Trade In Car But Still Owe Money – If you’re in the market for a new car but you have a loan on your current car, you may be wondering how to buy a car with no payment. The main reason is that your car is worth more than the rest of your debt. Here’s what you need to know.

If you’re planning to buy your car, it’s important to know what it’s worth before you go shopping. Without this information, you may unknowingly accept a low price from the seller.

Trade In Car But Still Owe Money

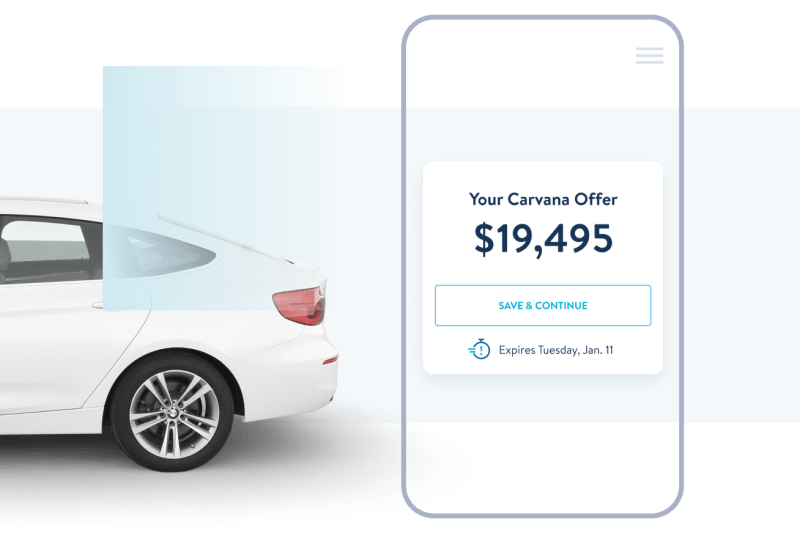

You can research your car’s value online using Kelley Blue Book and other appraisal guides. It’s a good idea to visit a few guides like this because the cost estimates and the number of years it takes can vary.

Things To Avoid When Buying A Used Car

Remember that you won’t get much from the trade-in when you sell the car. But knowing the value of your car will not make you rich.

If your car is worth more than what you owe on the loan, you’re in a tough spot. Let us e.g. The seller says he offers $13,000 for your car, but you still owe $11,000 on your loan. When you trade in your car, you get the difference ($2,000) representing your equity in the car.

If you finance your new car, you can use your old car finance for your down payment. There may be ways to lower the total cost of your new loan. You can add more money if you want to pay more and borrow less. If you pay cash for the car, the seller can deduct your transaction from the total price you pay.

If you owe more on your current loan than you can afford on your transaction, you are in debt. The same is true if you’re trying to buy a new car, because cars depreciate quickly within the first few years of ownership. After you own your car for a long time, the value will slow down and your loan will be paid off faster. So, if you have bad credit on your car, you may think you should wait to trade in until your loan balance reaches the value of your car.

How To Sell A Car With A Loan

If not, you have to make up the difference. Your dealer may offer to increase the amount on your new loan, but be careful. This means you start your new loan with the same bad credit. So you could find yourself in the same situation a few years down the road when you go shopping for that car.

It is possible to trade in a car you are currently leasing and the process is the same as trading in one with the amount remaining. . You should first contact the leasing company or check your lease information to find out what the car’s cost or purchase price is. This is the amount you pay if you want to buy the car before the lease contract ends. You’ll also want to find out if there’s an early termination fee for your lease.

Once you have this information, you can contact the seller to buy your new car and work directly with the leasing company. Because early termination or other fees are often included in the rental payment, you may not receive the full amount for your rental car transaction. So, just like buying into a car with bad equity, it makes sense to wait until your list is up and use the buying option.

At that time, of course, you don’t have to buy the car, but you can give it up and leave. And if you don’t plan on driving that car for a while before you trade it in—or the car dealer is willing to pay more than you’re willing to pay—it might be best to walk away. from a financial point of view.

Rev Up Your Trade In Strategy: Best Time To Swap Your Car

If your car’s trade-in value is more than the current balance, then you’re good to go – you can simply pay off the old loan and use the difference to pay for your new car. But if the debt on your car is more than the trade-in value, you must pay the difference. In that case, it may be better to wait until your loan is completed.

