What To Do When Being Audited By Irs – What should you do after you receive a letter from the Department of Revenue that your tax return has been selected for examination? The letter says you have 10 days to meet with the auditor. The letter explains the points to be checked during the examination and includes a request for an information document (“IDR”).

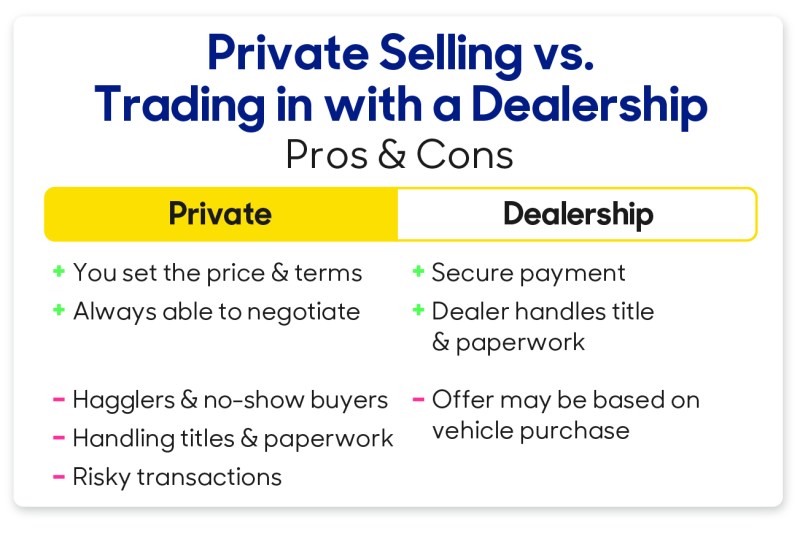

Taxpayers have the right to remain represented in their dealings with the IRS. Taxpayers only benefit from hiring an experienced professional to conduct an audit. But maintaining a dealer is expensive. Professionals charge hundreds of dollars an hour. Does it make sense to hire an expert to represent you? It depends. What are your risks? Let me give you an example: If the IRS is investigating your Schedule C deductions, what tax adjustment would you suggest if these expenses are disallowed? And compare that to the cost of maintaining the national team. It doesn’t make sense to make a $10,000 down payment if the proposed inspection improvements don’t exceed $5,000, but it usually makes financial sense to keep the dealership.

What To Do When Being Audited By Irs

It is important to understand that hiring an expert does not change the facts or your tax return. To demonstrate this, if the Taxpayer does not have the documents supporting the deduction, the designated agent will also not have the necessary documents to support the deduction.

Irs Representation Near You In Venice, Florida

If you have prepared an auditable tax return [Self-declaration] We recommend that you get a copy of your tax return and have it checked by an experienced tax professional. Many tax experts offer free consultations and can spot problems with your return.

1- Notary Public: Licensed by the State Court. [State Attorney] They usually have a bachelor’s degree in law and have passed the bar exam. Attorneys often receive continuing education and professional standards.

2- Certified Accountant: Licensed by the State Accounting Board. CPAs have passed the Uniform CPA Exam. They must have completed a college degree in accounting and meet the experience and good character requirements set forth by the relevant accounting board. In addition, CPAs must maintain ethical standards and complete a certain level of continuing education. to maintain an active CPA license.

3- Enrolled Agents: Licensed by the IRS, Enrolled Agents are screened for compliance and must pass a special three-part registration exam. This is a comprehensive examination that requires agents to demonstrate expertise in federal tax planning. Preparation and representation of tax returns of individuals and legal entities

How To Prepare For An Irs Audit

If you use an expert to prepare your tax return, you can trust that the expert will stand by your return and review it. You also believe that a tax return preparer is the best person to defend this tax return. It wasn’t always like that!

It is important that the taxpayer cooperates with the audit. A good tax return preparer maintains a working document that includes accounts and backups of return items. If your taxpayer does not have the documents or does not want to cooperate, you should ask for a representative from the other side.

Not all CPAs/attorneys have the knowledge or experience to represent taxpayers under investigation. Peter E. Alizio is an accountant who spent many years preparing tax returns before becoming an accountant. Peter has experience representing clients whose tax returns have been audited by the IRS.

