How To Pay If You Owe State Taxes – An underpayment penalty is a penalty imposed by the Internal Revenue Service (IRS) on taxpayers who do not pay enough taxes, have insufficient payroll deductions, or pay late. Individuals must generally pay at least 100% of last year’s tax or 90% of this year’s tax to avoid an underpayment penalty.

Tax penalties are imposed on taxpayers who do not pay a sufficient amount of estimated tax and withholding. Taxpayers can refer to the instructions for IRS Form 2210 to determine whether they must report an underpayment and pay a penalty.

How To Pay If You Owe State Taxes

Tax laws require taxpayers to pay income as it is earned during the year, by withholding, paying estimated taxes, or both.

The Irs Interest Rate For Unpaid Refunds And Balances Will Soon Be 7%

To avoid the underpayment penalty, individuals with adjusted gross income (AGI) of $150,000 or less must combine estimated tax and withholding tax and pay 90% of the current year’s tax or 100% of the prior year’s tax . Individuals whose AGI exceeds $150,000 for the previous taxable year must pay 90% of the tax for the current year or 110% of the tax on the individual return for the previous taxable year, whichever is less.

An underpayment penalty is payable when a taxpayer underpays estimated taxes or makes irregular payments during a tax year that do not adequately reflect the taxpayer’s current income for a particular period.

Taxpayers with self-employment income must take into account their Social Security and Medicare tax liability when calculating the amounts due.

Some taxpayers, such as sole proprietors, partners, and S corporation shareholders, must pay the tax in four equal installments throughout the year; But they can do it more often. Taxpayers who receive income unevenly may, in some cases, pay different amounts each quarter. Taxpayers can use IRS Form 2210 to determine if there is enough withholding and estimated taxes for the year to avoid penalties.

Taiwan Tax Faq

When taxpayers realize they’ve underpaid, they must pay the difference plus a penalty based on the unpaid amount and how long the amount is overdue.

The penalty is not a static percentage or a fixed dollar amount. This is based on many things, including the total amount underpaid and the period for which taxes are underpaid. A penalty of 0.5% of the outstanding amount is charged for non-payment of payments for each month and for the part of the month for which the tax is not paid.

Interest is also charged on underpayment and overpayment of tax. The IRS sets the interest rate every three months and is usually based on the federal short-term rate plus three percentage points for most individual taxpayers.

The rates are 8% for individual underpayments and 7% for large corporate underpayments for the fourth quarter (Q4) of 2023 and the first quarter (Q1) of 2024.

Will You Owe California Taxes On Your Equity If You Move Out Of State?

If you owed $5,000 in taxes each year and paid only $2,000, you would underpay taxes by $3,000. The amount is more than $1,000 and you haven’t paid at least 90% of what you owe. So you will be subject to an underpayment penalty unless you meet other criteria to avoid it. The penalty will be the then-current federal short-term interest rate plus three percentage points. In 2024, the rate will be 8%, or $240.

The best way to avoid an underpayment penalty is to take steps to pay your tax obligations on time. You can also avoid the underpayment penalty if:

If you are not eligible for an underpayment penalty exemption, you may be eligible for a reduced underpayment penalty in some cases. For example, a person who changes their tax return status from grandchild to married filing jointly may receive a smaller penalty because of the larger standard deduction.

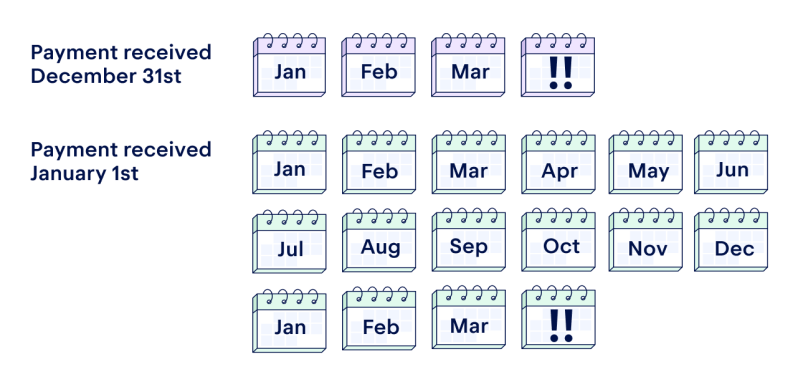

Rebates may also apply to taxpayers who receive a significant portion of their income at the end of the calendar year. An example of this is an investment property that was sold in December and incurred significant capital gains taxes.

