What To Do If Audited By Irs – The IRS may review a person’s or organization’s financial information and statements for inaccuracies or inconsistencies. This process is called auditing.

For certain returns that deviate from the norm, random selection is used using a computerized system. Your return may be flagged if it includes transactions with individuals or partners selected for audit.

What To Do If Audited By Irs

The IRS typically reviews returns filed within the past three years. However, if significant errors are found, the audit request may take another year.

Written Explanation Sample Letter To Irs

The duration of the audit depends on the nature of the case, how much you cooperated in documents and meetings, and whether you agree with the findings.

If the IRS just needs an explanation, you can get out of the audit unscathed. However, you may also be charged taxes or penalties. You may need to take legal action to protect your rights and avoid significant losses. Bottom line: If you’re going to do an audit, hire professionals who know how the IRS works.

Attach documentation to this schedule.

We use cookies to provide you with the best experience on our website. If you continue to use this website, we assume that you are satisfied with it. Well, if you’ve received a letter in the mail from the IRS saying that your tax return has been selected for audit, it’s time to prepare for an audit.

The Heat Is On For Large Partnership Audits

IRS Audit – Are there two more words that scare American taxpayers? Each year, the IRS selects a small portion of individual and business tax returns for further review, either because of random checks, unusual statistical test results, or other reasons that indicate the information on the tax returns may be incorrect. To the right.

If you received an IRS audit letter in the mail, it doesn’t necessarily mean you broke the law or did anything wrong, other than an honest mistake. That doesn’t mean the IRS is going to kick down your door.

However, receiving an IRS audit letter means that you must read everything carefully and follow all instructions and deadlines carefully.

It’s also important to double-check your audit letter to make sure it’s legitimate and not scammers trying to scare you into becoming their latest victim.

How To Request A Postponement Of A Tax Audit

For more information on what a legitimate IRS audit letter looks like, how to spot fraudsters trying to take advantage of tax concerns, what information is included in an IRS audit letter, and how to respond to and defend against an audit notice, see Learn more. .

