If My House Is In Foreclosure Can I Save It – Home prices are expected to rise significantly between 2019 and 2022, but many homeowners are currently struggling to keep up with their mortgage payments due to factors such as inflation, unemployment and divorce. If you stop making mortgage payments, it could lead to foreclosure – depending on your lender and the state laws in your area.

The short answer is yes, but there are some nuances. In general, the process can be more complicated than a regular home purchase. But the important question is how much equity you have in the property.

If My House Is In Foreclosure Can I Save It

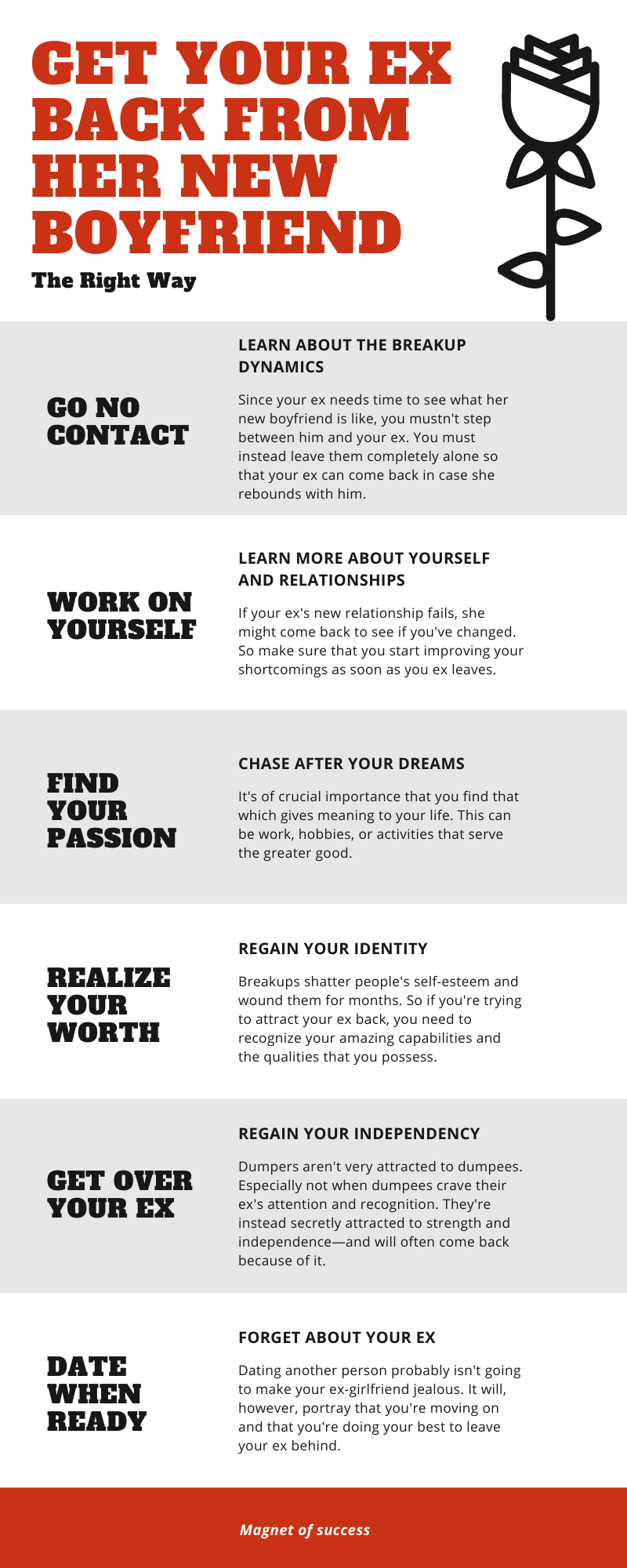

If you fall behind on your mortgage payments and the lender starts foreclosure proceedings, you may still be able to sell the home and avoid foreclosure. The options available to you depend largely on how much equity you have in your home. Does this mean your payments are less than the value of the property?

Is It Possible To Sell My House During Foreclosure In Montgomery County?

The amount of equity in your property can greatly affect your options to avoid foreclosure or simply sell your home on the market. Equity is the difference between the current market value of your property and your mortgage debt. If you have good equity (the property is worth more than your debt), it can give you more options.

If you have equity in your home, you can sell the property and use the proceeds to pay off your mortgage, which can be profitable. In this situation, you can pay off your mortgage in full and avoid foreclosure.

If you have more equity in your home, you can refinance your mortgage. Financing can help you lower your monthly mortgage payment, making it easier to stay. However, good credit information and reliable income are required to reapply.

If you are struggling with your mortgage payments but have equity in your property, your lender may want to change the terms of your loan. This can lower the interest rate, extend the loan period, or defer part of the capital.

How Many Mortgage Payments Can I Miss Pre Foreclosure?

On the other hand, if you are “underwater” on your mortgage – meaning you owe more than the property is worth – these options are not available. In this case, you may need to consider a short sale, which allows the lender to accept the proceeds from the sale, even if they are less than the mortgage balance. However, selling short can have a negative impact on your credit score.

Managing bankruptcy is difficult and can have lasting financial consequences. It is important to seek advice from a professional, such as a real estate agent or real estate advisor, who can help you understand your options and make the best decision for your situation.

