Selling House For Less Than You Owe – Posted by Jeanne Lee Posted by Jeanne LeeArrow Contributing Writer Jeanne Lee writes about mortgages, personal finance, and enjoys finding ways for people to manage their finances. Jean Lee and Mia Taylor Written by Mia TaylorArrow Featured Writer Mia Taylor is a contributing and award-winning journalist with two decades of experience working as a staff reporter or contributor for leading national newspapers and websites, including the Atlanta Journal -Constitution, San Diego Union -Tribune, TheStreet , MSN and Credit.com. Mia Taylor

Edited by Laurie Dupnock Edited by Laurie Dupnock Right Arrow Editor, Home Lending Laurie Dupnock is the Loans Editor on the Home Lending team. Connect with Lori Dapnock on LinkedIn Linkedin Lori Dapnock

Selling House For Less Than You Owe

Founded in 1976, the company has years of experience helping people make smart financial decisions. We have maintained this reputation for more than four decades by demystifying the financial decision-making process and giving people confidence in what to do.

What Is A Sheriff’s Sale? What You Need To Know In Pennsylvania

Follows a strict editorial policy, so you can trust that we have your best interests at heart. All our content is written by highly skilled professionals and edited by content experts who ensure that everything we publish is true, accurate and reliable.

Our credit writers and editors focus on the information that matters most to consumers – the latest rates, best lenders, navigating the home buying process, refinancing your loan, and more – so you can feel confident in your decision as a buyer and as a buyer. apartment owner. .

Follows a strict editorial policy, so you can trust that we have your best interests at heart. Our award-winning editors and reporters create reliable, accurate content to help you make informed financial decisions.

We appreciate your trust. Our goal is to provide readers with accurate and unbiased information, and we have editorial standards to ensure this happens. Our editors and reporters thoroughly check content to ensure that the content you read is accurate. We maintain a firewall between advertisers and our editorial team. Our editorial team does not receive funding directly from our advertisers.

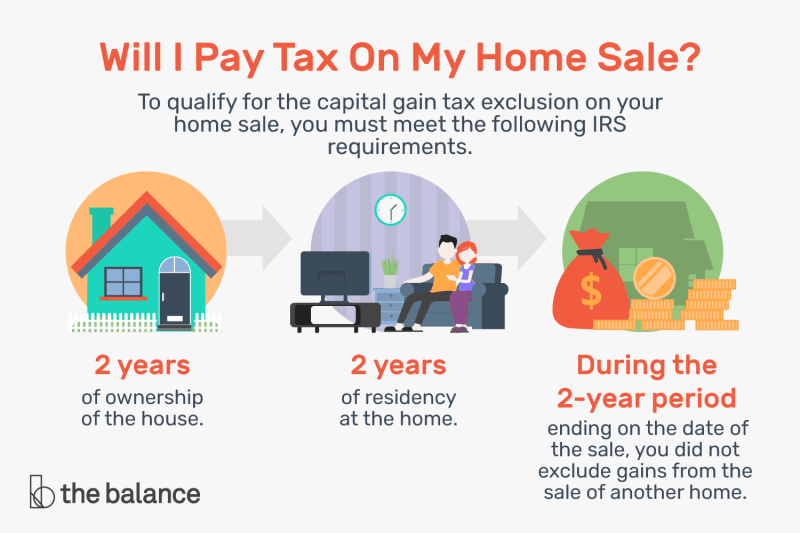

Will You Pay Income Taxes On The Sale Of Your Home?

The editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart financial decisions. We follow strict guidelines to ensure that our content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly reviewed to ensure accuracy. So, whether you read articles or reviews, you can be sure that you are getting reliable and trustworthy information.

You have questions about money. there is an answer. Our experts have been helping you manage your money for more than four decades. We always strive to provide clients with the expert advice and tools needed to succeed throughout life’s financial journey.

Follows a strict editorial policy, so you can trust that our content is true and accurate. Our award-winning editors and reporters create reliable, accurate content to help you make informed financial decisions. The content created by our editors is accurate, factual and not influenced by our advertisers.

We’re open about how we can provide you with high-quality content, competitive prices, and valuable resources by explaining how we make money.

Can I Sell A House As Is With A Reverse Mortgage?

