How Do I Find Out If I Owe Property Taxes – No one wants to owe the Internal Revenue Service anything. Ideally, you pay the exact amount of income tax and can be on your way without a second thought. Or maybe you will receive a surprising but welcome tax refund after filing your tax return. But this is not always the case.

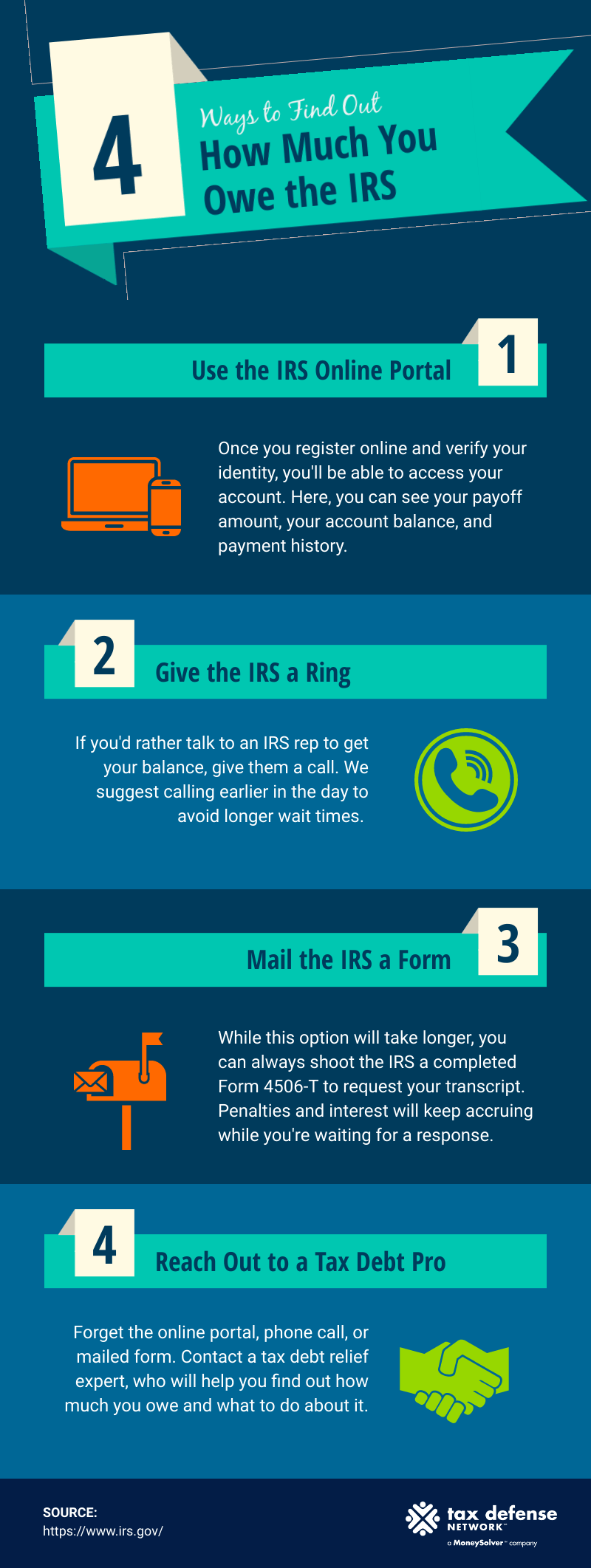

Sometimes an unexpected amount of tax can arise. You may know you have a federal tax benefit, but still wonder, “How much do I owe the IRS?” Don’t wait for the dreaded notice from the IRS to find out. We can help you figure this out using one of four simple methods.

How Do I Find Out If I Owe Property Taxes

In December 2016, the IRS released an online tool for taxpayers. This tool acts as a portal where you can view your account with the Tax Authorities. You can see your payment amount and balance for each year you owe taxes. You can also view up to 5 years of payment history, including tax estimates. Your account balance is updated a maximum of once every 24 hours and usually overnight. It’s completely free; you just need to register to access your account.

Tax Credit: What It Is, How It Works, What Qualifies, 3 Types

The IRS will also run a credit report with this information to make sure you are who you say you are. But this is a soft inquiry, so it won’t affect your credit score and lenders won’t see it.

If you decide to register and use the online portal, you can also use it to pay taxes online. Online payments typically take one to four days to appear in your account. If you pay by check or money order, this may take up to three weeks.

Not a big fan of using online tools to pay your federal taxes? Don’t have all the information you need to use online services? Don’t worry, you have other options.

Your first option is to contact the tax authorities. You may face a wait, but once you’re connected, an IRS representative should be able to tell you how much you owe.

He Owes Me Money, And Instead Of Paying, He Wants Me To Work And That Will Somehow Pay His Debt.

If you are an individual taxpayer checking your balance, you can call the IRS at 1-800-829-1040 between 7:00 a.m. and 7:00 PM local time.

Another option outside of the online portal is to contact the IRS by mailing the form.

While this is a viable option for all taxpayers, please note that it will take longer due to the nature of the mail. And if you are in debt, the penalties and interest will continue to accrue while you wait for an answer.

You also want to make sure the IRS has your current address. Otherwise, they will send their response (and any other notices) to the most recent address they have on file, which may not be your current address.

