What To Do If You Get Audited By Irs – In a world where everything is rapidly digitized, one can think about how important it is to keep those little pieces of paper – receipts. You’re in business or self-employed, and the last thing you want to think about is a shoebox overflowing with faded, unread papers. But come tax season, especially if you have an audit, these little slips can be important evidence.

Why should we keep receipts in the first place? Simply put, if the IRS decides to audit you, they will require proof of your business expenses. The receipts prove it. Because they can’t provide receipts, the IRS can disallow these expenses, leading to higher taxes and possible penalties.

What To Do If You Get Audited By Irs

Now imagine you are audited and you cannot provide the necessary receipts. What could have happened? The IRS may not allow deductions for expenses that cannot be substantiated with receipts or other relevant records. Depending on the situation, this may result in additional tax liability and possible penalties and interest.

What Happens If You’re Audited After Claiming The Employee Retention Tax Credit?

It is important to remember that this does not automatically mean that you will face these consequences. The IRS sometimes accepts other forms of proof, such as bank statements or invoices, but a receipt is the most reliable way to prove an expense.

This is where it comes in. Our AI-powered tool helps you automatically find receipts and invoices in your email, making it easy to track your expenses. It helps maintain an organized schedule, saves time, and most importantly, can save lives during an audit.

Although the inspection can be intimidating, it’s not too difficult if you have all the necessary documents. For this reason, it is important to keep accurate records of receipts. And with help, organizing these records becomes a chore, giving you peace of mind and more time to grow your business.

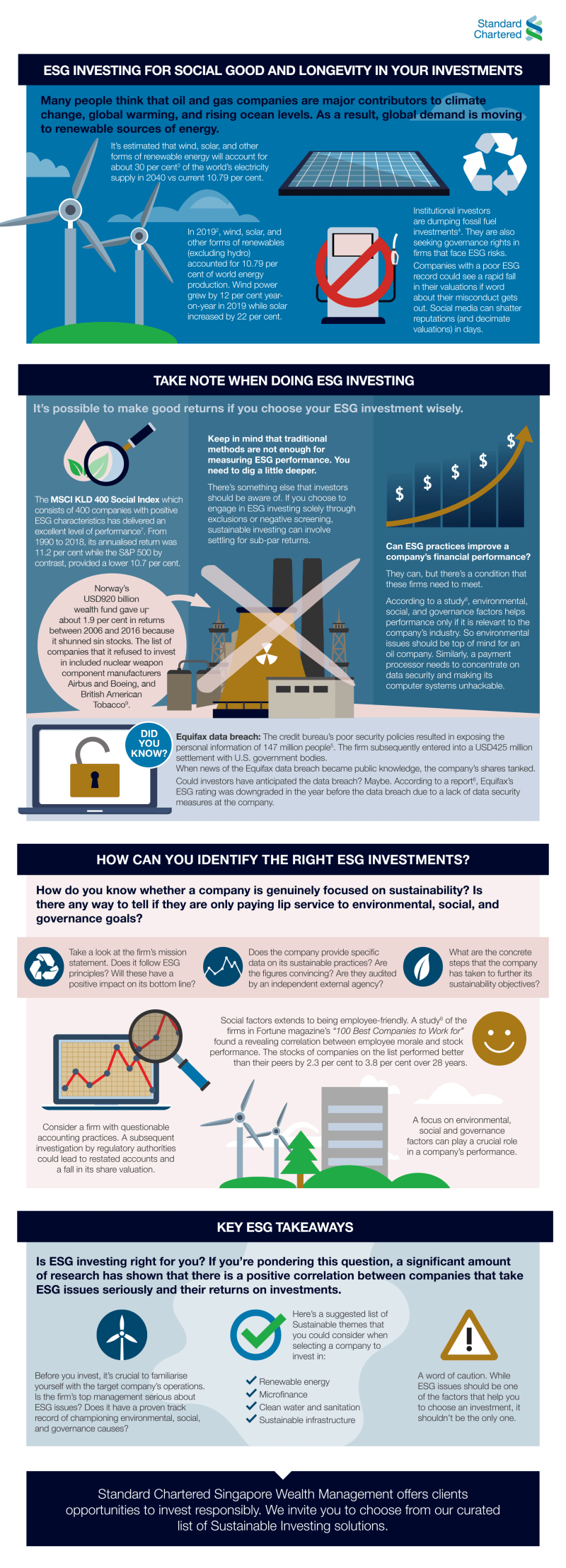

Follow @AI on Twitter for the latest updates, expense management tips, and insight into the future of AI and personal finance. A private limited company is the most suitable form of business structure in Singapore. This offers advantages such as limited liability, tax savings and easy compliance obligations. Singapore’s Companies Act recently introduced the concept of a “small company” that exempts private limited companies that meet certain criteria from the requirement of annual audits. This helps the company reduce its compliance costs as well as the overall regulatory burden. In this article, we explain the private limited company audit requirements for Singapore.

What Can Trigger An Irs Audit

The Companies (Amendment) Act 2014 revised Singapore’s audit exemption criteria and introduced the concept of “small companies”. The concept of small company refers to existing and new private limited companies in Singapore. This article explains the concept of small company audit exemption and the qualifying conditions under which a company may be exempted from the need to conduct an annual audit of its accounts.

