How To Know If You Owe Back Taxes – Residual taxes are a slippery slope. They can happen when you don’t pay enough in your taxes, don’t report all of your income, or don’t file a return at all. No matter how unintentional, the first step down that hindsight path can be expensive. And it can be scary trying to figure out how deep you are when you’ve fallen. So how do you know when you need to get a tax refund? What are the red flags that indicate you’ve reached the point where professional help is your best option for filing your taxes?

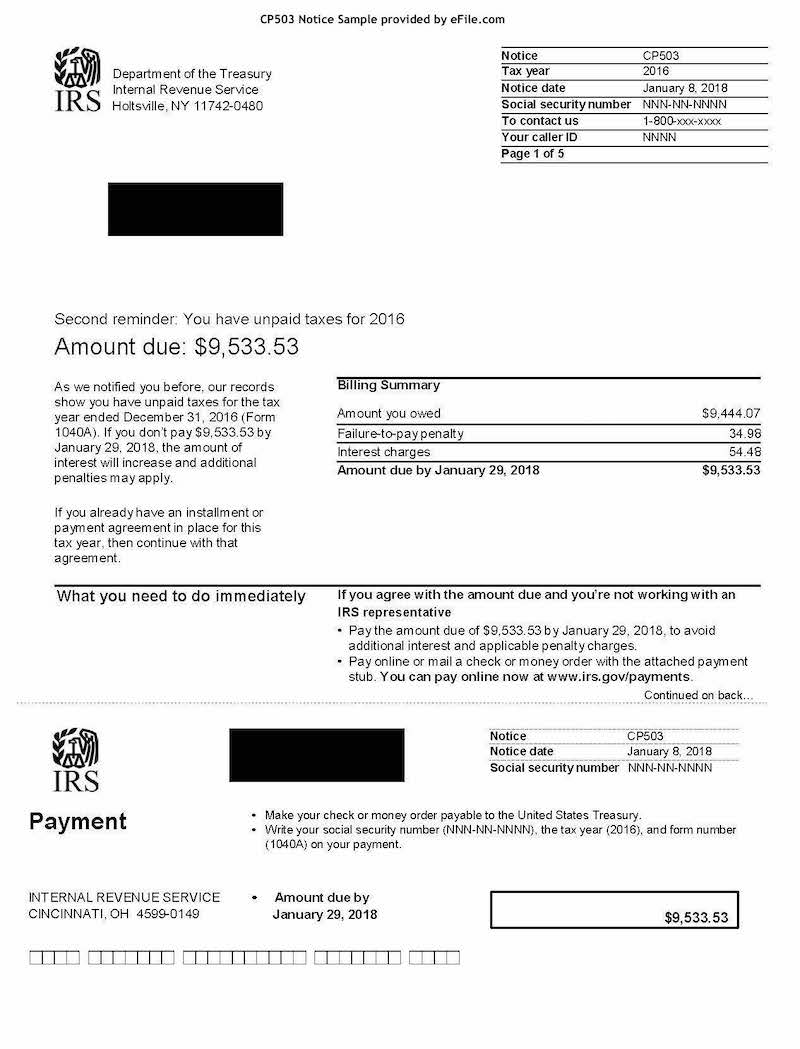

If any of the following symptoms are true for you, you may need professional tax help. 1. IRS notices are piling up in your mailbox.

How To Know If You Owe Back Taxes

If you’ve received a bunch of notices from the IRS about your back taxes, it might be time to do something about it. Instead of throwing the next CP14 notice over another notice (or worse, throwing it in the trash), reach out for help to stop the endless stream of IRS letters.

How Much Do I Owe The Irs? Here’s How To Find Out

Although the IRS will comply with sending notices via email, it may turn your case over to a private collection agency. They will let you know when they do this. Once that is done, however, the collectors will call and text you with the IRS about your unpaid debt. And as we all know, collective agents can compromise.

Believe it or not, a dishonest tax lien can cause the IRS to deny, limit or revoke your passport. Say goodbye to all your travel plans until you get your tax problem solved. If you have paid off your debt or plan to pay off your debt, the IRS may return your passport but it may not be overnight.

Refusing to pay your taxes can result in a lien, which means the government can seize your property to cover your delinquent debt. They can also seize your tax return and garnish your wages in an attempt to get what they are owed. Even though the IRS will send you notices in advance, taxes can still shake you to your core. That’s why it might be best to get in touch with a professional to help you solve your back tax problem. Keep your property where it belongs – in your hands.

If you have back taxes but can’t pay your full balance, the best thing you can do is pay that tax. However, this is rarely the case. Sometimes your total balance due to the IRS (including any liens) is more than what you have in your bank account. If so, it is in your best interest to see a tax professional who can help you solve your tax problem with a solution such as debt forgiveness or a payment plan.

