House Is Worth Less Than I Owe – For free real-time news alerts sent straight to your inbox, sign up for our latest emails. Sign up for our free newsletters

The worst problem is in those areas of the country where real estate prices have not yet recovered from the economic crisis.

House Is Worth Less Than I Owe

In Northern Ireland, for example, 68,000 homeowners, or 41 per cent of borrowers, had negative equity at the end of last year.

Academics Abolish Negative Equity — And Profits From Rising House Prices

This can be compared with 16 percent in North East England and Cumbria. Six months earlier, the value was 14 percent.

The figures, published by the mortgage group HML, are based on data from over one million home loans.

But in London, only 1 percent of borrowers were in trouble due to rising property prices in the capital.

And overall, just 8 percent, or 463,000, of mortgage owners had negative equity—an improvement over five years earlier.

Loan To Value (ltv) Ratio: What It Is, How To Calculate, Example

Negative equity occurs when the current value of a property is less than the outstanding amount on the mortgage.

This is a problem for the bank or building society as they no longer have enough money to cover the loan and the home owners cannot sell the property without paying back the difference.

“They might let you take out the mortgage and carry the loan you have to the next property. So it’s not catastrophic if that happens. The trick is to talk to your lender as early as possible,” she said.

Want to bookmark your favorite articles and stories for later reading or reference? Start your Premium subscription today.

Your N.j. Home Is Worth Less Than It Should Be, Thanks To The Trump Tax Law

Refresh the page or go to another page on the site to log in automatically. Please refresh your browser to log in. For the first time in generations, a high percentage of the country’s households have negative equity. A home is considered “underwater” if the value of the home is less than the amount owed. With so many people unable to pay their mortgages, a worrying new trend has emerged: “walk away”.

“It’s way too common in a lot of cases, but it’s a lot more common in Cranford because most of the homes here are owner occupied,” said Sean Carroll, a Cranford real estate agent. “Homeowners in Cranford have strong ties to the schools or the community so they want to do everything they can to stay in their home or sell it before it goes into foreclosure.”

Here are some terms and strategies to be aware of for those in Cranford who are having problems with their mortgages.

Real estate giant Tishman Speyer failed to foreclose on an 11,000-unit building in New York City last month. With more than $4.4 billion in debt and unable to keep up with the massive debt, developers just walked away from the sprawling Peter Cooper Village and Stuyvesant Town complex. It is believed to be the largest nationwide walk away estate in history.

Net Worth: What It Is And How To Calculate It

Just as large corporations abandon their real estate to escape debt, there is a ripple effect in encouraging Americans who can’t stay away from paying off their mortgages on purpose.

Many consumer advocates want the government to introduce rules to force banks to reduce the principal amount on homes that desperate homeowners can no longer afford.

Distressed homeowners are encouraged by banks and the government to find a way to meet their financial obligations despite paying for the property with no equity. But when companies move away from home loans for commercial real estate, they tend to frame it a little differently, almost as if it’s just a smart business decision. Morgan Stanley, for example, pulled out of some of its San Francisco properties last month, saying it was a “negotiated move to our lenders.”

Brent T. White, a professor at the University of Arizona School of Law, is one of the most vocal advocates for “underwater” homeowners to turn away from mortgages. Because they “have no reasonable expectation of getting back the hundreds of thousands of dollars they put into their homes,” default may be the most reasonable option, he said.

In Whose Interest?

Many homeowners may fear that their credit rating will be damaged by moving. Professor White claims they can restore reasonably good credit within two years of origination. Fannie Mae and Freddie Mac officials disagree with that view, noting that it would take years to rebuild credit after they leave and make it nearly impossible to get a new home loan in time to come

According to the Wall Street Journal, one in four American homeowners, or nearly 11 million Americans, are underwater, and in some states – Arizona, California, Florida, Michigan and Nevada – they h – even higher numbers.

In Cranford, the city does not track foreclosure numbers or the number of homes sold each year. But it’s clear that many homeowners, especially some retirees on fixed incomes, are struggling to make mortgage payments and don’t know where to turn.

“Even though there was some mortgage distress in Cranford, I think a lot more people in our area bought homes with more traditional loans than in more speculative areas like Florida and the Southwest,” Carroll said. “Most people in our area also have the income to pay our prices.”

A Shaky Foundation

Property values are affected by a number of variables, so the property market should be viewed as a series of local markets rather than the big picture.

“I always tell people there is no national real estate market,” Carroll says.

Many homeowners facing foreclosure may not know that you may not be evicted from your home until you are notified. Your landlord must notify the court and give you enough time to leave the premises. Some landlords try to lure tenants away by offering them “cash for keys”, a sum of money in exchange for their keys. This practice is illegal and the tenant has every right to stay in their apartment until the entire eviction process is completed.

“People need to understand that they have options other than leaving. Foreclosure is a devastating phenomenon – both for a homeowner’s credit and their emotional well-being. Lately, the media has helped advertise foreclosures, loan modifications, etc., but because there are so many scams, people are less likely to get help, Carroll says.

