What To Do If You Owe The Irs Back Taxes – You’re sure you’re behind on taxes, but you don’t know what you owe While any back taxes should be a cause for concern, the severity of the problem can vary dramatically depending on how much debt you owe. Fortunately, it doesn’t have to be a mystery; The IRS offers many options for determining what you owe and how to pay it.

The IRS allows taxpayers to register online and use the system. This handy tool shows your payment history for the past 24 months, as well as your current debt for each tax year. The balance is usually updated every 24 hours. You can make payments or set up a payment plan with IRS online tools.

What To Do If You Owe The Irs Back Taxes

As an individual taxpayer, you can request an IRS transcript if you file a Form 1040, 1040A, or 1040EZ. This statement is intended to cover only one tax year. They may not include recent interest or penalties on your account.

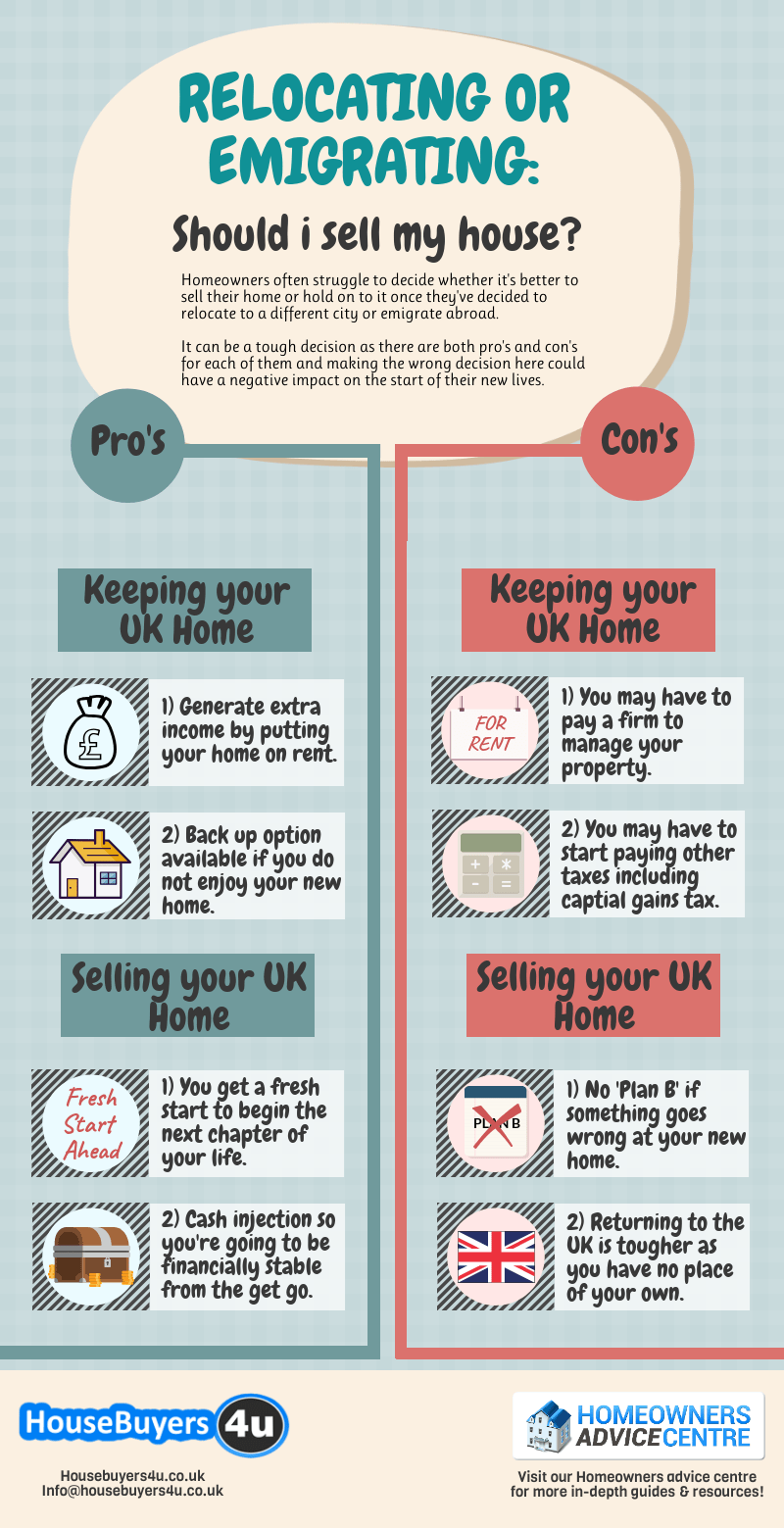

Learn About Irs Debt Forgiveness Programs [infographic]

If you haven’t filed Form 1040, your best bet for getting a transcript is Form 4506-T: Request for Tax Return Transcript. This document is particularly popular with business owners hoping to better understand their current tax obligations

If you don’t have Internet access, you can check your balance by calling the IRS directly at 1-800-829-1040. Remember that the IRS receives a large number of calls, so you may have to wait a while before speaking to a representative. Whenever possible, you should verify your account online.

