Can You Refinance Your House For More Than You Owe – A cash-out refinance is a mortgage refinancing option that allows you to convert your equity into cash. The new mortgage is contracted for an amount greater than the balance of the previous mortgage and the difference is paid in cash.

In the real estate world, refinancing is generally a popular way to replace an existing mortgage with a new one, usually extending more favorable terms to the borrower. By refinancing your mortgage, you can reduce your monthly mortgage payments, negotiate a lower interest rate, renegotiate periodic loan terms, remove or add borrowers from the loan obligation, and access cash-out refinancing. cash from your home’s equity.

Can You Refinance Your House For More Than You Owe

A cash-out refinance allows you to use your home as collateral for a new loan, along with some cash, creating a new mortgage loan for an amount greater than what you currently owe. Raising money using home equity can be an easy way to raise money for emergencies, expenses, and needs.

Best Mortgage Refinance Companies Of 2024

Borrowers who want to refinance their money find lenders willing to work with them. The lender considers the terms of the existing mortgage, the balance needed to pay off the loan, and the borrower’s credit profile. The lender makes an offer based on the collateral analysis. The borrower takes out a new loan that pays off the old one and is placed on a new monthly payment plan. The excess amount of the mortgage payment is issued in cash.

With a standard refinance, the borrower would never see any cash, only lower monthly payments. Cash-out refinancing can be used however the borrower sees fit, but many people often use the money to pay for important expenses, such as medical or tuition expenses, debt consolidation, or as an emergency fund.

A cash-out refinance means less equity in your home, which means more risk for the lender. This may result in higher closing costs, fees or interest than a typical refinance. Borrowers with specialty loans, such as U.S. Department of Veterans Affairs (VA) loans, including retirement loans, can often refinance on more favorable terms with lower fees and rates than non-VA loans. from the VA.

Lenders set loan limits on how much you can borrow during a cash-out refinance: typically 80% of your home’s available equity.

The Great Pandemic Mortgage Refinance Boom

Smart investors who analyze interest rates over time will generally jump at the opportunity to refinance when mortgage rates fall to new lows. There may be different refinancing options, but generally most will have several additional costs and fees that make the timing of mortgage refinancing as important as the decision to refinance.

In addition to checking rates and fees to make sure refinancing is a good option, consider the reasons you need the money. This refinancing option typically has lower interest rates than unsecured debt, such as credit cards or personal loans. But unlike a credit card or private loan, you risk losing your home if, for example, you can’t pay the mortgage or if the value of the home falls and the mortgage goes under.

Carefully consider whether it’s worth the risk of losing your home if you can’t pay in the future for what you need money for. If you need money to pay off consumer debt, take steps to control your spending so you don’t end up in an endless cycle of debt overload. The Consumer Financial Protection Bureau (CFPB) has several excellent guides to help you determine if refinancing is a good option.

A cash-out refinance provides the borrower with all the benefits they seek from a standard refinance, including a lower interest rate and possibly other beneficial changes. Additionally, borrowers receive cash that can be used to pay off other high-interest debts or perhaps finance a major purchase. This can be especially useful when interest rates are low or in times of crisis, such as in 2020-2021, after the global lockdown and quarantine, when lower payments and extra cash could be a big help.

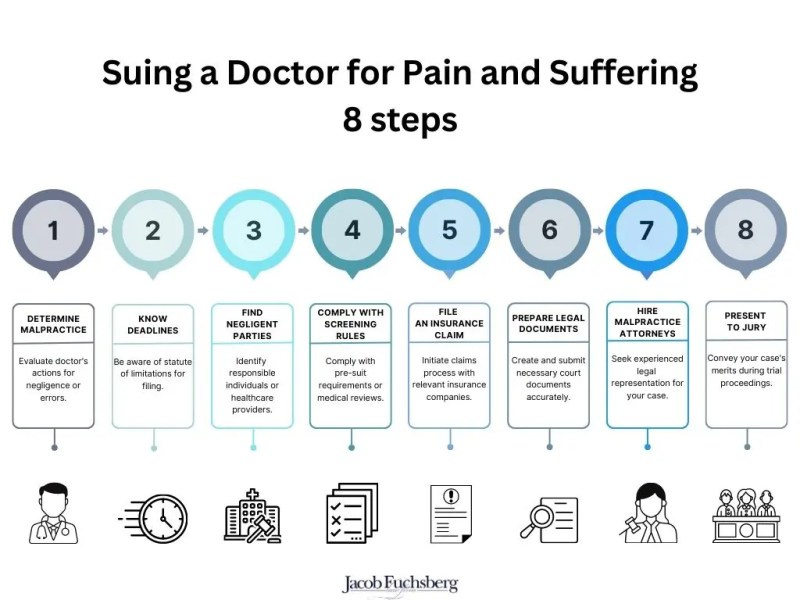

Steps To Refinance Your Mortgage

Home equity loans and home equity loans (HELOCs) are options for refinancing or activating your mortgage (or interest and term).

