How To Save My Home From Foreclosure – “Expert Reviewed” means that our Financial Review Board has thoroughly reviewed the item for accuracy and clarity. The review board is a group of financial experts whose purpose is to ensure that our content is always objective and balanced.

Written by Jean Lee Written by Jean Liero. By Jeanne Liero Law Contributing author Jeanne Lee writes about mortgages, personal finance, and loves finding ways people can hack their finances. Jean Lee

How To Save My Home From Foreclosure

Edited by Laurie Dupnok Edited by Laurie DupnokArrow Right Editor, Home Loans Laurie Dupnok is the Mortgage Editor on the Home Loans team. Connect with Laurie Dupnok on LinkedIn Linkedin Laurie Dupnok

How To Buy A Cheap Foreclosed Home

Reviewed by Jeffrey Beal Reviewed by Jeffrey Bealarrow True President, Real Estate Solutions Jeffrey L. Beal, president of Real Estate Solutions, has over 40 years of experience in various phases of the real estate industry. About our review panel Jeffrey Beale

Founded in 1976, it has a long history of helping people make smart financial choices. We have maintained this reputation for more than four decades by clarifying the financial decision-making process and giving people the confidence to take the next step.

Follows a strict editorial policy so you can be sure we put your interests first. All of our content is created by highly trained professionals and edited by subject matter experts who ensure that everything we publish is objective, accurate and reliable.

Our mortgage reporters and editors focus on what consumers care about most – the latest rates, the best lenders, navigating the home buying process, mortgage refinancing and more.

What Is The Foreclosure Process In Pennsylvania?

Follows a strict editorial policy so you can be sure we put your interests first. Our award-winning editors and reporters create honest and accurate content to help you make sound financial decisions.

We appreciate your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards to ensure this happens. Our editors and reporters carefully check editorial content to ensure the accuracy of the information you read. We maintain a firewall between advertisers and our editorial team. Our editorial team does not receive direct compensation from advertisers.

The editorial team writes on behalf of you – the reader. Our goal is to provide the best advice to help you make smart personal finance decisions. We follow strict rules to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly checked for accuracy. So, if you read an article or review, you can be sure that you are getting reliable and trustworthy information.

You have questions about money. They have the answers. Our experts have been helping you manage your money for over 40 years. We continuously strive to provide clients with the expert advice and tools they need to succeed in their lifelong financial journey.

What Is The Foreclosure Timeline In Washington State?

Follows a strict editorial policy so you can be sure our content is honest and fair. Our award-winning editors and reporters create honest and accurate content to help you make sound financial decisions. Content created by our publishers is objective, factual and not influenced by our advertisers.

We’re transparent about how we bring you quality content, competitive pricing, and helpful tools by explaining how we make money.

Is an independent, advertising-supported publisher and comparison service. We receive compensation for posting sponsored products and services or for clicking on certain links posted on our site. Therefore, this compensation may affect how, where and in what order products appear in the listed categories except where prohibited by law for mortgage, home equity and other home loan products. Other factors, such as our individual site rules and whether a product is offered in your area or within your selected credit range, may also affect how and where products appear on this site. Although we try to offer a wide range of offers, we do not include information about every financial or credit product or service.

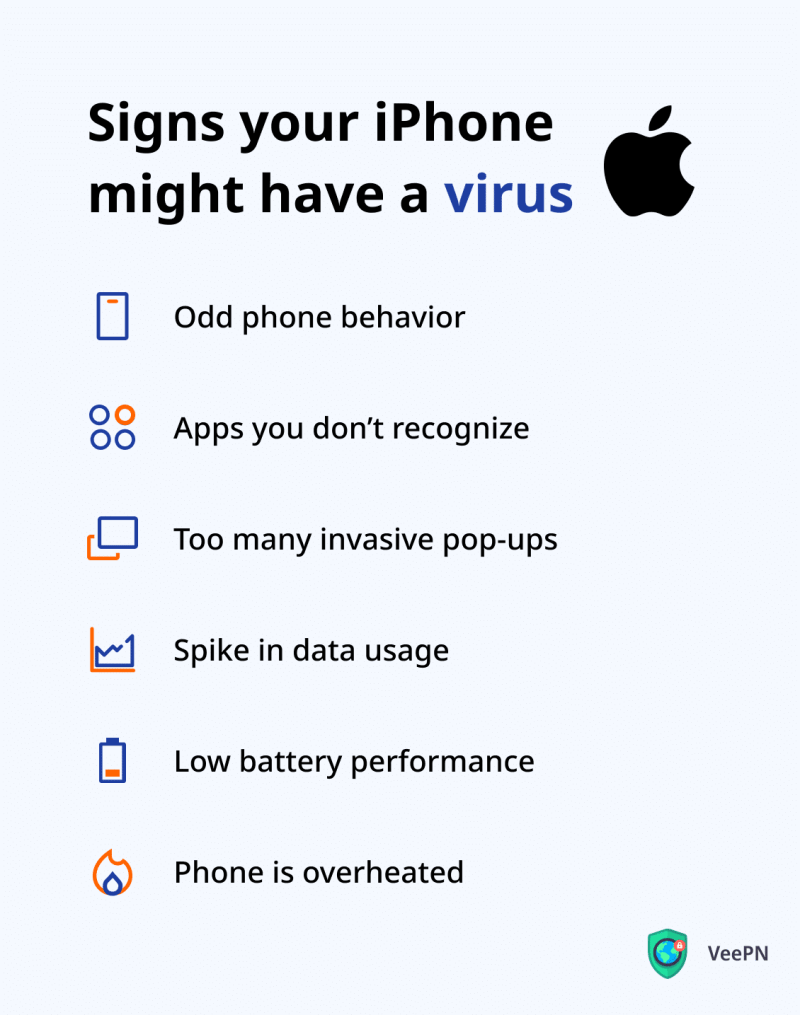

A lost job or an unexpectedly large medical bill can leave you facing a homeowner’s worst nightmare: foreclosure. State rules vary on how much time you have before foreclosure. If you find yourself in this situation, here are some great ways to avoid foreclosure.