How To File Taxes For Free In 2023

The IRS underpayment penalty was 7% for most underpayments and 9% for large corporate underpayments in the first three quarters of 2023. In Q4, that rate rose to 8%.

Safe harbor rules allow you to avoid paying fines or have your fines reduced if you meet certain conditions. You can avoid the IRS underpayment penalty if you owe less than $1,000 or pay more than 90% of your tax liability for the year.

Some taxpayers, such as sole proprietors, partners, and shareholders of corporations, must pay taxes at least quarterly if they owe more than $1,000. These payments are called estimated tax payments. You can’t pay your estimated tax payments right away, but you can do it in advance and pay monthly in advance if that fits your budget better.

If you don’t pay enough taxes, taxes withheld or due, you may have to pay an underpayment penalty. If you’ve been fined, check whether you’re eligible for exemption or a reduced sentence. The best way to avoid underpayment penalties is to make sure you calculate your estimated taxes correctly and pay your taxes on time. If you are not self-employed, you can also arrange withholding tax with your employer.

No Anchor Rebate? Reasons You May Not Get Your Money

It requires authors to use primary sources to support their work. These include technical documents, government data, original reports and interviews with industry experts. Where appropriate, we also cite original research from other reputable publishers. You can learn more about the standards we adhere to in creating accurate, unbiased content in our editorial policy.

The offers in this table come from partnerships that receive compensation. This compensation can affect how and where listings appear. Does not include all offers on the market. We look forward to many different occasions throughout the year – birthdays, Christmas, the first day of spring, Shrovetide. But there are some days we’d rather skip. We’re looking at you, tax day.

The irony of Tax Day is that we don’t actually “pay” taxes every year on April 15th. In fact, after Tax Day, most U.S. citizens When you file your tax return, you tell the IRS that you overpaid or underpaid taxes.

Responsible for making direct payments to the IRS. And if you earn more than a certain amount, that means you have to pay quarterly or estimated taxes.

What To Do About Overdue Income Taxes

Quarterly taxes are estimated tax payments made to the IRS four times a year. But taxes are never as simple as they say.

Your tax bill can add up pretty quickly, so if you’re self-employed, you should set aside 25-30% of each paycheck for taxes. You don’t want to be blindsided by a big tax. Have you ever seen a quarterback attempt a pass and then get picked off by a lineman? That’s what a surprise tax bill feels like.

If you owe less than $1,000, you can pay taxes on that income when you file your tax return at the end of the year.

A $1,000 tax bill won’t take long, so even a side hustle can complicate your tax situation. If you have a regular job and don’t want to deal with quarterly payments, you can increase your withholding from your job to offset the taxes you earn from your side hustle.

Irs Double Bills Some Taxpayers

If you’re not sure whether you need to pay taxes quarterly, you should consult with a tax professional to help you decide which camp you fall into. If you owe a significant amount of taxes and don’t make your quarterly payments, you may have to pay a late payment penalty on top of the taxes you owe. So don’t ignore it!

If you’re one of the many Americans who need to file quarterly, mark the deadlines on your calendar or set reminders on your phone so you don’t forget to pay on time! If you pay late, you’ll incur interest and late payment penalties that can be up to 25% of your unpaid taxes each month. These days fall on weekends or holidays.3 Here are the quarterly deadlines for 2023:

Okay, time to dust off your calculator and do some math! Here’s a step-by-step process to help you figure out how much you’ll have to pay in estimated quarterly taxes. Remember, this is just an estimate. Your quarterly taxes will vary based on your income, tax year, filing status, and applicable deductions. And don’t get me started on state income taxes!

Let’s say you’re a single filer with a small business that you expect to generate $50,000 in self-employment income. You estimate that your taxable income will be about $40,000 after deducting business expenses.

Collection Tools The Irs Or State Can Use When I Owe Taxes

Using our example, your income is taxed at 12%. This means that your income up to $11,000 will be taxed at a rate of 10%, while income between $11,000 and $44,725 will be taxed at a rate of 12%. If you take the standard deduction ($13,850), this reduces your taxable income

If you owe taxes, how to pay if you owe taxes, how to pay irs if you owe taxes, what happens if you owe taxes, what to do if you owe taxes, if you owe back taxes, i owe state taxes how do i pay, if i owe state taxes how do i pay, how to pay taxes you owe, if you owe state taxes how do you pay, what if i owe taxes and can t pay, how to find out if you owe taxes