What Do I Do If I Owe Federal Taxes – No one owes money to the Tax Office. Ideally, you should pay the correct amount of income tax and proceed without a second thought. Or you could get a surprise but welcome tax refund after you file. But it doesn’t always happen.

Sometimes, the amount of back taxes that can accumulate is unexpected. You probably know you owe federal taxes, but the question “How much do I owe the IRS?” Don’t wait for that dreaded IRS notice. We’ll help you figure it out using one of four simple methods.

What Do I Do If I Owe Federal Taxes

Back in December 2016, the IRS released an online tool for taxpayers. This tool serves as a gateway to view your account with the IRS. You can see your total payment and the balance for each year of the taxes you owe. You can also view a 5-year history including estimated tax payments. Your account balance is updated once every 24 hours and usually overnight. It is very free; You only need to register to get your account.

Due Date Approaches For 2022 Federal Income Tax Returns

The IRS will also provide a credit report with the following information to verify your identity. But this is a soft check, it won’t affect your credit score and lenders won’t see it.

If you register and choose to use the online portal, you can also use it to pay your taxes online. Payments made online usually appear in your account in one to four days. If you pay by check or money order, it can take up to three weeks.

Not a big fan of using online tools to manage your federal taxes? Don’t have all the information you need to access online services? Don’t worry, you have other options.

Your first option is to contact the IRS. You may have to wait, but when you get in touch, a representative from the IRS can tell you how much you owe.

How Did The U.s. National Debt Get So Big?

If you are a taxpayer looking for your balance, you can call the IRS at 1-800-829-1040 between 7:00 a.m. and 7:00 p.m. and 7:00 p.m. local time.

Another off-site option is to contact the IRS by mailing the form.

While this is a reasonable option for any taxpayer, remember that the nature of mail, it can be long. And if you owe money, you’ll continue to accrue penalties and interest while you wait for repayment.

You should also make sure the IRS has your current address. Otherwise, they will send their response (and any other notices) to the closest address on file, which may not be your current address.

National Debt Of The United States

Individual taxpayers filing Form 1040 can request an information letter by mail or by calling 800-908-9946. Data are available for the current financial year and the last three financial years.

If you file a different form or require a transcript for a later tax year, you must submit Form 4506-T, Tax Return Transcript Request. After the IRS receives and processes your Form 4506-T, they will provide you with a free transcript.

“How much do I owe the IRS?” The last option is probably the easiest and most hands-off answer to the question. No form is required online, by phone or by mail. Instead, you can ask someone to do the hard work for you.

Credit professionals (such as CPAs, tax attorneys and EAs) can work with the IRS on your behalf to find out how much you owe. All you have to do is give them your personal information and step back while they deal with the IRS on your behalf. And once they know how much you owe, they can also offer specific solutions to help you pay off debt and stay out of trouble.

Increasing Share Of U.s. Households Paying No Income Tax

Once you know how much you owe the IRS, the next step is figuring out what to do about it.

Paying your bills is easy when you have money in your bank account to pay your balance.

The IRS is not blind to this problem. They offer solutions to such cases, including payment agreements and offers of compromise. Not everyone is eligible for every solution, so it’s important to look for opportunities to find relief.

If you go the professional credit card assistance route, they can walk you through the options available to you and what they recommend for your unique situation. Our tax experts will also do the heavy lifting to give you the right tax solution, whether it’s a payment plan or an appeal.

Is Biden’s Student Debt Forgiveness Fair?

If you need help with your tax return, call for help before things get bad. Liens and garnishments are on the horizon until you take action to resolve your tax debt. Don’t wait. Take action today!

We use cookies to give you a better user experience. We also share that information with third parties for advertising and analytics. By using this website, you accept the use of cookies. Privacy | Terms of Use

We know tax debt can be scary, but help is just a click away! Answer a few questions to help us better understand your situation. It only takes a few minutes: The IRS and state revenue departments won’t immediately turn to collection tools if you don’t pay your taxes. The process begins with a bill and a letter of information, which can specify penalties and interest.

If you can’t pay the bill in full, you may have the option of setting up a financial plan or providing proof of why you can’t pay (bankruptcy, identity theft, living in a dangerous place, etc.).