Still not sure what you owe the tax authorities or how to resolve your tax situation? You don’t have to do it alone; Contact a registered agent at Highland Tax Resolution for assistance. Call us now at 720-398-6088 to arrange your loan.

COVID19: To minimize health risks to our employees and clients and maintain operational and business continuity, Highland Tax Group, Inc. Please be careful. Click here for more information. Nobody wants to pay money to the Internal Revenue Service. Ideally, you pay the right amount in income tax and are on your way without thinking about it. Or you may get a surprising but welcome tax refund after filing. But this is not always the case.

Wage Garnishment Or Tax Levy On Taxes Owed, Irs Tax Lien

Sometimes an unexpected amount of back tax can accrue. You may know you have a federal tax balance, but still wonder, “How much do I owe the IRS?” A question may appear. Don’t wait to hear about this scary IRS warning. We’ll help you find out using one of four simple methods.

In December 2016, the tax authorities released an online tool for taxpayers. This tool serves as a portal to view your account through the IRS. You can see the refund amount and balance for each tax year you owe. You can view up to 5 years of payment history, including estimated tax payments. Your account balance is updated every 24 hours and usually no more than once overnight. It’s completely free; Simply register to access your account.

The IRS will issue a credit report with this information to verify who you are. But it’s a soft inquiry, so it doesn’t affect your credit score and lenders don’t see it.

If you decide to register and use the online portal, you can also use it to pay taxes online. Payments made online usually appear in your account within one to four days. If you pay by check or money order, it can take up to three weeks.

What Is A Cp503 Irs Notice?

Not a big fan of using online tools to manage your federal taxes? Don’t have all the information you need to access online services? Don’t worry, you have other options.

Your first option is to call the IRS. You may need a waiting period, but once you’re connected, the IRS representative will be able to tell you how much you owe.

If you are an individual taxpayer looking for your balance, you can call the IRS at 1-800-829-1040 between 7:00 a.m. and 7:00 p.m. local time.

Another option outside the online portal is to contact the tax authorities by sending the form by snail mail.

Tax Relief: How To Get Rid Of Your Back Taxes

Although this is a convenient option for any taxpayer, remember that it can take a lot of time, depending on the nature of the item. And if you owe, penalties and interest will continue to accrue while you wait for a response.

You should ensure that the tax authorities have your current address. If they do not, they will send the reply (and any other messages) to the last registered address, which may not be your current address.

Individual taxpayers filing a Form 1040 can file by mail or by calling 800-908-9946. A printout is available for the current and three previous tax years.

If you are submitting a different form or need a transcript for a later tax year, you must submit Form 4506-T, Request for Tax Return Transcript. After the IRS receives and processes the Form 4506-T, they will send you a free printout.

What Happens If You Owe The Irs More Than $10,000?

How much do I owe to the tax authorities? The simplest and tacit answer to the question may be. No need for a web portal, phone call or postal form. Instead, you can have someone do the legwork for you.

Tax debt professionals (such as CPAs, tax attorneys, and EAs) can work with the IRS on your behalf to determine how much you owe. All you have to do is give them some personal details and pay back while they work with the IRS for you. Once they know how much you owe, they can offer tailored solutions to help you pay off debt and stay out of trouble.

Once you’ve figured out how much you owe the IRS, the next step is figuring out what to do about it.

If you have money in your bank account to cover your balance, it’s as easy as paying your bills.

Notification That Your Tax Return Is Being Examined Or Audited Tas

The tax authorities are not blind to the problem. They offer solutions to such situations with installment agreements and offers of compromise. Not all solutions are suitable for everyone, so it is important to find an affordable option that gives you a discount.

If you go the route of a tax debt relief specialist, they can tell you about the options available to you and what they can offer for your unique situation. Whether it’s a payment plan or an appeal, our tax experts will even take the trouble to set up a tax solution that works for you.

If you need help with your tax refund, get help before it gets too complicated. Unless you take steps to address your tax liability, liens and garnishments are on the horizon. don’t wait Take action today!

