What To Do If You Are Audited By The Irs – A private limited company is the most suitable form of business structure in Singapore. It provides benefits such as limited liability, tax savings and simple compliance obligations. Singapore’s Companies Act recently introduced the concept of a “small company” which exempts private limited companies that meet certain criteria from the annual audit requirement. This helps the company reduce its compliance costs as well as its overall regulatory burden. In this article, we explain the audit requirements of private limited companies for Singapore.

The Companies (Amendment) Act 2014 changed the criteria for exemption from audit in Singapore and introduced the concept of “small companies”. The small company concept applies to both existing and newly registered private limited companies in Singapore. This article will explain the concept of exemption from a small company audit and the eligible conditions under which a company can be exempted from the requirement for an annual audit of its accounts.

What To Do If You Are Audited By The Irs

The Singapore Companies Act states that every company must have its financial statements and accounts audited by an accountant on an annual basis, unless the company meets the Singapore audit exemption requirement.

Management Response To Internal Audit Reports Memo

The Companies Law was amended in 2014 to update the criteria for exempting companies from auditing and introduced the concept of “small company”. A company that qualifies as a small company does not need to appoint an auditor and audit its accounts. The amended law entered into force on July 1, 2015. A company is considered a small company if it meets at least two of the following three conditions:

In addition to private companies, group companies (holdings and subsidiaries) can also be exempted from audit in Singapore if they qualify as a small group according to the criteria described below.

A group company is defined as a company and its subsidiaries that together form a group due to a common source of control.

A company in the group is exempt from an annual audit of its accounts if the owner and all the subsidiaries separately:

Nonprofit Audit Vs. Review — Altruic Advisors

To qualify as a “small group”, the group (consisting of all companies) must meet two of the following three conditions during the previous two financial years:

In other words, this means that in order to qualify for exemption from audit, individual subsidiaries as well as the holding company, as a group, must meet the qualifications of a small company.

I’ve always heard that starting a company in Singapore is easy, but I didn’t expect it to be this easy. The entire team came together with no surprises; From the initial quote to checking the paperwork to the actual listing, they handled everything smoothly. Their quick and professional assistance in opening a corporate bank account was the icing on the cake.

Once a company reaches the status of “small company”, it continues to enjoy the benefit of exemption from audit unless the company is disqualified. A company will be disqualified if the company:

These Are Some Of The Top Red Flags For An Irs Audit, Tax Pros Say

Is your company making use of all the Singapore government tax breaks, subsidies and incentives available to it? Find out with matchME™

Prior to the 2014 Amendment Act, an exempt private company with an annual turnover of less than or equal to S$5 million was exempt from having its accounts audited. A registered private company is a company with less than 20 shareholders and no corporate shareholders.

According to the 2014 amendment, the criteria have changed. Now any company defined as a “small company” is entitled to exemption from audit.

If my company is exempt from audit, do I still need to prepare and submit my annual accounts?

Oh No! I’m Getting Audited And Don’t Have Receipts: What To Do Next

Yes, you still need to prepare and file your annual unaudited financial statements. Among other things, your company’s annual financial statements are the main basis for calculating and preparing corporate tax reports. The only difference is that if your company is exempt from audit, you do not need to appoint an audit firm and formally audit your accounts.

My company qualifies as a small company and is therefore exempt from the audit requirement. Can you handle the bookkeeping and tax payment for my business?

Whether your company is unregulated or not, we offer the full spectrum of accounting and bookkeeping services in Singapore. When an audit is required, we are in contact with the appointed audit office in order to carry out the audit for you in an efficient and stress-free manner. Contact us today if you need help or want to register a company in Singapore.

Transitional provisions A company incorporated before the changes in the law can receive exemptions from audit even if the company meets two of the three eligibility criteria for a small company. Specifically, a company incorporated before July 1, 2015 can qualify as a small company: if it is a private company and meets the criteria of a small company in the first or second financial year after its establishment (ie July 1, 2015) the table below explains the transition arrangements:

Quality Audit Checklist Is Necessary For Qa Audits

The company is a small company because the company meets the criteria in the first year after the presentation of the concept.

The company does not meet the eligibility criteria in FY 15, but does in FY 16.

The company is a small company because the company meets the criteria in the second year after the introduction of the concept.

In the first and second year after the introduction of the concept, the company does not meet the criteria and is therefore not eligible as a small company.

Irs Audit Penalties And Consequences

The revision of the criteria for exemption from audit further simplifies the compliance obligations for small companies. Other companies, including subsidiaries of foreign companies, that meet the definition of “small companies” are not entitled to exemption from audit. Singapore is a very attractive choice to establish a base for your business. The country promotes some of the best trade policies in the world, making it easy for your business to take root and grow. It is a world-class economy full of people with innovative ideas and opportunities to create successful businesses.

A survey was recently conducted of startup founders in five countries. To gauge global sentiment about Singapore’s attractiveness as a startup location, the survey ranked Singapore on measures deemed important by entrepreneurs. Read our report for more details.

Avoid Penalties: 10 January 2024 Compliance Dates for Singapore Companies Regulatory Updates in Singapore: December 2023 28 December 2023

Our team of experts can provide all corporate services at a very affordable price on a world-class platform – the best in the world. Did you know that 1 in 16 people who prepare their own taxes will be audited by the IRS?