The approach Alizio Law, PLLC performs is a tax return audit investigating potential problems. [Eggshell release] We discuss all potential issues and risks with taxpayers. We prepare and send a package of documents to the auditors that will facilitate deductions. If you need help with IRS matters, Alizio Law offers a free initial consultation. If you receive a letter in the mail saying that your tax return has been selected for audit, it’s time to prepare for an audit. The experienced tax advisors at Wiggum Law can help you prepare the appropriate documents. Answer correctly and you will be represented in the review process.

Irs Audit 101 (infographic) |

IRS Audits – Two Scary Words for American Taxpayers? Each year, the IRS selects a small number of individual and business tax returns for additional review. whether it is related to sampling, inaccurate statistical test results or other reasons that indicate that the information reported in the tax return is inaccurate.

If you receive an audit letter from the IRS in the mail, it does not necessarily mean that you have broken the law or done something wrong. If you have made an honest mistake. That doesn’t mean the IRS is going to knock down your door.

However, getting an IRS audit letter means you have to read everything carefully. And pay attention to all instructions and deadlines.

It’s important to review your checklist carefully to make sure it’s legitimate and not just the result of a scammer trying to scare you into becoming their latest victim.

Here Are The Odds Of An Irs Audit

Read on to learn more about what a real IRS audit letter looks like. How to spot scammers trying to take advantage of your tax worries. What does the information in an IRS audit letter mean? and how to respond to inspection alerts and protect yourself.

Audit letters are sent via the United States Postal Service in an IRS registered mail envelope. and identifies the name Tax identification number Form number Employee identification number and contact information clear The language of IRS audit letters is often simple and makes the IRS’s intent clear.

An IRS audit letter begins by informing you that your federal tax return has been selected for audit. The Department of Revenue will explain your tax refund questions and what they need from you. The IRS always makes a written request for specific documents they want to see.

Some checks can be answered by mail. However, many IRS audits are conducted in person through field interviews. If your IRS audit letter indicates that your tax return has been selected for an in-person interview, the letter will be more detailed and include additional information about the details of the upcoming in-person audit, such as:

What Irs Commissioner Werfel Said About Under $400k Audits

Letters notifying you of an upcoming personal interview will include a link to Form 4564, also known as a request for information documents. These are the details of the documents you need to prepare.

Audit letters vary by taxpayer. They also include detailed information about your specific tax situation and descriptive information that the IRS expects. But a sample list from the IRS might look like this:

Most IRS audit letters begin by stating that your return has been selected for an “audit.” It should also include specific points for consideration, such as specific schedules.

If you receive a check in the mail, the IRS tax audit letter indicates that the audit is limited to a few items. This is generally a simple question and may include:

Irs Audits Few Millionaires But Targeted Many Low Income Families In Fy 2022

There are limits to what the IRS can claim. Some information may be sensitive or proprietary to the taxpayer. It is best to have your IDR reviewed by an experienced tax professional.

You will be notified of the audit by registered mail notifying you that your tax return has been selected for audit. The IRS will never attempt to contact you via email, phone, or text regarding an audit, tax debt, or tax refund request. never requires you to pay immediately or through a specific payment processor or merchant.

Don’t miss the next letter. If you ignore the verification letter, you waive your defense and the IRS will properly evaluate your original return and determine the amount of additional taxes, as well as any penalties and interest.

Audit letters from the IRS always include supporting documents, such as receipts and other documents, to verify the information on your tax return. If you are verified, it is your responsibility to collect the necessary supporting documents. Make a copy and submit a copy—not the original—with a written explanation of your service by the deadline specified in the review letter.

Irs Audit: What Increases Odds Of One And What To Do If I’m Audited?

Responding to an audit letter is the first step in protecting yourself from an audit. At best, the documents you provide can tell the IRS that the initial audit decision was incorrect. And you won’t have to pay any additional taxes, penalties or interest. In other cases, your documents can reduce the amount of taxes, penalties, or interest you owe if errors are discovered.

There is no reason not to respond to an IRS audit letter and protect yourself! Although an audit letter is easier than you might think, there are nuances and details about how to respond to an audit that the average taxpayer can do.

What to do when audited by irs, what is being audited by the irs, what to do if you get audited by irs, irs being audited, what to do if audited by irs, what is being audited by irs, chances of being audited by the irs, i am being audited by the irs, being audited by irs, what to do if you are audited by the irs, when being audited by irs, what to do if i get audited by the irs