If My House Is Worth More Than I Owe Can I Refinance – I went above and beyond with the progress of my offer, even on a holiday weekend. This is a sacrifice for you!

There seems to be a misconception that house prices are relatively stable and will gradually rise or fall depending on the whims of the market. But house prices are a lot like the zombies that appear: sometimes they look a lot like Shaun of the Dead prices, creeping up on you and creeping closer and closer. Sometimes they are like World War Z; before you know it, they’ve covered 200 meters (read thousands of pounds) in seconds.

If My House Is Worth More Than I Owe Can I Refinance

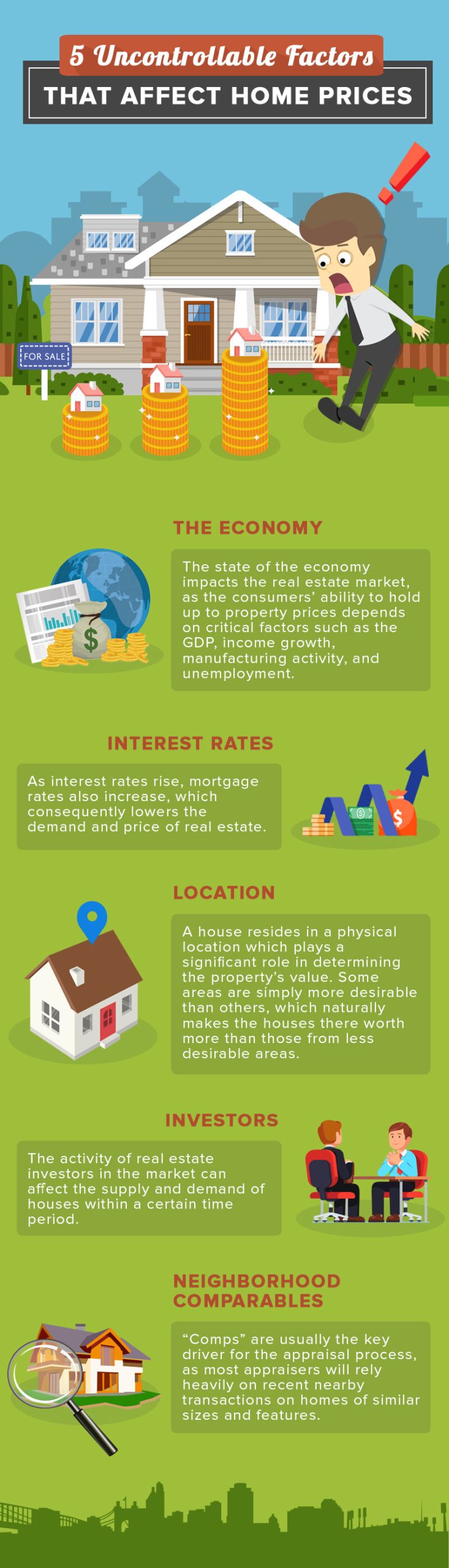

Yes, politics! But seriously, the promise of massive development in an area can drive up real estate prices and suddenly create better jobs and economic security. Also, investors anticipate a certain demand for real estate, especially for short-term rentals, and prices will rise as large investors begin to buy properties in the area. This is where a lot of politics comes in, because politicians and the laws they make can directly affect the number of jobs in your area.

Detached Houses Worth Lot More Than Units

We are talking about major infrastructure developments. Things like HS2, city megaplans and even the London Olympics (yes, we know it was six years ago, but it still had a huge impact on the local area). And we’re also talking about smaller things, for example, exempting first-time buyers from stamp duty; this has resulted in an immediate rise in house prices in certain brackets.

Well, nothing lowers the price of a house faster than a newly approved plant right on your street. Conversely, a new Waitrose can push house prices up significantly as the area is suddenly seen as trendy. It’s surprising how even given planning permission for Waitrose (and to a lesser extent M&S) can drive up property prices. We are talking about tens of thousands of books here. However, according to Lloyds Bank research, an Aldi can undercut prices in the area by an average of £2,902.

Of course, there are some payoffs. For example, if there is a sudden investment in chemical plants in your area, the value of houses in the area is likely to decrease, but house prices in the surrounding towns may increase because of the expected profit. without affecting the sight and/or smell of the new plant.

We’re all about buying the latest stuff because it’s cool, this one from someone who really wants a Samsung Galaxy Note 8.

How To Determine Whether That House You Have Your Eye On Will Increase In Value

It also applies to the housing market. Areas suddenly become desirable because “cool” people move there; just look at Swanley, which is just inside the M25 in Kent. According to Zoopla, house prices have increased by 10.78% in the last year, which is a huge increase. This is not due to an additional house or sudden changes in the fortunes of the area. Rather, it’s because it’s considered a desirable area to live in, and being within easy reach of London helps a lot. These are important trends and can quickly affect prices. Think about the current trend of minimalism: clean out your home completely and adopt a simpler aesthetic. MOE? It is suggested that a new kitchen can add six percent to the value of your home.

Smart technology can have a huge impact on home value. According to Barclays, those looking for a smart home can spend an extra £10,000 for this feature, but it’s the practicality of the smart tech that adds serious value. Smart meters, smart thermostats, lights that turn on and off independently, and even a complete wireless audio system from room to room provide comfort and convenience. Being ahead of the curve can make your home more valuable in the future. Oh, and don’t forget an electric car charging point: by 2040, you won’t be able to buy a new petrol or diesel.

