Car Has Been Repossessed What To Do – My car was abandoned. What should I do? If your car is repossessed, learn when to make up your current balance—the lender may have ways to help, too. Learn more about what happens when a car is repossessed.

Having your car repossessed can put you in a difficult situation – an important form of transportation is no longer available. Adoption can be stressful, but we’re here to help you figure out your next step. If you are planning to repossess your car, there are a few things you should keep in mind. Let’s go over some frequently asked questions about what happens when your car is repossessed.

Car Has Been Repossessed What To Do

The answer really depends on your specific situation. State laws and regulations generally govern your rights after returning your vehicle. In some cases, lenders may have policies that give you more options after repossessing your vehicle.

What You Should Know About Car Repossession (when The Bank Takes Your Car)

If you take some steps in time you can get your car back. These steps will include:

It’s important to remember that all the equity in the vehicle is yours, not your lender’s. All special items dropped on the car at the time of return must be stored in a storage facility (repo) for a specified period of time in accordance with state laws and regulations. You must contact the storage facility directly to make an appointment to pick up your items. The lender will let you know the contact details of the repo agency. You can contact your lender to get more details about the agency, including their business hours to contact them.

If the lender is Capital One and you want to know how the bank will contact you personally, please call our support center and use the letter you received from us.

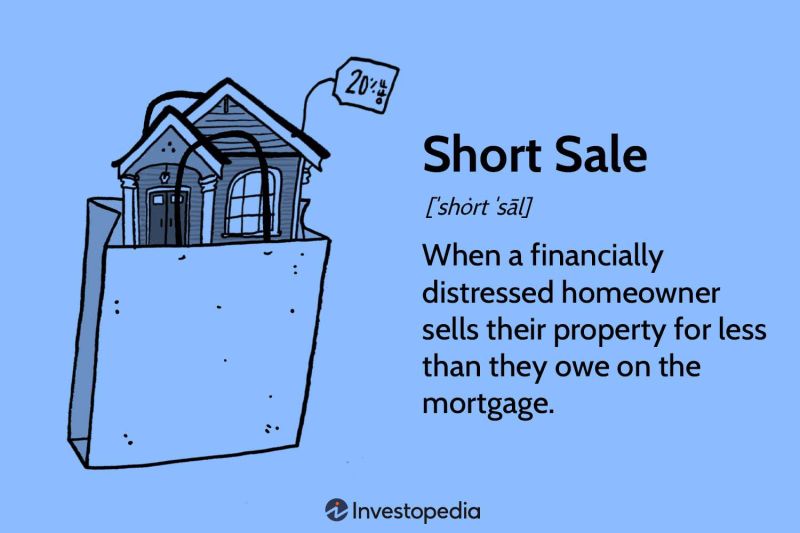

In some cases, you can still pay the balance after your car is repossessed and sold at auction. If the sale of the repossessed vehicle cannot cover the amount owed to the borrower, you will have to pay the balance after the sale. The lender will often add the cost of insurance and necessary repairs to the vehicle paid on the balance. Some states prohibit the lender from filling the deficiency under certain circumstances.

How To Stop A Car Repossession In Colorado

Finally, if the lender sells the car for sale and makes more money than you owe, they must send you the extra money.

Knowing what to do if your car is repossessed can help you get out of a bad situation and work to improve your finances. Regardless of the outcome of your situation, it’s a good idea to learn about credit scores after you’ve been approved. Continue to make on-time payments on all your accounts to improve your credit score. Although repossessions affect your credit, making payments on time can play an important role in improving your credit score.

This site is for educational purposes only. The third parties listed are not affiliated with Capital One and are responsible for their opinions, products and services. Capital One does not provide, endorse or guarantee any third party products, services, information or advice. The information presented in this article is believed to be correct at the time of publication, but is subject to change. Images displayed are for illustration purposes only and may not be an accurate representation of the product. The information provided on this site is not intended to provide legal, investment, or financial advice or to suggest the availability or suitability of Capital One products or services for your situation. For advice specific to your situation, you can consult an expert.

