What Happens If I Get Audited And Owe Money – Here are some steps you can take to reduce your chances of being singled out for a tax audit.

This article is for informational purposes only. This content is not legal advice and is not intended to reflect the author’s accuracy or changes in the law.

What Happens If I Get Audited And Owe Money

There’s no guaranteed way to avoid an audit, but there are precautions you can take to ensure your business doesn’t raise any red flags.

Does This Mean I’ll Get Audited?

Until recently, the likelihood of your small business tax being revised was very low. Bloomberg published IRS data showing that only 140 of the 4 million small business returns were filed in 2018. The number is slightly higher for S corporations, but less than 0.5%.

But at the end of 2020, the IRS announced that it is adding auditors to allow the agency to increase its audits by 50%.

Reporting annual losses — especially small losses — can put you on the IRS radar. The IRS may see the loss as an indicator of undisclosed income, prompting them to look at your income.

Steven John Kaplan, CEO of True Contrarian Investments, LLC said, “When the IRS sees an online business loss, it’s almost always asking for an audit.” He added, “You have to report everything you earn, but you don’t have to report everything you spend, so if you have a small annual profit, leave some money. “

What To Do If You Get Audited By The Irs?

Although you must always report 100 percent of your income, you can avoid overreporting the loss by reducing the amount of deductions you claim. For example, eliminating rent, car payments, mileage and technology can save you money, but if the numbers are higher than your income, they could result in an IRS audit.

Your business financial statements show transparency and prevent the IRS from questioning the information you provide. Being vague about business expenses can make the IRS think there’s a problem or that you’re intentionally underreporting your income.

“If you have a choice between putting an expense in a general category or listing it specifically under ‘other expenses,’ you always prefer to list it plainly,” Kaplan says. “If you join an ad or travel together without submitting any specific advertising or travel expenses, the IRS may think you’re trying to find money that doesn’t exist.”

300% 300% 300% 300% 300% 300% 300% 300% Your travel expenses last year.

Tax Audit Process: Procedure, Rules & Guidelines For Irs To Audit

So, if your return is marked and you come in front of the person, you have already answered most of their questions about the sudden changes.

Some people believe that filing earlier in tax season increases the chances of an audit because there are fewer returns in the pool. This myth makes people stay late, asking for more. But Steven Terrigino, CPA and partner at the Bonadio Group, says filing late is not a good way to avoid an audit.

“Fill on time, pay on time,” he said. “[Doing this] will create a record of compliance for all additional revenue—including payroll and sales tax.”

Don’t worry about scanning risks on e-file and paper file. Since the data storage method does not increase the possibility of revision in any way, choose the one that is most convenient for it.

How Far Back Can Irs Audit You

Some businesses believe that filing a return convinces the IRS that you didn’t pay the first time. Submitting an amended return does not trigger an automatic audit, which increases the chance of making major changes without a valid reason. This is because returns older than three years cannot be filed online, so suspect returns are flagged for manual processing and human review.

Remember to include documents supporting the changes when you return. However, if it is not important for the change, it is better not to overwhelm the IRS with unnecessary documents that could lead to an investigation.

Most IRS audits are determined by classification and accounting errors. “Make sure you report all government forms like 1099-INT and 1099-DIV on your tax return,” Terrigino said.

Double check your list to make sure there are no mistakes in your documentation. If the numbers don’t match, the IRS will notice.

I’m Being What?! What Does It Mean To Be Audited By The Irs?

Try to use exact numbers as much as possible, as round numbers are suspect. The IRS generally doesn’t care if you round to the nearest dollar, but adding tens or hundreds of dollars to a clean, round number can trigger an audit.

Make sure you don’t use the same numbers every year unless the numbers are correct and you have documentation. Prices are expected to change, and if yours isn’t, that may raise some red flags.

How much can you ask for in charitable donations without being assessed? Answer Be honest and report the exact amount you paid or any deductions you are entitled to. Save details and documents of your deductions and contributions so you can show proof if needed.

“Don’t go over your gift amount, take too much of the home deduction, or take too much of the deduction for food and travel,” Terrigino says.

Bookkeeping, Accounting, Auditing And Business Advisory Services: What’s The Difference? By Mizaelpartners

These and other costs such as bad debt, loss of life and medical expenses are analyzed with more care. Also, don’t add too many deductions that you haven’t already made. It is observed.

