What Happens If You Get Insurance After An Accident – A lot of unexpected things can happen in life and if you don’t sign up for adequate insurance, this is the best time to avoid accidents or unexpected accidents at any time of the year. With adequate insurance, you can start 2023 with peace of mind knowing you and your loved ones have cash in case of an emergency.

With this in mind, Independence Insurance wants to share some of the types of insurance you want to offer this 2023 for full coverage. If you already have this insurance, make sure it is adequate and covers all the required coverage.

What Happens If You Get Insurance After An Accident

First of all, the basic type of accident insurance that a person should have. Some may not realize it but having personal accident (PA) insurance can save lives, especially when your world is turned upside down due to an accident. Having a dad around can really help in unexpected situations that occur after an accident. Especially, if you are the sole breadwinner, having a PA is important.

Understanding Life Insurance Loans

Liberty PA protection policy offers you and your family members 24/7 complete coverage and worldwide protection in case of emergency. It covers accidental death, permanent disability, medical expenses, accidental theft, personal liability and a total of 23 benefits.

Malaysia is a flood prone country with unprecedented floods and major floods. Can’t we learn from the past? As Malaysia experiences heavy rains every year, it is not guaranteed that your insurance will cover floods.

Some say flood coverage is unnecessary because they don’t live in flood prone areas, but based on the incessant rains of the past two years, even flash floods can instantly damage homes and cars. In order to protect yourself and your loved ones from having to save big on one eye flood repairs, this is very important.

With the end of a wonderful year and the end of a new year, it’s hard not to be tempted by the best deals and new car deals. Whether it’s a business or the first car you own, getting the right car insurance is important. It doesn’t matter if it is a two-wheeler or a four-wheeler… an insurance plan is necessary to protect against unexpected incidents and problems.

Should I File A Claim With My Auto Insurance Or Theirs?

Meanwhile, a car insurance premium policy protects your vehicle from damage caused by unexpected accidents. It covers all parts of your car, as well as protects you from other people’s clothing. With this policy, your vehicle is also covered against loss or damage to your vehicle due to fire, theft, accident and third party bodily injury and death.

In the case of motor comprehensive, it covers losses caused by the owner, fire or theft and also protects the owner from liability to third parties.

With so much uncertainty and so much talk about the recession hitting every sector of the economy and industry, it can be stressful to think about the future of your own business. A lot when it comes to s, and a lot more when it comes to any unexpected hits.

That’s why getting your insurance coverage is so important. It doesn’t matter if the company has one employee or 50 employees, everyone needs insurance. Another myth is that home insurance is sufficient if you operate your business from your home.

Can You Reinstate A Cancelled Insurance Policy After Drive No Insurance Charges?

This is not true because home and business are two different things and should be treated as such. If a fire or flood damages your business property or equipment in your home, it may not be covered by your home insurance. So to protect your business, Independence Insurance offers its BizCare program, a comprehensive program that aims to address all business needs.

Along with BizCare, Liberty Insurance also offers Legal Shield, an additional policy that protects businesses from litigation. This does not include legal claims by third parties such as customers or other companies, and also includes legal disputes with employees and former employees. Legal Shield aims to protect businesses from all legal challenges and high costs.

© 2024 Asia Magazine. & Creative Journalism and Journalism and Logo and / or Logo Business Media International may be a late life insurance policy issue. Here are some things that can happen if you don’t pay your premium.