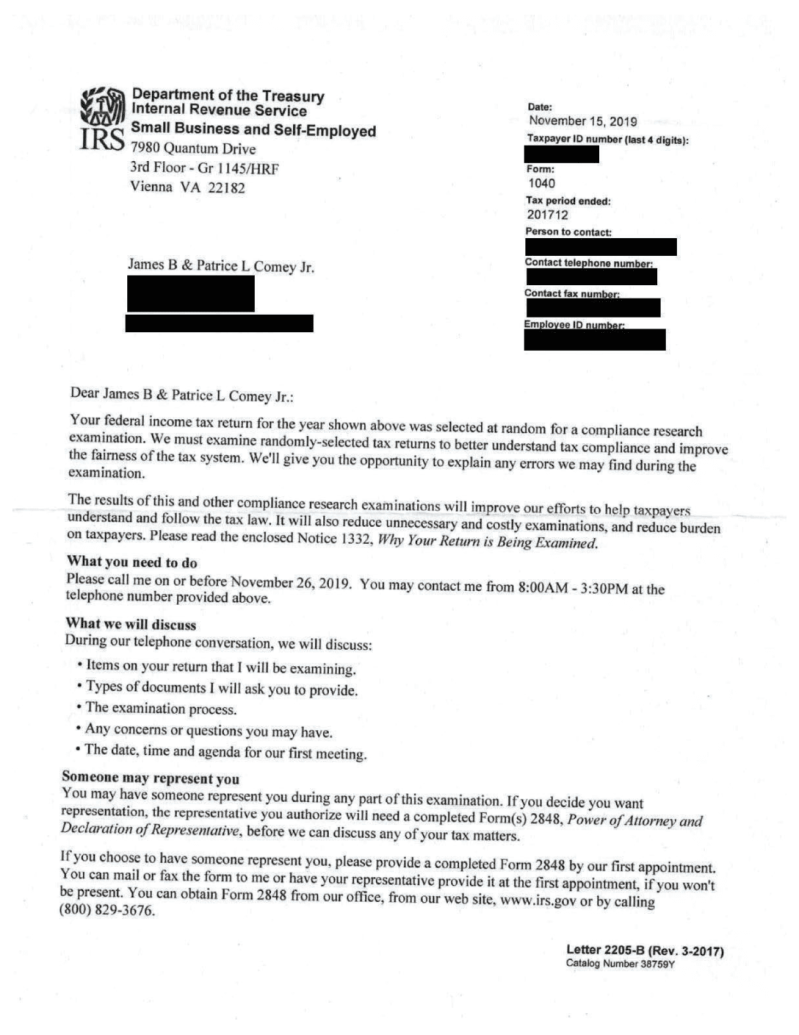

The audit letter is delivered in an envelope with IRS certified mail via US Mail and clearly shows your name, taxpayer ID, form number, employee ID number and contact information. The language of an IRS audit letter is usually very simple and makes the IRS’s objectives clear.

An IRS audit letter begins by notifying you that your federal income tax return for a particular year has been selected for examination. The IRS explains in detail its tax return requests and what it needs from you. The IRS will always request in writing the specific documents they want to see.

Some audits can be answered by mail, but many IRS audits are also conducted in person with an on-site interview. If your IRS audit letter states that your tax return has been selected for an in-person interview, the letter will be more detailed and include more information about the specifics of the upcoming in-person audit, such as:

Tax Audit Lawyer In Chicago

The letter notifying you of your upcoming face-to-face interview will also include a Form 4564, also known as a Request for Information document, which details the documents you must provide.

Audit letters vary from taxpayer to taxpayer, provide specific information about their unique tax situation, and clarify what information the IRS is looking for. Although they come in many shapes and sizes, a sample IRS audit letter might look like this:

Most IRS audit letters begin with a statement that your return has been selected for “examination.” This letter specifies the form to be audited as well as the tax year to be audited. It should also state what is set for learning, such as a specific time schedule.

If you are being audited by mail, the IRS tax audit letter indicates that only certain items are being audited. These are usually simpler questions and can include:

What To Do If You Are Audited By The Irs: Learn The Types Of Audit Letters Here And Follow These 5 Steps

The IRS may require restrictions. Some information may be confidential or privileged for taxpayers. It is always best to have an IDR reviewed by an experienced tax attorney.

