Do Insurance Rates Go Up After Accident Not Your Fault – If you’re using the Galaxy Fold, consider unlocking your phone or viewing it in full screen mode to optimize your experience.

Advertiser Information Many of the offers displayed on this page are from companies for which The Motley Fool receives compensation. This compensation may affect how and where products appear on this site (for example, including ordering), but our reviews and ratings are not affected by the compensation. We do not include all companies or all offers on the market.

Do Insurance Rates Go Up After Accident Not Your Fault

Most or all of the products listed here are from our paying partners. This is how we make money. However, our editorial integrity ensures that our experts’ opinions do not influence compensation. Terms and conditions may apply to offers on this site.

When Not To File A Car Insurance Claim

All drivers need car insurance to protect them in the event of an accident. However, if they are involved in an accident, the cost of their policy is likely to increase. The question is: “How much does insurance increase after an accident?” The answer depends on the driver’s place of residence and the insurance company he works for. Here we dive into car insurance to find out what the policy will be worth after an accident.

How much more you pay if the driver is at fault depends on many factors, including where you live and which car insurance company you use.

Benefits may increase depending on the specifics of the accident. However, the following table shows how much the average increases in each state after an at-fault accident. These averages apply to the following policies:

Here’s what these price increases could mean for your daily budget. Let’s say the driver lives in Arkansas and currently pays $1,200 a year ($100 a month). If you are at fault in an accident, premiums can increase by 67 percent. So instead of paying $1,200 a year for coverage, you pay $2,004 ($167 a month).

Top 7 Things Car Insurance Companies Won’t Tell You

Generally no, premiums will not increase after a no-fault accident. From vehicle repair to medical expenses, the driver’s insurance company is responsible for all expenses. If the insurer does not want to pay the sum, the sum insured will not increase.

The answer to the question, “How long does an accident stay on your record?” It is about three to five years. However, drivers should do everything possible to avoid traffic fines and more accidents during this time. If the owner has another accident during this period, the insurance premium may increase.

It depends on the situation. Let’s say the driver lives in California. They went off the road in the rain, crashed into a neighbor’s mailbox, and the front bumper of their car was punctured. Now they must decide whether to press charges. They were certainly guilty, but there are two things to consider. Making a claim first means that the risk (no matter how small) will remain on the insurance record for three to five years.

Also because they live in California, their premiums can increase by 68 percent. Let’s say you’re currently paying $1,200 a year for coverage. That could bring in up to $2,016 a year (or $168 a month). Multiply this annual increase of $816 by three years (the minimum period for which the risk is recorded). That’s a total of $2,448 (816 x 3 = $2,448). Can you fix the mailbox and the car for less? In that case, the driver prefers to put it in his pocket.

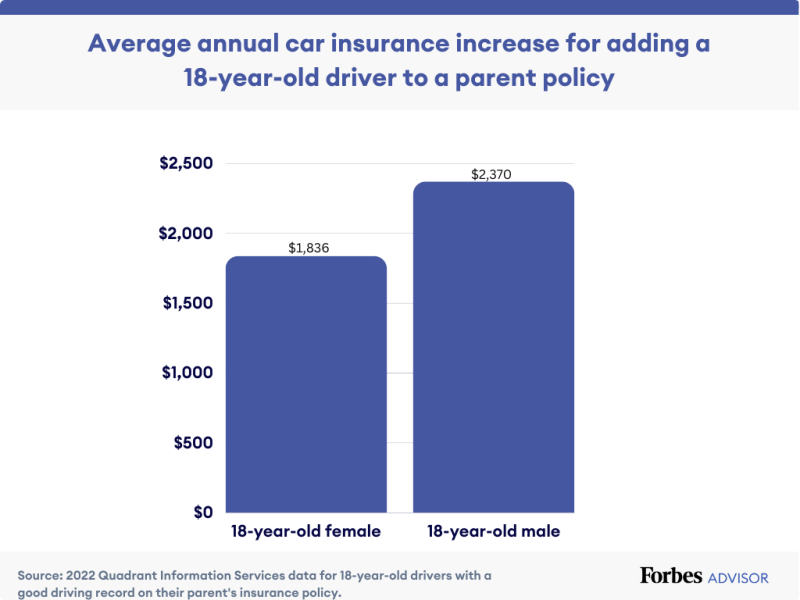

How Much You’ll Pay For Car Insurance For Your Age & Gender

Another thing to consider is your car insurance deductible. Let’s say they have a $1,500 deductible. If you can fix it for that price (or less), there’s no point in claiming it.

