Can You Get A Mortgage If You Owe Taxes – Mortgages and mortgages are large loans that use the property as collateral, or collateral, for the loan. This means that the lender can take the house if you don’t make the payments. However, home loans are used for different purposes and at different stages of the home buying and home ownership process.

A conventional loan is when a financial institution, such as a bank or credit union, gives you money to buy a home.

Can You Get A Mortgage If You Owe Taxes

In many conventional loans, banks lend up to 80% of the value of the property or the purchase price of the home, whichever is lower. For example, if a home is appraised at $200,000, the lender will guarantee around $160,000. The borrower must pay the remaining 20%, or $40,000, as a down payment.

Calculate Mortgage Payments: Formula And Calculators

In other cases, such as government-backed loan programs that provide down payment assistance, you can get a loan of up to 80% of the appraised value.

Non-traditional loan options include the Federal Housing Administration (FHA) loan, which allows you to put down up to 3.5% if you pay an insurance premium. Loans from the Department of Veterans Affairs (VA) and the United States Department of Agriculture (USDA) require a 0% down payment.

The interest rate on the loan can be fixed (the same for the entire term of the loan) or variable (for example, it changes every year). You repay the loan plus interest over a specified period of time. The most common term of the loan is 15, 20 or 30 years, although there are other terms.

Before you take out a loan, it is important to research the best lenders to determine who will give you the best interest rate and loan terms. A loan calculator is also important to show how the rate and loan term affect your monthly payments.

Do Subprime Mortgage Lenders Add Value? Our Answer May Surprise You

If you fall behind on payments, the lender can foreclose on your home. The lender then sells the property, usually at auction, to recoup the money. If this happens, this loan (known as a “first”) takes priority over future loans made against the property, such as a home equity loan ( sometimes called a “second” mortgage) or a home equity loan (HELOC). ). ). The original lender must be paid in full before subsequent lenders receive the proceeds from the foreclosure sale.

A home loan is also a type of loan. However, you get a home loan once you own the property and have built up the equity. Lenders usually limit your home loan amount to 80% of your total home equity.

As the name suggests, a home loan – that is, secured – is backed by the owner of the home, which is the difference between the value of the home and the balance at this time. For example, if you owe $150,000 on a home worth $250,000, you have a $100,000 down payment. If you think you have good credit, and otherwise qualify, you can take out another loan and use some of the $100,000 as collateral.

Like conventional loans, home equity loans are loans that are repaid over a fixed period of time. Different lenders have different standards for the percentage of the home they want to pay. Your score helps inform this decision.

What If My Mortgage Is Not Approved?

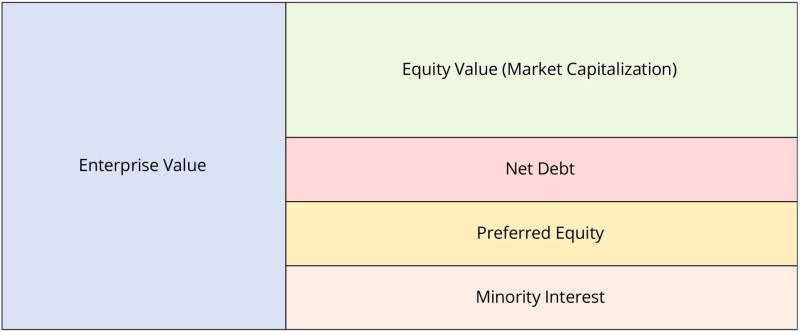

Lenders use the loan-to-value (LTV) ratio to determine how much you can borrow. The LTV ratio is calculated by dividing the loan amount by the appraised value of the home. If you’ve paid off a large portion of your loan – or if the home’s value has increased significantly – your loan-to-value ratio will be higher and you may be able to get a larger loan.

Home loans are usually offered at fixed rates, but traditional loans can have fixed or variable rates.

In most cases, a home equity loan is considered a second mortgage. If you already have an existing mortgage on your property. If your home goes into foreclosure, the lender holding the home loan will not be paid until the original lender is paid.

Because of this, the risk for the borrower is greater with home equity loans, so these loans often carry higher interest rates than conventional loans.

Late Mortgage Payment: What You Need To Know

However, not all home loans are second mortgages. If you own your property directly, you can decide to take a home loan. In this case, the borrower who takes out the home loan is considered the first owner of the loan. An appraisal may be required to complete the transaction if you own the property.

As a result of the Tax Cuts and Jobs Act of 2017, mortgages and home equity loans can be tax-deductible in the same way as cash payments. debt to equity.

Now, loan interest can be tax-deductible for loans up to $1 million (if you took out the loan before December 15, 2017) or $750,000 (if you took out after that date). This new limit applies to certain home loans if they are used for the purchase, construction or improvement of the home.

Homeowners can use a home loan for any purpose. But if you use the loan to buy, build, or improve a home for other purposes (such as debt restructuring or paying for your child’s college), you won’t be able to deduct the interest.

How To Calculate Your Net Worth And Make It Fun! (if Not Funny…)

A home equity loan is a second type of loan that allows you to borrow money from the equity you have in your home. You take this money as salary. This is also called a second mortgage because you have additional payments on top of your primary loan.

There is a big difference between a home equity loan and a HELOC. Home loans are fixed, one-time payments that are repaid over time. A HELOC is a revolving line of credit that uses a home as collateral that can be used and repaid like a credit card.

Home equity loans often have lower interest rates than home equity loans or HELOCs. First mortgages receive the first payment priority in the event of default and are less risky for the borrower than a home equity loan or HELOC. However, home equity loans can have lower closing costs.

If you have a very low interest rate on your current mortgage, you may be able to use a home equity loan to borrow the extra money you need. But there are limits to this tax deduction, which includes using the money to improve your property.

Can I Sell My House With A Mortgage? Complete Guide 2022

If your mortgage rate has dropped significantly since you left your current mortgage – or if you need money for a purpose related to your home – you may be able to benefit from refinancing. the loan. If you refinance, you can save the extra money you borrowed because conventional loans often have lower interest rates than home equity loans, and you can pay a lower interest rate on the outstanding balance. you.

Authors are required to use primary sources to support their work. These include white papers, government data, original reports and interviews with industry experts. We also include original research from other reputable publishers where appropriate. You can learn more about our standards for producing accurate and unbiased content in our editorial policy. You can pay off your home if you are buying in a competitive housing market, or if you want to pay interest on your mortgage. This can help you win deals and win over other buyers. However, there are downsides to not using a mortgage, such as the risk of tying up your money in worthless assets. Find out when you have to pay the down payment on the house.

The first step in buying a home with cash is, unsurprisingly, coming up with cash. Until you have enough money in the bank, you may need to cancel other investments and transfer the income to your bank account. Keep in mind that selling securities at a profit will result in capital gains taxes.

Potential sellers may also ask for proof that you have money, such as your most recent bank statement.

Selling A House With A Mortgage

After that, the process is similar to buying a home with a mortgage – except that there is a lender looking over your shoulder. After you have chosen the house you want to buy:

A seller who knows you don’t intend to apply for a mortgage may take you more seriously. The loan process can take a long time, and there’s always the possibility that the applicant will decline, the deal won’t go through, and the seller will have to start over, notes Marie Adam, a certified financial analyst at Boca Raton. ,

If you owe taxes can you make payments, what happens if you owe federal taxes, can you get a mortgage if you owe taxes, how to check if you owe taxes, if you owe taxes, if you owe state taxes, what to do if you owe taxes, how to know if you owe taxes, if you owe back taxes, if you owe delinquent property taxes, what happens if you owe taxes, how to see if you owe taxes