Jc White Law Group

Foreclosure is the process by which a lender takes control of your property after you stop making your mortgage payments. If you don’t take immediate action, you could lose your home.

Missing a payment on your home for a few days won’t put you in foreclosure. If you make a payment shortly after the due date, notify your lender or servicer that it is late.

If you still haven’t paid by the end of the grace period (usually 10-15 days), your mortgage lender has sent you a late notice, or you have too many mortgage payments, you need to act fast to get a loan. Get your mortgage back in good standing and avoid foreclosure proceedings.

While you may want to seek legal advice before going down any of these routes, here are some of the best ways to avoid foreclosure:

What Is Foreclosure Homes Mean And How It Work?

At the first sign of financial trouble, contact your lender to alert them to the problem. This gives the lender an opportunity to share potential solutions available to help avoid foreclosure. Plus, getting in touch with the lender right away to resolve the issue can mean you can get back on track with your loan repayments sooner. But if the foreclosure process has already started, there are other strategies to stop it.

If you’re experiencing short-term financial hardship (such as an expensive car repair or medical emergency), your lender may give you some breathing room by agreeing to pay off the missed payments in two installments over the next two months.

Mortgage servicers can permanently adjust the terms of your loan — often by extending the repayment schedule, lowering the interest rate, or rolling over the balance and re-amortizing the new balance — to help keep the loan going. However, a loan modification cannot lower your principal.

Foreclosure involves voluntarily surrendering your home to a creditor to avoid foreclosure proceedings. In some cases, going this route can help you pay off the balance on your mortgage, but it depends on the lender’s rules and the state you live in. Before you get a mortgage, ask your lender: What is the difference between the value of your home and what you still owe on your mortgage, whether they will forgive any deficiency. (If there is a deficiency, the lender may try to collect even after you leave the house.)

When Is It Too Late To Stop Foreclosure?

A short sale is when the lender allows you to sell the home for less than the outstanding loan amount, take the proceeds and forgive the remaining debt. A short sale can help you save some of your equity, but the lender must approve it first. An experienced short sale real estate agent can help you find a buyer and guide you through obtaining the necessary approvals.

With a short refinance, the lender forgives part of your debt and refinances the rest into a new loan. This type of refinance became more common after the mortgage crisis and may no longer be available to most homeowners.

You may not like the high rates and fees of a hard money loan — often a personal loan from a private lender — but it can give you some time to sell your home and avoid foreclosure. If you can help it, it shouldn’t be your first choice.

If you’ve contacted your creditor and done everything you can to avoid foreclosure and it still seems imminent, the last thing you can do is file for bankruptcy. This will negatively affect your credit and limit your ability to apply for a loan, but it can help you out of a financial crisis.

What Are The Steps In The Florida Foreclosure Process?

Specifically, filing for bankruptcy will trigger an order known as an automatic stay. An automatic stay will continue the foreclosure process as long as the bankruptcy remains in effect.

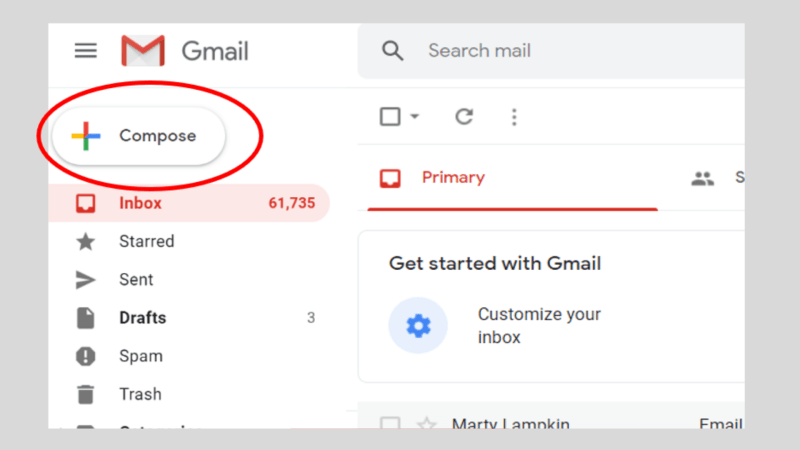

Again, contact your lender as soon as you realize you are struggling to pay your mortgage. Most lenders have a customer service phone number or email to contact them. The sooner your lender knows about your problem, the better they can help you.

Federal law requires mortgage servicers to work with borrowers to help them get back into good standing. Tell your bank or lender that you want to know about “loss mitigation” options, which is the technical term for avoiding foreclosure.

Look for a letter from your lender that describes how to avoid foreclosure, along with instructions and applications for any programs that may apply to you. Your mortgage servicer should also provide a person to contact by phone to answer your questions and give you accurate information about your foreclosure avoidance options. By law, this person must be assigned to you within 45 days of your loan becoming delinquent.

What To Know About Foreclosure Laws

How to save home from foreclosure, help to save my home from foreclosure, save your house from foreclosure, can i save my house from foreclosure, save your home from foreclosure, save my home from foreclosure, how to save your home from foreclosure, save home from foreclosure, how to save your house from foreclosure, how to save my house from foreclosure, save my house from foreclosure, save house from foreclosure