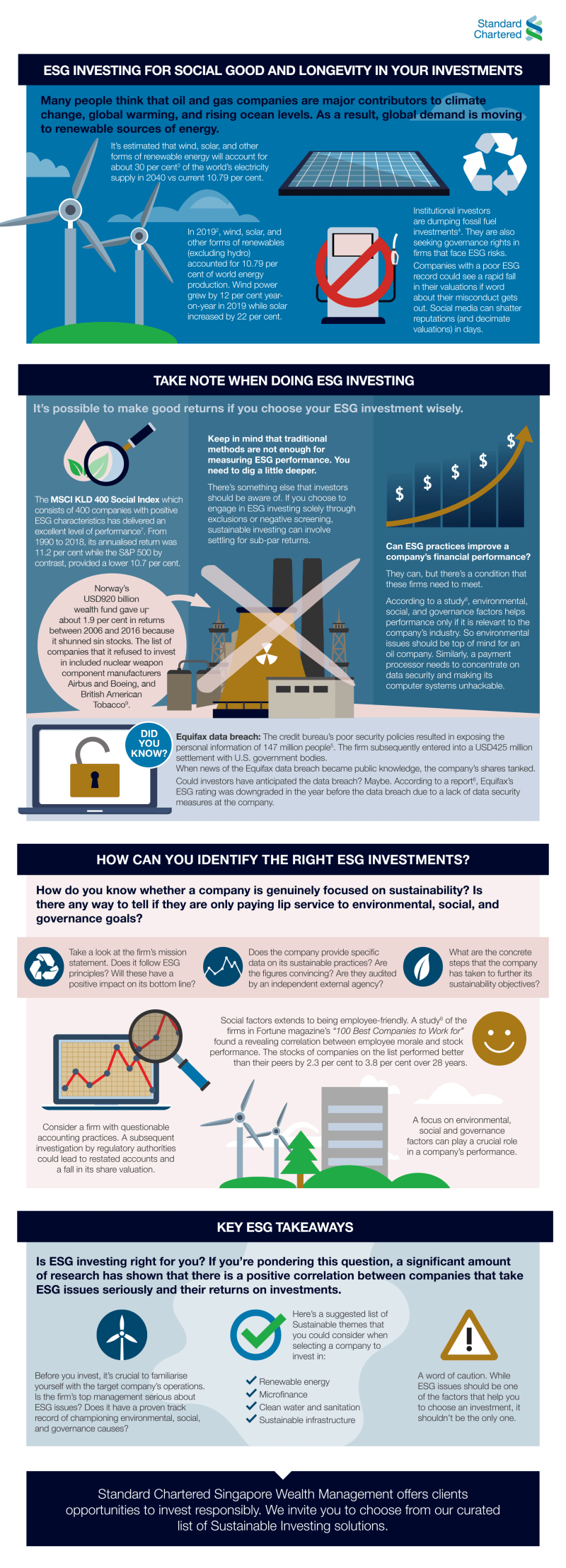

What To Do If Your Audited By The Irs – A limited company is the most suitable form of business structure in Singapore. It offers benefits such as limited loans, tax savings and easy compliance obligations. Singapore’s Limited Companies Act recently introduced the term “small company”, which exempts limited companies that meet certain criteria from the annual audit requirement. This helps the company reduce its compliance costs as well as its overall regulatory burden. In this article, we explain the audit requirements for limited companies in Singapore.

The Companies (Amendment) Act 2014 improved Singapore’s deregulation and introduced the concept of “small companies”. The concept of small business applies to existing and newly registered companies with limited liability in Singapore. This article will explain the concept of an audit exemption for small businesses and the qualifying conditions based on which a business can be exempt from the requirement to conduct an annual audit of its accounts.

What To Do If Your Audited By The Irs

The Singapore Companies Act states that all companies must have their financial statements and accounts audited annually by an auditor, unless the company meets Singapore’s financial exemption requirements.

What To Do If You’re Late Filing Taxes

The Companies Act was amended in 2014 to update the exemption criteria for companies and introduced the term “small company”. A company that qualifies as a sole proprietor does not need to appoint an auditor and have its accounts audited. The amended law came into effect on 1 July 2015. A company is considered a sole proprietorship if it meets two of the following three conditions:

In addition to private companies, group companies (companies with limited assets and subsidiaries) can also take advantage of the Singapore audit exemption if they qualify as a small group according to the specified criteria below.

A group company is defined as a holding company and its joint subsidiaries forming a group due to a single source of control.