Iso 9001 Internal Audit: Five Main Steps To Make It More Effective

For many people, the news that they will be audited by the IRS is like a death sentence. Are you one of the unlucky taxpayers to be audited this year?

Simply put, an IRS audit is designed to determine whether or not your reported income and other tax information is accurate. If they don’t, you can expect an adjustment on your tax return and you’ll have to pay penalties.

An audit consists of a thorough examination of your financial accounts, books, records, documents, vouchers and more. You may need to disclose non-financial information if it helps paint a more accurate picture of your situation.

However, not all fixes are exactly the same. Of course, there are several different types of audits you may be subject to depending on the circumstances, such as correspondence audits, office audits, and others.

Outsourced Audit — Steps For The Audited Organisations

Correspondence reviews are often the easiest reviews to handle. If you have received news that you are undergoing a correspondence audit, you should not panic at all.

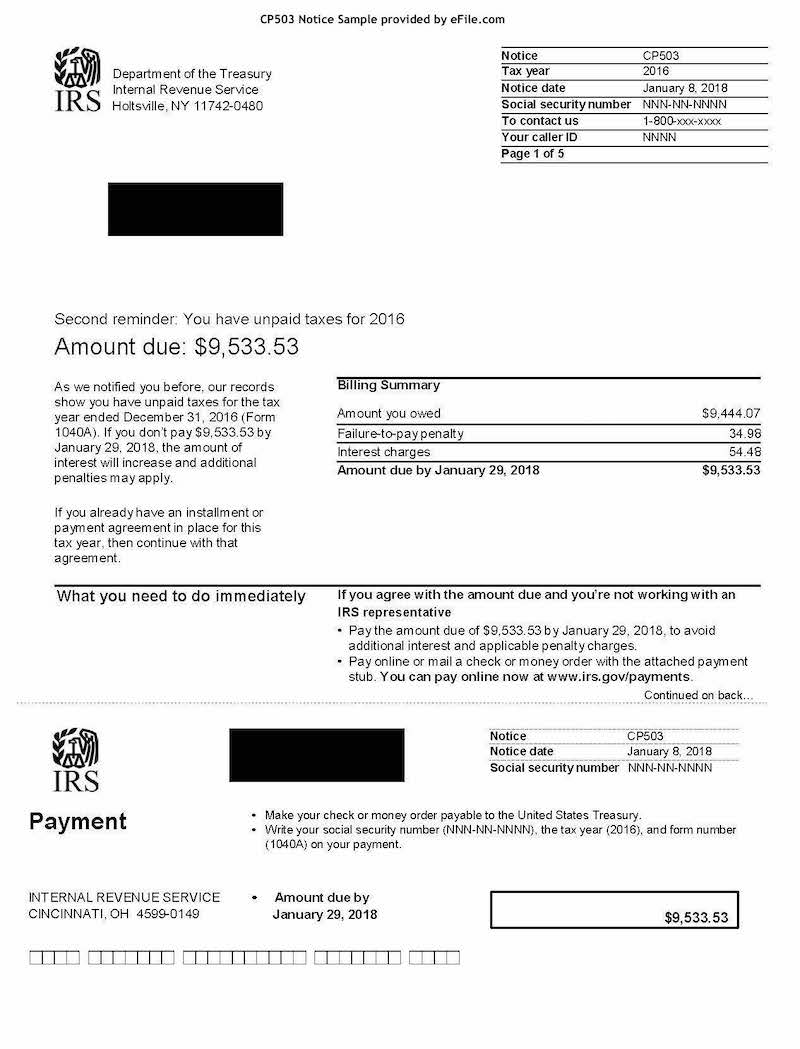

In most cases, this type of audit can be resolved by sending the IRS proof of any deductions or credits you have entered on your tax return.

This type of evidence usually takes the form of copies of receipts, checks or other documents that can prove the correctness of the tax forms you filled out.

Of course, if you don’t have supporting documentation, things may not be easy to resolve and may result in tax adjustments, penalties and possibly additional audits.

What To Do If You Receive An Irs Tax Audit Notice

The IRS used to conduct many audits in person, covering a wide range of material, but budget cuts over the years have resulted in the agency switching to more specific audits conducted by mail.

However, just because face-to-face auditions aren’t as common as they used to be, that doesn’t mean you can never be on the receiving end.

If you find yourself in the midst of a face-to-face audition, there are certain steps you can expect. In fact, you will receive a notification in the mail that you are under review. You will also receive a Form 4564, called an IDR (Information Request).

After that, you will have to attend an initial interview at the office in the Income Tax Building. Depending on the complexity of your situation, this office review interview can last two hours or a full day. Based on this interview, the auditor will be able to determine what he is dealing with.

Irs Audits Few Millionaires But Targeted Many Low Income Families In Fy 2022

The next step is for the IRS to focus on a few key issues related to you

Audited by the irs, what happens if you get audited by the irs, what if you get audited by the irs, what to do if i get audited by the irs, what to do if audited by irs, what to do when audited by irs, if i get audited by the irs what happens, what happens if you are audited by the irs, what to do if you get audited by the irs, what to do if your audited by the irs, if you are audited by the irs, what to do if you get audited