The Singapore Companies Act states that all companies must have their financial statements and accounting records audited annually by an auditor unless the company meets Singapore’s audit exemption requirement.

The Companies Act was amended in 2014 to update the criteria for exempting companies from audit and introduced the concept of “small company”. A company that qualifies as a small company does not need to hire an auditor to audit its accounts. The amended law entered into force on July 1, 2015. A company is considered a small company if it meets at least two of the following three conditions:

Apart from individual companies, group companies (holding companies and subsidiaries) can use the Singapore audit exemption if they qualify as a small group according to the criteria set out below.

The Financial Audit Process: How To Perfect It

A group company is defined as a holding company and subsidiaries that together form a group due to a common source of control.

A group company, if the owner and each subsidiary company:

To qualify as a ‘small group’, a group (which includes all companies) must meet two of the following three conditions for the next two financial years:

In other words, this means that individual subsidiaries as well as the holding company as a group must meet the qualifying criteria for small companies in order to qualify for the audit fee criteria.

Audit: What It Means In Finance And Accounting, And 3 Main Types

I’ve always heard that starting a company in Singapore is easy, but I never expected it to be this easy. There is something surprising about the team; from the first assessment to the revision of the paperwork, they handled it all with care. He was quick and professional in opening a bank account for the company.

If the company obtains the status of “small company”, the company will continue to enjoy the audit exemption unless it is disqualified. Disqualification of a company if the company:

Does your company take advantage of all tax credits, grants and incentives from the Singapore government? Find with matchME™

Prior to the 2014 amendment act, private company accounts with an annual turnover of less than or equal to S$5 million were exempted from auditing. A voluntary private company is a company with less than 20 shareholders and no corporate shareholders.

Why Should You Get Your Defi & Nft Smart Contracts Audited?

The criteria have changed since the 2014 amendment. Now any company defined as a “small company” is eligible for exemption from inspection.

If my company is exempt from audit, do I still need to prepare and file annual accounts?

Yes, you still need to prepare and file an annual unaudited financial statement. Among other things, your company’s annual reports are the main basis for calculating and preparing your company’s tax returns. The only difference is that if your company is exempt from audit, you do not need to hire an auditing firm to formally audit the accounts.

My company qualifies as a small company and is therefore exempt from the audit requirement. Can you handle booking accounts and payments for my business?

How Long Does A Tax Audit Take From Start To Finish?

Whether your company is audit exempt or not, we offer a full range of accounting and bookkeeping services in Singapore. If an audit is required, we will work with an appointed audit firm to complete the audit for you in an efficient and stress-free manner. If you need help or need to register a company in Singapore, contact us today.

Provisional Provisions A company formed before the amendment of the Act can also use the audit exemption if the company meets two of the three qualifying criteria for a small company. In particular, a company incorporated before 1 July 2015 if: It is a sole proprietorship and meets the qualifying criteria in the first or second financial year after the start of the small business criteria (ie on 1 July 2015) Transitional provisions in the table below cited:

A company is a small company because the company meets the criteria in the first year after the introduction of the concept

The company does not meet the eligibility criteria in FY15 but will in FY16

How To Handle An Irs Audit & When To Get Expert Help

Since the company met the criteria in the second year after introducing the concept, the company is a small company.

It does not qualify as a small company because the company does not meet the criteria in the first and second year after the introduction of the concept.

Changes in audit exemption criteria will ease compliance obligations for smaller companies. Many companies that meet the definition of “small company,” including subsidiaries of foreign companies, are not eligible for exemptions. Singapore is a very attractive choice for setting up a base for your business. The country promotes the best business policies in the world, making it easy for your business to take root and succeed. It’s a world-class economy full of opportunities for people with innovative ideas and the drive to build successful businesses.

We recently conducted a survey of startup founders from five countries. To gauge global sentiment about Singapore’s attractiveness as a startup location, the survey ranked Singapore on indicators that entrepreneurs believe are important. Read our report for more information.

Streamline Your Audits With Approval Automation: How Approvalmax Can Help

Avoid Penalties: Compliance Dates for Singapore Companies in 2024 January 10, 2024 Singapore Regulatory Update: December 2023 December 28, 2023

Our team of experts can deliver all corporate services on a world-class platform at a very affordable price – the best of all worlds. If you’re in the less than one percent of people who receive an IRS audit letter, don’t worry. It’s likely that your tax return was flagged for one of the common reasons for an IRS audit.

For most postal audits, the IRS will ask you to explain or prove something simple on your return, including:

Assuming you were completely honest when you filled out your tax return, your IRS audit can be handled relatively easily. However, if you are intentionally dishonest on your tax return, you could find yourself in hot water. However, when you receive a request letter, the first thing you need to do is open it

Irs Audit Period Is 3 Years, 6 Years Or Forever: How To Cut Your Risk

What happens if you get audited by the irs, what if you get audited by the irs, what to do when being audited by irs, what to do if your audited by the irs, what to do if you are audited by the irs, what to do if audited by irs, what to do if i get audited by the irs, what to do when audited by irs, if i get audited by the irs what happens, what to do if you get audited by the irs, what to do if you get audited, what happens when you get audited by the irs