What Happens If Your Taxes Get Audited – Did you know that 1 in 16 people who file their taxes may be audited by the IRS?

For many people, the news of an IRS audit is a death sentence. Are you one of those unfortunate taxpayers who will be under scrutiny this year?

What Happens If Your Taxes Get Audited

Simply put, the purpose of an IRS audit is to determine whether your income and other tax information is correct. If not, you may have to wait for your tax return to be corrected and you may have to pay penalties.

Irs Audit Letter 566 S

An audit will consist of a thorough examination of your financial accounts, books, records, documents, vouchers, etc. You may need to disclose non-financial information if it helps to create a clearer picture of your situation.

However, not all audits are created equal. In fact, there are several different types of inspections, such as letter inspections, office inspections, and more, depending on your circumstances.

A non-surface audit is perhaps the simplest audit. If you have received a message that an audit letter is waiting for you, then you should not be particularly worried.

In most cases, this type of audit can be resolved by sending the IRS a document about certain deductions or credits you’ve claimed on your tax return.

Reasons That Trigger An Ato Tax Audit

This type of evidence usually comes in the form of copies of pay stubs, checks, or other documents that verify the accuracy of the tax forms you filled out.

Of course, if you don’t have supporting documents, it may not be so easy to solve the problems and it can lead to tax returns, penalties and even additional investigations.

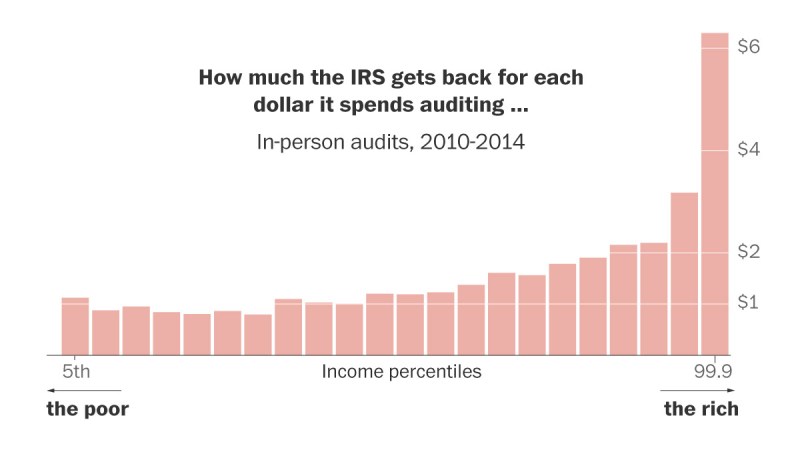

The IRS used to conduct most audits in person, which involved extensive material, but budget cuts over the years have forced the agency to switch to more specific audits conducted by mail.

However, just because personal audits don’t happen as often as they used to, doesn’t mean you’ll never get one.

