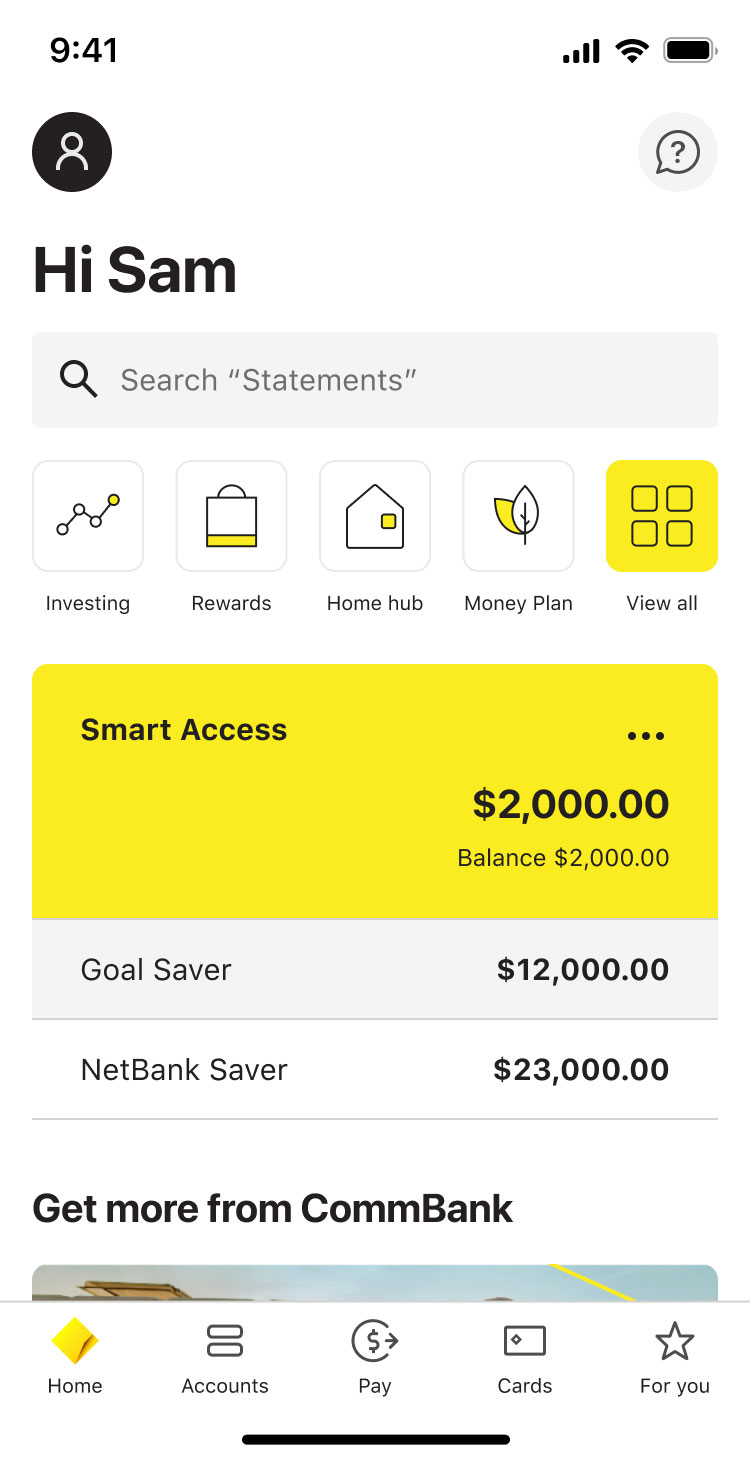

Can I Sell My House During Forbearance – We patiently buy homes in EVERY zip code! Do you have questions? Call us at 678-540-4725 WHAT DO YOU HAVE TO LOSE? Call us now!

Have you ever wondered what a mortgage loan is? Hopefully you’ll never need it. However, it is useful if you are in serious financial difficulties. If you have a foreclosure, you must skip your mortgage payments. This can help give you some much needed breathing room. Do not let the pressure build up. Start making plans now. That way, when the time comes, you know what to do.

Can I Sell My House During Forbearance

Before you decide to sell your home, you need to understand what a suspect is. These programs are not always available. However, the federal government issued orders this year authorizing them.

Can I Sell My House During Foreclosure In Massachusetts?

Forbearance is a financial term that refers to a period of withholding loan payments. Normally, you do not make any payments while in forbearance. When the forgiveness is over, you will pay whatever you would have paid.

Mortgage loans can be useful for people who have lost their income. If you’re having trouble paying, it’s worth considering. However, there are some rules and regulations that you should know first.

First of all we want to inform you that at this moment it is possible to sell your house. Even if you don’t make the payments, you can find someone to buy the property from you. This is the perfect method to protect your credit. If you can’t pay your mortgage, sell the house.

Selling during the delay can be a great idea, even with a caveat. You must pay the full amount to Foreborn immediately after the sale. These funds come from the sale price before you receive the money.

Va Enacts Pause On Foreclosures For Veterans, Service Members

Patience and delay are two closely related concepts. Both of these allow you to skip a mortgage payment. However, there are several important differences.

If you are serviced, you must repay any late payments. When the mortgage loan comes due, all the money must be paid at once. Sometimes lenders may be willing to negotiate.

