I Owe The Irs Money And Can T Pay – If you owe money to the IRS and can’t pay it, you may be worried about the consequences. Fortunately, you may have some options.

In this article, we’ll take a closer look at one of the most common questions people ask: What happens if I owe money to the IRS and don’t pay it?

I Owe The Irs Money And Can T Pay

If you owe money to the IRS and don’t pay it, the IRS knows how much you owe and charges you not only the unpaid interest, but also other fees, such as penalties for nonpayment. If you are unable to pay your taxes and choose not to file them, the IRS will impose certain penalties for failure to file.

Five Signs That You Need Back Taxes Help Now

These all increase your debt over time, allowing the IRS to use more aggressive tactics to force payment. The IRS will send you a bill detailing the amount you owe, including penalties and interest already accrued.

If you start with just a few hundred dollars in debt, accumulated penalties and ongoing interest can add up over several months, significantly increasing your total debt.

The IRS collection process begins when the IRS sends you a notice of the amount you owe. This may not be followed by the payment of federal taxes or taxes.

However, for small loans, the IRS will remind you of your payment obligations and provide instructions on how to meet them, including a long-term payment plan.

Reasons You Shouldn’t Talk To The Irs Yourself If You Owe Back Taxes

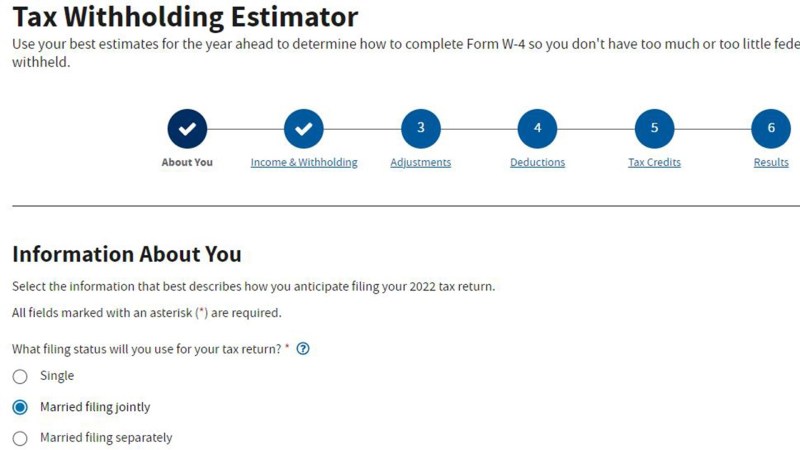

If you can’t afford to pay, the IRS recommends considering a payment plan. If you haven’t filed your taxes, the IRS and tax professionals will encourage you to do so to avoid further penalties, even if you can’t pay them.

Having information and all tax returns for the past three years is also important for most payment plans with the IRS. Announcing an extension of the tax filing deadline can also help you avoid applicable penalties in the future.

If you haven’t had a chance to file your taxes in recent years because it’s a hassle, start by understanding your taxes thoroughly.

If you don’t file a return, the IRS will often use information already provided by your financial institution to file a return on your behalf, even if you don’t take advantage of any tax refunds or credits. Please note.

My Tax Return Is So Low This Year When It’s Been Generally Bigger Other Years And I Can’t Figure Out Why! I Worked Full Time All Year, I’ve Looked Over My 1040

If you owe money to the IRS and don’t pay it, the IRS has the right to use other collection agencies against you. This starts with filing your federal tax return. Generally, there are limitations for taxpayers who owe more than $10,000, but the IRS can issue a tax return as soon as possible and within 10 days of notifying you of the total amount owed.

Income tax is not levied directly on your accounts or assets. In fact, this law acts as a state law for everything you owe and excludes anyone you owe money to, past and present. This means you will not be able to use your real estate or assets to obtain new loans, and even if your debt is not affected by the loan, it may affect your ability to meet payment deadlines or apply for a loan. It means that there is a gender.

It’s not difficult to remove a federal tax lien. In many cases, the plan remains in place even after you pay off your debt (though there are ways to discharge your tax debt during bankruptcy) and even if you claim you are insolvent (i.e., there is no way to pay it). It will remain.

The only way to obtain a temporary lien is to negotiate with the IRS to pay off the debt. This allows other lenders to prioritize the loan you need to pay off your debt. The only way to avoid fraud is to file your taxes.

The Irs Froze A Big Tax Credit. It Didn’t Stop All The Money From Flowing.