Gift Tax Audits: What To Expect During A Gift Tax Audit And How To Prepare

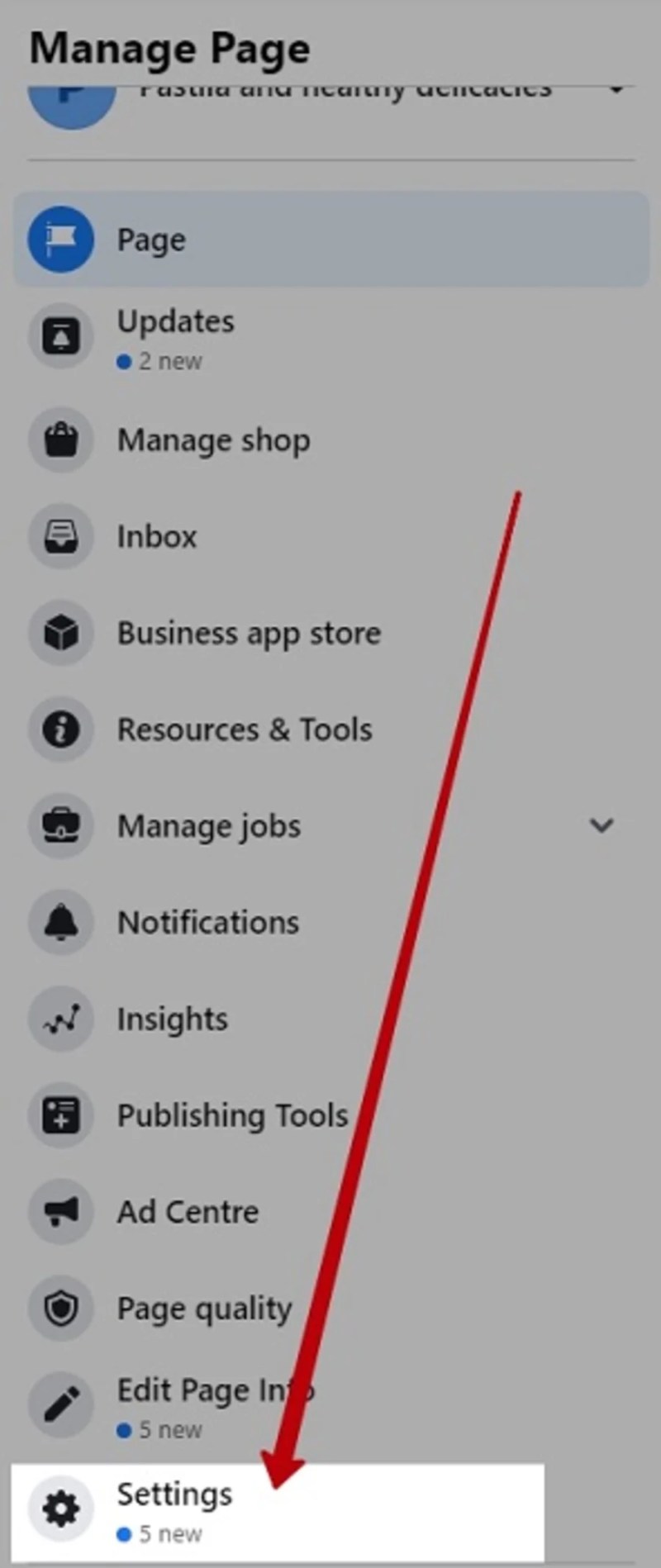

When you’re in the middle of a personal audit, there are certain steps you can expect. Of course, you will receive a notification by mail that you have passed the test. You will also receive a Form 4564, otherwise known as an IDR (Information Document Request).

After that, you will have to go through the first interview in the office in the tax office building. Depending on the complexity of your situation, this office audit interview may take 2 hours or a full day. From this conversation, the auditor can determine what he is dealing with.

The next step involves asking the IRS a few basic questions about your situation. It can also lead to more IDRs and office interviews. After all these processes are completed, you may have to correct your tax return and possibly penalties.

Like an office audit, an on-site audit is another type of face-to-face audit that can be more invasive because it is conducted at your home or business.

Everything You Wanted To Know About Audit Requirement In Singapore

If you’re doing a home audit, you don’t have to let the IRS into your home unless they’re legally allowed to by a court order. For example, if you claim a tax deduction on your tax return, an auditor may need to enter your home. Of course, if you refuse to allow the required IRS personnel into your home, your home office tax deduction will be denied.

Of course, you will be notified in advance so that you can prepare the documents. As soon as the auditor knocks on your door, you should be ready to show him copies of your documents.

It is important to remember that a tax professional or legal advisor should be involved in the field audit.

After the audit is complete, the auditor may find it necessary to correct one or more of the previous tax returns. You may also have to pay various fees.

Income Tax Audit: Who Has To Get Their Accounts Audited Before Filing Itr

However, you still have the option to appeal. If you decide to appeal, an IRS appeals representative will hear your case at a hearing. The process is usually not quick and you may have to wait several months after the audit is completed.

In most cases, an appeals officer will contact you by phone. However, if you would like to meet an appeals officer in person, you will need to ask for one.