Let’s say you took out a $200,000 mortgage to buy a $300,000 property and years later you still owe $100,000. Assuming the property value has not fallen below $300,000, you will also have built up at least $200,000 in home equity. If interest rates have fallen and you are considering refinancing, you may be approved for up to 80% of your principal, depending on your policy.

Most people don’t necessarily want to take on the burden of another $200,000 loan in the future, but home equity can help you get that amount of cash. Let’s say your lender wants to lend you 75% of the value of your home. For a $300,000 home, that would be $225,000. You need $100,000 to pay off the remaining principal. That makes $125,000 in cash.

If you decide to get only $50,000 cash, you will refinance into a $150,000 mortgage with a new interest rate and terms. The new mortgage will consist of the $100,000 balance of the original loan and the desired $50,000 available for cash withdrawal.

Refinancing Versus Repricing In Singapore: Which Should You Pick?

In other words, you can take out a new mortgage for $150,000, get $50,000 in cash, and start a new monthly payment plan for the full amount. This is the advantage of secured loans. The downside is that re-foreclosure on your home applies to both $100,000 and $50,000 because it’s all included in one loan.

As mentioned above, borrowers have many options when it comes to refinancing. The simplest mortgage refinance is the interest-bearing refinance, also known as cashless refinancing. With this type, you try to get a lower interest rate or adjust the loan term, but nothing changes in your mortgage.

For example, if you purchased your property a year ago when interest rates were higher, you can take advantage of refinancing to take advantage of lower interest rates. The variables in your life may also have changed so that you can handle a 15-year mortgage (with big interest savings), even if that means giving up the lower monthly payments of a 30-year mortgage. With installment and interest refinancing, you can reduce the interest rate, adjust it to a 15-year payment, or both. Nothing else changes, only the rate and the term.

A cash-out refinance serves a different purpose. You get the difference between the two loans in tax-free money. This is possible because you only owe the lender what is left of the original mortgage amount. Any outstanding loan amount on a refinanced and paid-off mortgage is paid to you in cash at closing, which generally occurs 45 to 60 days after application.

Things To Know Before Refinancing Your Mortgage

Compared to interest-bearing and term loans, there are typically higher interest rates and other costs, such as points. Cash loans are more complicated than interest rate and term and generally have higher collateral standards. A high credit score and lower loan-to-value (LTV) ratio can alleviate some of your concerns and help you get a better deal.

With a cash-out refinance, you pay off your current mortgage and take out a new one. With a home equity loan, you get a new mortgage on top of your original mortgage, which means you now own your property. This means you have two separate creditors, each with a potential claim on your house.

Mortgage closing costs are generally lower than cash-out refinancing costs. If you need a large amount of money for a specific purpose, a mortgage may be helpful. But if you can get a lower interest rate with a cash-out refinance, and if you plan to stay in the house for a long time, refinancing probably makes more sense. In both cases, make sure you can afford the new loan amount; Otherwise, you could lose your home.

Discrimination in mortgages is illegal. If you believe you have been discriminated against because of your race, religion, gender, marital status, use of public assistance, national origin, disability, or age, you can take action. One of those steps is to file a report with the Consumer Financial Protection Bureau (CFPB) or the U.S. Department of Housing and Urban Development (HUD).

Is Cash Out Refinancing Your Property A Good Move For Your Home Equity Loan?

Home equity is the market value of the home minus any liens, such as the amount you owe on your mortgage or mortgage. The equity in your home may fluctuate depending on real estate market conditions in the community or region where you live.

To calculate your home equity, simply subtract the mortgage balance from the market value of the property. For example, if your house is

Can you refinance for more than you owe, if my house is worth more than i owe can i refinance, can you refinance your home for more than you owe, can you refinance a mortgage for more than you owe, refinance home for more than you owe, can i refinance for more than i owe, can you refinance your house for more than you owe, refinance more than you owe, refinance car for more than you owe, refinance for more than you owe, owe more than your house is worth, can i refinance my house for more than i owe