Can You Buy A House If You Owe Federal Taxes In Florida? 2024

However, if you are out of options and there is no reason acceptable to the IRS or the state department of revenue, you may have a lien on your property, seizure of your assets (levy ) or withhold refunds. Ultimately, this means you can lose yourself:

In some states, the IRS can revoke your driver’s license (or your professional license). However, generally, this sales tool is used in the state because driver’s licenses (and various business licenses) are issued by the state.

The Chief Executive (the person who oversees the government’s finances) works with the Department of Motor Vehicles to ensure that individuals and businesses pay their taxes. If you are labeled a state debtor, you may not be able to renew your driver’s license or vehicle registration.

Unfortunately, you have to get a driver’s license at the manager’s office. If you contact them as soon as you become aware of the pressure, you may be able to agree to a settlement and be allowed to return it on time, but usually you will be required to pay a percentage of what you credit.

Digital Ad Tax Argued By Attorneys In Maryland Federal Court Case

Your best bet is to work with a tax attorney before contacting the sheriff’s office. We will discuss this later in the chapter.

The IRS reserves the right to report serious tax debts to the State Department, which may take action, including denying or revoking your passport. .

For this purpose, a gross tax liability of approximately $54,000 (adjusted annually for inflation and including interest and penalties). If this federal debt is legally enforceable, and a lien or tax is filed, the debt can be certified to the Department of State.

As with other collection tools, the Department will not immediately take action to cancel your passport. First you will receive a letter and have 90 days to resolve the issue, pay the debt or set up a payment plan. If you do any of these things, the certificate from the IRS to the Department of State will be changed.

Withholding Allowance: What Is It, And How Does It Work ?

For many people, losing their driver’s license or passport is a serious obstacle to their income. Obviously, losing a business or professional license can do the same.

If you have a serious tax problem and are worried about losing your license or passport, be sure that working with a tax attorney can help. Even if you have canceled something, know that you can restore your passport or license after taking the necessary steps.

Contact the manager. Our understanding of licensing and renewal processes is essential in negotiating withdrawals and payment plans. We can help you discharge payments, dispute debt, create a payment plan and negotiate a reduction in your debt amount.

If you or someone you love is facing serious back taxes, lost a license or passport, or is hoping to renew a license or passport, contact S.H. Block today for advice and information from a tax attorney.

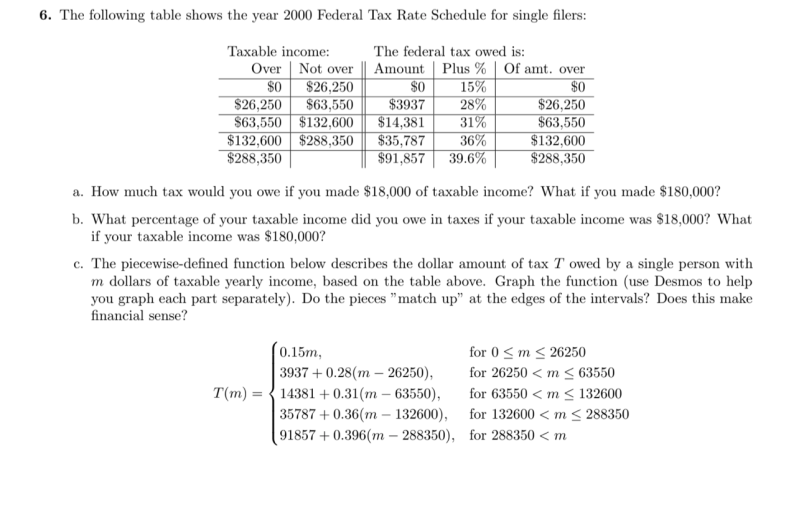

The Following Table Shows The Year 2000 Federal

Call (410) 872-8376 or fill out the contact form on our website to schedule your consultation. It is our honor to work with you!

The material presented here is for informational purposes only and should not be construed as legal advice on any matter.

Https:///wp-content/uploads/2021/02/shutterstock_127998287-e1612805278416.jpg 1001 1500 S.H. Tax Service block https:///wp-content/uploads/2016/12/new-logo.png

If you owe federal taxes how do you pay, if you owe federal taxes, what to do if you owe taxes, what to do if you owe federal taxes, how do i find out if i owe federal taxes, what do i do if i owe federal taxes, how do i know if i owe federal taxes, what happens if you owe federal taxes, what to do if i owe taxes, do i owe federal taxes, what to do if we owe taxes, what do i owe in federal taxes