Schedule C is the IRS tax form for reporting your business profits or losses. If you own a small business, always report your income or losses using Schedule C for the best chance of avoiding an audit.

“While there are other ways to avoid paying a portion of the Medicare tax or receiving certain benefits, they also increase the likelihood of being audited,” Kaplan said.

Fill out the tax return carefully and don’t leave any questions blank. Every question on the tax form must have the correct answer, even if the answer is $0. A casual look can draw your attention back.

Being Audited? Here Are Your Tax Audit Defense Options

Filing a tax return without a signature is more common than you might think. If you fail to do something as simple as marking, the IRS may think you’re ignoring other areas of your return that are worth checking. Check and double-check your signature return before filing to reduce the chance of an IRS audit.

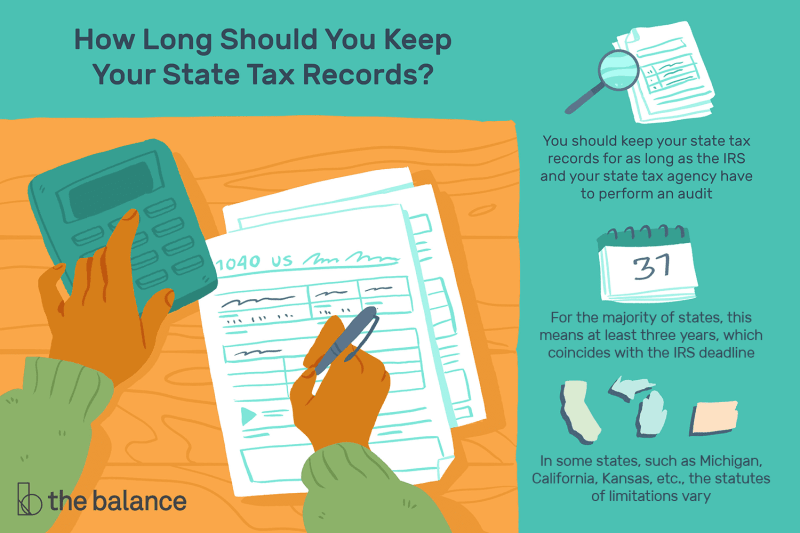

There is a three-year window in the 2022 IRS audit process, so your 2019 tax year can still be selected. Even if you follow every tip on how to avoid conflict, it can still happen. Here are some things you can do if you get a scary IRS letter in the mail.

In the end, your chances of getting audited are slim. Following these tips on how to avoid your business being audited can help reduce the odds even further. Don’t give the IRS a reason to check your accounts, and you’ll save yourself some time and stress.

Now that you know how to avoid an IRS audit using our tips, you can get back to what you do best – managing your business.

Audit: What It Means In Finance And Accounting, And 3 Main Types

Knowing what other trademarks are available will help you determine if the trademark you want to protect has a place. It is better to find out early so that you can find a brand that is easy to secure.

Do you want to talk to your parents or grandparents about estate planning, but do you think it’s a taboo subject? You are not alone. Estate planning discussions are difficult for many families. Use our tips to approach the issue carefully.

Considering an LLC for your business? The application process is not difficult, but to apply for an LLC, you need to do some homework first. If the term “IRS audit” fills you with dread, you’re not alone. Auditing is something that no business owner wants to be involved in. But, sometimes comments are made. What happens if the IRS audits you?

Most business owners don’t want to think about what happens during an audit – they want to know how to avoid an IRS audit. There are many reasons why the IRS may audit you. The IRS may randomly select you for an audit. Or, you may have made a mistake on your IRS form.

Are 87,000 New Irs Agents Coming For Your Tax Dollars?

Only 2.5% of entrepreneurs are audited. But understanding what happens when you are audited is an important part of being a business owner. If you are being assessed, you may have a few questions:

The IRS will let you know what information they want to see. These are written documents that support a claim on your tax return. Here is some information the IRS may ask you:

Be sure to organize your information by year and type of income or expense. Add additional information describing transactions. If you have further questions about the data, contact your researcher.

Make sure you have a to-do list before the end of the year. Download our free white paper at the end of the year

How Serious Is A Tax Audit?

What happens if you owe taxes, what happens if you get audited, what happens if i get audited and owe money, what happens if you owe the irs, if i get audited what happens, what happens if i owe taxes, what happens if you get audited and owe money, what to do if you get audited, what happens if you owe federal taxes, what happens if your taxes get audited, i was audited by the irs and owe, what happens if you get tax audited