What Happens If You Owe Taxes And Can T Pay – Paying taxes can be stressful, especially if you can’t pay them on time. Most of the time, you won’t go to jail for tax evasion, but instead you’ll be charged interest or penalties.

If you can’t pay by tax day, you’ll need to file or file for an extension of at least six months. Next, consider whether you may owe the IRS.

What Happens If You Owe Taxes And Can T Pay

In this article, we’ll explain the consequences of not filing or paying on time and what you can do if you owe the IRS.

I Didn’t Pay Estimated Taxes To The State Or Irs…now What?

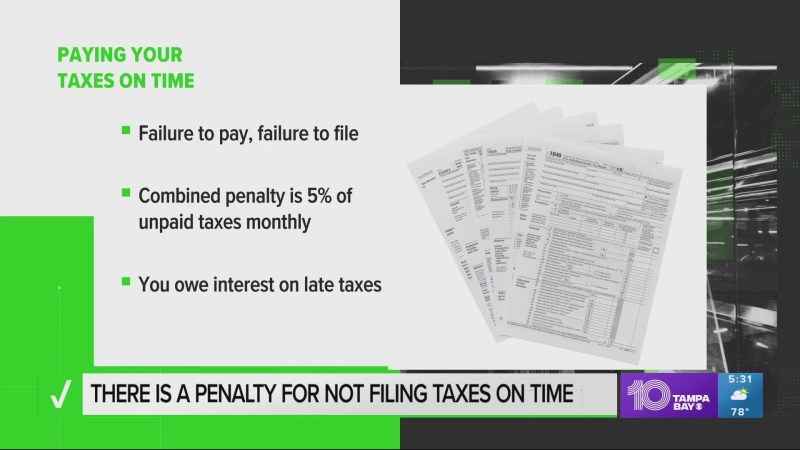

If you can’t pay your taxes, you may want to consider filing. However, this is the most important thing. You must submit your application or extension to avoid loss. This penalty is equal to 5% of the unpaid tax in one month and 25% of the unpaid tax of one part of the month.

Note: 5% monthly penalty increases to 15% for fraudulent non-filing. After more than 60 days of the due date or extension date or extension, the minimum refund penalty is $210 or 100% of the unpaid tax (for 2019 returns).

If you owe taxes or current taxes, if you don’t pay, you could face significant penalties and interest deductions over time. Fixed fees start at 0.5% of your balance per month (plus 25% of taxes paid). The fixed interest rate is currently 6% until May 2019, but may change quarterly.

Understanding your options can help you decide what to do if you owe the IRS. So you can plan. Here are some common options for people who have debt and can’t pay it off.

How Stock Options Are Taxed: Iso Vs Nso Tax Treatments

Taxpayers can set up IRS payment plans, known as payment agreements. The type of deal you get depends on your situation, how much you can afford to pay, and how you can pay off the balance. If you can pay off the balance within 120 days, you don’t need to enter into a payment agreement (see #2 below).

Fees or Costs: Application fee is $149 for online payment plans or $31 if payments are made electronically. For low-income taxpayers, the fee is $43. 13844 file format for low-income.

Action Required: Complete an online payment agreement or Form 9465. Contracts of $50,000 or less are not required to file financial statements. You can also hire a professional to assess your situation and determine the best solution for you.

Pros or Cons: If you take out an installment plan, your unpaid balance penalty will be reduced to 0.25% per month and you’ll pay off the balance on time. Loans are charged at the short-term federal interest rate plus 3% interest (rate may vary quarterly). Usually, if you don’t pay on time, the IRS can cancel the contracts.

Do Teens Have To File Taxes?

Forms: If the balance exceeds $50,000, you can pay with the maximum Form 433-A or 433-A Wage Deduction (Form 2159, Wage Withholding Agreement).

Related: Will Your Credit Report Show a Plan of Arrangement or IRS Debt? Learn from our experts.

Rates or Costs: There is no fee to request an extension. There is a penalty of 0.5% per month for unpaid balances.

Advantages or Disadvantages: This option is suitable for taxpayers who need a short period of time to pay their tax bill in full. The IRS charges the short-term federal rate plus 3% interest (the rate may change quarterly). With a short-term extension, you avoid the application fee (see #1), but you also avoid late payment penalties and interest.