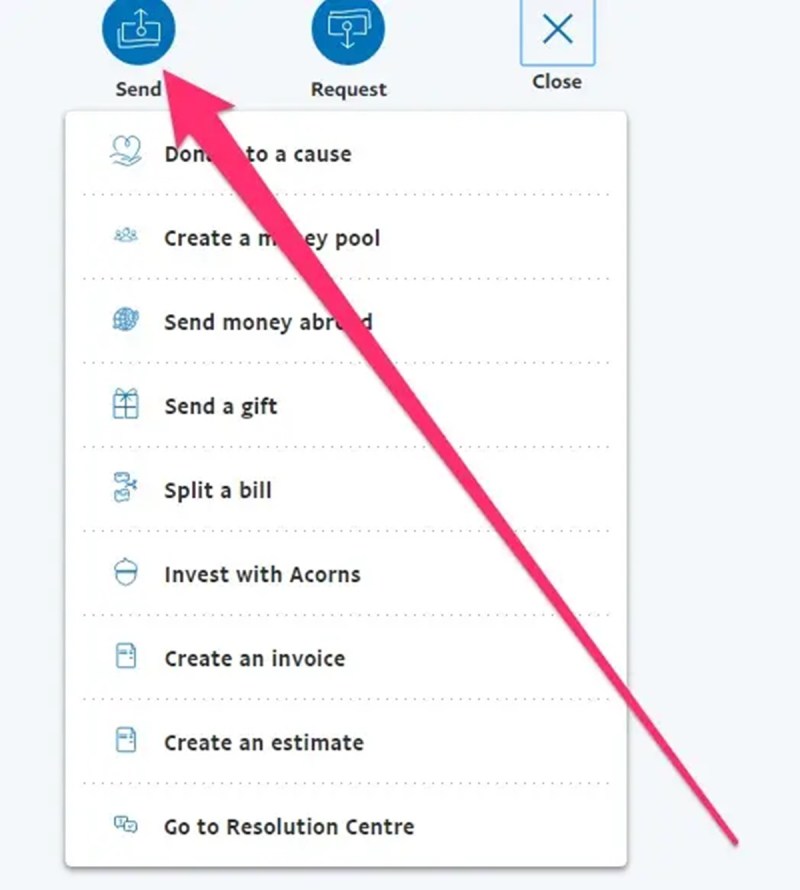

Audit will notify you by certified mail that your tax return has been selected for review. The IRS will never attempt to contact you via email about an audit, tax liability, or tax refund. by mail, phone call or SMS and never ask to pay immediately or pay only with a specific payment processor or merchant.

Don’t ignore the audit letter. If you ignore your audit letter, you essentially waive your defense, and the IRS will assume it was correct in the original decision and assess the additional tax you owe, plus any penalties and interest.

An IRS audit letter always asks for supporting documents such as receipts and other documents that support your tax return. If you are being audited, you are responsible for collecting the necessary documents, making copies and sending copies, but not the originals, as well as a written explanation of your position by the deadline set by the audit.

State Tax Audit [what Happens & What To Do]

Responding to an audit letter is the first step in defending your audit. At best, your supporting documents can tell the IRS that the original audit decision was wrong and that you don’t owe any additional taxes, penalties or interest. In other cases, your documents may reduce the amount of back taxes, penalties, or interest you may pay if an error is found.

There is never a reason not to respond to an IRS audit letter and defend yourself! Although audit letters are simpler than you might think, there are nuances and features in an audit response that the average taxpayer may miss, so it is always important to seek the help of a tax audit professional.

If you do not respond to an IRS audit letter, the IRS will issue a report based on the available information as well as a tax bill. It is best to respond within any given deadline, even if you need to request additional time to prepare the documents.

Warnings from the IRS should always be taken seriously and responded to immediately, because as soon as you receive a letter, the clock starts ticking on how to set up audit protection. But for this reason, scammers like to use the same seriousness and urgency.

Irs Audit 101 (infographic) |

Taxes are serious business, and communications with the IRS or other government revenue agencies should be taken seriously and with appropriate urgency. Unfortunately, this means that many unscrupulous actors use the threat of an IRS audit and other tax problems to defraud millions of Americans.

Don’t fall for IRS scams. Bad actors use the fact that ordinary people don’t know how the IRS works to scare them. Official tax notices, such as audit letters, are sent only by IRS certified mail. In addition, the audit letter always includes the following information:

Most IRS audit scams ask for the above information. The real IRS already has this information – no need to ask them to provide it! Although the audit letter asks for information from them, the information they request is always clearly related to the reason for your audit, which you can read and learn more about.

The IRS never uses an aggressive tone in its audit communications. As you can see in the sample IRS letter above, the language will always be clear, complete and neutral. Only scammers try to scare you with loading language.

Notification That Your Tax Return Is Being Examined Or Audited Tas

The IRS offers a comprehensive guide on how to spot tax fraud on its website. These resources will help you spot scammers’ scare tactics to take advantage of innocent taxpayers.

Completing an IRS audit, and especially responding appropriately to your audit letter so that you can best defend yourself against an audit, is complex and may require knowledge of tax laws and experience negotiating with the IRS. The average American taxpayer doesn’t have that experience, so they may even be dealing with an IRS audit

What to do when audited by irs, what happens if you get audited by the irs, if i get audited by the irs what happens, what to do if i get audited by the irs, what if you get audited by the irs, what to do if you get audited by irs, what happens if you are audited by the irs, what to do if you get audited, what to do if your audited by the irs, what to do when being audited by irs, what to do if you are audited by the irs, what to do if audited by the irs