What Does Being Audited Mean By The Irs – Did you know that 1 in 16 tax preparers will be audited by the IRS?

For most people, notification of an IRS audit is a death sentence. Are you one of the unfortunate taxpayers who will be audited this year?

What Does Being Audited Mean By The Irs

Simply put, an IRS audit aims to determine the accuracy of your income and other tax information. If not, you may have to amend your tax return and you may have to pay a penalty.

What Is A Tax Audit And To Whom Is It Applicable?

Audit includes financial accounts, books, records, documents, vouchers, etc. will consist of a thorough investigation. You may need to disclose non-financial information if it helps you better understand your situation.

However, not all audits are the same. In fact, depending on the situation, you may encounter several types of audits, such as correspondence audits, office audits, etc.

A correspondence audit is probably the easiest audit. If you receive a message saying that correspondence will be checked, there is absolutely no need to worry.

In most cases, this type of audit can be resolved by sending the IRS documentation of certain deductions or credits reported on your tax return.

How Far Back Can The Irs Audit?

This type of evidence is usually in the form of a receipt, check, or other document confirming the correctness of the completed tax form.

Of course, if you don’t have the documents, it may not be easy to resolve the issues and you may have to correct the tax return, incur penalties and additional audits.

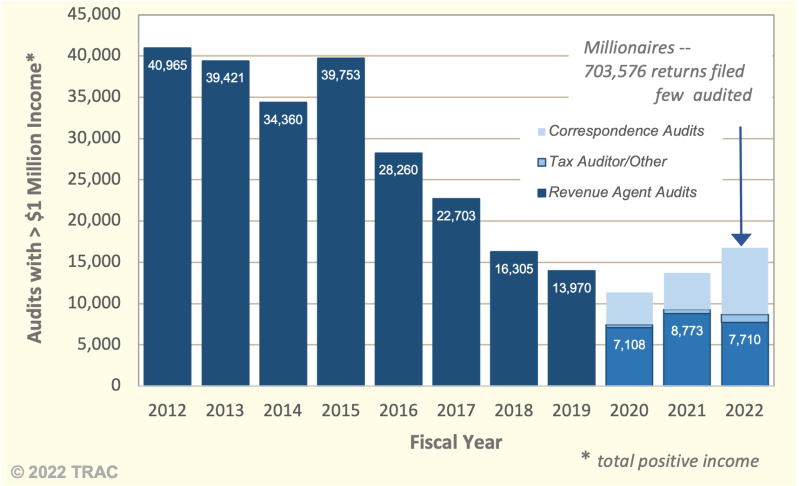

The IRS used to conduct most audits in person, covering a variety of materials, but budget cuts over the years have forced the agency to switch to specialized audits conducted by mail.

However, in-person inquiries don’t happen often because you’re never accepted.

Written Explanation Sample Letter To Irs

If you’re in the middle of a personal audit, there are some steps you can expect. You will certainly receive an audit notice in the mail. You will also receive a Form 4564, otherwise known as an IDR (Information Documentation Request).

You must then attend an initial interview at an office in the IRS building. Depending on the complexity of your situation, this office audit interview can last 2 hours or a full day. Based on this conversation, the auditor can determine what to do with it.

The next step is for the IRS to address several key issues related to its situation. It can also lead to more IDRs and office interviews. After these processes are completed, you may have to amend your tax return and pay a penalty.

Like an office audit, a field audit is another type of live audit that can be less intrusive because it takes place in your home or business.

Raw Data: The Cost Of An Irs Audit

When it comes to conducting a field audit of your home, you don’t have to give permission to the IRS unless they can get permission to do so based on a court order. For example, if you claim a home office deduction on your taxes, auditors may need to enter your home. If you refuse to incorporate the IRS into your home, your office will certainly be subject to tax deductions.

You will certainly be notified in advance to prepare your documents. When the auditors come knocking on your door, you should be ready to show them a copy of your documents.

It is important to remember that tax professionals or legal advisors should be part of the field audit.

After the audit is completed, the auditor may find that previous tax returns need to be corrected. You may also have to pay various fees.

