Insurance Goes Up After Non Fault Accident – Even if your car insurance rates go up after a no-fault accident. If it increases, the risk of accidents will decrease.

Accidents can have a big impact on your car insurance costs, but even accidents that aren’t your fault can raise your premiums. However, the Impact of a no-fault accident on your car insurance rates is less than an at-fault accident.

Insurance Goes Up After Non Fault Accident

If you are involved in a car accident, your insurance premiums will increase. However, if another driver is involved in your car accident. Where you live Depending on the amount of damage and other factors, especially the type of car insurance you have, your premium may or may not increase. If your insurance premiums go up after a no-fault accident. You tend to improve rather than if you are the wrong driver.

Who Pays For Car Damage In A No Fault State? Well, It Depends

If the at-fault driver has little or no auto insurance, your premiums may increase. In such cases, your Insurance may drop down to uninsured/underinsured motorist coverage to cover the costs associated with the accident. In most states, uninsured/underinsured coverage is optional.

If you have accident waiver coverage. Your premium will not increase after an accident, even if you are at fault or if the accident is serious. For example, if you don’t claim an accident for five years, your insurance company may forgive your accident.

In addition to no-fault accidents; Factors that can increase your premium include the severity of the accident and your driving record. Additionally, the Impact of a no-fault accident on your premiums varies from insurance company to insurance company. Some states prohibit insurance companies from raising rates after a no-fault accident.

Insurance companies will determine who is at fault in an accident by reviewing police reports and forensic evidence. This will also be determined by checking the insurance laws of the state where the accident occurred. In some states, the amount each driver pays is calculated using their percentage of fault for the accident, as determined by the claims investigator.

Michigan’s No Fault Insurance Ruling Means Changes For Pre Reform Crash Survivors

Some states require drivers to have no-fault insurance; Or at least insurance companies should offer it as an option. No-fault insurance helps cover medical expenses and loss of income for you and your passengers if you are injured in an accident, regardless of who caused the accident.

Many factors go into calculating your car insurance premium. In addition to your accident record; These include:

A combination of these factors can affect your insurance rates, even if you’re not in an accident.

Even if you have an accident-free driving record, you’re still trying to save money on car insurance. Here are six tips to reduce the cost of car insurance.

Must I Repair My Car After An Insurance Claim Accident?

Changing your car insurance can pay off in the long run if you can find lower premiums with other carriers. Take a few minutes each year to assess the level of cover you need and see if you can get better rates to reduce your risk of accidents with other insurance companies and your premiums. . Our auto insurance comparison tool can help you compare quotes from up to 40 auto insurance providers in minutes.

If you’re looking for ways to lower your monthly costs, see if you can save on car insurance.

The Smart Money™ Debit Card is issued by Community Federal Savings Bank (CFSB) under license from Mastercard International. Banking services provided by CFSB member FDIC. Program Manager; No bank.

Editorial Policy: The information contained in Ask is for educational purposes only and is not legal advice. Should you consult your lawyer or seek separate legal advice on legal matters? Be aware that rules change over time. Posts describe the rules when writing. Archived posts are kept for your information, but do not reflect current rules.

How Much Does A Car Accident Increase Insurance?

The views expressed here are the views of the Bank; The views are the author’s only and not those of the credit card issuer or other company, and there is no review of these organizations; Neither approved nor approved. All information, including rates and fees, is accurate at the date of publication and is updated as provided by our partners. Some offers on this page may not be available through our website.

The strengths and weaknesses of the offer are determined by the editorial team based on independent research. Banks Lenders and credit card companies are not responsible for the content posted on this site and do not endorse or guarantee reviews.

Advertiser Disclosure: Offers that appear on this site are from third-party companies (“our partners”) that receive compensation for their services to consumers. This indemnity does not apply to products displayed on this site. Where and how can affect the order. Offers on the website are financial services available; Does not represent all companies or products.

*Full terms and conditions of the offer can be found on the website of the issuer or partner. After clicking the Apply button, you will be redirected to the publisher’s or partner’s website where you can read the terms and conditions of the offer before applying. We are showing a summary, not the full legal terms – you should understand the full terms of the offer as stated by the issuer or partner before applying. Although the Service makes reasonable efforts to provide the most accurate information to consumers, all information about the Offer is provided without warranty.