A group company is exempt from the annual audit of its assets and all subsidiaries separately:

Why You Need A Data Audit And How To Conduct It

To qualify as a “small group”, a group (which includes all companies) must meet two of the following three conditions during the last two financial years:

In other words, this means that to qualify for the exemption criteria for audit, both the subsidiary and the holding company as a group must meet the eligibility criteria of the subsidiary company. .

I always heard that starting a business in Singapore was easy, but I never expected it to be this easy. The team made everything happen without any surprises; From the initial quote to document verification and actual inclusion, they handled everything with finesse. The icing on the cake was the quick and professional help in opening a company bank account.

Once a company is granted “small business” status, it continues to enjoy zero income unless denied. A company’s disqualification occurs if the company:

How To Write An Audit Report: 14 Steps (with Pictures)

Is your company taking advantage of all the Singapore government tax credits, grants and incentives it is entitled to? Find out with matchME™

Prior to the 2014 Amendment Act, an exempted private company with an annual turnover of less than or equal to S$5 million was exempt from having its accounts audited. An exempt private company is a company with less than 20 shares and no shareholders.

According to the 2014 amendment, the standards have been changed. Currently, any company classified as a “small business” will be eligible for exemption.

If my company is exempt from audit, do I still need to prepare and present my annual accounts?

Internal Audit: What It Is, Different Types, And The 5 Cs

Yes, you still have to prepare and file your annual unaudited accounts. Among others, your company’s annual accounts are the main basis for reading and preparing your company’s disclosure. The only difference is that if your company is exempt from auditing, you will not have to appoint an auditing company and have your accounts audited.

My company is a small company, so it is not exempt from the audit requirements. Can you take care of my company’s bookkeeping and tax registration?

We offer comprehensive bookkeeping services in Singapore, regardless of whether your company is exempt from audit or not. When an audit is required, we will contact a selected audit firm to conduct the audit in an efficient and stress-free manner for you. Contact us today if you need help or registering a company in Singapore.

Transitional provisions A company established before the changes in the law can also benefit from transparency if it meets two of the three requirements for a small company. In particular, a business incorporated before 1 July 2015 may qualify as a small business if: it is a private business and meets the qualifying criteria in the first or second financial year following the commencement of business operations younger (ie, July 1, 2015). defines temporary settings:

Tax Mistakes That Could Get You Audited By The Irs

The company is a Small Business because it meets the criteria in the first year after generating the idea

The company does not meet the eligibility criteria in FY15 but meets in FY16

The company is a small business because it meets the standards in the second year after developing the idea

It does not qualify as a small business because the business does not meet the criteria in the first and second year after generating the idea.

Auditor Resume Examples & Guide For 2024

The change in audit release phases eases compliance requirements for small businesses. Some companies, including foreign companies that meet the definition of “small business,” may not qualify for an audit exemption. Singapore is an excellent choice to set up your business base. The country promotes some of the best policies in the world, enabling your business to grow and prosper. It is a world-class economy full of opportunities for people with innovative ideas and the desire to create a successful business.

I recently conducted a survey of startup founders from five countries. To gauge the world’s perception of Singapore’s attractiveness as a start-up location, the survey evaluated Singapore based on the values that entrepreneurs value. Read our report for more details.

Avoid Penalties: Time to Order Singapore Businesses 2024 January 10, 2024 Singapore Regulatory Enforcement: December 2023 December 28, 2023