Tax Audit: Navigating The Storm: Surviving Tax Audits With Relief

However, you have a chance to fight the appeal. If you decide to appeal, an IRS Appeals representative will hear your case. This process is usually not quick and you may have to wait several months after your audit is completed.

In most cases, the appeals officer will contact you by phone. However, if you want to meet an appeals officer in person, you should ask.

Appeals may not end in your favor. In this case, you can appeal to the US Tax Court.

Remember that an audit may not land you in jail. Tax fraud usually starts at $70,000. If any discrepancy is caused by an honest mistake, you should not expect criminal liability.

Where In The U.s. Are You Most Likely To Be Audited By The Irs?

When someone asks you, “What does testing mean?” you can tell them everything.

If you have a tax problem, Loyalty Tax can help. An audit doesn’t have to be the end of the world. We can provide you with guaranteed results throughout the entire process.

Our knowledgeable professionals can help you with tax negotiations, offers in compromise, wage freezes and more.

If you have any questions about our high quality service, please contact us. We are always happy to help.

The Irs Audited 1.2 Million Households In 2015

When you owe federal taxes, one common collection action is to pay the IRS taxes, usually on your wages or salaries. A wage garnishment can leave a person with less to live on.

Have you received a letter from the IRS? Check to see if you’re eligible for free work consideration and whether you’re eligible for tax credits.

The IRS has announced new rules for those struggling with tax debt. In 2022, you have the opportunity to reduce your tax liability to this level

If you owe money to the IRS, the agency has the right to collect it from you through penalties, fees, or accrued interest. Martha Stewart, Al Pacino, Lionel Richie – What do these celebrities have in common? All of them are audited by the IRS. With the latest news about celebrity audits coming out, 0.6% of personal income tax is audited every year, which seems to be the norm. But a small number of audits doesn’t mean you’re out of trouble. If the IRS suspects suspicious activity related to your taxes, they may put you on their audit list.

What Triggers An Irs Audit?

So what leads to an IRS audit? You will know! Below, we discuss the top tax reporting mistakes that could land you in an IRS audit. Read on to see the most common IRS red flags that could land you in Uncle Sam’s hot seat, or use the links below to jump to the section of your choice.

Before discussing the reason for a tax audit, it is important to first understand what an IRS audit is. An IRS audit is an examination or examination of a taxpayer’s or business’s accounts and financial information to ensure that the information provided is accurate and compliant with tax laws. When the IRS conducts an audit, they want to verify the accuracy of the amounts reported on your personal or business tax return.

Fortunately, most income tax returns are not audited, and IRS audits have decreased recently due to budget and staff cuts. Overall, only 991,168 of the 195,750,099 tax returns filed in 2017 were audited, a 42% decrease from 2010. That doesn’t mean you have to falsify your tax return. The IRS still takes tax fraud seriously, so if they see any discrepancies on your return, they will knock on your door.

There are many IRS audit red flags that can get you into trouble. For example, lying on your tax return to get more money increases your chances of being audited. Or claiming fraudulent deductions could raise an IRS red flag. Here are some common red flags that could trigger an IRS audit:

How To Be Irs Audit Ready As A Small Business

If you make too much or too little income, your chances of being audited by the IRS increase. In general, taxpayers with adjusted gross income between $25,000 and $500,000 may pay more than taxpayers with adjusted gross income above $25,000 or $500,000, as determined by the 2018 IRS Factbook.

Why it’s For taxpayers with a lower adjusted gross income, the IRS may think you’re claiming too many deductions or underreporting extra income. The 2018 Fact Book found that 2.04 percent of those who did not report adjusted gross income were audited by the IRS in 2018, compared to 0.44 percent of those who reported between $100,000 and $200,000.

Instead, taxpayers take home a lot more

What does it mean to get audited by the irs, being audited by the irs, what does being audited by the irs mean, what is the chance of being audited by irs, irs being audited, what is being audited by irs, what is being audited by the irs, audited by the irs, chances of being audited by the irs, reasons for being audited by the irs, what to do when being audited by irs, i am being audited by the irs