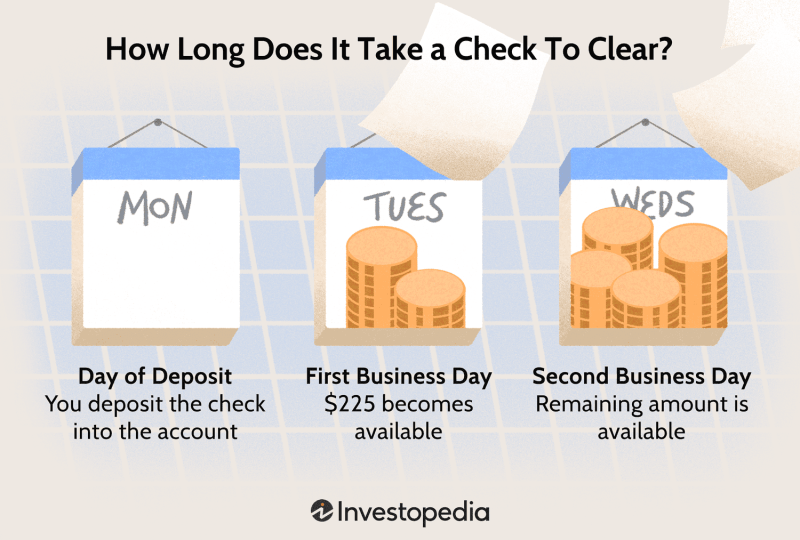

There are many factors in your mind that can cause you to miss your life insurance payout date. If you don’t renew your policy on time, this can be a costly mistake as you may lose out on many benefits. The best part is that the insurance usually gives a grace period of 15-30 days if you forget to pay the premium on the due date. Here’s how to refresh your life insurance policy if you miss a payment date.

After An Accident In California, How Much Would My Insurance Cost?

“A lapsed policy is a policy where the terms and conditions of a health insurance policy are no longer valid. However, depending on the product type, you can renew your life insurance policy within 15-30 days,” said Reliance CEO Rakesh Jain. General insurance.

Realizing the importance of expiry dates for health insurance policies, the Insurance Regulatory and Development Authority of India (IRDAI) last year asked all insurance companies to send renewal notices a month before the policy expires. Advertisements should also mention the prize money to be paid.

“Renewals can easily be done online by visiting the insurance company’s website, using the mobile app or through an agent or branch. All you need is identification, age and address, your previous policy and medical report/ declaration of good health if having health insurance. Insurance / life insurance policies can be renewed through the Reliance Self-i app.”

But if you don’t renew your policy even within the grace period, the policy will expire and you will lose three important benefits. For example, any claim arising between the scheduled time and the payment date will not be handled by the insurance company. Hence, have insurance for a short period of time.

Things You Should Know About The Changes In Health Insurance From 1 April 2021

Second, if you miss the renewal date, you must complete the waiting period. Because the existing health insurance policy does not cover the continuation for 2-4 years.

Third, if your policy lapses, the claim free fee, which may range from 5 to 50% of the sum assured depending on your policy. No claims premium is a percentage of the amount the life insurance company pays you as premium for every year you make no claims. The percentage varies from company to company but the amount of this insurance usually increases by 5 percent for each year unpaid up to 50%.

“In a standard case, the employer must renew within a grace period, most health insurance plans offer a 30-day period. Insurance companies also offer an option to renew the policy (for a specified period), the good news is that the benefits of the waiting period are also lost, buying a new cover with a new waiting period and a medical examination. The owner is left with no option but to do it,” said Indranil Chatterjee, co-founder of the company. , RenewBuy. Being involved in a car accident can change your life. One minute you are driving with some questions in your mind and the next minute, you have new questions to replace them. Top of the list is how to fix your car after an accident.

Millions of Americans rely on their cars and trucks to get to work, school, supermarkets, nursing homes and just about every other place we want to go – until we don’t have a commute. If you’ve been in a car accident and need to get back on the road quickly, read on to find out more about where to take your damaged car, paying for it, your insurance covers and your car accident repair rights.

When Should You Get Life Insurance?

Now, you’ve exchanged insurance information with the other driver(s) at the scene of the accident, gathered evidence and witness accounts, and talked to the police. The officer at the crime scene determined that your vehicle did not need to be towed and could be towed. Now, repairing your car after an accident means doing the following:

You may wonder if you can fix yours

What happens if someone sues you after a car accident, what happens if you get into a car accident without insurance, if i get insurance after an accident, what happens if you are in an accident with uber, what happens if you get in an accident without insurance, what happens if i get insurance after an accident, what happens if i get in an accident without insurance, what if you get in an accident without insurance, what happens if someone sues you after a car accident without insurance, what happens if you get into a car accident, what happens if you get into a car accident with no insurance, what happens if you have an accident without insurance