Authors should use primary sources to support their work. These include white papers, government documents, original reports and interviews with experts. We also look at previous research from other reputable publishers where appropriate. You can learn more about the procedures we follow to post accurate and objective information in our Posting Program. There are many reasons why you might want to get rid of your current car and buy a car that still has a warranty. , which means you have a car loan and a car loan, you might be in trouble. But that doesn’t mean you can’t buy them individually.

When it comes to buying a car, you usually don’t have many options. The easiest way for many owners who still have a loan on their car, have a bank loan, is to go to a dealer for a trade-in, where the salespeople know better working knowledge. There are pros and cons to this, as well as the pros and cons of selling your custom car through social media and the internet, especially if you have financing on the car. But just because you don’t have a title doesn’t mean your options are limited, because many banks and financial institutions have a way of allowing you to buy a car on credit. a special purchase.

Sold separately by owner | Michael Siluk, Educational Photography, World Photography Group, Getty Images

How To Sell A Car With A Loan

There are many reasons why car owners choose to buy a used car instead of trading in a car, and that means making money. Although selling a car is less complicated and confusing than buying it, the buyer still has some big costs to consider when buying a used car, so you get make less money selling on your own. Of course, private sales come with downsides, which means it’s not too painful for some buyers, and in the current market, you may be looking at a sale price that seems to be you get a special deal, though.

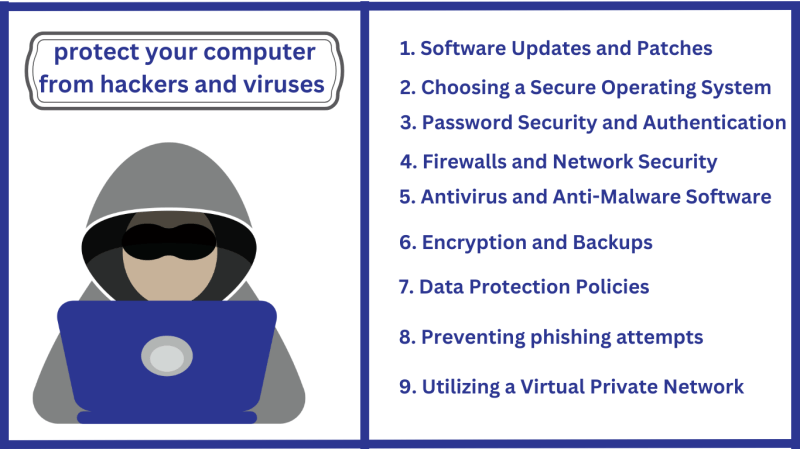

Most cars on the market only have a bond with the bank for a few years, meaning the bank holds the property until unless the vehicle is paid for. This does not mean that you cannot sell your car to someone else, it just means that there are a few hurdles to be overcome in this situation, which is not always a bad thing, if you can buy a car. at a reasonable price. Remember that your bank does not give you the right to sell the car for free, the price you sell your car for must be equal to your car loan balance – if you need to pay it off. out of pocket to cancel the car. The best thing is to contact the bank that holds your car and talk about the purchase options with them, because they will tell you that you have to come to the bank office with the seller to complete the transaction.

There are many things to keep in mind when buying a car on your own, especially if the car is subject to a loan. Under no circumstances can you transfer the title to the vehicle during a private sale before the loan is settled, either by you or by the seller. . It is not appropriate or recommended that the seller pay for a vehicle before the title is released, as it takes several days for the title to be released from the owner. is owned, and you must not allow one to be accepted in your vehicle. . and the transfer of the title was not completed. All mortgages and banks have different functions and may have different rules for this process, so the only way to know the right options is to contact your bank or mortgage directly before the List of vehicles for the purchase. I do! There is nothing to worry about if you are ready to buy a new or used car but still have a loan for your current car. It’s just a few easy steps

Trade in car still owe money, trade in my car but i still owe money, still owe on car but want to trade in, want to trade in car but still owe money, i want to trade in my car but still owe, can you trade in car you still owe money on, trade in car still owe, i want to trade in my car but i still owe on it, trade in car that you still owe money on, trade in car you still owe money on, trade in car you still owe, car totaled but still owe money