Is an independent publisher and advertising-supported comparison service. We are paid in exchange for placement of sponsored products and services, or by clicking on other links posted on our site. Therefore, these securities may influence how, where, and in what order they appear in the listed sections, unless the law prohibits mortgage, equity, and other home loan products. Other factors, such as our website policies and whether a product is offered locally or on a website of your choice, may also influence how and where products appear on this site across the internet. While we strive to provide a variety of offerings, we do not include information about every financial or credit product or service.

Short sales were common in 2008 to 2012, but are extremely rare in today’s housing market. However, these distress sales—where the lender allows the borrower to pay off their mortgage for less than the total amount owed—can also be part of the home buying process. For the buyer, a short sale can result in a good property sale, but generally requires a certain amount of effort and patience, as well as a lot of luck.

A short sale is when a mortgage lender agrees to accept a mortgage for less than the balance, usually to facilitate the sale of the property. Lenders forgive homeowners—usually people experiencing financial hardship—for the remainder of the loan.

Short sales only occur with the lender’s approval. Typically, this occurs when home values decline and the homeowner owes more than the home is worth, placing them in a negative equity position.

How Soon Can You Sell A House After Buying It?

There is a difference between buying a home through a short sale versus foreclosure. In foreclosure, the lender takes control of the property and tries to sell it for enough to cover its costs. In a short sale, the buyer purchases the home from the original owner, who will pay off the mortgage. The borrower accepts that he will not pay the full amount of the loan.

The reality is that short sales are a mixed bag situation for buyers, sellers, and lenders. Everyone gets something, but also gives something up.

The first step in the short sale process is to convince the lender or mortgage lender that you are facing financial problems that prevent you from continuing to make mortgage payments. This could include job loss, health problems, divorce, or the death of your spouse. You must communicate changes in your circumstances to your lender through what is called a hardship letter or hardship package. As part of the hardship report, the lender may ask you to provide important documents that prove your hardship, such as bank statements and copies of bills or other expenses.

Unless you plan to move yourself, you’ll need a real estate agent to list your home. It’s best to find a Real Estate Agent who has direct experience with short sale issues and can help you navigate the process successfully (some agents may have completed courses related to short sales). Talk to several agents before deciding to find a professional who understands the process well.

Bought A House With Your Significant Other But The Relationship Didn’t Work Out

Once you’ve hired an agent, the next step is to list your home as you would in a traditional home sale. You’ll hold an open house and wait for offers to come in. Work with your Real Estate Agent to get the lowest price.

Once you receive an offer you wish to accept, you must send it to the lender for review and approval. The lender’s vetting process can take a long time, and the lender does not have to accept an initial offer from a prospective buyer. Finalizing the deal may require further negotiations between the lender, buyer, and you as the seller. And remember, there’s no guarantee the lender will accept the offer.

If the lender accepts the offer, the sale can proceed, and the lender uses as much money as possible to pay off your mortgage.

Find reservations in your area by checking online classifieds, searching for court filings or legal notices, or using an experienced buyer’s agent. When searching, try to find out how much debt is owed on the home compared to its appraised value. If it seems high, then it is a good candidate because it indicates that the seller may be having difficulty selling enough to meet the loan.

Can You Sell A House With Property Taxes Owed?

Start looking at properties. Assess its condition and estimate how much needs to be repaired or replaced. If it needs repairs, most “average” customers won’t accept it, and that’s good for you. Then find out how much you can earn by investing in property: What is the value and profit of the property? Finally, ask the seller or agent if there are any liens on the property and who the primary lender is. Verify this information by searching the title before closing to ensure there are no unmentioned links on the site.

You need to know how you will pay for the property. It’s important to understand that with short-term sales, you need the ability to move quickly. Once you’re under contract, lenders typically want to close within 20 days, so get your financing right.

You or your agent should talk to the creditor’s loss mitigation or recovery department. You need the homeowner to complete and sign a consent form (usually notarized), which gives the lender permission to contact you about the terms of the mortgage. Additionally, many lenders have specific requirements for short sale applications. If they don’t have a short sale application, find out what documents they need to consider a short sale.

Next, you will combine the results,

What Is A Short Sale? Buyer & Seller Guide

Selling home for less than you owe, selling your house for less than you owe, selling a car for less than you owe, selling house for less than you paid, selling my house for less than i owe, how to sell a house for less than you owe, selling a car you owe money on, can you sell a house for less than you owe, can you sell your house for less than you owe, selling a house for less than you owe, selling house for less than mortgage, selling a house you still owe on