Irs Collections: Dealing With Irs Collections For Outstanding Back Taxes

If you see any of these signs in your life, it may be time to get tax refund help. The longer you wait, the worse it can get. Call our tax experts today to take the first step towards tax relief.

We use cookies to give you a good user experience. We also share that information with third parties for advertising and analytics. By using this page, you accept our use of cookies. Privacy | terms

We know the tax bill is scary, but help is just a click away! Answer a few questions to help us better understand your situation. It only takes a few minutes, and you’ll get the following: In this article, we’ll learn how to find out how much you owe to the Internal Revenue Service, ie. IRS withholding tax.

Paying taxes on time can save you from very difficult and unacceptable situations. That’s why it’s best to keep track of your taxes and always be prepared. If you manage to pay taxes every month, you can expect a small tax refund instead of paying taxes. Again, it all depends on how careful you are.

Tax On Rental Income: How Much Tax Do You Owe?

If you’ve accrued IRS taxes because of some financial problem, don’t wait for IRS notices. It’s best to find out how much you owe the IRS before the IRS sends you threatening notices. The Stay Up To Date game will help you figure out how to pay a certain amount to the IRS. Is there any other way the IRS can give you relief from these penalties?

Therefore, you can contact Coast One Tax Group or other reliable tax authority to get information about your back taxes. You can contact IRS officials but they do not respond immediately. That’s why we’ve given you quick ways to help you get your tax back.

You can find out how much you owe in total IRS Back Tax penalties by using the following methods.

To make things easier for taxpayers and digitize the tax system, the IRS launched a Citizen Tax Portal in 2016. This portal provides information about your penalties, unpaid taxes, and your two-year payment history with the IRS. This platform is free and shows you updated results after 24 hours.

How Much Do You Owe

To know your tax information you need to register on this online platform. To register online, you must provide the following information on the platform.

This confidential information is required to verify your identity. With this information, the IRS will also pull your credit history to verify it. However, since this is a soft inquiry, it will not affect your credit report and creditors will not be able to see anything.

Additionally, once you are registered, you can use the platform to pay your taxes online. After one to three weeks, the payment history page will refresh and your most recent transactions will be displayed.

If you are not a technical expert or don’t have the right knowledge to register on an online portal, don’t worry. You still know about your back taxes. All you have to do is contact the IRS officials by phone.

Common Frustrations When Dealing With The Irs When You Owe Back Taxes

You can call the IRS at 1-800-829-1040 between 7:00 A.M. and 19.00 local time. During the call, you may have to wait an average of 27 minutes to be connected to an IRS representative. The representative will ask you for some details and tell you about your back taxes.

To find out how much you owe in IRS Back Taxes, you can email the IRS. Another way to find out about your back taxes is to email the IRS and ask about your taxes. You must complete Form 1040, 1040A, or 1040EZ. After you file, you can request a receipt from the IRS. This document covers one year’s tax and must not include additional taxes, interest or other charges.

Form 4506-T, Request for Tax Refund Transcript, is required if you filed another form or if you represent a business. The IRS will provide you with a complete transcript when it receives and processes your Form 4506-T.

Additionally, you should be aware that receiving information about your refunds via email will be a delayed process. The IRS takes a long time to respond to an email request. Therefore, if you are subject to unpaid taxes, you may incur additional taxes due to late and late payments.

The Irs Is Waiving $1 Billion In Penalties For Some Who Owe In Back Taxes

Also, double check that the IRS is sending the required documents to the correct address. The IRS usually sends responses to the most recently registered address. If it is not your address, you will not be able to receive your SMS, which will cause problems in the future.

If you are busy and don’t have time to know about your back taxes, you can just contact a tax specialist and give them all your tax problems. These professionals can contact the IRS on your account to determine how much tax you owe. All you have to do is give them the information they need and relax while they negotiate with the IRS on your behalf. They can also give you more personalized ways to help the IRS with their taxes after they know how much you owe.

So once you know all of your IRS taxes, now is the time to prepare to pay those taxes. It is better to go back in time and save yourself from punishment.

Enterprise World is a business magazine, a platform that enables all companies to share their success stories and the difficulties they faced to become the star that they are now in the business world. No one wants to owe the Internal Revenue Service. Ideally, you can pay the exact amount of income tax and be on your way without a second thought. Or you might be surprised at the end

People Who Owe Years Of Back Taxes: What You Need To Do

How do you know if you owe back taxes, how to find out if you owe state taxes, how to know if i owe taxes, if you owe back taxes, how to know if you owe taxes, if i owe back taxes, how to find out if you owe taxes, if you owe taxes, how to know if i owe back taxes, how to check if you owe taxes, how to check if i owe taxes, what to do if you owe taxes