Studies Find Huge Benefit From Life Saving Social Distancing Policies, Despite Economic Pain

Resources for struggling homeowners include the Courts Office’s Foreclosure Mediation Program, which can be reached at 1-888-989-5277, and the Office of Housing and Urban Development (HUD).

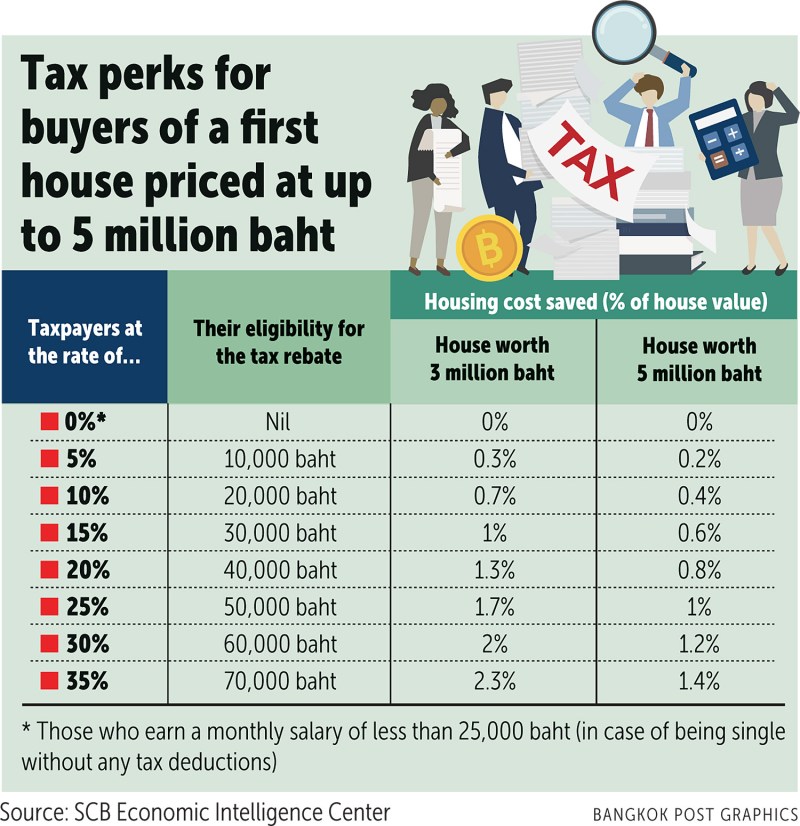

The president has enacted a mortgage modification program for struggling homeowners and offered to expand the tax credit for home buyers.

“Unfortunately, nearly seven out of ten homeowners nationwide go into foreclosure without obvious signs of intervention (loan, broker listing, etc.). That number is much higher in other homes or vacation centers or in areas where they are.” “There is a higher proportion of investment properties or multi-family properties,” Carroll said.

“The first calls they make should really be to a licensed agent they trust and a real estate attorney who can help them understand the options they’re going to have.”

Is Housing A Bubble Waiting To Pop?

Although numbers vary, according to the New York Times this month, 10 percent of American homeowners will reach the point of “walking away” by June of this year. It could take years for the housing market – and the American dream – to fully recover until unemployment and the economy fall back. Home ownership may be a lifelong goal for many Americans, but that doesn’t mean it’s right for everyone. Home ownership rates are currently high in the United States, but that wasn’t always the case. Historically, families had to build their own homes or rent a home from someone else. Although it may not be ideal, renting also has its advantages. For some people, it may make more sense to rent for financial reasons. Below we have listed 10 of the most important advantages of renting over buying a property.

One of the advantages of renting a home is that there are no maintenance or repair costs. This means that when you rent a property, your landlord takes full responsibility for maintenance, improvements and repairs. If an appliance stops working or your roof begins to leak, contact the landlord who will need to repair or replace the appliance.

Homeowners, on the other hand, are responsible for the costs of home repairs, maintenance and renovations. Depending on the nature of the work (and if several jobs appear at the same time) it can be quite expensive.

Another financial benefit of renting is access to amenities that would otherwise cost a lot. Luxuries such as an indoor pool or a fitness center are standard in many mid-rise and high-rise apartment buildings at no extra cost to tenants.

Living Room Worth More Than Resource Boom Houses

If a homeowner wanted access to these facilities, they would likely have to spend thousands of dollars on installation and maintenance. Owners of condominiums are also not exempt from these costs. These costs are included in the monthly HOA fees.

One of the main advantages of renting rather than owning is that tenants are not entitled to it

What if you owe more than your house is worth, owe more than the house is worth, car is worth more than i owe, house is worth less than i owe, trade in car worth less than i owe, home is worth less than i owe, selling house for less than you owe, i owe more than what my house is worth, my house is worth less than i owe, my car is worth less than i owe, what if my car is worth less than i owe, car is worth less than i owe