What Is Comprehensive Insurance And What Does It Cover?

The website is modern, designed to support the latest Internet browsers. Not supported by Internet Explorer. If you are using an unsupported browser, your Experience may not be optimal; Rendering problems may occur; You may be exposed to potential security risks. It is recommended to upgrade to the latest browser version.

© 2024 All rights reserved. . and trademarks used herein are trademarks or registered trademarks of the Company and its affiliates. other trade names; Use of copyright or trademark is for identification and reference purposes only and does not imply association with the copyright or trademark owner of the product or brand. Other products and company names mentioned herein are the property of their respective owners. License and Disclosure. If you’re using the Galaxy Fold, try folding the phone or using the full screen to maximize your experience.

Advertiser Disclosure Many of the offers that appear on this site are from companies that receive compensation from The Motley Fool. This compensation may affect how and where products appear on this site (including, for example, the order in which they appear); However, our reviews and ratings do not affect compensation. We do not include all companies or all offers available in the market.

Many or all of the products listed here are from our compensated partners. This is how we make money. But we make sure that our editorials are not influenced by compensation and experts’ opinions. Terms and conditions may apply to offers listed on this page.

Here’s Why Your Car Insurance Goes Up After A Claim, Even If You’re Not At Fault

All drivers need car insurance to protect themselves in the event of an accident. However, If they have an accident. There is a possibility that the price of the policy will increase. The question is, “How much does insurance increase after an accident?” The answer depends on where the driver lives and the insurance company he works with. Here we investigate car insurance to get an idea of what happens to policy prices after an accident.

How much will you pay for your car insurance if you are at fault for a car accident? It depends on a number of issues, including the country they live in and the car insurance company they use.

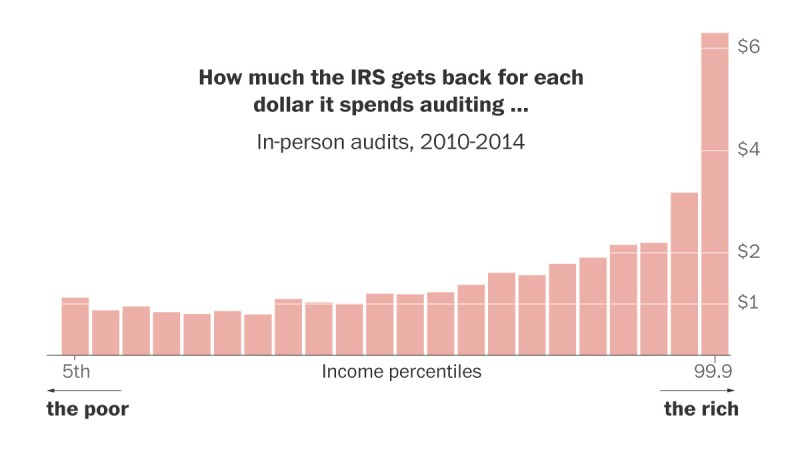

Rates may increase depending on the details of the accident. However, the Table below shows how much the average rate increases after an at-fault accident in each state. These average rates apply to policies:

This interest rate can be applied to other people’s daily budget. Let’s say the driver lives in Arkansas and currently pays $1,200 per year ($100 per month) for coverage. If there is a fault in the accident, the premium can increase by 67%. So instead of paying $1,200 a year for coverage. He paid $2,004 ($167 per month).

Will My Insurance Rate Increase After A Not At Fault Accident?

Typically, insurance rates do not increase after an accident. The at-fault driver’s insurance company is responsible for all costs, from vehicle repairs to medical expenses. As long as the insurer doesn’t have to pay any money, insurance rates won’t go up.

The answer to the question, “How long does an accident stay on your record?” which is three to five years. However, drivers should do their best to avoid tickets and other accidents during this period. If the insured participates in another event during the period. Those insurance rates may go up.

It depends on what happened. Let’s be a driver living in California. They will slip.

Non fault car accident, car insurance increase after non fault accident, non fault accident, will my insurance go up after a non fault accident, no insurance at fault accident, non fault accident insurance, insurance increase after non fault accident, at fault accident without insurance, at fault accident insurance, no fault accident without insurance, non fault accident without insurance, do insurance rates go up after no fault accident