When a driver is involved in an accident and is not sure who is at fault, they should call the police. If they have an accident and the other party is found to be at fault, the police should still be called, even if the other party says they won’t. Insurance companies will require a police report, which can help bolster the no-fault driver’s case if the other driver decides to change their record of events.

Accident waivers are a type of auto insurance that protects drivers from higher premiums after an accident. Depending on the insurer, accident forgiveness may be offered after a certain period of safe driving, or the driver may pay an additional fee to add to the policy. If the driver is at fault for the accident, their policy may not increase after the initial accident.

If the driver is involved in an accident and is at fault, it does not matter if the policy increases. If so, all is not lost. Here are five possible ways to cut costs.

Will My Insurance Rate Increase After A Not At Fault Accident?

After the increase in insurance premiums, there is no reason not to shop around for other insurance companies. In fact, it’s wise for drivers to shop once a year to get the most comprehensive coverage possible. Depending on the severity of the accident, the policyholder can purchase higher car insurance. Not all insurance companies cover at-fault accidents, but some charge lower premiums than others.

If a driver currently has a low deductible, they should be able to lower the cost of their policy by increasing their deductible. Before doing so, drivers should budget and make sure they have enough emergency savings to cover the excess in the event of another accident.

It is possible to lose the discount when applying for car insurance. Or some conditions for discount eligibility may change. Here are some of the most common car insurance discounts:

Many insurance companies take your credit score into account when determining your policy amount. If your score is low when you first take out your policy, you can take steps to raise it. Once your credit score improves, you can ask your insurer for a quote.

Top 15 Factors That Affect Car Insurance Rates

Taking a defensive driving or accident prevention course can reduce the cost of your driver’s premium. The amount varies by insurance company, but it’s a discount worth checking.

An ordinary driver can really handle a lot. Worrying about what will happen to their car insurance rate in the event of an accident should not be one of them. If you’re worried about your insurance going up after an accident, first check with your insurance company to see if they offer accident forgiveness. Some insurance companies apply accident forgiveness immediately after the driver has been accident-free for a certain number of years. Others allow the driver to add an accident exclusion to their standard policy to increase premiums. Here are some questions you should ask yourself when contacting your insurance company.

The first, most important step is insurance coverage. The next step is to make sure the coverage matches the amount of risk you’re comfortable with. If you haven’t compared quotes from multiple insurance carriers lately, you might be pleasantly surprised by your options.

Check out our handpicked list of the best car insurance companies. Our best deals are packed with valuable benefits such as low prices, discount packages and best-in-class service.

Californians Say Car Insurance Harder To Get

Dana George holds a bachelor’s degree in management and organizational development from Spring Arbor University. She has been writing and reporting on business and finance for over 25 years and remains passionate about her work. Dana and her husband recently moved to Champaign, Illinois, where the Illini Warrior lives. And when he finds orange on most people, he thinks they really like champagne.

Ashley Meredy He is a former history museum professional who started writing and editing digital content in 2021. She earned a bachelor’s degree in history and philosophy from Hood College and a master’s degree in applied history from Shippensburg University. Whether it’s salt mines, channel mullets, or personal finance information, Ashley loves creating content for the community and learning new things to educate others.

Share this page on Facebook. Email icon Share this page by email

We are firm believers in the Golden Rule, so editorial opinions are ours alone and have not been reviewed, endorsed or approved by any previously featured advertisers. Upside does not cover all offers on the market. Ascent’s editorial content is separate from The Motley Fool’s editorial content and is produced by a separate team of analysts.

How Much Is Car Insurance?

Dana George has no position in listed shares. The Motley Fool recommends Progressive. The Motley Fool has a disclosure policy.

The ramp is motolly.

What to do after accident not your fault, do insurance rates go up after no fault accident, accident not my fault, not at fault accident no insurance, car accident no insurance not at fault, not at fault accident, does insurance go up if accident not your fault, accident not my fault insurance go up, car accident no insurance not my fault, not at fault accident insurance rates, does your insurance go up after a no fault accident, not at fault accident without insurance