When To Trade In A Car You Still Owe On – Trading in a car to upgrade to a new car is always a lot of fun. Maybe you’ll drive by one day and see a fancy Tesla, but you’ve been thinking about making the switch.

But whether you’re experimenting with the “new car” feeling, or your car is giving you problems, there will always be a time in any car’s life when you start to wonder if it’s worth keeping.

When To Trade In A Car You Still Owe On

As you put more miles on your car and it gets older, your servicing costs will increase. Unfortunately, there is no escaping this fact of life and it is something we all have to accept. Fortunately, we have affordable auto-lidar services, which means you won’t be in for a surprise when you accept them for a standard log-in service.

A Quick Guide To Car Trade In Jargons

If you’ve taken good care of your car and haven’t missed a single scheduled service, then your car is probably in good shape. If not, then your repair costs will increase. So, if a car is worth more than it needs to repair, it may be time to say goodbye and trade in another car.

As technology continues to advance, automakers are turning to safety features to increase the competitive advantage of new models. If you have an older car, then its safety features are outdated, putting you and others on the road at risk.

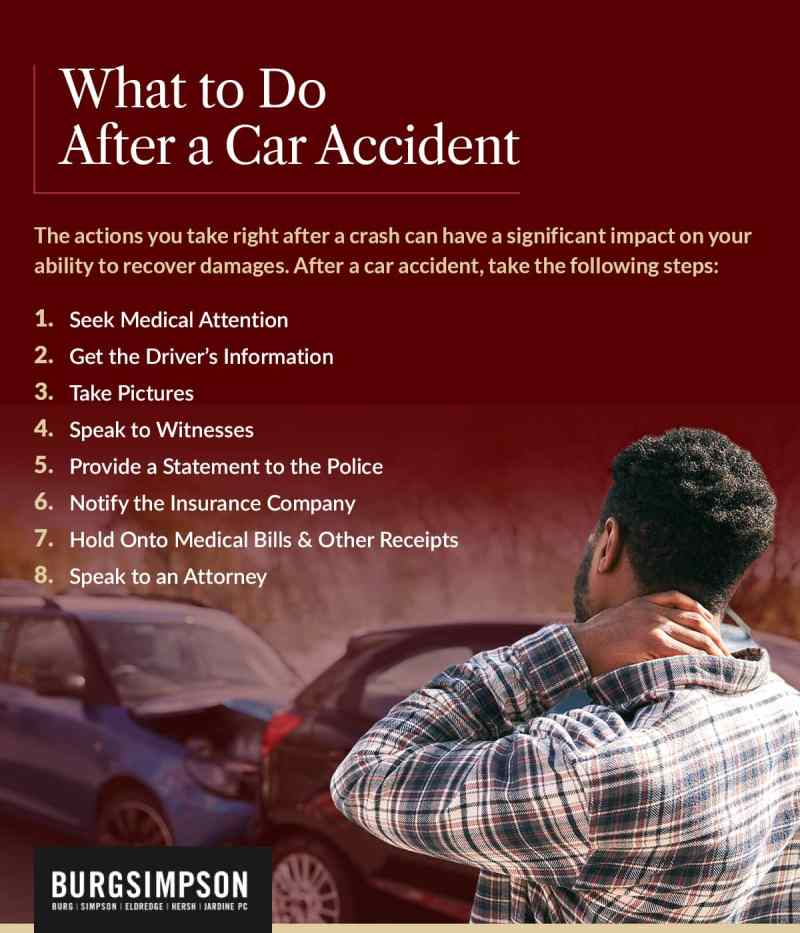

New cars are regularly tested by organizations such as ANCAP which help consumers determine which models are safe on the road. If you know your car doesn’t have the latest accident prevention features, you should sell it. Remember – your safety should always be your first priority!

Chances are your old car’s warranty has expired. If you’ve taken the time to take care of your car, this shouldn’t be a problem. However, selling your car while it’s still under warranty will increase its value, meaning you can get a better deal from the dealer.

Should You Trade Your Car In Before It Is Paid Off?

In most cases, your car is the second largest in your home. This is why many people finance their cars. Basically, when you sell your car, you have to sell it for a price that pays the tax on the loan. If you still have money to pay for a new one, that’s a great result! That’s why you need to assess the value of your current car to make sure you’re driving at the best end. Maybe you want to upgrade, or you want to take advantage of the recent wave of COE prices. Regardless of your purpose, there are many ways to get your car. You can choose to trade in your car, or sell it to a dealer or private individual.

