Car Insurance Increase After No Fault Accident – Auto insurance provides financial protection to drivers and car owners as protection against damages caused by accidents. This can help cover medical expenses for injuries caused by accidents as well as damage to your car.

However, in most cases, your auto insurance premiums will increase in a car-related accident or auto accident, especially after an at-fault accident. However, the increase in your premiums

Car Insurance Increase After No Fault Accident

One of these factors is whether or not you were at fault in the accident. If your insurance policy rates will not increase, if the accident was not your fault or if it was your first accident, every case is different.

How No Fault Insurance Works

At Schwartzapfel Attorneys, our qualified team can provide you with all the information you need about accidents and how they may affect your auto insurance rates.

To help with your case or to speak directly and for free with an experienced car accident attorney, contact Attorney Schwarzapfel today, visit them online or call them at 1-516-342-2200!

One of the most important determinants of your car insurance rate is your driving record and accident history. In short: the more accidents you have, the more coverage your car insurance should provide; To cover their earnings, your insurance company may increase the insurance premium on your account.

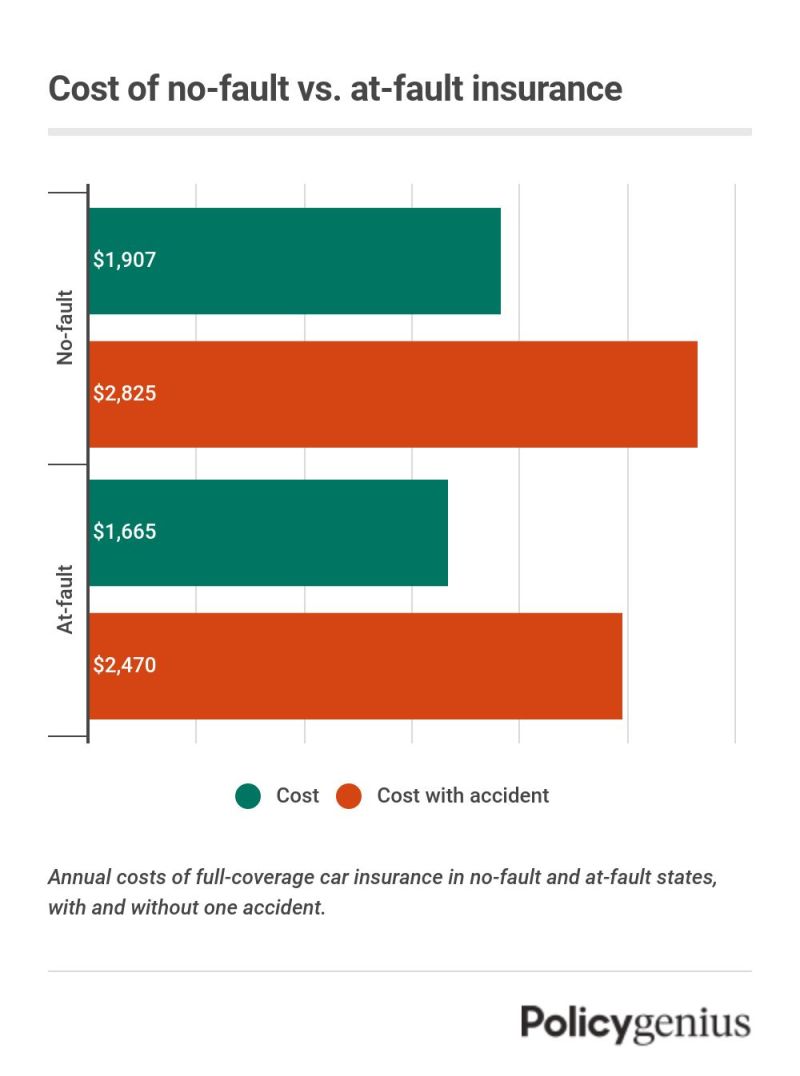

On average, car insurance rates increase by 45% after an accident or car accident. However, the increase in your car insurance payment depends on a number of different factors, including:

How Car Insurance Works When You’ve Had An Accident

When more than one vehicle is involved in a car accident, the at-fault driver may be responsible for providing coverage to other people injured or injured in the accident.

However, if you are not at fault, your car insurance premiums or monthly car insurance costs may not be affected if your at-fault insurance covers injuries or damages in an accident or accident.

Typically, an at-fault car insurance provider covers medical expenses and damages for all parties involved in a car accident. However, with simple insurance, this may not always be the case.

Simple insurance helps cover drivers regardless of whether they are at fault for an accident or an accident. In most cases, simple insurance will only cover medical expenses after personal injury caused by an accident, not after property damage. However, this may depend on the circumstances of your case. To learn more about the specific remedies you may be entitled to, you should speak with a qualified car accident attorney like Schwartzapfel Attorneys as soon as possible.

How Many Accidents Can You Have Before Your Insurance Drops You?

In New York State, simple coverage is required as part of your auto insurance plan. This is to avoid unnecessary legal action between the various parties involved in the accident.