However, what technology really affects us is the ability to find information about an area without leaving the house. Reducing crime and increasing the quality of schools can quickly affect the status of an area, and you can find out immediately on the Internet (here’s our Commute Center guide – very nice).

Dozens of things can affect the value of your property in the short term, and that’s before you even start painting the walls or planning. To find out what your property is worth, book a free valuation from one of our local experts today. They know all the latest things that affect real estate prices in your area.

Mayfair Property Worth More Than £1m Makes Up 95% Of The Market

Tags: tips, asking price, real estate agent, fees, house price, moving, news, real estate agent online, property, savings, sale, appraisal, tour, house is worth buying if you have enough savings to save plus closing costs, and the rates are low enough so that all of your housing costs are equal to or less than what you pay in rent each month.

The upfront cost of paying rent is a non-monetary benefit of buying a home. If you might be moving soon, don’t buy.

To buy a home, you need to save for a down payment and closing costs. In fact, if you’re buying a home with financing in New York, you’ll typically need to save up to 20% for a standard down payment, and another 3% to 4% in closing costs. Closing costs will vary by city and even the state you buy from.

In our example of buying a home in New York, you’ll need to put down 23-24% of the purchase price and put that amount down to cover the down payment and closing costs.

Us Household Net Worth Increased In Fourth Quarter On Equities

This does not include ongoing mortgage principal and interest payments, home insurance premiums, home owner association (HoA) fees, and repair or maintenance fees.

Pro Tip: Calculate for yourself what your closing costs will be for buying a home in New York with our highly accurate closing cost calculator for New York home buyers.

Our authority, your advantage. Our regular partner brokers are never heavily discounted, which means less hassle and better execution for you.

If mortgage rates are low and you can finance your purchase, you may be lucky enough to pay less in mortgage payments, home insurance and HoA fees than you would in rent each month. If so, or even if the payments are about the same, buying and renting is usually a no-brainer. This is because your mortgage payment includes principal and interest payments. While the interest payments go to the bank, your principal payment reduces your mortgage principal and therefore the amount you owe on your home. When you reduce the amount you owe on your home, you have a larger share of the home’s equity. For example, let’s say your house can sell for $1,000,000 and you have a mortgage of $800,000. This means that if you were to sell today, assuming no closing costs in a perfect world, you would have $200,000 in equity. However, if you paid off your mortgage for $500,000 in 10 years and sold it for $1,000,000, you would clear $500,000, including closing costs. In our perfect world. As you can see, all those mortgage payments you made over the years actually went to you because you reduced your debt and thus increased your home equity.

Should Canadians Pay A Surtax On Homes Worth Over $1m?

Pro tip: If the amount you pay in rent is just your mortgage interest + home insurance premium + HoA fee, not including the primary mortgage, the decision process will be more difficult. From a purely financial point of view, buying or renting should be considered with the opportunity cost in mind. Would the money saved be better spent on real estate or the stock market or other investment opportunities? Read our complete guide to investing in New York real estate and the stock market.

Save 2% on your home purchase Save thousands on your home purchase with a discounted buyer’s agent commission

Keep in mind that real estate is one of the most liquid asset classes out there. Unlike buying stocks, you can easily and quickly buy and sell real estate. For example, the average days on the market for a signed contract in New York is over 100 days as of this writing. That means it takes more than three months to close on a buyer, and that’s not counting the extra 30 to 90 days it takes from contract signing to closing.

In addition, there is no guarantee that you will be able to find a home there

The 5 Stages Of Nft Acceptance (the Non Fungible Grief Cycle)

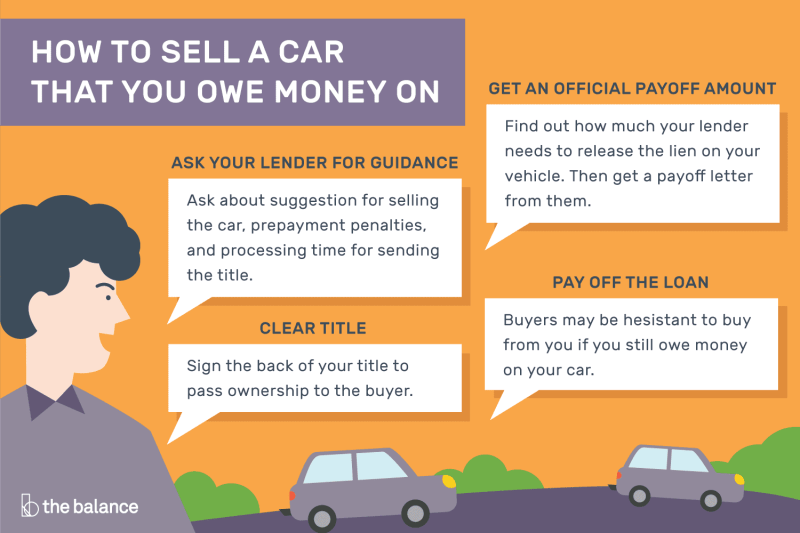

Can you refinance your house for more than you owe, if my car is worth more than i owe, refinance more than you owe, if my house is worth more than i owe can i refinance, i owe more than my car is worth, what if i owe more than my car is worth, what if my car is worth less than i owe, car is worth more than i owe, my home is worth more than i owe, refinance for more than you owe, what if i owe more than my house is worth, refinance car for more than you owe