If you have debt, you don’t have to make any payments. Instead of paying off all late payments after the deferment ends, you pay them off by extending the term of the loan. In effect, you now stop making payments and instead extend the term of the loan.

Exposure is usually limited to a certain time. Homeowners are currently protected under federal regulations. As part of the CARES Act, homeowners received up to 180 days of maintenance costs.

Mortgage Forbearance: What Is It And How Does It Work?

These federal regulations apply to mortgages backed by the federal government. These mortgages automatically qualify for 180 days. You must then return any payments received.

Homeowners have an additional option. After the initial 180 days, they can appeal for more. They should be considered on a case-by-case basis. Depending on your circumstances, you may be entitled to an additional 180 days.

Why would anyone consider selling if they don’t have to pay? This is generally recommended if you do not plan to pay after the grace period ends. In this case, it can be a good solution. Selling before foreclosure will help protect your credit.

As you can see, your situation will determine which decision is right. If you’re still running out of patience, it’s best to let someone else have it. Homeowners are understandably reluctant to let their properties go. But if you can’t make the payments, you won’t be able to keep the property either. If you sell it, it will protect your credit. In addition, you can benefit from any assets you have accumulated in the property.

Can I Sell My House While In Forbearance?

Should you consider selling your home? Ultimately, no one can answer this question for you. Our best advice would be to be honest with yourself. If you are honest, you can objectively assess your circumstances. Are you likely to pay off your mortgage before your forgiveness ends? If so, explore this approach in its entirety. You can keep your home without damaging your credit. On the other hand, if there is no hope, just leave it. Wait until your forgiveness is over and it will only culminate in expropriation. Unless you have the income to pay the mortgage, the final destination is foreclosure. If not, this is the most appropriate way to sell. This may not be what you want. However, this is the best option you have right now. Limiting purchases. It’s a terrible word. If you are facing foreclosure, you may be scared, stressed, or overwhelmed with all the uncertainty that comes with significant financial stress and the possibility of losing something as big as your home to someone else. In this post, we’ll answer some common questions you may have about the foreclosure process, and at the end of the post we’ll outline how we can help you come out on the other side of this difficult situation.

Foreclosure is the name of the initial period of the foreclosure process. Foreclosure is what happens when you can’t make the payments on the loan you took out to pay off your home—after a few missed payments, your bank begins the process of repossessing your home. This process may end up selling your home at auction. After a predetermined number of late payments, your bank will send you a notice and the foreclosure process will begin.

Under Massachusetts state law, your lender must wait 120 days from the time your account first becomes delinquent to begin foreclosure proceedings. This four month period is designed to give you enough time to analyze your situation and consider all options.

Even if receiving a foreclosure notice seems like the end of the world, there are still some things you can do to save the day and prevent the bank from foreclosing on your home.

Coronavirus Help Can Put Off Mortgage Bills. What’s Next?

A loan modification is a great option. Ultimately, the bank wants to get the money it owes, so it’s willing to work with you to adjust the interest rate or other terms of the loan to make it more manageable and more likely to make the payments. To learn more about this option and see if you qualify, contact your loan provider for more information.

Patience is another similar option. In this case, the bank will agree to foreclose, and you will have to agree to some kind of payment plan. However, the reduced payments are only temporary and you must pay off the remaining debt at the end of the predetermined term. Make sure you understand the terms of the contract as they vary from person to person.

A viable but riskier option is bankruptcy. There are four types of bankruptcy in Massachusetts, two of which may apply to home loan foreclosure situations.

Chapter 7 bankruptcy, or liquidation, is for individuals who cannot pay the debts they currently owe. In this situation, your property will be held by the trustee (some of your property may be considered exempt, so be sure to ask questions during the process). The bank will then liquidate your assets and use the sale proceeds to pay off your remaining debt.

Mortgage Relief: A Comprehensive Guide

The other type of bankruptcy is Chapter 13 bankruptcy, where individuals who currently have an existing source of income can work with their lender to develop a new debt repayment plan that will help you address your debt for years to come.

Sometimes you have the opportunity to buy the home back before the foreclosure goes through and the home goes to auction. This is known as “righteous salvation.” If your foreclosure is out of court and you are unable to purchase your home before the sale, you will lose the ability to purchase the home.

Note. We are not giving you legal advice by sharing these options – these descriptions are for informational purposes only and provide general information on how to navigate the process! If you are considering these options, you should consult with an attorney or foreclosure attorney.

One fact that will give you comfort is the fact that you still retain ownership of your home during the foreclosure process. This means you can still make the decision to sell your home if buying a home isn’t right for you.

Cares Act, Section 4023

One of the main advantages of selling your home before foreclosure is the fact that it can be a quick process – you can get a cash advance. This money can be used to pay the lender everything, including late payments and fees, and you can get out of the situation relatively unscathed. Also this option

Can you sell a house during probate, can i sell my house during forbearance, can i sell my house while in forbearance, can i refinance my home during forbearance, can you sell a house in forbearance, can you sell your home during forbearance, can you sell your house during forbearance, can you sell your house in forbearance, can i sell my house during foreclosure, can you sell house while in forbearance, can you sell house in forbearance, can i sell my house if it's in forbearance