How Likely Am I To Get Audited By The Irs – Here are some steps you can take to reduce your chances of being selected for a tax audit.

This article is for informational purposes. This content is not legal advice, it is a statement by the author and has not been checked for accuracy or legal changes.

How Likely Am I To Get Audited By The Irs

There’s no guaranteed way to avoid an audit, but there are precautions you can take to prevent your business from raising red flags.

Real Effects Of Tax Audits

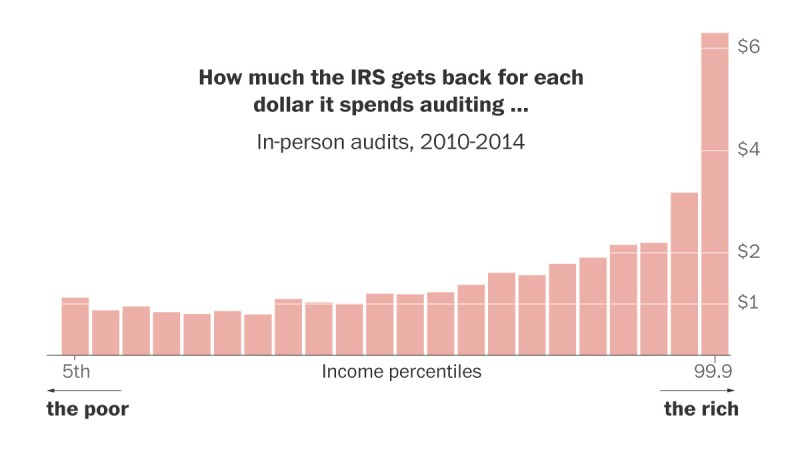

Until recently, your chances of getting a business tax audit were slim. Bloomberg cited IRS data showing that only 140 small businesses — out of four million — filed for audit in 2018. This number is slightly higher for S corporations but still less than 0.5%.

But at the end of 2020, the IRS announced that it will add auditors so that the agency can increase its audits by 50 percent.

Reporting annual net losses — especially small losses — can put you on the IRS radar. The IRS may view these losses as evidence of unreported income, prompting them to amend your return.

Steven Jon Kaplan, president of Truthful Contradictory Investments, LLC, said, “When the IRS looks at net business losses, it often looks for an audit. He added, “You should report all of your income, but you don’t have to report expenses. all of you, so leave some expenses if it produces a small net profit for the year.”

Audit: What It Means In Finance And Accounting, And 3 Main Types

Although you should always report 100% of your income, you can avoid reporting more losses by minimizing deductions. For example, writing off rent, car, transportation, and technology bills can save you money, but they can also trigger an IRS audit if the expense is higher than the income.

Creating your business expenses shows transparency and prevents the IRS from asking for information you provided. Being vague about business expenses can lead the IRS to suspect that there is a problem or that you intentionally underreported your income.

“Whenever you have a choice between putting a specific expense in a general category or listing it specifically under ‘other expenses,’ it’s best to list it properly,” Kaplan says. “The IRS may think you’re trying to create non-existent expenses if you’re writing off advertising or travel expenses, rather than reporting any specific advertising or travel expenses.”

Instead of assuming that an auditor will understand why your travel expenses suddenly increased 100% last year, or why your online advertising expenses increased 300%, fill out additional documents to clearly explain why. and why. Include them in your return. file

What Happens If You Get Audited And Don’t Have Receipts?

That way, if you mark your return and in front of people, you will have answered many questions about their sudden change.

Some people believe that filing early at tax time increases the chances of an audit because there is less return in the pool to draw from. This myth causes people to apply late, and still request an extension. But Steven Terrigino, a CPA and partner at the Bonadio Group, said filing late isn’t a good way to avoid an audit.

“File on time and pay on time,” he said. “[It will] create a compliance report, including all returns – that is, tax liability and sales tax.”

Don’t worry about e-file vs. Review the risk documentation file, too. Choose the one that is best for you, because the application process may not increase the chances of getting a review.

Tax Mistakes That Could Get You Audited By The Irs

Some companies believe that filing a return is admitting to the IRS that you didn’t properly file the return in the first place. While submitting an amended return does not automatically trigger an audit, it can increase your chances if you make large changes without proper justification. This is because returns that are older than three years cannot be e-mailed, so suspicious returns are listed for document processing and human review.

Remember to file supporting changes when you return. However, if there is no need to change it, it is better not to submit unnecessary documents to the IRS that can be audited.