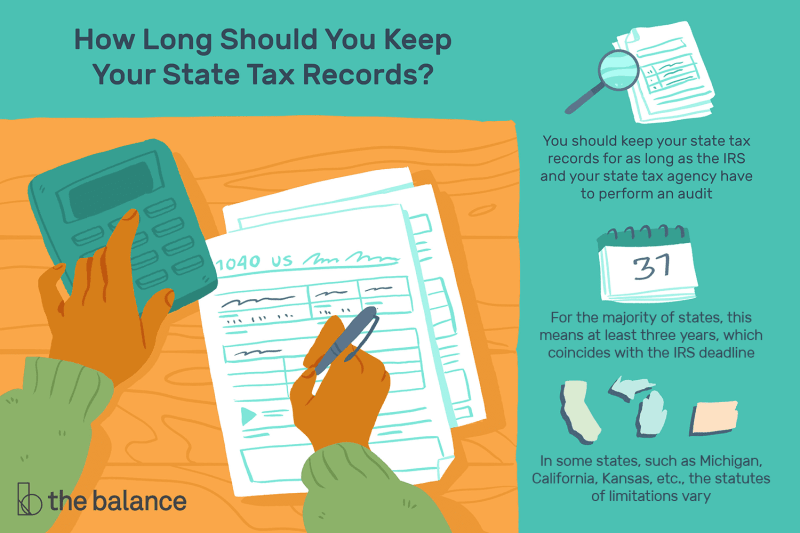

Our team of experts can provide all business services on a world-class platform at the lowest prices – the best in the world. Whether you own a large or small business or are an individual taxpayer, no one is immune to receiving an audit notice from the IRS. In the 2019 tax year, the IRS audited 771,095 tax returns, which resulted in an additional tax of $17.3 billion.

Things To Be Aware Of If You’re Audited

Although many believe that wealthy people are more likely to be scrutinized, this is not always true. In fact, 256,708 assessments were made in 2019 on individual tax returns where the Income Tax Credit was claimed – for the benefit of people with low incomes.

If your tax return is audited by the IRS, the IRS is more likely to find errors on your return, which can result in significant IRS audit penalties and interest. In extreme cases, fines can cost tens of thousands of dollars – or even result in prison time.

IRS audit penalties are criminal fees or penalties imposed on taxpayers who make mistakes on their tax returns or fail to pay taxes due to non-payment of taxes.

Many IRS audit penalties are related to tax filing errors. Keep in mind that the IRS can charge more than 150 different penalties. As a result, when the IRS audits your tax return, you will likely receive a larger tax bill.

Auditing I Ch 6

In some cases, the IRS will randomly select taxpayers for an audit based on a statistical form to verify property and financial information. With a random audit, the IRS will compare your tax return to previous years to find any errors before issuing an audit.

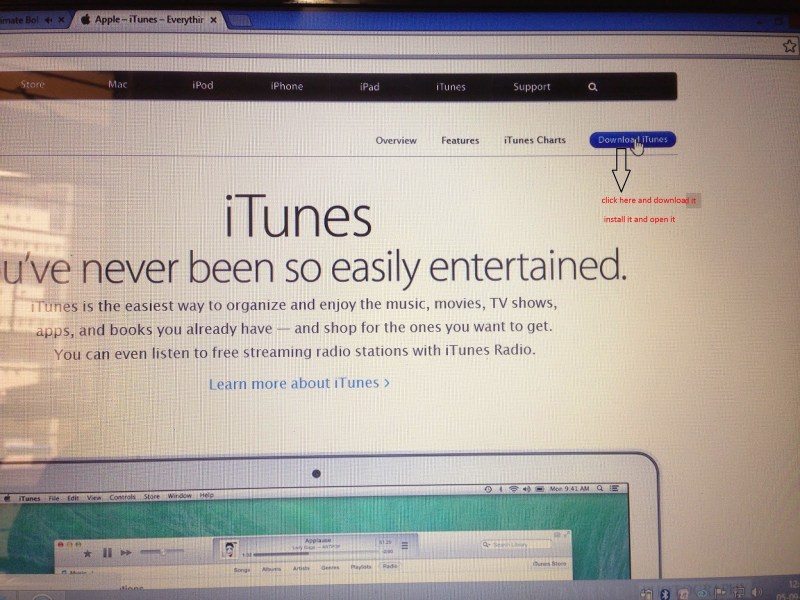

The IRS will notify you if your business qualifies for an audit by mail or in person. All initial communications will be made by mail, and the letter you receive will contain all necessary information such as contact information and filing instructions.

If the audit is conducted in person, it may be at the IRS office, your company or your accountant’s office. For a letter audit, the letter will ask you to provide additional information about certain items on your tax return. If your records are too big to

Email, your company can use the instructions and information contained in the letter to request an individual review.

Irs Audits: Underwithholding And Irs Audits: Minimizing Your Risk

There is no specific time frame for the review process, and your review will begin as soon as your company receives the first notice in the mail.

The timeline depends a lot on how your records are organized, their accuracy, the type of audit being conducted, your availability and that of the auditor, and how you respond to the audit.

For example, just because you disagree with your test results

What to do if audited by irs, what happens if your audited by the irs, what to do if you get audited by the irs, what to do when being audited by irs, audited by the irs, if audited by the irs, what happens if you get audited by the irs, if i get audited by the irs what happens, what to do when audited by irs, what happens if your audited by irs, what to do if you are audited by the irs, what to do if i get audited by the irs