What Happens If You Don’t File Your Taxes On Time?

The IRS offers people in difficult situations, including uncontrollable circumstances and settlement offers. Under the IRS financial standards, you are eligible to claim hardship only if you can prove that paying the taxes will cause you financial hardship.

Fees or Costs: There is no fee to apply for a challenge extension. There is no penalty, but interest is calculated at the short-term federal rate plus an additional 3% (rate may vary quarterly).

You can ask a personal connection, perhaps a friend or family member, for a loan. Prices and costs vary by source. This may be the cheapest option, but you should use your best judgment.

If your 401(k) plan allows you to take out this type of loan, you’re usually limited to 50%, up to a maximum of $50,000, and you have to pay back the money within five years.

You Owe Taxes In California

Pros or Cons: A loan from your 401(k) plan can be a ready and cheap source of cash for current or back taxes. However, if you default, taking out a loan can negatively affect your future retirement savings. If you don’t pay on time, leave the company without repaying the loan, or your plan is terminated, the loan is treated as a taxable dividend. Also, if you are younger than age 59½, taxable distributions are subject to a 10% early distribution penalty.

Prices or costs: Varies; Typically $2.49 to $3.95 (debit card) or 1.87% to 2.35% tax (credit card).

Advantages or Disadvantages: This form of payment is convenient and provides taxpayers with more control and flexibility in making payments. They can also earn points, miles or other credit card rewards. However, high credit cards can have a negative impact on your credit score, and credit card payments may not be ideal for people with unmanageable credit cards.

Our tax experts can help you determine what steps to take if you are unable to pay your taxes. Get help from a trusted IRS professional. Back taxes are a slippery slope. If you underpay your taxes, you may not report all of your income, or you may not file a tax return. No matter how unexpected, taking the first step toward paying your taxes can be costly. Trying to figure out how deep you are after a fall can be daunting. So how do you know when to apply for a tax refund? What red flags indicate that professional help with your taxes is the best option?

What Does This Mean? I Owe Money Or Am Being Given It? I’ve Paid My Taxes In Full.

If any of the following symptoms apply to you, you need tax help. 1. IRS notices are piling up in your mailbox.

If you’ve had a bunch of notices from the IRS about your taxes, it’s time to do something about it. Instead of throwing another CP14 notice on top of the rest (or worse, trashing it), get help to stop the endless stream of IRS letters.

The IRS will continue to send you notices, but they may refer your case to a private debt collection agency. If they do, they will let you know. However, collectors will bombard you with phone calls and notices about your debt with the IRS. As we all know, collection agents can be persistent.

Believe it or not, a tax lien can cause the IRS to deny, suspend, or revoke your passport. Say goodbye to all your travel plans until you have the tax issue behind you. After you pay off your debt or plan to pay off your debt, the IRS can reinstate your passport, but not overnight.

To Pay Or Not To Pay More Tax

Failure to pay back taxes can result in a lien, which means the government will seize your property to cover the unpaid debt. They can also file tax refunds or debt repayments to get their wages back. If the IRS has sent you an advance warning, the levy may shock you. So consult a professional to help you solve your tax problem. Put your wealth where it belongs.

If you owe taxes but can’t pay your total balance, your best bet is to pay taxes. However, this is often not the case. Sometimes your total balance from the IRS (including any penalty penalties) will be higher than what you have in your bank account. In this case, it is in your best interest to find a tax professional who can help you solve your back tax problem with a solution such as debt forgiveness or a payment plan.

If you recognize any of these symptoms in your life, it may be time to seek tax help. The longer you wait, the worse it can get. Call our tax experts today to take the first step toward tax freedom.

We use cookies to provide the best user experience. We share this information with third parties for advertising and analytics. By using this site, you agree to our use of cookies. Privacy | Terms of Use

What To Do If You Haven’t Filed Your Taxes In Years

We know tax credits are scary, but help is at hand

What happens if you owe taxes, what happens if you owe taxes and can t pay, how to pay if you owe taxes, if you owe taxes, what happens if you can t pay your taxes, what happens if you pay taxes late, what if you owe taxes and can t pay, what happens if i owe taxes and can t pay, what if i owe taxes and can t pay, if you owe back taxes what happens, what happens if you owe federal taxes, what happens if i owe taxes