Super Jumbo Mortgages: What Makes Them Different Nov 6, 2023 This comprehensive guide explores the key differences that set Super Jumbo apart from other mortgages, so read on.

The Ultimate Guide to Home Loan Management Oct 23, 2023 Explore your business mortgage by learning about the differences between home loans and commercial mortgages.

What Is Foreclosure?

How and when to lock in an interest payment in reconstruction 15 August 2023 Whether you are locking in a payment or choosing the right construction loan, always make decisions according to your process and statistical forecast.

The Essential Guide to Winning Real Estate Marketing Strategies Jun 3, 2023 From networking with local professionals to marketing online platforms and social media, these steps will help take your business to the next level. Many homeowners take out a mortgage when they buy their home. …and most keep their mortgage payments under control. But what happens when that can’t be done – when the homeowner doesn’t make those regular payments?

In Ontario, when a mortgage is unpaid, the mortgagee may have the right to enter and take possession of the property. This can be done in two ways: purchasing power or ownership. These two measures can lead to very different results for the homeowner. It is important to know the differences.

In Ontario, when a homeowner or mortgage holder defaults, the bank or lender can put the home up for sale, usually at or near market value, to recover the mortgage amount.

The Pros And Cons Of Buying A Foreclosed Home

The buyer hopes to get a deal on the apartment. However, the mortgage holder wants to get the property’s market value.

In a typical real estate transaction, the salesperson works with the seller and their agent, usually the seller. In purchasing power, the buyer is directly connected to the seller, so the home owner/buyer may have less bargaining power when the value of the property increases.

If the property is sold for more than the mortgage and there is money left over after paying expenses and fees, the borrower can get the remaining balance from the lender.

If the property is sold for less than the debt, the lender is responsible for the loss. In addition, the lender can negotiate commissions and fees to reduce losses from the sale of the property and to recover as much of the loan as possible.

How To Buy A Cheap Foreclosed Home

When a lender sells a property, it is different than when the owner sells the property. When you sell your own property, you must sign documents confirming that the electricity is in order, the mortgage is paid off, the appliances are working…etc.

When you buy from a seller with purchasing power, you are not guaranteed anything other than the payment of real estate tax. NO WARRANTY ON THE BUILDING PROPERTY, USER… NOTHING.

So if you buy a house in foreclosure, even if you get a better deal for the money, the underlying problems won’t be discovered until the sale is complete.

As a retailer, when it comes to sales force, what you see is what you get. And what you don’t know… you already have. You may get a better price, but there is also risk involved.

If My House Is In Foreclosure Can I Sell It

To reduce the risk, you can include terms in your offer that include a home inspection (which you will have to pay for) that will reveal any potential problems with the property. It is best to know everything about the property before starting negotiations. Of course, this can allow your real estate agent to negotiate a better price for you.

A lender with purchase power only has the right to sell the property, while with a mortgage the lender can take ownership of the property. This means suing the debtor and waiting for the court’s decision. Consistency is a more complex, time consuming and expensive process than sales staff. The grantor must dot every “I” and cross every “T” to take title to the property and ensure that the original owner has no right to any future property.

The good news is that if the value of the mortgage is less than the value of the property, the lender can make more money by using a bond.

Whether you are in a buying or selling situation or considering the option as a lender or investor, we are ready to discuss the advantages and disadvantages with you; and help you decide the best option to protect your money and/or grow your portfolio. You can contact our Toronto office at 416-663-4423 or toll-free at 1-877-224-8225. We hope we can help you sort through the details and make the right decision. “Expert verified” means that the article has been thoroughly reviewed by our budgeting committee for accuracy and clarity. The audit committee consists of a panel of financial experts whose goal is to ensure that our information is accurate and balanced.

How To Buy A Foreclosed Home In Missouri

By Jeanne Liero By Jeanne Liero Contributor Jeanne Lee writes about mortgages, personal finance and enjoys finding ways people can hack their money. Jeannie Lee

Posted by Laurie Dupnok Posted by Laurie DupnokArrow Equity Editor, Home Lending Laurie Dupnok is a mortgage editor at Home Lending. Connect with Laurie Dupnok on LinkedIn Linkedin Laurie Dupnok

Reviewed by: Jeffrey Beale Reviewed by Jeffrey Beale, Director, Real Estate Solutions Wright Director, Real Estate Solutions Jeffrey L. Bill has over 40 years of experience in many areas of the real estate industry. About our Jeffrey Beale review board

Founded in 1976, it has a long history of helping people make smart financial choices. We have maintained this reputation for over four years by simplifying the financial decision-making process and giving people confidence in the work being done.

Detroit’s Foreclosure Crisis Is Coming For Renters

We follow a strict editing policy, so you can be sure that we put your interests first. All of our content is written by leading experts and edited by subject matter experts, ensuring that everything we publish is objective, accurate and reliable.

Our mortgage brokers and editors look at what consumers care about most – the latest

How can i tell if my house is in foreclosure, if your house is in foreclosure can you sell it, if a house is in foreclosure can it be sold, if my house is in foreclosure can i sell it, what can i do if my house is in foreclosure, my house is in foreclosure how can i save it, if a house is in foreclosure can it be bought, if my house is in foreclosure can i save it, if a house is in foreclosure can i buy it, my house is in foreclosure can i save it, how can i see if my house is in foreclosure, if my house is in foreclosure can i file bankruptcy