We use cookies to give you a good user experience. We share this information with third parties for advertising and analytics. By using this page, you agree to our use of cookies. confidential Terms of use

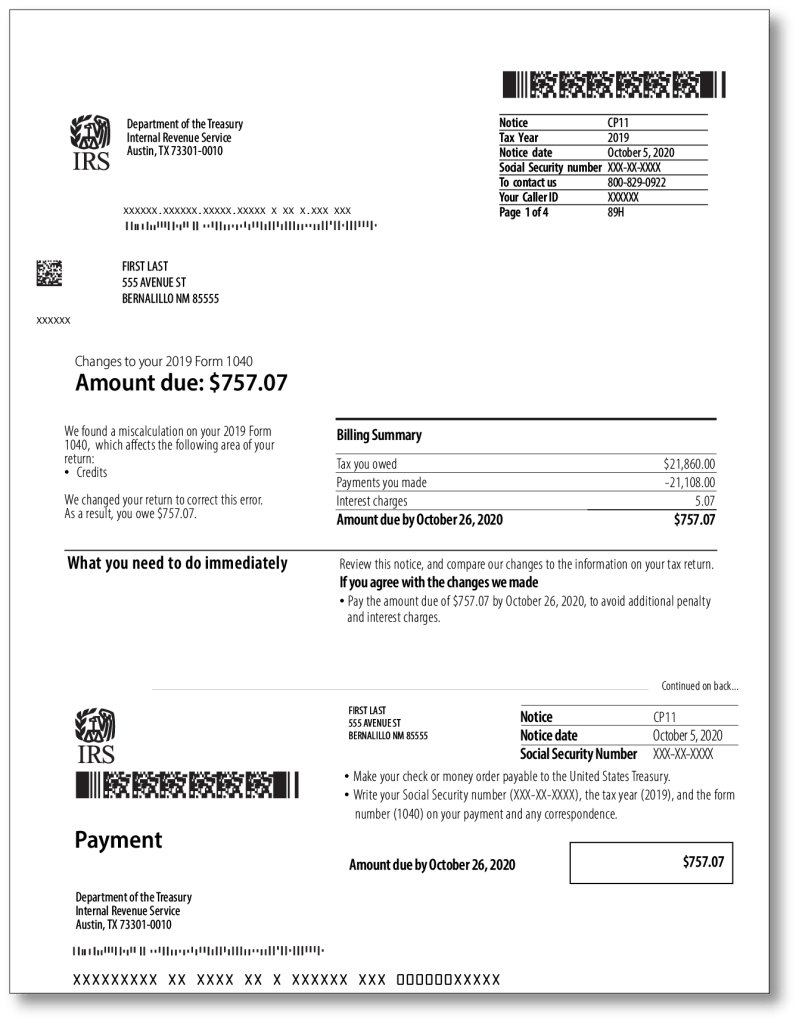

Shindelrockwhat To Do When An Irs Notice Shows Up In Your Mailbox

We know tax debt is scary, but help is just a click away! Answer some questions to help you better understand your situation. It only takes a few minutes and you’ll find: If you’re a taxpayer who owes back taxes, you’ve probably asked the IRS or even the state how much you owe in back taxes. Some people find out how much they owe when they receive a notice of unpaid debt from the tax authorities. But of course we don’t want to wait until that happens.

There are several ways to find out how much you owe the IRS. You can find out via email, phone call or online check. We’ll explain these options later and how to do each.

The IRS offers an online tool to help you figure out how much tax you owe. The tool shows the balance for each tax year, including principal and any penalties or interest. It also shows the payments you have made in the last 18 months and the amount of payments.

One of the reasons the IRS online tool is so convenient is the up-to-date information it provides. This is the most convenient way to access information about tax payments. You must have an account on the IRS website to use this service. Make sure you have the following information ready when you register:

Owe Taxes This Year? Here’s How To Lower Your Balance Due In The Future.

The beauty of the online tool is that it updates interest rates and fines every 24 hours, making the data reliable. Transcripts can be viewed or printed here. If you would like to request a printout to be sent to you, it will take five to ten days. Payments usually take one to three weeks to post.

Where to find IRS online tools If you don’t know which year to order

If you owe back taxes, what if you owe the irs, owe the irs back taxes, owe taxes to irs, what to do if you owe taxes, what to do if i owe taxes, if you owe taxes, owe irs back taxes, if you owe the irs, what to do if i owe back taxes, if you owe the irs back taxes, what to do if you owe the irs