Can You Refinance A Car That Is Paid Off – Whether you are buying a new car, used car or want to renew your car’s COE or perhaps refinance your car, we have you covered. Below are the car loan promotions we currently offer. Gives you the opportunity to get the lowest interest rates and the most flexible terms for your loan.

Bank Partners: DBS, HL Bank, Hong Leong Finance, Maybank, OCBC, POSB, Singapura Finance, Sing Investments & Finance, Standard Chartered, Tokyo Century Leasing, UOB

Can You Refinance A Car That Is Paid Off

Keep your current vehicle to save even more money. Practical options like COE renewal are needed now more than ever.

Calculate How Much A Car Loan Refinance Could Save You

Let us help you renew your vehicle’s COE and offer you a promotional rate starting from 2.88%.

How high is your current car interest rate? How long will it take to pay off your loan?

If you think your interest rate is in the high range, a car refinance can be a great way for you to lower your monthly payment or get a longer repayment period to reduce expenses or ease the financial burden.

With the largest network of banks, financial institutions and insurance partners, Speed Credit offers customized car financing and car insurance solutions for all types of car owners in Singapore.

How Many Times Can You Refinance Your Car?

With over 50 years of combined industry experience, Speed Credit has underwritten over 1.7 billion car loans and served over fifty thousand car owners in Singapore.

We are always committed to offering the lowest car interest rates with the most flexible and comprehensive financing packages, as we want to ensure all our customers get the best value for their car and loan. Affiliate Content. This content was created by a company. is an associate at Dow Jones and has researched and written for independent news. Links in this article may earn us a commission. learn more

There are no laws that dictate how often you can refinance your car, but there are pros and cons to consider before choosing to refinance your car loan.

He wrote: Daniel RobinsonWritten by: Daniel Robinson Author Daniel is a writer for the Guides team and has written for a number of automotive news sites and marketing companies in the US, UK and Australia, specializing in the topics of car finance and car care. Daniel is a team of guides on car insurance, loans, warranty options, auto service and more. Senior writer

Here’s How To Pay Off Your Car Loan Faster

Edited by Rashawn Michner Managing Editor Rashawn Michner is a Guide team editor with more than 10 years of experience covering personal finance and insurance topics. Senior Editor

Whether you want to take advantage of a lower interest rate or hope to change the terms of your loan, there are many reasons to refinance your auto loan. But how often can you refinance your car?

We at the guidance team will be examining the refinancing process here. When you can do it, how often you can refinance your car and whether you should do it in the first place. Before refinancing your car, remember to compare car refinance rates online to save money.

Best 72-Month Auto Loan Interest Rates for Auto Loan Refinance Can I refinance my mortgage and auto loan at the same time? Car Loan Calculator Best Car Refinancing Rates How Do You Pay Off Your Car Loan Faster? The Complete Car Loan Dictionary. Concepts You Should Know (Guide)

How Soon Can I Refinance My Car Loan After I Purchase My Vehicle?

Average monthly savings of $150 with a personal loan concierge to compare option A+ BBB rating

No application fee Lending platform that collaborates with banks Approval and loan terms based on multiple variables including education and employment

All APR figures were last updated on 23/6/2023. Please check partner website for latest details. Rate may vary based on credit score, credit history and loan tenure.

The Guide team is committed to providing reliable information to help you make the best decision about your car finance. Because consumers depend on us to provide objective and accurate information, we’ve created a comprehensive rating system to create our ranking of the best car loan companies. We’ve collected data from dozens of lenders to rate companies on a wide range of rating factors. After 300 hours of research, the final result was an overall ranking of each supplier, with the top scoring companies at the top of the list.

Refinancing An Auto Loan (january 2024)

You can refinance your car as often as you want, and there are no legal restrictions on how long you have to wait before doing so. You will run into zero laws that will prevent you from refinancing your car at any time.

On the other hand, there are some problems that can arise if you refinance too often. Drivers who repeatedly extend their payment terms put their credit at risk and can damage their credit score.

If you owe more than the original value of your car your loan will be “recovered”. This can happen if you don’t get a good interest rate, or if you refinance too early, when the car’s value is at its highest.

Car loans can also be reversed if you extend your refinancing terms too often and experience a significantly longer repayment period. During the term of the loan, you pay more than the original value of the car. With multiple refinances on the same vehicle, you are more likely to get a reverse car loan.