Although it provides coverage regardless of who is at fault and how the accident or accident occurred, there are some exceptions. A driver may be disqualified without insurance if:

If your injuries are covered by simple insurance after an accident, you may not be able to file a claim against the at-fault party or receive coverage from your insurance provider. You can do this if you were seriously injured or if the at-fault party’s negligence caused the accident to be harmful.

In addition, depending on your injuries and the nature of the accident or accident, your insurance rates may increase if you receive coverage under simple insurance. However, being at fault after an accident will not help keep your rates low.

No Claim Discount Protector. Should You Get It?

Because every case is different, contacting the right attorney can help you better understand what to expect in terms of insurance rates and coverage after an accident or mishap. We can put you in touch with a qualified car accident attorney at Schwartzapfel Lawyers when you call us today at 1-516-342-2200. Alternatively, you can schedule your free consultation, case evaluation and more by visiting us online now.

After an accident or car accident, there are important steps to take to ensure your well-being and build your case. Taking the necessary precautions can also help you determine the cause of the accident or accident and prevent your insurance rates from increasing.

To ensure your safety, here are some of the most important steps to take after an accident or mishap:

After the accident or accident is over and you have received treatment for the injuries you may have sustained, the next step is to build your case and determine how the accident or accident occurred.

What Happens If You Get In An Accident Without Insurance?

Claiming that the accident was not at fault can help you avoid higher insurance premiums for policyholders, preserve your driving record, and avoid lawsuits against other drivers. However, it may not be easy to determine who is responsible for the accident.

System crashes can occur for various reasons. This includes disobeying traffic laws, such as exceeding the local speed limit or running a red light. It can also include drug and alcohol use, texting while driving, and falling asleep at the wheel.

Sometimes there is no one to blame for an accident. In such cases, the accident may be caused by extreme weather conditions or icy roads.

Regardless of the details, here are some tips for proving that you are not at fault in an accident:

Average Cost Of Car Insurance (2024)

Remember: If you can prove to your insurer that you were not at fault for the accident or mishap, you may be able to keep your insurance rates low.

If you have been involved in an accident or car accident, the members of our team at Schwartzapfel Lawyers can help you make the most of your situation. For more free information, call us today at 1-516-342-2200 or visit us online. It will be our honor and privilege to fight for you along the way!

It’s no big secret that car insurance payments often go up after an accident or accident. However, if you are not at fault, your insurance rate may remain the same.

After an accident, injuries and damages may be covered by the at-fault party’s insurance. You can also get simple insurance that provides medical coverage to the insured driver regardless of the fault of the accident or mishap.

Do Insurance Rates Go Up After No Fault Accidents?

To better understand how your insurance rates can be affected as a result of an accident, even if you are not at fault, it is best to speak to an experienced attorney for advice tailored to your case.

At Schwartzapfel Attorneys, our experienced car accident and insurance attorneys are ready to help you protect your rights after an accident. Plus, it’s our privilege to fight for you in and out of court, and a simple phone call to our team can save you a lot of headaches and heartache.

That’s right, you don’t have to wait. Your future is too important to leave alone. Instead, act now by contacting Attorney Schwarzapfel at 1-516-342-2200 to protect yourself, your family, and your wallet.

: Nothing on this page should be construed as legal advice. You should seek the appropriate advice that your situation requires. Please contact for more information

Insurance Claim Definition

In the case of car accidents, medical malpractice, or other personal injuries, many people think that it is a physical injury.

Intersections, intersections where roads meet, often become the site of car accidents and other road accidents. in New York

On New York State’s busy roads, minor car accidents happen regularly. But what happens when the accident is minor

Attorney Schwartzapfel P.C. is a prominent personal injury law firm with over 150 years of experience handling injury recovery claims. If you are involved in an accident, your car insurance can help pay for your damages. However, the process for receiving compensation may vary by state. The state you live in may have an accident compensation scheme. It may also affect the process you have to go through to receive financial compensation. In any case, you should be aware of the rules and procedures that apply where you live. This will help you in case of an accident.

How Much Does Insurance Go Up After A Fender Bender?

Confused about the difference between a fault or accident compensation scheme? Read more to know:

In an at-fault accident compensation plan, the driver who caused the accident is responsible for paying for the damages caused to other people involved in the incident. This basically means that the at-fault driver can claim on their insurance or use their pocket money to pay for other people’s damages related to the accident. Affected countries have compensation schemes of this type.

For example, you accidentally rear-ended the car in front of you because you were distracted. In this case, you are the wrong driver. If you cause an accident, you can use the property damage liability portion of your auto insurance policy to pay for the damage to the other driver’s vehicle. If the driver or other passengers in the car are injured in an accident, your bodily injury liability insurance is meant to cover their medical treatment. However, this coverage can only be used as specified in your policy. to bear any cost

Will insurance increase after no fault accident, non fault accident insurance increase, at fault accident insurance increase, not at fault accident insurance increase, car accident no fault, car insurance increase after non fault accident, insurance premium increase after no fault accident, car insurance increase after accident not at fault, no fault accident insurance, does insurance increase after no fault accident, car insurance increase after accident, fault accident insurance increase