Most IRS audits are determined by paperwork and math errors. Terrigino recommends that you “make sure all forms issued by the government, such as 1099-INT and 1099-DIV, match what you report on your tax return”.

Make sure your paper is error-free by double-checking your math. If the numbers don’t match, the IRS will find out.

Avoiding Trouble: How Amended Tax Returns Can Help Prevent Audits

Because round numbers look suspicious, try to use exact numbers if possible. The IRS generally doesn’t mind rounding to the nearest dollar, but rounding up tens or hundreds of dollars to clear, round numbers can trigger an audit.

Make sure you don’t use the same number every year unless the number is valid and has documentation. Expect the price to change, and if you don’t, this could raise some red flags.

How much can you get from an unaudited charitable donation? The answer is to be honest and report how much you contributed – or any other deductions you qualify for. Keep details and documentation of your deductions and contributions to show evidence if necessary.

“Don’t overestimate your contribution limit, deducting too much money from the office, or overspending on food and travel,” says Terrigino.

More Details On Small Company Concept For Audit Exemption

These expenses are closely monitored along with other expenses such as bad debt, emergency expenses and medical expenses. Also, don’t add a large amount that you used to take by accident. It will be noticed.

Schedule C is the IRS tax form for reporting profits or losses for your business. If you’re a small business, report your income or losses using Schedule C for the best chance of avoiding an audit.

“Although there are other ways that can sometimes avoid paying part of your Medicare tax or have other benefits,” Kaplan says, “they increase the likelihood of an investigation”.

Fill out your taxes correctly and don’t leave any questions blank. Every question on the tax form must have an appropriate answer, even if the answer is $0. Self-monitoring can make you more focused.

Audit Risk Model: Explanation Of Risk Assesment

Filing a tax return without signing it is more common than you might think. Failure to do something as simple as entering it can make the IRS think you’ve neglected other parts of the return, allowing for more scrutiny. Be sure to check and double check your signature return before submitting to reduce the chances of it being audited by the IRS.

There is a three-year window in the IRS audit timeline for 2022, so your tax year for 2019 may still be due. Even if you follow every advice on how to avoid being a detective, chances are it can still happen. Here are some things you can do if you get a scary IRS letter in the mail.

In the end, the chances of you being scanned are slim. Following these tips to avoid audits of your business can help reduce the chances of others. Don’t give the IRS a reason to check your numbers, you’ll save yourself time and stress.

Now that you know how to avoid an IRS audit using our tips, you can get back to what you do best – doing your business.

How To Do A Time Audit (with Time Audit Template)

By knowing what other trademarks are out there, you will be able to understand if there is an opportunity for the mark you want to protect. It’s best to search early, so you can find signs that are easy to save.

Want to talk to your parents or grandparents about home design, but think it’s an awkward topic? You are not alone. Negotiating housing arrangements is difficult for many families. Use our tips to explain the topic better.

Considering an LLC for your business? The filing process isn’t complicated, but to file for an LLC, you need to do your homework first. An auditor’s report is a letter written by a public auditor expressing his opinion about whether a company’s financial statements conform to generally accepted accounting principles. standards (GAAP) and no material disclosures.

Independent and external audit reports are often published through the company’s annual report. The auditor’s report is important because banks and lenders require an audit of the company’s financial statements before lending money.

The Financial Audit Process: How To Perfect It

An auditor’s report is a written letter attached to a company’s financial statements that expresses his opinion about the company’s compliance with accounting principles. An auditor’s report must be filed with the public company’s financial statements when reporting to the Securities and Exchange Commission (SEC).

However, an analyst’s report is not an analysis of whether the company is a good investment. Also, research reports do not analyze the company’s performance for that period. Rather, the report is merely an examination of the reliability of the financial statements.

The auditor’s letter is based on standard procedures, as defined by the Generally Accepted Auditing Standards (GAAS). Articles usually have three paragraphs.

Another paragraph can tell the investor about the results of a different analysis of the other company’s work. Investors will be important in the third paragraph, the response area

What To Do If You Have To Complete A Tax Audit?

How likely am i to get audited by the irs, i am being audited by the irs, audited by the irs, i got audited by the irs, how to get audited by the irs, what happens when you get audited by the irs, who is most likely to get audited by irs, how likely am i to get audited, getting audited by the irs, what happens if you get audited by the irs, how likely is it to get audited by the irs, if i get audited by the irs what happens