The bank should leave you with the same feeling you get when driving on a mid-week holiday. And that’s what I want when I write tips and reviews – passionate about cars and passionate about everything between money and buying a new car. If your car has been repossessed for non-payment, you can quickly learn about state and federal laws in this area. It can be very difficult. Here are five tips for car recovery in Massachusetts.

What Happens If My Car Gets Repossessed?

In Massachusetts, car lenders must repossess cars for 20 days before selling them. After this short period, the lender can sell the car. If the sale price doesn’t cover the total amount owed plus return charges, the lender can also collect the remaining amount from you. This is called “imbalance”. Therefore, if the car is sold for repossession, you will not be able to return it, and you may still owe money.

This 20-day deadline gives you a short time to evaluate your options and make the best choice for your job, so it’s important not to delay.

The best place to start is to contact your lender to see what they are willing to do to free you from ownership of the car. Massachusetts law allows creditors to demand full debt repayment and repayment, which may not be appropriate for many people. However, some lenders will be willing to work with you and only ask you about past dues and payments.

If the amount requested by the lender is not enough, you need to make a quick decision to repossess the car.

What Is The Law Surrounding Car Repossessions?

One important difference between Chapter 7 and Chapter 13 is that debtors in Chapter 13 are entitled to keep their assets. This is not the case with Chapter 7. So, if you’re trying to get the car back into business, a Chapter 13 business is your only option.

In most cases, requests to replace a car back are resolved quickly and informally. Our office will usually contact the credit company to let them know the bankruptcy has been filed, and we ask them to return the items to the vehicle. In response, many lenders will ask for proof that the car is insured. Once this is confirmed, most lenders will agree to return the car title to our customers.

However, it is not clear how this will hold due to the recent decision of the US Supreme Court.

Filing for bankruptcy automatically stays (or bars) almost all collections against you or your assets. Automatic seizure is governed by 11 U.S.C. § 362, which contains several limitations.

What Are The Vehicle Repossession Laws In Pennsylvania?

If the borrower refuses to return the repossessed vehicle prior to filing for bankruptcy in violation of § 362(a)(3), which prohibits the borrower from taking actions to control the debt. The court ruled that the debtor’s “mere possession” of the car was not a violation of this rule.

However, no other aspect of direct residence is considered. Although Justice Sotomayor concurred in this decision, she wrote an opinion that indicated that the same practice by auto lenders would be void.

Of the automatic stay rule, specifically sections 362(a)(4) and/or 362(a)(6). Section 362(a)(4) prohibits taking any action to create, perfect, or enforce a lien on property in a claim against the debtor.

Since the Supreme Court has not ruled on various sections of this law, a borrower who refuses to return the car title after filing a business case may violate this section of the automatic stay.

Car Repossessions Rise Amid Covid, With No Help, Relief For Consumers

The Supreme Court also noted that the Bankruptcy Code has a specific provision (Section 542) dealing with transfer of assets. Unfortunately, as noted in Justice Sotomayor’s opinion, if the borrower refuses to change immediately and wants to change in bankruptcy court, the process is willing to spend weeks or months.

It is unclear how creditors will react to the Supreme Court’s decision in this case, but according to Justice Sotomayor’s concurring opinion, we expect that exchange agreements in these cases will also be swift and friendly. . In addition, we expect more litigation regarding other areas of automatic residency. And our office is committed to directly enforcing these laws.

When setting up a foreclosure, there are several steps that most car providers must take and rules to follow.

Most importantly, this includes written notice at least 21 days before the return about the amount owed to bring the debt current and prevent repossession. If you have fallen behind on past payments and received this notice, please

Hyundai Motor Finance Repo

My car has been repossessed, what to do if my identity has been stolen, how do you know if your car has been repossessed, my car has been repossessed what do i do, car has been repossessed, how to find out if a car has been repossessed, how to find out if my car has been repossessed, find out if your car has been repossessed, how do i know if my car has been repossessed, my car has been repossessed now what, how to find out if your car has been repossessed, what to do if your car has been repossessed