You Might Owe More Money On Your Taxes If You Moved To A New State Last Year. Here’s Why

Individual taxpayers who filed Form 1040 can request a statement by mail or by calling 800-908-9946. Statements are available for the current tax year and the three previous tax years.

If you are filing a different type of form or need a transcript for a later tax year, you must submit Form 4506-T, Tax Return Transcript Request. After the IRS receives and processes your Form 4506-T, you will receive a free transcript.

The last option is probably the easiest and clearest answer to the question “How much do I owe the IRS?” No need for online portals, phone calls or mailed forms. Instead, you can let someone do the hard work for you.

Tax debt professionals (such as CPAs, tax attorneys, and EAs) can work with the IRS on your behalf to accurately determine how much you owe. All you have to do is give them some personal information and relax while they handle the tax for you. And once they know how much you owe, they can also provide you with customized solutions to help you pay off your debts and stay out of trouble.

Solved If $4,351 Was Withheld During The Year And Taxes Owed

Once you know how much you owe the IRS, the next step is to figure out what you can do about it.

If you have money in your bank account to cover your balance, it’s as simple as paying the bill.

The Tax Authorities are not blind to this problem. For such cases, they offer solutions, including installment agreements and compromise offers. However, not everyone is suitable for every solution, so it is important to find an alternative that can provide relief.

If you choose the path of a tax debt relief specialist, they can guide you through the options available and guide you through your unique situation. Tax professionals do their best to create a tax solution that works for you, whether it’s a payment plan or an appeal.

Here’s What You Owe To Your Students

If you need help with a tax refund, get help before things get worse. Liens and bankruptcies loom on the horizon until you take steps to manage your tax obligations. Do not wait. Trade today!

We use cookies to provide you with an excellent user experience. We also share this information with third parties for advertising and analytics. By using this site you accept the use of cookies. Private | Terms of Use

We know tax debt is scary, but help is just a click away! Answer a few questions so we can better understand your situation. It only takes a few minutes and you’ll get: Chris Huntley By Chris Huntley All articles → Former Certified Credit Counselor, Licensed Insurance Agent, and Former Registered Investment Advisor Series 65. follow:

Review by Steve Rogers Review by: Steve Rogers All articles → Steve Rogers has been a professional writer and editor for more than 30 years, specializing in personal finance, investing, and the impact of political trends on the financial markets and personal finance. to follow:

Reasons You Might Owe Money To The Irs This Tax Season

The content is free. When you make a purchase through a referral link on our website, we earn a commission. Advertiser announcements

If you owe $10,000 to $15,000 to the IRS, you need a solution to your problem. Your options include payment plans, compromise offers and more. Choose the best option for you, but don’t wait any longer. The IRS will work with you, but they will not forgive or forget.

If you have $10,000 to $15,000 in IRS tax debt and aren’t sure where to turn, this article is for you.

We’ll review all your best tax relief options to immediately stop the IRS collection efforts, including asking for debt forgiveness (offer in compromise), working out a payment plan (installment plan), bankruptcy, and do-it-yourself (do-it-yourself) the-self). considerations, or getting help from a corporate tax exemption.

John Maynard Keynes Quote: “if You Owe Your Bank A Hundred Pounds, You Have A Problem

You’re here because you already know that the IRS can garnish wages or file a tax lien on your property. You owe the IRS and it has reached the point where you need to take action.

By the end of this article, you’ll be ready to make a decision about which tax relief option is best for you and whether you should proceed on your own or hire an expert to help you.

Whoever accrued that amount of tax debt must have made good money along the way. IRS logic says that you can clearly afford to pay your debts.

But they don’t know what’s going on in your life, which makes it almost impossible to take more than €13,000, for example.

Can The Irs Take My Professional License?

Fortunately, there are tax relief options you can use to get the IRS off your back and put an end to your tax problems.

It’s true that you probably don’t have $11,000 or $12,000 to pay the IRS all at once.

The good news is that the IRS allows you to set up a payment plan known as an installment agreement. You can request an installment agreement using IRS Form 9465.

Here are some examples of monthly payments, including eligibility for each payment and the forms required. If you can’t afford these fees, skip to the next section to explore other options.

Intercepting Tax Refunds To Cover Unpaid Child Support

*Monthly costs are estimates only and do not include prepayments. The IRS accepts a large percentage of installment applications, but acceptance is not guaranteed. We recommend that you speak to a tax specialist at Optima Tax Reliefor before entering into an installment agreement or if you are unable to pay the above monthly payments.

Keep in mind that interest and penalties can quickly add up and move your balance into a higher category. That’s why we’ve also created a guide for you to show you how to eliminate tax debt if you owe between $16,000 and $25,000 to the IRS.

Keep in mind that if you enter into an installment agreement and have trouble paying it on time (if you default), the IRS has been known to demand the entire balance you owe or file tax liens and IRS tax actions. This may be a reason to try to offer them a lower amount than you owe. (Offer in compromise)

Quick Tip: Once you start a repayment plan, it will be harder for you to get out of debt

Can I Get Disability If I Owe Back Taxes?

How to find out if i owe state taxes, what to do if i owe taxes, find out if i owe taxes, how to find out if you owe state taxes, how do i find out if i owe property taxes, how to find out if you owe property taxes, what to do if you owe taxes, find out if you owe taxes, if you owe taxes, find out if i owe back taxes, how to find out if i owe property taxes, if you owe delinquent property taxes