Auto Loan Refinancing

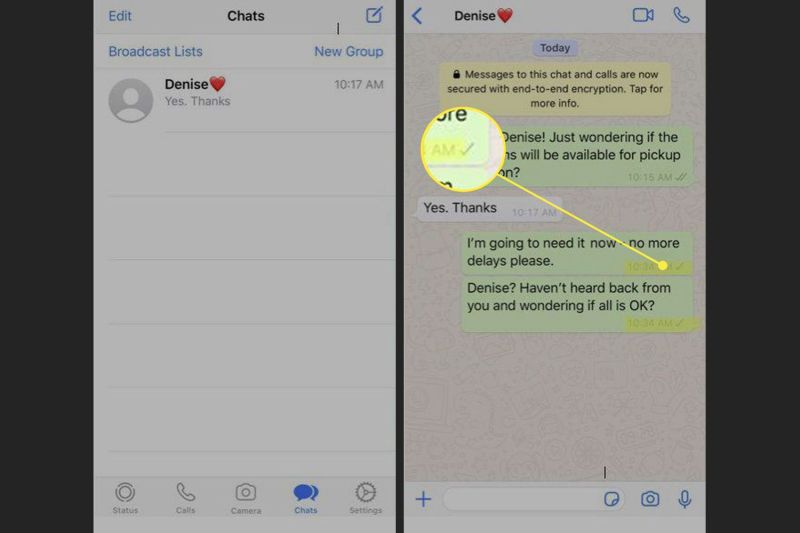

When you get pre-approved for a car loan, your credit score may take a small hit because of the hard inquiry. Generally, your credit score will recover relatively quickly. However, if you file another application within a month or two, your FICO score may actually be lower than it is. This can make it difficult to get approved for new credit cards, personal loans, or even mortgages.

Multiple requests for the same type of loan within 14 days will be added only once, but then the calculation usually starts again. If you’re in between two credit score brackets, you can actually start getting higher auto loan rates after more than one refinance.

You can refinance your car loan the next business day after completing the original transaction. There is no law that requires you to wait a certain amount of time before refinancing your car with a new loan. However, make sure you can get a really low interest rate by refinancing your current loan, or you could face tougher payments in the long run.

If you bought your new car from a dealer, the salesperson may ask you to wait six months or a year before refinancing. Generally, this is not true. Dealers often charge commissions after you’ve made six months of loan payments to encourage you not to refinance right away. It’s rare that drivers need to wait a while before refinancing their vehicles on contract.

When Is A Good Time To Refinance A Car?

Prepayment penalties are another issue to be aware of. Auto lenders in 36 states and the District of Columbia are allowed to charge drivers a fee to cancel auto loans less than 60 months old. Along with prepayment penalties, new or used car refinancers may have to pay property taxes.

People usually refinance their vehicles to save money by getting a lower monthly car payment. Refinancing your car is best when you can get a better interest rate while keeping the payment period the same or less than your current auto loan.

In other words, it’s smarter to choose a 48-month refinance loan than a 60-month loan if each option has the same interest rate.

Extending the remaining loan term to 60 months may get you a slightly cheaper monthly car payment, but you could end up paying much more than your original loan. If you get a higher interest rate, lower monthly payments can result in higher total payments.

How Soon Can You Refinance A Car Loan

If you carefully compare the best rates on the market, there is a good chance that refinancing your loan balance may be the right choice. The biggest exception is for drivers who have recently refinanced their car frequently.

As far as we have researched, there are no legal restrictions that prevent you from replacing your existing car loan with a refinance offer. However, there may be certain restrictions or fees that your lender applies to a new car loan. However, we recommend that you pre-qualify with several lenders to compare your options before making a decision.

Refinancing your car loan is often a fairly simple process that can be completed in a matter of hours. We recommend that you check with credit unions in your area, as well as consider the most popular auto financiers. Below are our top two options if you are looking to refinance your car loan.

Refinance Loan 4/5 Offers financing special military rates A+ BBB rating for customers with bad, limited or no credit

Can You Refinance A Car Loan?

AutoApprove is a marketplace where you can compare refinance offers from multiple online lenders. Borrowers with excellent credit reports can find refinancing rates as low as 2.94% from AutoApprove. Most customers have positive experiences with Auto

Refinance paid off home, can you refinance a fully paid house, can you refinance a house that's paid off, can you sell a car that is not paid off, can you refinance a house that is paid off, can you refinance a home that is paid off, refinance paid off car, refinance paid off house, can you refinance a car that is paid off, can i refinance a house that is paid off, can you refinance a home that's paid off, refinance car that is paid off