The appeal may not end in your favor. In this case, you can go further and file a complaint with the US Tax Court.

It’s important to note that an audit doesn’t end with you going to jail. Tax fraud usually starts at $70,000. If any deviation is due to an honest mistake, criminal liability should not be expected.

How To Avoid A Tax Audit

The next time someone asks you, “What does inspection mean?” you can tell them everything.

If you have a tax problem, Fidelity Tax Relief can help. An audit doesn’t have to be the end of the world. We can provide you with guaranteed results throughout the entire process.

Our team of experts can guide you through a range of tax negotiations, offers in compromise, payroll and more.

If you have any questions about our quality services, please contact us. We are always happy to help.

Can The Irs Audit You More Than Once?

If you owe federal taxes, one of the most common collection actions is for the IRS to file a garnishment, usually against your wages. A salary garnishment can leave a person with very little money to live on.

Have you received a letter from the tax authority? Find out if you qualify for a free hearing and if you qualify for tax credits.

The IRS has issued new rules for those struggling with tax debt. In 2022, you have the opportunity to reduce your tax liability

If you owe taxes to the IRS, the agency has the right to collect them from you with penalties, fees, or any accrued interest. There are a few steps you can take to reduce your chances of going through a tax audit.

Tips For Avoiding An Irs Audit For Optometrists

This article is informative. This content is the opinion of the author, not legal advice, and has not been evaluated for accuracy or changes in the law.

There’s no guaranteed way to avoid an audit, but there are precautions you can take to ensure your business doesn’t end up in the news.

Until recently, small business tax returns were less likely to be audited. Bloomberg, citing IRS data, shows that only 140 of the 4 million small business returns filed in 2018 were audited. The numbers were slightly higher for S corporations, but still less than 0.5%.

But in late 2020, the IRS announced it would add auditors to allow the agency to increase the number of audits by 50 percent.

Faqs] Introduction & Applicability Of Tax Audit

Reporting an annual net loss, especially a small loss, can put you on the IRS’s radar. The IRS may view losses as a sign of unreported income, which will make them take a closer look at your income.

“When the IRS sees net losses in a business, it actually requires an audit,” says Steven John Kaplan, CEO of True Contrarian Investments, LLC. He adds, “You’re required to report all of your income, but you don’t have to report all of your expenses, so if it’s a small net profit for the year, skip some expenses.”

While you should always report 100 percent of your income, you can avoid overstating your losses by reducing the number of deductions you claim. For example, writing off rent, car, mileage, and technology expenses can save you money, but if the numbers are higher than you earned, it can also trigger an IRS audit.

Listing your business expenses provides transparency and prevents the IRS from questioning the information you provide. Inaccuracies in business expenses can lead the IRS to think there’s a problem or that you’re intentionally misreporting your income.

Common Reasons Your Investments May Trigger An Irs Audit

“If you have a choice between listing some expenses in a general category or listing them as a separate ‘other expense,’ you’ll always prefer to itemize,” advises Kaplan. “The IRS may think you’re trying to cover expenses that don’t exist if you include advertising or travel instead of listing each individual advertising or travel expense.”

Instead of assuming that a potential auditor will understand why your travel expenses suddenly dropped 100% over the past year or why your online advertising costs increased 300%, fill out additional documents to explain in detail what happened and attach them to the declaration. if the file.

So, when your return is marked and in front of the person, you have already answered many questions that they will have about the sudden change.

Some people believe that filing returns early in the tax season increases the chances of an audit because there are fewer returns to choose from. This myth causes people to delay their application and even ask for an extension. But

Irs Audit Triggers

What happens if you get audited, what happens if i owe taxes, what happens if you can t pay your taxes, what happens if you get tax audited, what happens if your audited, what happens if you file your taxes late, what happens when your taxes get audited, what happens if you get audited on your taxes, if i get audited what happens, what happens if you owe federal taxes, what happens if you owe taxes, what happens if you file taxes late