The next step in raising money is taxes. If you do not try to repay your loan, the IRS has the right to claim your property or account or seize a portion of your monthly payments through garnishment. Tax credits vary depending on your income, where you live, and the number of dependents you have.

IRS collections do not stop until you pay the debt or the debt reaches its collection law deadline. The latter possibility is very low. This is because it takes 10 years for a tax debt to be discharged, and various circumstances can significantly extend that period (payment), such as filing for bankruptcy, staying abroad for an extended period of time, filing as non-collectible, or paying taxes. It’s from. Entering into a payment plan with the IRS.

In most cases, you can resolve your tax debt by creating a long-term payment plan. This way, your debt is divided into possible monthly installments and debited from your linked account or sent to the IRS before payment is due.

If you’ve never missed a payment, filed all your returns, owed less than $25,000, and made at least three consecutive payments, even if you didn’t pay any taxes. You can ask the IRS to write off your tax lien. Not paid. Everything you owe. Otherwise, your loan will be automatically canceled within 30 days of your last payment.

What Happens If You Owe The Irs Money And Don’t Pay?

If you are unable to pay within a year, you may consider making a fraudulent donation. If you think it’s the best choice for you, consider talking to a tax credit professional about your options. The IRS can be very finicky about filing a joint return, and the process can be lengthy, especially if you underestimate your ability to collect.

If you are unable to set up a payment plan or actively promote, default is your last resort to delay collection. This won’t ease your burden, but it will delay taxes and other measures until your financial situation improves.

Our website uses cookies to give you the most convenient experience by remembering your preferences and repeat visits. By clicking ‘Agree’, you consent to the use of all cookies. Cookie settings that I purchase

This site uses cookies to improve your experience while you browse the site. Out of these, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. We also use several cookies that help us analyze and understand how you use our website. These cookies will be stored in your browser with your consent. You also have the option to opt out of these cookies. However, opting out of some of these cookies may have an effect on your browsing experience.

Don’t Feel Bad About Avoiding Taxes

Necessary cookies are essential for the website to function properly. These cookies anonymously provide functionality and security to the website.

This cookie is set by the GDPR Cookie Consent plugin. The cookie is used to store the user’s consent for his cookies in the “Analytics” category.

Cookies are set using GDPR Cookie Consent to record the user’s consent to cookies in the ‘Functionality’ category.

This cookie is set by the GDPR Cookie Consent plugin. The cookie is used to store the user’s consent for cookies in the “Other” category.

Irs Delays $600 Tax Reporting Rule For Paypal, Etsy, Venmo, Cash App Payments

This cookie is set by the GDPR Cookie Consent plugin. Cookies are used to store the user’s consent for cookies in the “Settings” category.

This cookie is set by the GDPR Cookie Consent plugin. Cookies are used to store user consent for cookies in the “Performance” category.

Cookies are set by the GDPR Cookie Consent plugin and are used to store whether the user has given consent. No personal data is stored.

Functional cookies help us perform certain functions, such as sharing website content, collecting comments and other third-party information.

Blac Chyna V. Kardashian: Tax Claim Raises Questions

Usage cookies are used to understand and analyze key metrics about how a website performs, and help us provide a better user experience for our visitors.

Analytic cookies are used to understand how visitors interact with her website. These cookies help us provide information about things like visitor numbers, traffic, and sources of traffic.

Advertising cookies are used to provide relevant advertising and marketing to our visitors. These cookies collect information to track visitors across websites and provide personalized advertising.

Some unshared cookies are being analyzed and not classified. I received a letter from the IRS saying I owe money. What should I do?Personal Tax Tips, January 12, 2023

Don’t Know How Much You Owe The Irs? Here’s How To Find Out

The IRS is in the thick of this pandemic, and information is coming out…and it’s just getting started. Here are the 2020 tax year IRS notices sent to taxpayers from the end of 2022 to the beginning of 2023.

The IRS will never call you. Please note that these calls are spam. But the IRS sends notices and sends notices.

What do you do if you receive an IRS notice? Here are some tips on what to do

I owe the irs, owe irs money can t pay, owe the irs help, what if i owe the irs and can t pay, i owe the irs and can t pay, owe irs money and can t pay, i owe irs and can t pay, i owe the irs money and can t pay, owe the irs money but can t pay, owe the irs but can t pay, i owe the irs money but can t pay, i owe irs money and can t pay