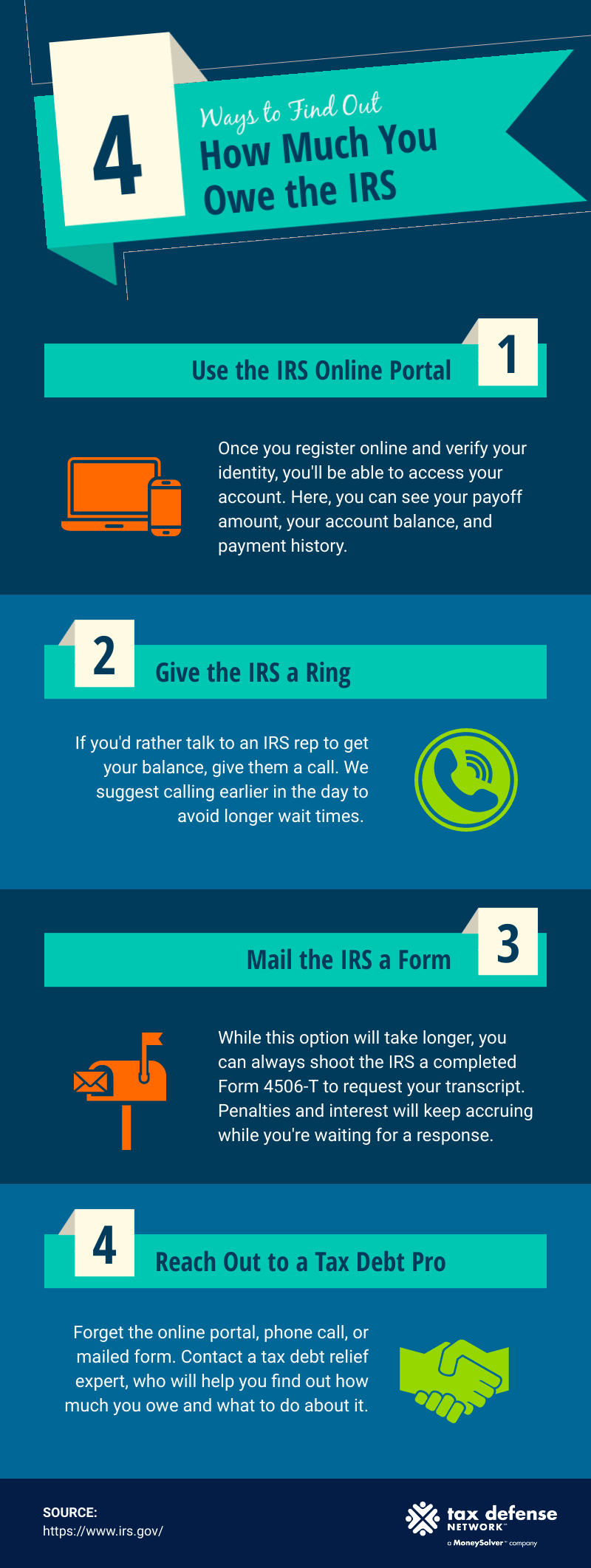

An Online Irs Account Is Worth It

So when you claim the Recovery Rebate Credit, you won’t get a check, but the IRS will record that you paid too much tax, which it can then use to pay off your debt.

One action you can take if you owe taxes and are worried about not getting your stimulus check is to set up a payment plan with the IRS. The IRS offers people several options for paying their tax debts over time, including a payment agreement and an offer in compromise.

By setting up a payment plan, people may be able to receive a stimulus check because the IRS will not withhold the payment to pay off their tax debt.

Another action you can take is to request a hardship. If youare experiencing financial problems, such as unemployment or medical bills, you may qualify for hardship. This allows you to temporarily defer your tax debt and possibly receive a stimulus check.

Keyword:state Tax Bill

If youare one of those people who are self-employed or have recently lost your job, you may also want to check to see if you qualify for the Earned Income Tax Credit (EITC).

The EITC is a refundable credit that can help low- and moderate-income taxpayers, including those who owe no taxes, and can help them get a bigger stimulus check.

Individuals earning up to $75,000 per year and couples earning up to $150,000 per year

How to check if you owe back taxes, how to check if i owe taxes, check if you owe taxes, how to pay if you owe taxes, how to check if you owe taxes, if you owe taxes, how to know if i owe taxes, how to check if i owe back taxes, how to know if you owe taxes, check if i owe taxes, how to tell if you owe taxes, how to see if you owe taxes