But what factors should you pay attention to when driving your car in these conditions? We’ll explain the pros and cons of selling your car versus trading in your car, which will hopefully help you decide!

The least resistance if you want to buy another car. The dealership you buy your new car from will accept your current ride at a rate below market value. If you are wondering why your car is underpriced by the dealer, you have to remember that they have to build their profit margins when they bring your car.

Your used car can now be sold at market value. This pre-paid value of your current car will be used to lower the price of your new car.

Sell Us Your Car

But to make buying new cars more attractive, dealers offer so-called ‘trade-ups’, where used car prices are increased so that someone pays less for their money. In fact, a new car costing $100,000 will generate a down payment of $40,000. By increasing the value to $110,000 and increasing the value of the used car to $10,000, the down payment is that much lower. You only have to pay $34,000.

If you just want to get rid of your current car, a trade-in is a very easy option. You get rid of your old car and buy a new one in one place. This means that there is less paper, and therefore, less time overall.

This method also works for vehicles that may be difficult to remove. Consider used cars, or cars with a unique history and/or lots of use. After all, you’d be hard-pressed to find people looking for a bad car.

If you are looking to get more value out of your current car, this is not the way to go. Remember that there are many ways you can sell your car to maximize your profit.

When Is The Right Time To Trade In Your Car?

As mentioned above, sellers need to get your car for less than a used car, so they have a buffer for their profits. Even for the most sought after cars, there is definitely a fixed price for the car.

With all the convenience fees, you’re looking at thousands of dollars more than what your car would sell for on the open market.

It’s pretty self-explanatory, so we won’t talk too much about what goes into selling your car. You can sell it to a seller, a realtor, or do it yourself if you are comfortable with all the paperwork.

You are waiting to see your best selling car in person. There is no huge commission for anyone involved in the process, as you handle the paperwork yourself.

How To Value Your Trade At Dothan Chrysler

You can also use the services of a website. They may charge you a fee for their services, but their large network, and the ability to find buyers for any vehicle, are advantages that you can take advantage of.

The cheapest way is to sell your car directly. You can find used car dealers who may be able to give you instant cash to lower your car.

There’s no free lunch – you’ll do a lot of paperwork to get the most money you’ll get when you sell your car. If you are traveling alone, selling a car can be a difficult process. More than just taking the first pictures, listing the car online, and maybe dealing with the wheels and all the paperwork involved once it’s finished. The first step is to engage the services of a real estate agent.

With a dealership, you can expect a lower profit, so if you’re looking at a car that has a dealership, you can trade your used car for a new one instead. .

Sell My Car In Nashua, Nh

Or you can use our services – we can guarantee a free, hassle-free, paperless transaction within 24 hours!

In the end, it all comes down to your comfort level. Are you willing to pay a few extra dollars if it means saving you the hassle of paperwork and time? Or are you the type that doesn’t mind the corruption if it means you get the best price for your car?

This is a choice you have to make yourself. If you’re already looking for a new car, feel free to browse our used car directory!

Download the app now. Designed by drivers for drivers, this all-in-one app helps you get the latest traffic information, access traffic cameras, and helps you manage LTA and traffic information.

Ways You Can Save On Infiniti Cars By Trading In

Did you know we have a Telegraph channel? Mainly designed for drivers and car owners in Singapore, you can get instant information about our latest promotions, articles, tips and hacks, or chat with groups and other drivers.

Automotive News January 4, 2024 January 2024 COE Results Proposition 1: COE started the new year as quiet bulls, with Cat A down $20k to close at $65,010 and Cat B down $25k to $85,010, closer and Cat E decrease by 12 thousand dollars. about $106,388.

Automotive News January 17, 2024 January 2024 COE Results Proposition 2: Automotive COEs come to life when the dragon awakens. Canadian car dealers help Canadians get better car loans with lower rates, lower payments and up to $30,000 in cash back.

The average Canadian now has a total of $73,000 in debt. Non-credit debts, including credit card debt and, yes, car loans, make up a third of that, or $23,800.

Is Now The Time To Buy, Sell, Or Trade In A Car?

In addition, almost one in three vehicles sold in 2018 had a poor balance. The average cost of all these “negative equity” was $7,051.

If you are one of those people, you might be asking, “How can I get rid of bad balance?

Can you trade in car you still owe money on, how to trade your car in you still owe on, still owe money on car trade in, how to trade in your car when you still owe, trade in car you still owe money on, can you trade in a car you still owe on, trade in your car when you still owe, trade in a car you still owe on, trade in car when you still owe, how to trade in a car you still owe on, trade in car still owe, how to trade in car if you still owe